5 Tax Forms Homeowners Need

Introduction to Tax Forms for Homeowners

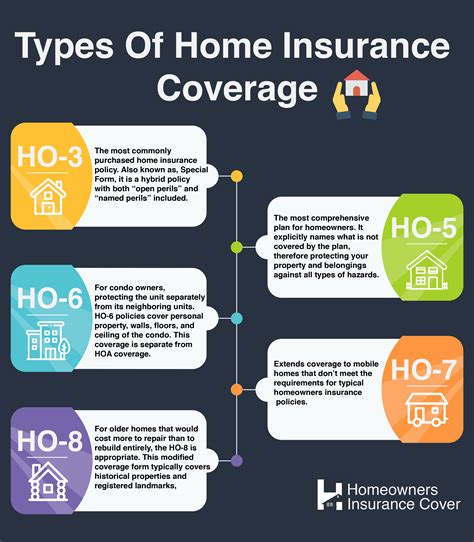

As a homeowner, understanding the various tax forms you need to file can be overwhelming, especially when it comes to taking advantage of deductions and credits that can reduce your tax liability. The process involves several key forms and schedules that are crucial for accurately reporting your income, deductions, and credits to the Internal Revenue Service (IRS). In this guide, we will walk through the essential tax forms that homeowners need to be familiar with, including those related to mortgage interest, property taxes, home office deductions, and more.

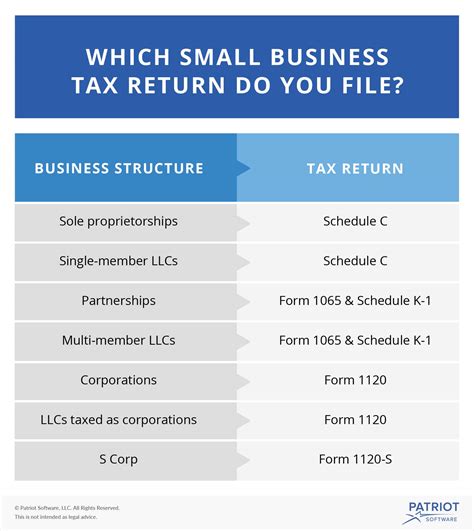

Understanding Key Tax Forms

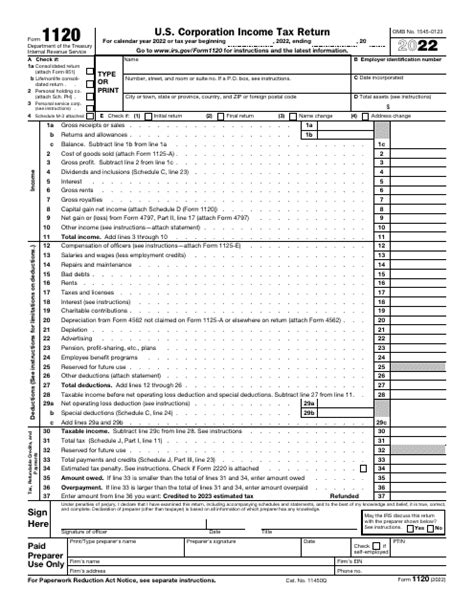

Homeownership comes with several tax benefits, but navigating the relevant tax forms can be complex. Here are the primary forms you should know about:

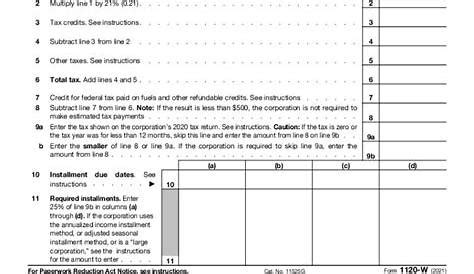

- Form 1040: This is the standard form used for personal income tax returns. It’s where you’ll report your income, claim deductions and credits, and calculate your tax refund or amount owed.

- Schedule A (Form 1040): If you itemize deductions, you’ll use Schedule A to list them out. For homeowners, this often includes mortgage interest, property taxes, and potentially home office deductions.

- Form 1098: Your lender will provide you with a Form 1098, which shows how much mortgage interest you paid during the year. This is a crucial document for claiming the mortgage interest deduction.

- Form 8829: If you use a portion of your home for business, you might be eligible for a home office deduction. Form 8829 is used to calculate this deduction based on the business use percentage of your home.

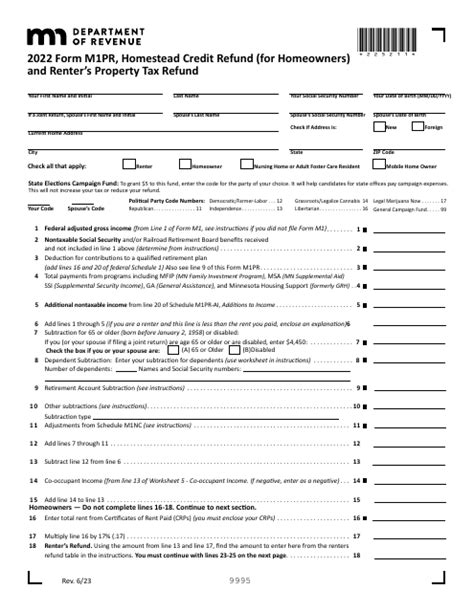

Deductions and Credits for Homeowners

Homeowners can benefit from several deductions and credits that can significantly reduce their tax liability. Here are some key ones to consider:

- Mortgage Interest Deduction: One of the most significant deductions for homeowners is the mortgage interest deduction. This allows you to deduct the interest you pay on your mortgage from your taxable income, which can lead to substantial savings.

