5 Bank Reconciliation Tips

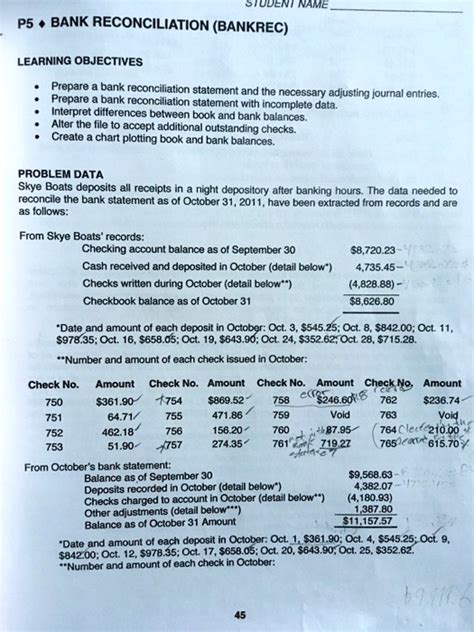

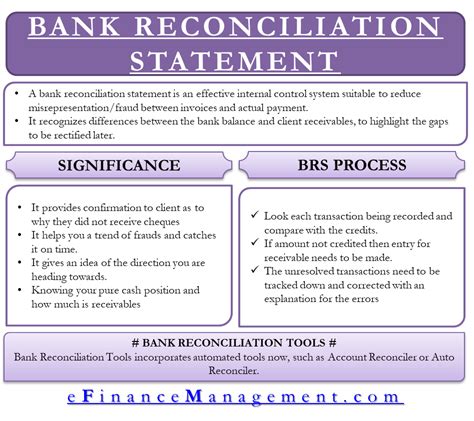

Introduction to Bank Reconciliation

Bank reconciliation is a crucial process in accounting that involves matching the company’s internal financial records with the bank’s records to ensure accuracy and detect any discrepancies. This process helps in identifying any errors or fraud, and it also assists in maintaining the integrity of the company’s financial statements. In this article, we will provide you with 5 bank reconciliation tips to help you streamline this process and ensure that your company’s financial records are accurate and up-to-date.

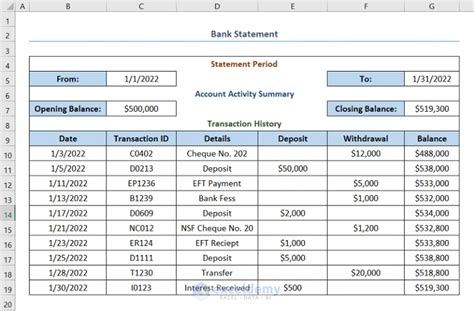

Tip 1: Regularly Review Bank Statements

Regular review of bank statements is essential to ensure that all transactions are accurate and authorized. It is recommended to review bank statements at least once a month, but for companies with high transaction volumes, it may be necessary to review them more frequently. When reviewing bank statements, make sure to check for any unusual or unauthorized transactions, and investigate any discrepancies immediately. It is also important to verify that all deposits and withdrawals are correctly recorded in the company’s internal financial records.

Tip 2: Use Bank Reconciliation Software

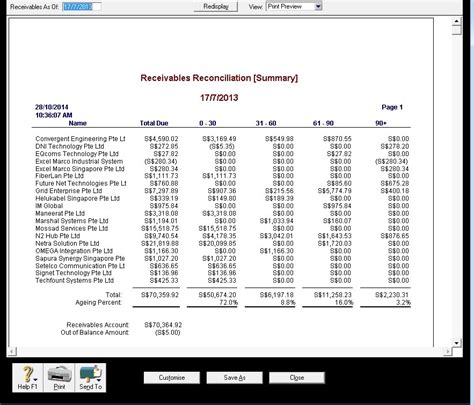

Using bank reconciliation software can greatly simplify the reconciliation process and reduce the risk of errors. This software can automatically match transactions between the company’s internal financial records and the bank’s records, and it can also identify any discrepancies. Some popular bank reconciliation software includes QuickBooks, Xero, and SAP. When choosing a bank reconciliation software, make sure to select one that is user-friendly and compatible with your company’s accounting system.

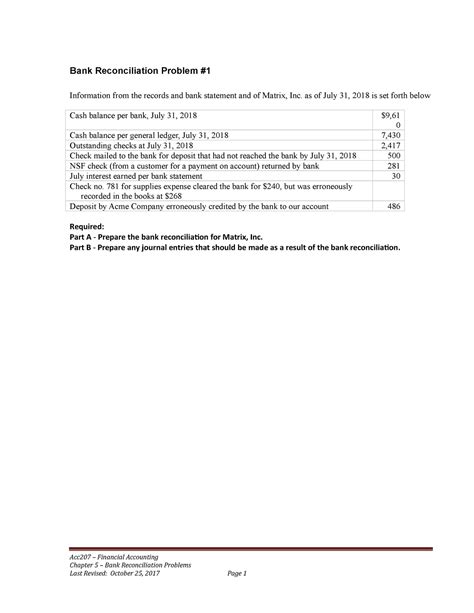

Tip 3: Identify and Investigate Discrepancies

Identifying and investigating discrepancies is a critical step in the bank reconciliation process. Discrepancies can arise due to various reasons such as errors in recording transactions, unauthorized transactions, or differences in timing. When a discrepancy is identified, it is essential to investigate it immediately and take corrective action to resolve it. Here are some steps to follow when investigating discrepancies: * Verify the transaction details * Check for any errors in recording transactions * Investigate any unauthorized transactions * Contact the bank to resolve any discrepancies

Tip 4: Maintain Accurate Internal Financial Records

Maintaining accurate internal financial records is essential for accurate bank reconciliation. This includes ensuring that all transactions are correctly recorded, and that all accounting entries are up-to-date. It is also important to ensure that all internal financial records are reconciled with the bank’s records on a regular basis. Here are some tips for maintaining accurate internal financial records: * Ensure that all transactions are correctly recorded * Verify that all accounting entries are accurate and up-to-date * Reconcile internal financial records with the bank’s records regularly

Tip 5: Implement Internal Controls

Implementing internal controls is essential to prevent errors and discrepancies in the bank reconciliation process. This includes implementing procedures for authorizing and recording transactions, and ensuring that all transactions are properly documented. Here are some internal controls that can be implemented: * Implement procedures for authorizing and recording transactions * Ensure that all transactions are properly documented * Limit access to internal financial records and bank statements * Regularly review and update internal controls to ensure that they are effective

📝 Note: Implementing internal controls can help prevent errors and discrepancies, but it is also important to regularly review and update these controls to ensure that they are effective.

In summary, bank reconciliation is a critical process that requires attention to detail and regular review of bank statements. By following these 5 bank reconciliation tips, companies can ensure that their financial records are accurate and up-to-date, and that any discrepancies are identified and investigated promptly. The key takeaways from this article are the importance of regularly reviewing bank statements, using bank reconciliation software, identifying and investigating discrepancies, maintaining accurate internal financial records, and implementing internal controls. By implementing these tips, companies can streamline their bank reconciliation process and maintain the integrity of their financial statements.

What is bank reconciliation?

+

Bank reconciliation is the process of matching a company’s internal financial records with the bank’s records to ensure accuracy and detect any discrepancies.

Why is bank reconciliation important?

+

Bank reconciliation is important because it helps to identify any errors or discrepancies in the company’s financial records, and it also assists in maintaining the integrity of the company’s financial statements.

How often should bank statements be reviewed?

+

Bank statements should be reviewed at least once a month, but for companies with high transaction volumes, it may be necessary to review them more frequently.