Refinance Paperwork Timeline

Introduction to Refinancing

Refinancing a mortgage can be a great way to save money on interest, switch from an adjustable-rate to a fixed-rate loan, or tap into your home’s equity. However, the process can be complex and time-consuming. One of the most important aspects of refinancing is understanding the refinancing paperwork timeline. In this article, we will break down the steps involved in refinancing and provide a detailed timeline of the paperwork process.

Pre-Refinancing Steps

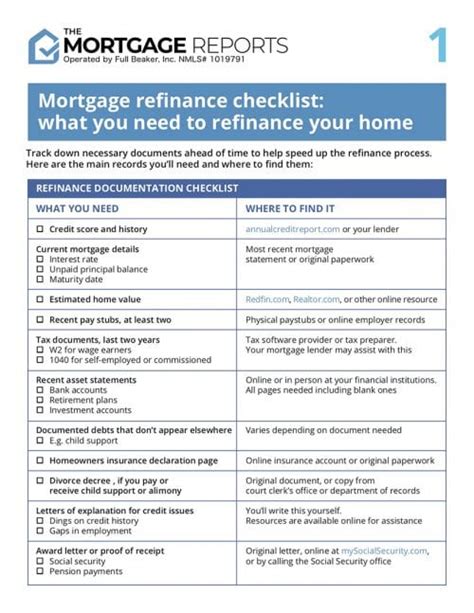

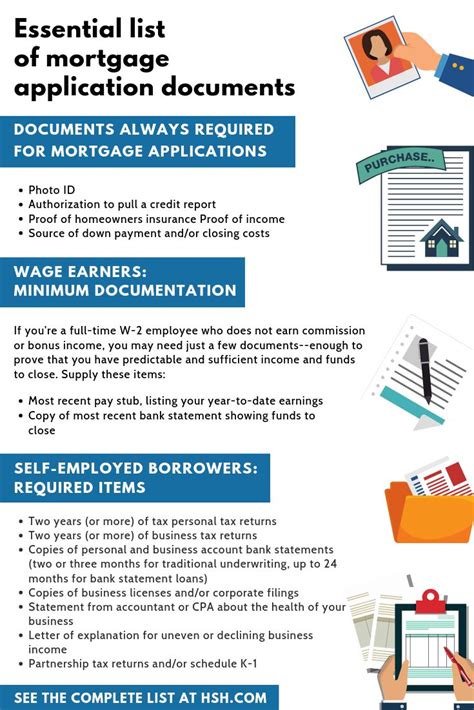

Before starting the refinancing process, it’s essential to take a few preliminary steps. These include: * Checking your credit score and report to ensure there are no errors or surprises * Gathering financial documents, such as pay stubs, bank statements, and tax returns * Shopping around for lenders and comparing rates and terms * Determining your refinancing goals, such as lowering your monthly payment or paying off your loan faster

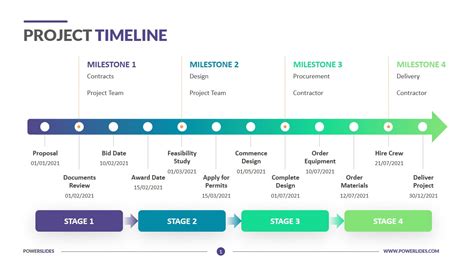

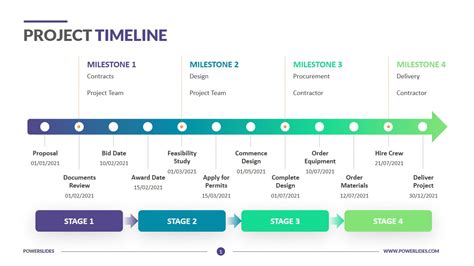

Refinancing Paperwork Timeline

The refinancing paperwork timeline can vary depending on the lender and the complexity of the loan. However, here is a general outline of the steps involved: * Day 1-3: Application and pre-approval + Submit your application and provide financial documents to the lender + Receive pre-approval and a Good Faith Estimate (GFE) of closing costs * Day 4-10: Processing and underwriting + The lender reviews your application and orders an appraisal of your property + The underwriter reviews your credit report, income, and debt-to-income ratio * Day 11-17: Appraisal and inspection + The appraiser inspects your property and provides a report to the lender + The lender reviews the appraisal report and orders any additional inspections or tests * Day 18-24: Final approval and closing + The lender issues a final approval and a Closing Disclosure (CD) statement + You review and sign the CD statement and complete any final paperwork

