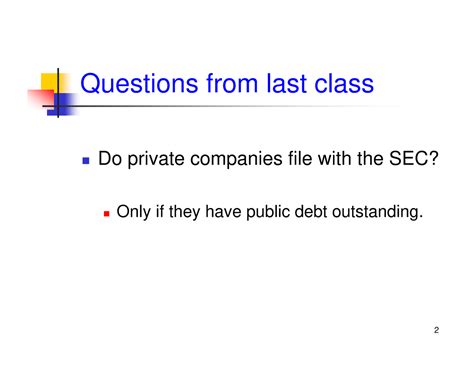

Private Companies File SEC Paperwork

Introduction to SEC Filing for Private Companies

When private companies decide to go public or engage in certain financial activities, they are required to file paperwork with the Securities and Exchange Commission (SEC). This process can be complex and involves submitting detailed financial information and other disclosures. The SEC is responsible for protecting investors, maintaining fair and efficient markets, and facilitating capital formation. In this context, understanding the SEC filing process is crucial for private companies aiming to comply with regulatory requirements and achieve their financial goals.

Why Do Private Companies Need to File SEC Paperwork?

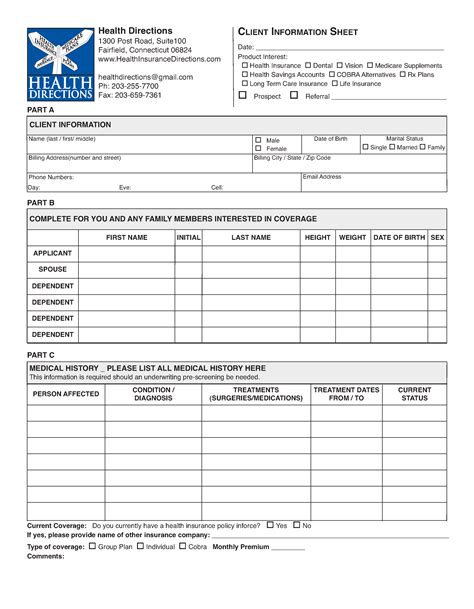

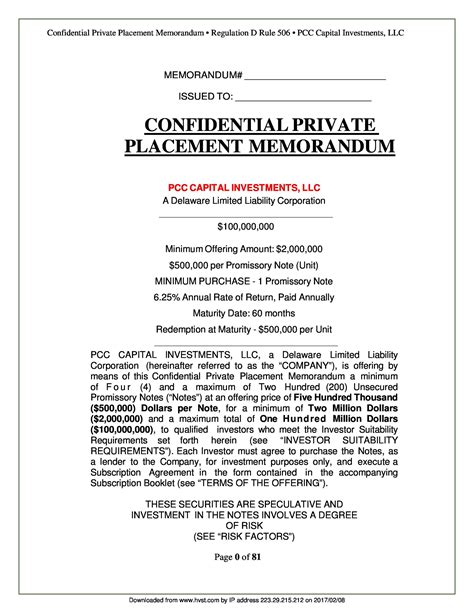

Private companies may need to file SEC paperwork for several reasons, including: * Initial Public Offerings (IPOs): When a private company decides to go public, it must file a registration statement with the SEC. This statement provides detailed information about the company, including its financial condition, business operations, management, and the terms of the offering. * Mergers and Acquisitions: Private companies involved in mergers and acquisitions may need to file paperwork with the SEC, especially if the transaction involves the issuance of securities. * Private Placements: Companies that issue securities through private placements may need to file a notice with the SEC, depending on the exemption used. * Reporting Requirements: Once a company goes public, it is subject to ongoing reporting requirements, which include filing periodic reports (such as Form 10-K and Form 10-Q) and current reports (Form 8-K) with the SEC.

