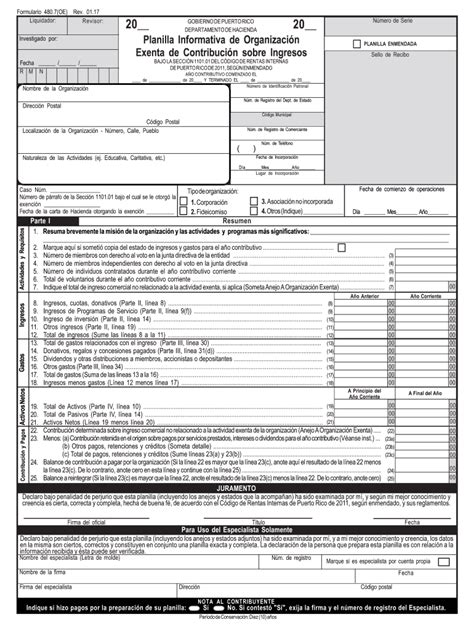

Paperwork

7 Tax Forms

Understanding Tax Forms: A Comprehensive Guide

When it comes to filing taxes, understanding the various tax forms is crucial. The process can be overwhelming, especially for those who are new to filing taxes. In this guide, we will break down the key tax forms, their purposes, and who needs to file them. Tax forms are documents used by individuals and businesses to report their income, expenses, and other tax-related information to the government.