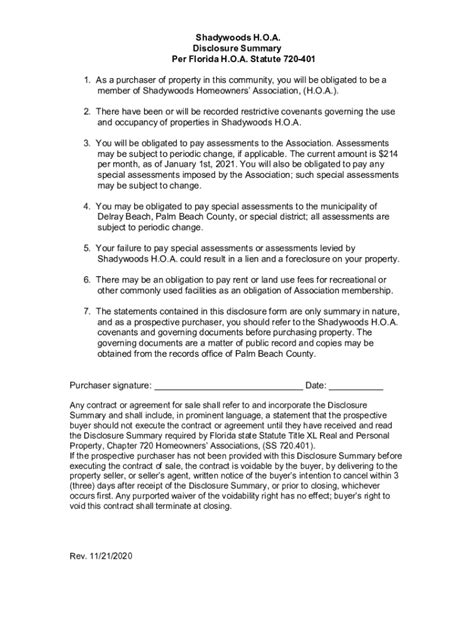

- Property Tax Deduction: You can also deduct your property taxes. However, there are limits to how much you can deduct, especially with the changes introduced by the Tax Cuts and Jobs Act (TCJA).

- Home Office Deduction: If you work from home and use a dedicated space for your business, you might be eligible for the home office deduction. This can help offset the costs of maintaining that space.

- Mortgage Points Deduction: When you buy a house or refinance your mortgage, you might pay points to lower your interest rate. These points can be deductible over the life of the loan or in the year they’re paid, depending on the circumstances.

Tables for Quick Reference

Here’s a quick reference table to help you understand which forms are used for which deductions:

| Deduction | Relevant Form(s) |

|---|---|

| Mortgage Interest | Form 1040, Schedule A, Form 1098 |

| Property Taxes | Form 1040, Schedule A |

| Home Office | Form 1040, Form 8829 |

| Mortgage Points | Form 1040, Schedule A |

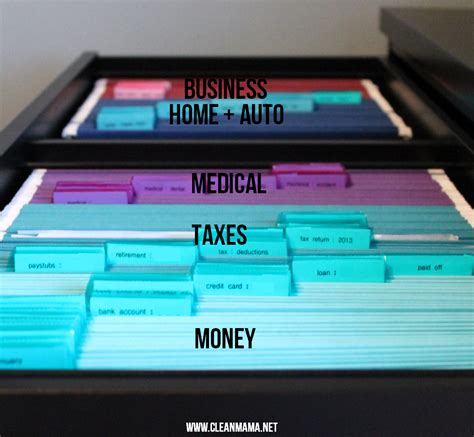

📝 Note: It's essential to keep accurate records of your mortgage interest payments, property taxes, and any home office expenses to ensure you can claim these deductions accurately.

Steps to File Your Tax Return as a Homeowner

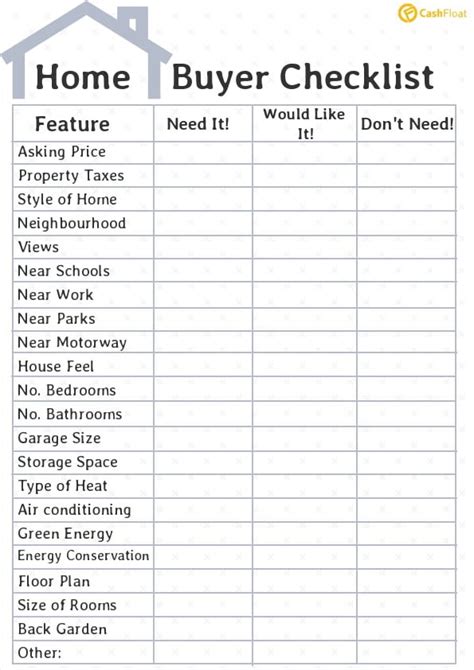

Filing your tax return as a homeowner involves several steps, including gathering your documents, deciding whether to itemize deductions, and actually filing your return. Here’s a simplified overview:

- Gather all relevant documents, including your W-2, Form 1098, and any receipts for home improvements or expenses.

- Determine if you will itemize deductions or take the standard deduction. For many homeowners, itemizing can provide greater tax savings, especially if you have significant mortgage interest and property tax payments.

- Use tax software or consult with a tax professional to help guide you through the process, especially if you’re claiming a home office deduction or have complex tax situations.

- Once you’ve prepared your return, you can e-file it through the IRS website or mail a paper return. Be sure to keep a copy of your return and supporting documents for your records.

As you navigate the world of tax forms and deductions as a homeowner, remember that tax laws and regulations can change. Staying informed and consulting with a tax professional can help ensure you’re taking full advantage of the deductions and credits available to you.

In the end, understanding and utilizing the appropriate tax forms and deductions can make a significant difference in your tax liability, helping you save money and make the most of your investment in your home. By being proactive and informed, you can ensure you’re taking full advantage of the tax benefits of homeownership.

What is the primary form used for personal income tax returns?

+

The primary form used for personal income tax returns is Form 1040.

How do I report mortgage interest for tax purposes?

+

You report mortgage interest on Schedule A (Form 1040), using the information provided on Form 1098 from your lender.

Can I deduct property taxes on my tax return?

+

Yes, property taxes are deductible on Schedule A (Form 1040), but there are limits to how much you can deduct, especially with the changes introduced by the Tax Cuts and Jobs Act (TCJA).