Save Old IRA Paperwork

Introduction to Saving Old IRA Paperwork

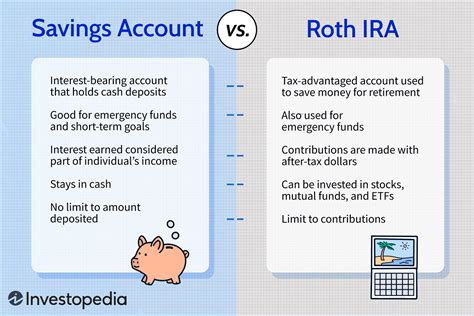

When it comes to managing your Individual Retirement Accounts (IRAs), one crucial aspect often overlooked is the importance of saving old IRA paperwork. This documentation is vital for tracking your contributions, understanding your investment choices, and making informed decisions about your retirement savings. In this article, we’ll delve into the reasons why saving old IRA paperwork is essential, what documents you should keep, and how to organize them efficiently.

Why Save Old IRA Paperwork?

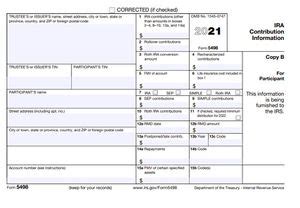

Saving old IRA paperwork is crucial for several reasons: - Tax Purposes: Your IRA documents can serve as proof of your contributions and distributions, which are essential for tax filings. The IRS may request these documents to verify your tax deductions or credits related to your IRA. - Audit Trails: In case of an audit, having comprehensive records of your IRA activities can help you navigate through the process more smoothly. These documents provide a clear audit trail, showing all transactions, contributions, and distributions over time. - Investment Tracking: By keeping old IRA paperwork, you can monitor the performance of your investments. This is particularly useful for making future investment decisions, as you can see which investments have performed well and which may need adjustment. - Beneficiary Information: Your IRA documents will include information about your beneficiaries. It’s essential to keep these records up to date to ensure that your retirement savings are distributed according to your wishes after your passing.

What Documents Should You Keep?

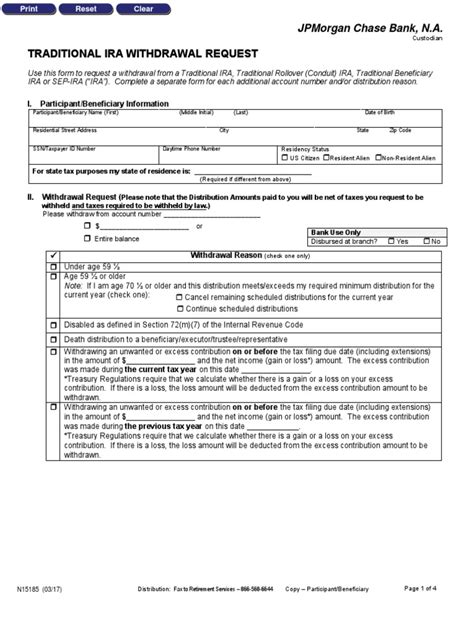

To maintain a complete record of your IRA activities, consider saving the following documents: - Annual Statements: Keep annual statements from your IRA custodian, which detail your account balance, contributions, and any distributions made during the year. - Contribution Records: Save records of all your contributions, including the date and amount contributed. This is especially important for demonstrating your eligibility for tax deductions. - Distribution Records: Keep records of any distributions you’ve taken from your IRA, including the date and amount. This information is crucial for tax purposes and for understanding the impact of distributions on your retirement savings. - Investment Records: Maintain records of your investment choices within your IRA, including any changes or adjustments made over time. - Beneficiary Designation Forms: Ensure you have the most current beneficiary designation forms on file. Review and update these forms as necessary to reflect any changes in your beneficiaries.

How to Organize Your IRA Paperwork

Organizing your IRA paperwork efficiently can make it easier to find the documents you need when you need them. Here are some tips: - Digital Storage: Consider scanning your documents and storing them digitally. This can help reduce clutter and make it easier to access your documents from anywhere. Ensure your digital storage method is secure and backed up regularly. - File Folders: Use file folders labeled with the year or type of document to keep your physical IRA paperwork organized. This can help you quickly locate specific documents. - Safe Deposit Box: For especially important documents, such as beneficiary designation forms or initial account setup paperwork, consider storing them in a safe deposit box at your bank. This provides an additional layer of security.

Best Practices for Managing IRA Paperwork

To make the most out of saving your old IRA paperwork, follow these best practices: - Regular Reviews: Schedule regular reviews of your IRA paperwork to ensure everything is up to date and accurate. - Update Beneficiaries: Whenever there’s a change in your personal life, such as a divorce, marriage, or the birth of a child, review and update your beneficiary designations as necessary. - Consult a Financial Advisor: If you’re unsure about how to manage your IRA paperwork or need advice on investment strategies, consider consulting a financial advisor.

📝 Note: Always keep your IRA paperwork in a secure and easily accessible location. Regularly review your documents to ensure they are accurate and up to date.

Conclusion Without Heading

In summary, saving old IRA paperwork is a critical aspect of managing your retirement savings effectively. By understanding the importance of these documents, knowing what to keep, and organizing your paperwork efficiently, you can ensure that your IRA is well-managed and ready for when you need it. Whether you’re just starting to build your retirement nest egg or are nearing retirement, maintaining comprehensive records of your IRA activities will serve you well in the long run.

What is the primary reason for saving old IRA paperwork?

+

The primary reason for saving old IRA paperwork is for tax purposes and to maintain a clear record of your contributions, distributions, and investment choices within your IRA.

How should I organize my IRA paperwork?

+

You can organize your IRA paperwork by using digital storage for easy access, file folders for physical documents, and considering a safe deposit box for critical documents like beneficiary designation forms.

Why is it important to review and update my IRA beneficiary designations?

+

Reviewing and updating your IRA beneficiary designations is important to ensure that your retirement savings are distributed according to your current wishes after your passing. Life changes such as marriage, divorce, or the birth of a child may necessitate updates to your beneficiaries.