Types of Tax Forms

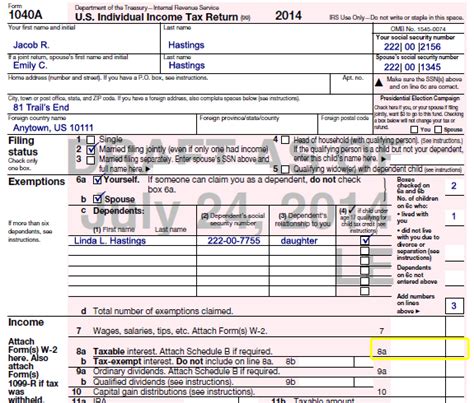

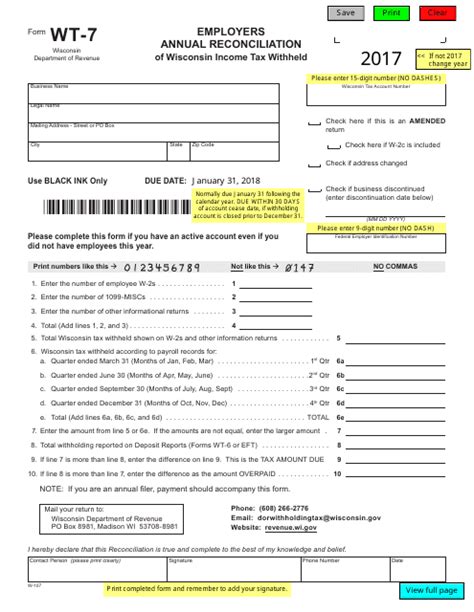

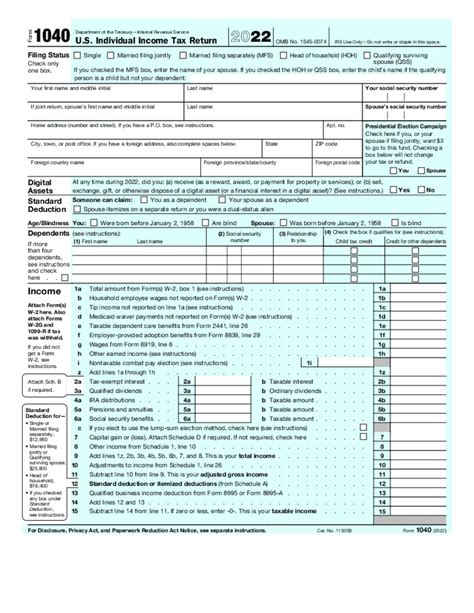

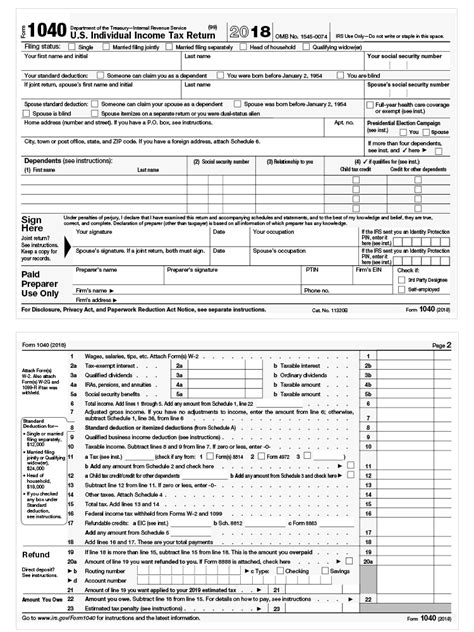

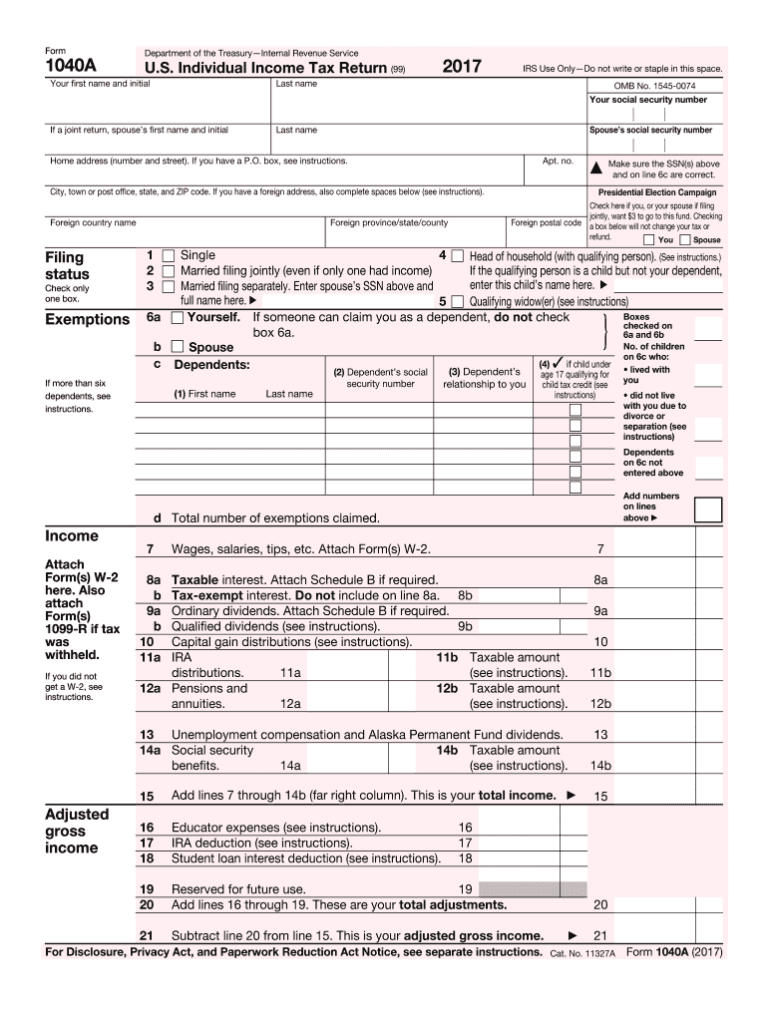

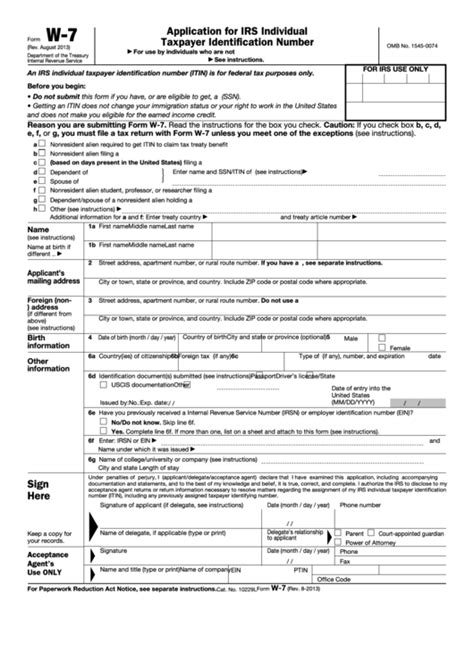

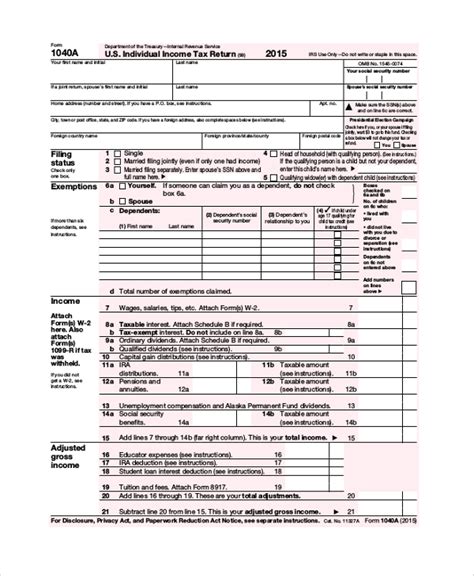

There are several types of tax forms, each serving a specific purpose. Here are 7 common tax forms: * Form 1040: The standard form used for personal income tax returns. * Form W-2: Used by employers to report employee income and taxes withheld. * Form 1099: Reports income earned from self-employment, freelancing, or contract work. * Form 1040EZ: A simplified version of Form 1040, used for those with basic tax returns. * Form 8962: Used to claim the Premium Tax Credit for health insurance premiums. * Form 8829: Used to calculate business use of your home deductions. * Form 4562: Used to claim depreciation and amortization on business assets.

Filing Tax Forms

Filing tax forms can be done electronically or by mail. E-filing is the faster and more secure method, allowing for quicker refunds and reduced errors. The IRS (Internal Revenue Service) provides free e-filing options for those who qualify. When filing by mail, make sure to use the correct mailing address and follow the instructions carefully.

Deadlines and Penalties

Tax forms have specific deadlines, and failing to meet these deadlines can result in penalties and interest on the amount owed. The standard deadline for personal income tax returns is April 15th. However, this deadline can be extended by filing Form 4868, which grants an automatic six-month extension.

📝 Note: Missing the deadline can lead to penalties, so it’s essential to plan ahead and file on time.

Tax Forms for Businesses

