5 Tips Organize Bills

Introduction to Bill Organization

Managing bills can be a daunting task, especially with the numerous services and subscriptions we pay for monthly. From electricity and water to internet and streaming services, it’s easy to lose track of what needs to be paid and when. However, staying on top of your bills is crucial for maintaining a good credit score, avoiding late fees, and ensuring that you have access to the services you need. In this article, we’ll explore five tips to help you organize your bills effectively.

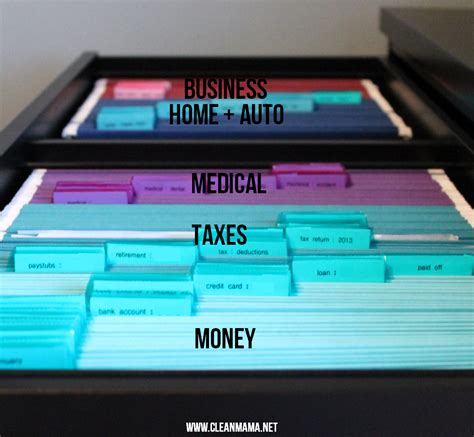

Understanding Your Bills

Before you can start organizing your bills, you need to understand what you’re dealing with. Take some time to gather all of your bills and sort them into categories. This could include:

- Essential services like electricity, water, and gas

- Communication services like phone, internet, and TV

- Subscription services like streaming platforms and software

- Loan payments and credit card bills

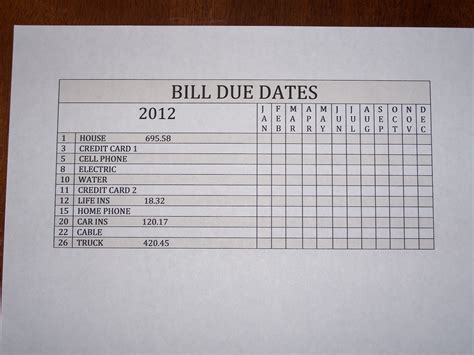

Tip 1: Create a Bill Calendar

One of the most effective ways to stay on top of your bills is to create a bill calendar. This can be a physical calendar or a digital one, whichever you prefer. Write down the due date for each bill and the amount that needs to be paid. You can also set reminders for a few days before each bill is due to ensure that you never miss a payment. A bill calendar helps you visualize your bill payments and plan your finances accordingly.

Tip 2: Automate Your Payments

Another way to simplify your bill payments is to automate them. Many service providers offer autopay options, which allow you to set up recurring payments that are automatically deducted from your bank account. This way, you’ll never have to worry about missing a payment again. Just be sure to keep enough money in your account to cover the payments. Automating your payments can save you time and reduce the risk of late fees.

