Keep Old Home Loan Paperwork

Why You Should Keep Old Home Loan Paperwork

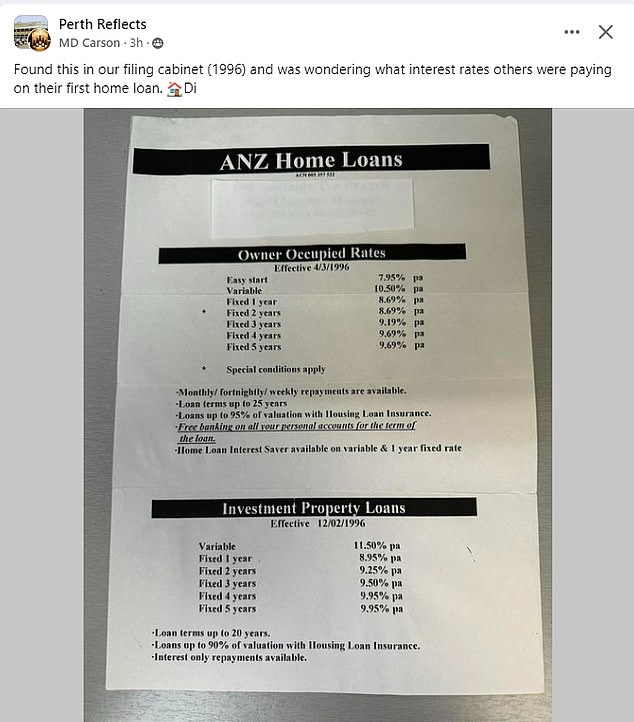

When you finally pay off your home loan, it’s a significant milestone that brings a sense of relief and accomplishment. However, once the loan is paid off, many homeowners are unsure about what to do with the old loan paperwork. While it may seem unnecessary to keep years’ worth of documents, holding onto them can be beneficial for several reasons. In this article, we will explore the importance of keeping old home loan paperwork and what documents you should consider keeping.

Benefits of Keeping Old Home Loan Paperwork

Keeping old home loan paperwork can be beneficial for tax purposes, insurance claims, and future reference. For instance, you may need to provide proof of loan repayment when applying for a new loan or credit. Additionally, if you’ve claimed mortgage interest deductions on your taxes, you’ll need to keep records of your loan payments to support your tax returns.

Some of the key benefits of keeping old home loan paperwork include: * Proof of loan repayment: Keeping records of your loan payments can help you prove that you’ve paid off your loan in full. * Tax deductions: If you’ve claimed mortgage interest deductions on your taxes, you’ll need to keep records of your loan payments to support your tax returns. * Insurance claims: In the event of a natural disaster or other catastrophic event, you may need to provide proof of loan repayment to support an insurance claim. * Future reference: Keeping old home loan paperwork can provide a valuable record of your financial history, which can be useful when applying for future loans or credit.

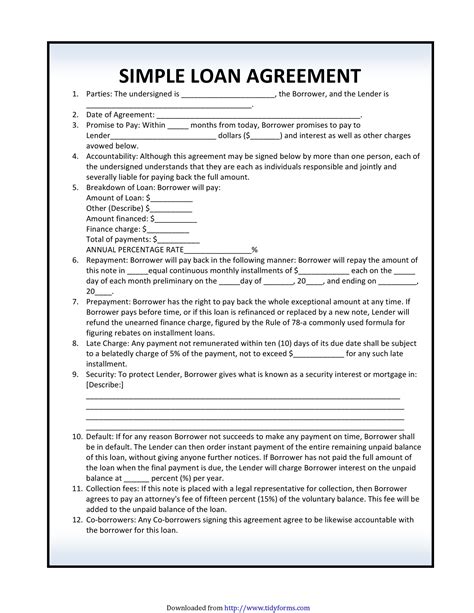

What Documents Should You Keep?

