-

7 Tax Tips

Learn how long to keep tax paperwork, including receipts, invoices, and returns, to ensure compliance with IRS guidelines and maintain accurate tax records, minimizing audit risks and maximizing deductions.

Read More » -

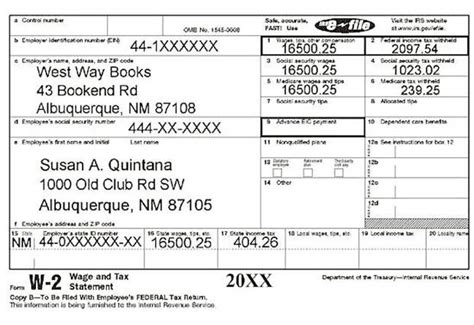

Get Tax Return Paperwork

Learn how to get tax return paperwork easily, including W-2 forms, 1099 forms, and other necessary tax documents, to file your income tax return accurately and maximize your refund with tax preparation and filing guidance.

Read More » -

5 Tax Forms Homeowners Need

Homeowners need specific paperwork to file taxes, including mortgage interest statements, property tax receipts, and home office deductions, to claim tax credits and deductions like the Mortgage Interest Credit and Home Office Deduction.

Read More » -

Lost Tax Paperwork Last Year

Lost last year's tax paperwork? Don't panic, learn how to recover missing tax returns, W-2 forms, and 1099 statements, and understand tax filing consequences, audit risks, and IRS solutions for previous year's tax documentation.

Read More » -

5 Tax Paperwork Tips

Learn how to organize tax paperwork with easy tips and tricks, including tax document sorting, digital storage, and record-keeping for deductions and receipts, making tax season stress-free and streamlined.

Read More » -

5 Tax Deadline Tips

Discover the last day to receive tax paperwork, including W-2 and 1099 forms, for timely tax filing and avoiding penalties, with insights on tax deadlines, extensions, and IRS requirements.

Read More » -

7 Tips Tax Papers

Keep tax return paperwork for 3-7 years, depending on audit risk, including W-2 forms, 1099s, and receipts, to ensure compliance with IRS record-keeping requirements and potential tax audits, deductions, and credits.

Read More » -

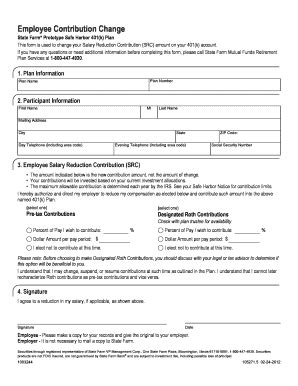

5 Tips 401k

Learn how to fill out 401k paperwork with ease, navigating retirement plans, contribution limits, and investment options, to secure your financial future with employer-matched savings and tax benefits.

Read More » -

7 Tax Paperwork Tips

Keep income tax paperwork for at least 3 years to ensure audit compliance, including W-2 forms, 1099s, and receipts for tax deductions and credits, to maintain accurate tax records and minimize IRS audit risks.

Read More » -

7 Tax Forms

File taxes with ease, knowing what paperwork to gather, including W-2s, 1099s, and receipts, to ensure accurate tax returns and maximize deductions, making tax filing a seamless process with necessary tax documents.

Read More »