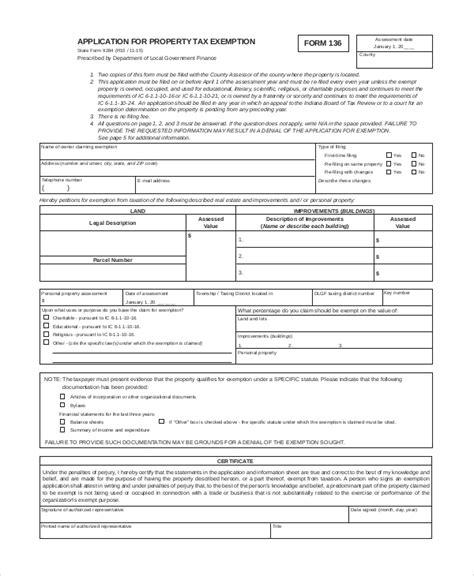

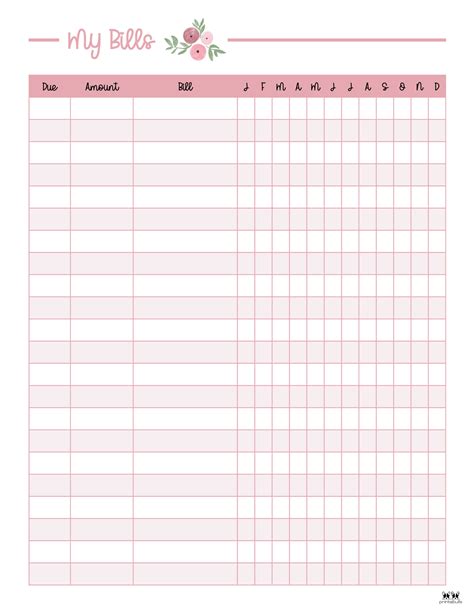

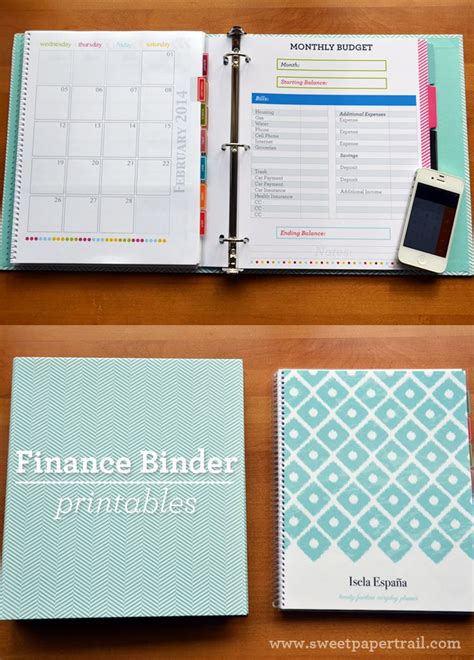

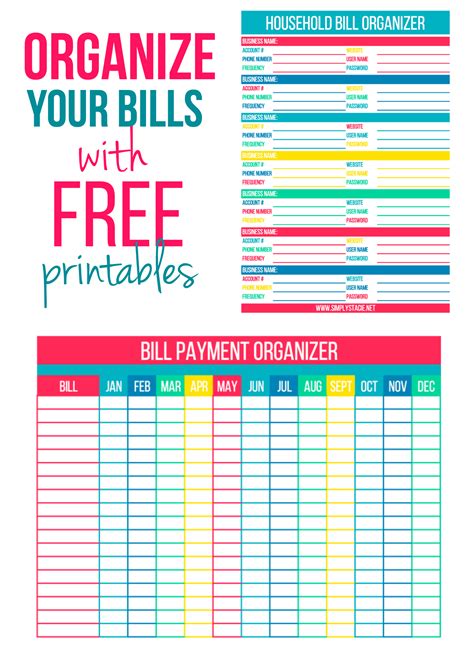

Tip 3: Use a Bill Tracker

A bill tracker is a tool that helps you keep track of your bills and payments. You can use a spreadsheet or a budgeting app to create a bill tracker. Write down the bill name, due date, amount, and payment status. This will help you stay organized and ensure that you’re paying all of your bills on time. You can also use a bill tracker to identify areas where you can cut back and save money.

Tip 4: Prioritize Your Bills

If you’re struggling to pay all of your bills, it’s essential to prioritize them. Start by identifying the essential services that you need to pay, such as electricity and water. Then, focus on paying the bills with the highest interest rates or the most significant late fees. By prioritizing your bills, you can avoid late fees and ensure that you have access to the services you need.

Tip 5: Review and Adjust

Finally, it’s essential to review and adjust your bill organization system regularly. Check your budget and bill tracker to see if there are any areas where you can improve. Look for ways to reduce your expenses and save money. You can also use this opportunity to negotiate with service providers or switch to cheaper alternatives. Regularly reviewing and adjusting your bill organization system can help you stay on top of your finances and achieve your financial goals.

💡 Note: Regularly reviewing your bills and payments can help you identify errors or discrepancies and ensure that you're not overpaying for services.

In summary, organizing your bills is crucial for maintaining a good credit score, avoiding late fees, and ensuring that you have access to the services you need. By creating a bill calendar, automating your payments, using a bill tracker, prioritizing your bills, and reviewing and adjusting your system regularly, you can stay on top of your bills and achieve your financial goals.

What is the best way to organize bills?

+

The best way to organize bills is to create a bill calendar, automate payments, use a bill tracker, prioritize bills, and review and adjust the system regularly.

How can I avoid late fees?

+

You can avoid late fees by setting up autopay, using a bill tracker, and prioritizing your bills. It’s also essential to review your budget and adjust your bill organization system regularly.

What is a bill tracker?

+

A bill tracker is a tool that helps you keep track of your bills and payments. You can use a spreadsheet or a budgeting app to create a bill tracker.