Businesses have their own set of tax forms, which vary depending on the type of business and its structure. Form 1120 is used for corporations, while Form 1065 is used for partnerships. Form 1040 is used for sole proprietorships and single-member LLCs. Businesses must also file Form W-2 and Form 1099 for their employees and contractors.

| Business Type | Tax Form |

|---|---|

| Corporation | Form 1120 |

| Partnership | Form 1065 |

| Sole Proprietorship | Form 1040 |

Conclusion and Final Thoughts

In conclusion, understanding tax forms is essential for individuals and businesses to navigate the tax filing process. By knowing which forms to file and when, you can avoid penalties and ensure you’re taking advantage of the deductions and credits you’re eligible for. Remember to stay organized, keep accurate records, and seek professional help if needed. Tax filing may seem complex, but with the right guidance, you can master the process and make tax season less stressful.

What is the deadline for filing personal income tax returns?

+

The standard deadline for personal income tax returns is April 15th. However, this deadline can be extended by filing Form 4868, which grants an automatic six-month extension.

What is the difference between Form 1040 and Form 1040EZ?

+

Form 1040 is the standard form used for personal income tax returns, while Form 1040EZ is a simplified version used for those with basic tax returns. Form 1040EZ is used for single or joint filers with no dependents, income below $100,000, and no deductions or credits.

Can I file tax forms electronically?

+

Yes, you can file tax forms electronically through the IRS website or authorized e-file providers. E-filing is faster, more secure, and allows for quicker refunds.