When it comes to keeping old home loan paperwork, it’s essential to know what documents are worth holding onto. Some of the key documents you should consider keeping include: * Loan agreements: Keep a copy of your original loan agreement, which outlines the terms and conditions of your loan. * Loan statements: Keep a record of your loan statements, which show your payment history and loan balance. * Payment receipts: Keep receipts for each loan payment you make, which can help you prove that you’ve made payments on time. * Title documents: Keep a copy of your property title, which shows that you own the property outright. * Insurance documents: Keep a record of your insurance policies, which can help you support an insurance claim in the event of a disaster.

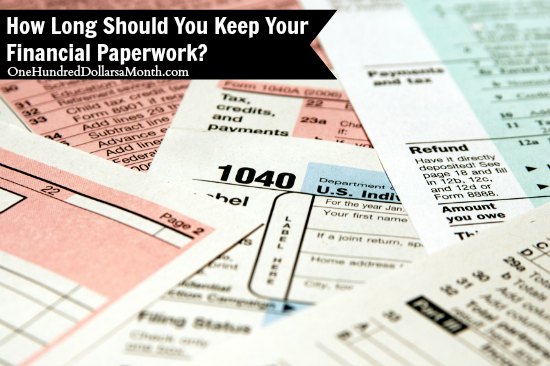

How Long Should You Keep Old Home Loan Paperwork?

The length of time you should keep old home loan paperwork depends on the type of document and your individual circumstances. As a general rule, it’s a good idea to keep: * Loan agreements and title documents: Keep these documents indefinitely, as they provide proof of ownership and loan repayment. * Loan statements and payment receipts: Keep these documents for at least 7 years, in case you need to support a tax return or insurance claim. * Insurance documents: Keep these documents for as long as you have the policy, and for at least 3 years after the policy has expired.

📝 Note: It's essential to keep old home loan paperwork in a safe and secure location, such as a fireproof safe or a secure online storage service.

Best Practices for Storing Old Home Loan Paperwork

When it comes to storing old home loan paperwork, it’s essential to keep documents in a safe and secure location. Some best practices for storing old home loan paperwork include: * Keep documents in a fireproof safe: Consider investing in a fireproof safe to store your important documents, such as loan agreements and title documents. * Use a secure online storage service: Consider using a secure online storage service, such as Dropbox or Google Drive, to store your documents. * Keep documents organized: Keep your documents organized and easy to access, using folders and labels to categorize your documents.

| Document Type | Retention Period |

|---|---|

| Loan agreements and title documents | Indefinitely |

| Loan statements and payment receipts | At least 7 years |

| Insurance documents | At least 3 years after policy expiration |

In summary, keeping old home loan paperwork is essential for tax purposes, insurance claims, and future reference. By keeping a record of your loan agreements, loan statements, payment receipts, title documents, and insurance documents, you can ensure that you have a valuable record of your financial history. Remember to store your documents in a safe and secure location, and keep them organized and easy to access.

As we reflect on the importance of keeping old home loan paperwork, it’s clear that this documentation plays a critical role in our financial lives. By holding onto these documents, we can ensure that we have a clear record of our financial history, which can be useful in a variety of situations. Whether we’re applying for a new loan, supporting an insurance claim, or simply keeping track of our financial progress, old home loan paperwork is an essential part of our financial toolkit.

What is the benefit of keeping old home loan paperwork?

+

The benefit of keeping old home loan paperwork includes proof of loan repayment, tax deductions, insurance claims, and future reference.

How long should I keep old home loan paperwork?

+

The length of time you should keep old home loan paperwork depends on the type of document and your individual circumstances. As a general rule, it’s a good idea to keep loan agreements and title documents indefinitely, loan statements and payment receipts for at least 7 years, and insurance documents for at least 3 years after policy expiration.

Where should I store old home loan paperwork?

+

It’s essential to keep old home loan paperwork in a safe and secure location, such as a fireproof safe or a secure online storage service.