Types of SEC Filings for Private Companies

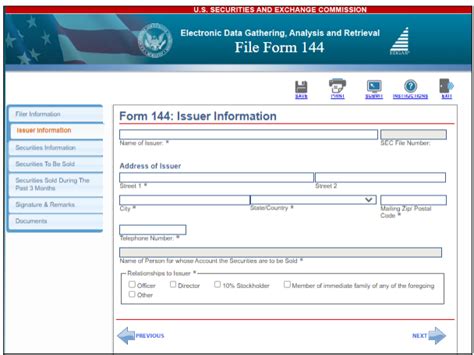

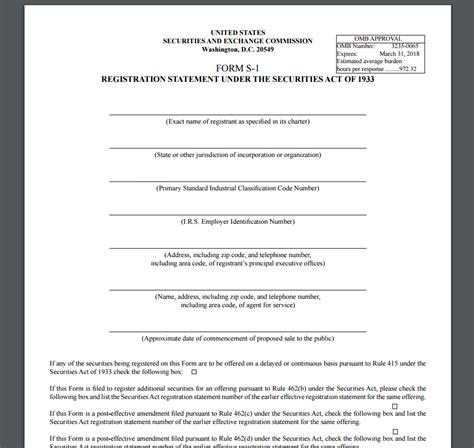

Private companies may need to make various types of SEC filings, including: * Form D: Used for private placements, this form provides notice of an exempt offering of securities. * Schedule 13D: Filed by beneficial owners of more than 5% of a registered equity security, this schedule discloses the ownership and intentions of the filer. * Form 8-K: Used to report significant events, such as changes in control, acquisitions, or financial statements. * Registration Statements (Form S-1, Form S-3, etc.): Used for IPOs and other public offerings, these statements provide comprehensive information about the issuer and the offering.

Steps Involved in Filing SEC Paperwork

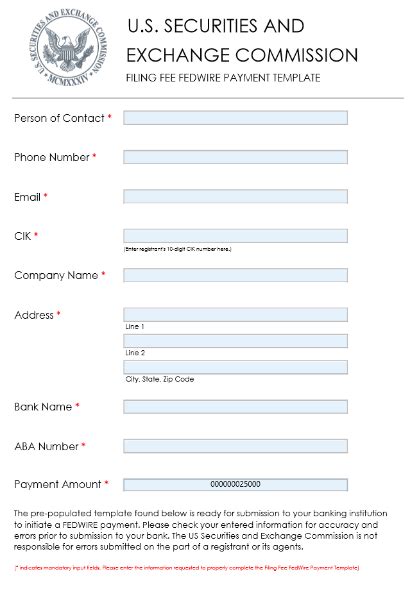

The process of filing SEC paperwork involves several steps: * Determine the Appropriate Filing: Identify the type of filing required based on the company’s activities and the applicable SEC rules. * Prepare the Filing: Gather all necessary information and draft the filing, ensuring compliance with SEC regulations and the specific requirements of the form. * Review and Edit: Review the draft filing for accuracy and completeness, making any necessary edits before submission. * Submit the Filing: File the document through the SEC’s EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system, which is the primary system for companies and others to submit filings to the SEC. * Pay Fees: Pay any required filing fees.

Importance of Compliance with SEC Regulations

Compliance with SEC regulations is critical for private companies. Failure to comply can result in: * Penalties and Fines: The SEC can impose significant penalties and fines for non-compliance. * Reputational Damage: Non-compliance can damage a company’s reputation and erode investor confidence. * Legal Action: In severe cases, non-compliance can lead to legal action, including lawsuits and enforcement proceedings.

💡 Note: Private companies should consult with legal and financial advisors to ensure compliance with all applicable SEC regulations and to navigate the complex filing process effectively.

Best Practices for Private Companies Filing SEC Paperwork

To ensure a smooth and compliant SEC filing process, private companies should: * Stay Informed: Keep up-to-date with the latest SEC regulations and filing requirements. * Plan Ahead: Allow sufficient time for the preparation and review of filings to avoid last-minute rushes and potential errors. * Seek Professional Advice: Consult with experienced legal, financial, and accounting professionals to ensure compliance and accuracy in filings. * Maintain Accurate Records: Keep detailed and accurate financial and operational records to facilitate the filing process and support compliance efforts.

| Form Type | Purpose | Filing Requirements |

|---|---|---|

| Form D | Notice of Exempt Offering of Securities | Within 15 days after the first sale of securities |

| Form 8-K | Current Report | As soon as practicable, but not later than 4 business days after the event |

| Registration Statements (Form S-1, Form S-3, etc.) | Registration of Securities | Before the offering of securities to the public |

As private companies navigate the process of filing SEC paperwork, understanding the requirements, types of filings, and the importance of compliance is essential for successful regulatory navigation and achieving business objectives. By following best practices and seeking professional advice when needed, companies can ensure they are well-prepared for the complexities of SEC filings.

In wrapping up this discussion, the key points to remember include the necessity of understanding SEC regulations, the types of filings required for different activities, and the critical nature of compliance to avoid penalties and maintain a positive reputation. Whether a company is preparing for an IPO, engaging in private placements, or simply ensuring ongoing compliance as a public entity, a thorough understanding of the SEC filing process is indispensable.

What is the primary purpose of the SEC?

+

The primary purpose of the SEC is to protect investors, maintain fair and efficient markets, and facilitate capital formation.

What types of companies need to file SEC paperwork?

+

Public companies and private companies that engage in certain financial activities, such as IPOs or private placements, need to file SEC paperwork.

What are the consequences of non-compliance with SEC regulations?

+

Non-compliance can result in penalties, fines, reputational damage, and legal action, including lawsuits and enforcement proceedings.