5 GEICO Insurance Tips

Understanding GEICO Insurance

When it comes to insurance, one of the most recognizable names in the industry is GEICO. Known for their catchy advertisements and promise of saving customers 15% or more on car insurance, GEICO has become a household name. However, navigating the world of insurance can be complex, and it’s essential to understand the intricacies of GEICO’s policies and how to make the most out of them. In this article, we will delve into five valuable tips for getting the most out of your GEICO insurance.

Tip 1: Bundle Your Policies

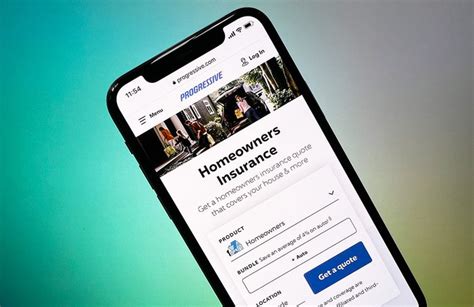

One of the most effective ways to save money with GEICO is by bundling your insurance policies. If you have multiple vehicles or types of insurance (such as home, renters, or condo insurance), combining them under GEICO can lead to significant discounts. This approach not only saves you money but also simplifies your insurance management by having all your policies in one place. When bundling, ensure you understand the terms and conditions of each policy, as they may vary.

Tip 2: Take Advantage of Discounts

GEICO offers a wide range of discounts that can lower your premium rates. These include: - Good Student Discount: Available for students with good grades. - Military Discount: For active and former military personnel. - Defensive Driving Course Discount: After completing an approved defensive driving course. - Multi-Vehicle Discount: For insuring multiple vehicles under the same policy. - Membership and Employee Discounts: For members of certain organizations or employees of participating companies. It’s crucial to review the discounts GEICO offers and apply for those you’re eligible for to maximize your savings.

Tip 3: Customize Your Coverage

Customizing your insurance coverage to fit your specific needs can help ensure you’re not overpaying for features you don’t require. GEICO allows policyholders to adjust their coverage levels, deductibles, and add optional features such as roadside assistance or rental car coverage. When customizing, consider factors like the value of your vehicle, your driving habits, and your financial situation to make informed decisions.

Tip 4: Utilize GEICO’s Digital Tools

GEICO provides a variety of digital tools and resources that can help you manage your policy more efficiently. The GEICO mobile app, for instance, allows you to: - View and manage your policies. - Pay bills. - Submit claims. - Access digital insurance cards. - Get quotes for additional policies. Staying connected through these digital platforms can enhance your overall experience with GEICO and provide you with easy access to the information and services you need.

Tip 5: Regularly Review Your Policy

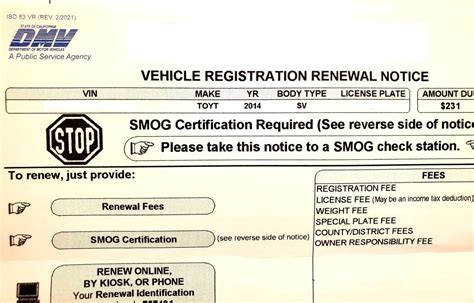

Insurance needs can change over time due to life events, changes in driving habits, or the acquisition of new assets. It’s essential to regularly review your GEICO policy to ensure it continues to meet your needs. Consider factors such as: - Changes in marital status or the addition of new drivers to your household. - Moves to a new location, as insurance rates can vary significantly by area. - The purchase of new vehicles or assets that may require additional coverage. By periodically assessing your situation and adjusting your policy as necessary, you can ensure you have the right coverage without overpaying.

📝 Note: Always keep your policy documents and contact information up to date to avoid any issues with claims or renewals.

In the world of insurance, being informed and proactive is key to saving money and ensuring you have the right protection. By following these tips and staying engaged with your GEICO policy, you can navigate the complexities of insurance with confidence and make the most out of your coverage.

As we reflect on the importance of optimized insurance coverage, it becomes clear that understanding and leveraging the features and discounts offered by providers like GEICO can significantly impact our financial security and peace of mind. Whether you’re a long-time policyholder or considering switching to GEICO, taking the time to review and adjust your insurance strategy can lead to better protection and more savings in the long run.

What types of insurance does GEICO offer?

+

GEICO offers a variety of insurance types, including auto, home, renters, condo, motorcycle, ATV, boat, and more. They also provide life insurance and umbrella insurance for additional protection.

How do I get a quote from GEICO?

+

You can get a quote from GEICO by visiting their official website, calling their customer service number, or using their mobile app. You’ll need to provide some basic information about yourself and what you’re looking to insure.

Can I manage my GEICO policy online?

+

Yes, GEICO allows policyholders to manage their policies online through their website or mobile app. You can view your policy details, make payments, submit claims, and more, all from the convenience of your computer or mobile device.