Key Documents in the Refinancing Process

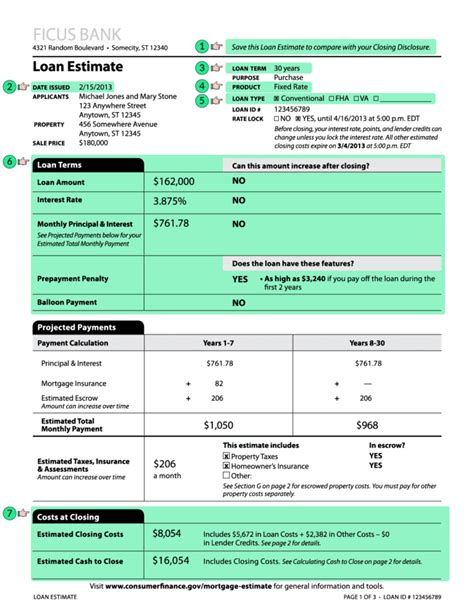

There are several key documents involved in the refinancing process. These include: * Application: The initial application for refinancing, which includes personal and financial information * Good Faith Estimate (GFE): An estimate of closing costs provided by the lender * Appraisal report: A report provided by the appraiser that estimates the value of your property * Closing Disclosure (CD) statement: A statement that outlines the final terms of the loan, including the interest rate, monthly payment, and closing costs

Common Refinancing Mistakes to Avoid

There are several common mistakes to avoid when refinancing a mortgage. These include: * Failing to shop around for lenders: Compare rates and terms from multiple lenders to ensure you get the best deal * Not checking your credit report: Errors on your credit report can affect your interest rate and ability to qualify for a loan * Not understanding the terms of the loan: Make sure you understand the interest rate, monthly payment, and closing costs before signing any paperwork

💡 Note: Refinancing can be a complex and time-consuming process. It's essential to work with a reputable lender and to carefully review all paperwork before signing.

Refinancing Costs and Fees

Refinancing a mortgage can involve several costs and fees. These include: * Origination fee: A fee charged by the lender for processing the loan * Discount points: Fees paid to the lender to reduce the interest rate * Appraisal fee: A fee paid to the appraiser for estimating the value of your property * Closing costs: Fees paid to the lender and other parties involved in the transaction, such as title insurance and escrow fees

| Cost/Fee | Typical Range |

|---|---|

| Origination fee | 0.5-1.0% of the loan amount |

| Discount points | 0.25-1.0% of the loan amount |

| Appraisal fee | $300-$1,000 |

| Closing costs | 2-5% of the loan amount |

In summary, refinancing a mortgage can be a great way to save money on interest, switch to a fixed-rate loan, or tap into your home’s equity. However, it’s essential to understand the refinancing paperwork timeline and to carefully review all paperwork before signing. By avoiding common mistakes and understanding the costs and fees involved, you can ensure a smooth and successful refinancing process.

To recap, the key points to consider when refinancing a mortgage include understanding the refinancing paperwork timeline, avoiding common mistakes, and carefully reviewing all paperwork before signing. It’s also essential to shop around for lenders, check your credit report, and understand the terms of the loan. By following these tips, you can ensure a successful refinancing process and start saving money on your mortgage payments.

What is the typical refinancing paperwork timeline?

+

The typical refinancing paperwork timeline can vary depending on the lender and the complexity of the loan. However, it usually takes around 30-60 days from application to closing.

What are the common refinancing mistakes to avoid?

+

Common refinancing mistakes to avoid include failing to shop around for lenders, not checking your credit report, and not understanding the terms of the loan.

What are the typical costs and fees associated with refinancing a mortgage?

+

The typical costs and fees associated with refinancing a mortgage include origination fees, discount points, appraisal fees, and closing costs. These can range from 2-5% of the loan amount.