Lost Tax Paperwork Last Year

Lost Tax Paperwork Last Year: What to Do Next

If you’ve lost your tax paperwork from last year, you’re not alone. Many people misplace important documents, and it can be especially stressful when it comes to tax season. The good news is that there are steps you can take to recover your lost paperwork and get back on track with your taxes. In this article, we’ll walk you through the process of recovering lost tax paperwork and provide tips on how to avoid losing important documents in the future.

Understanding the Importance of Tax Paperwork

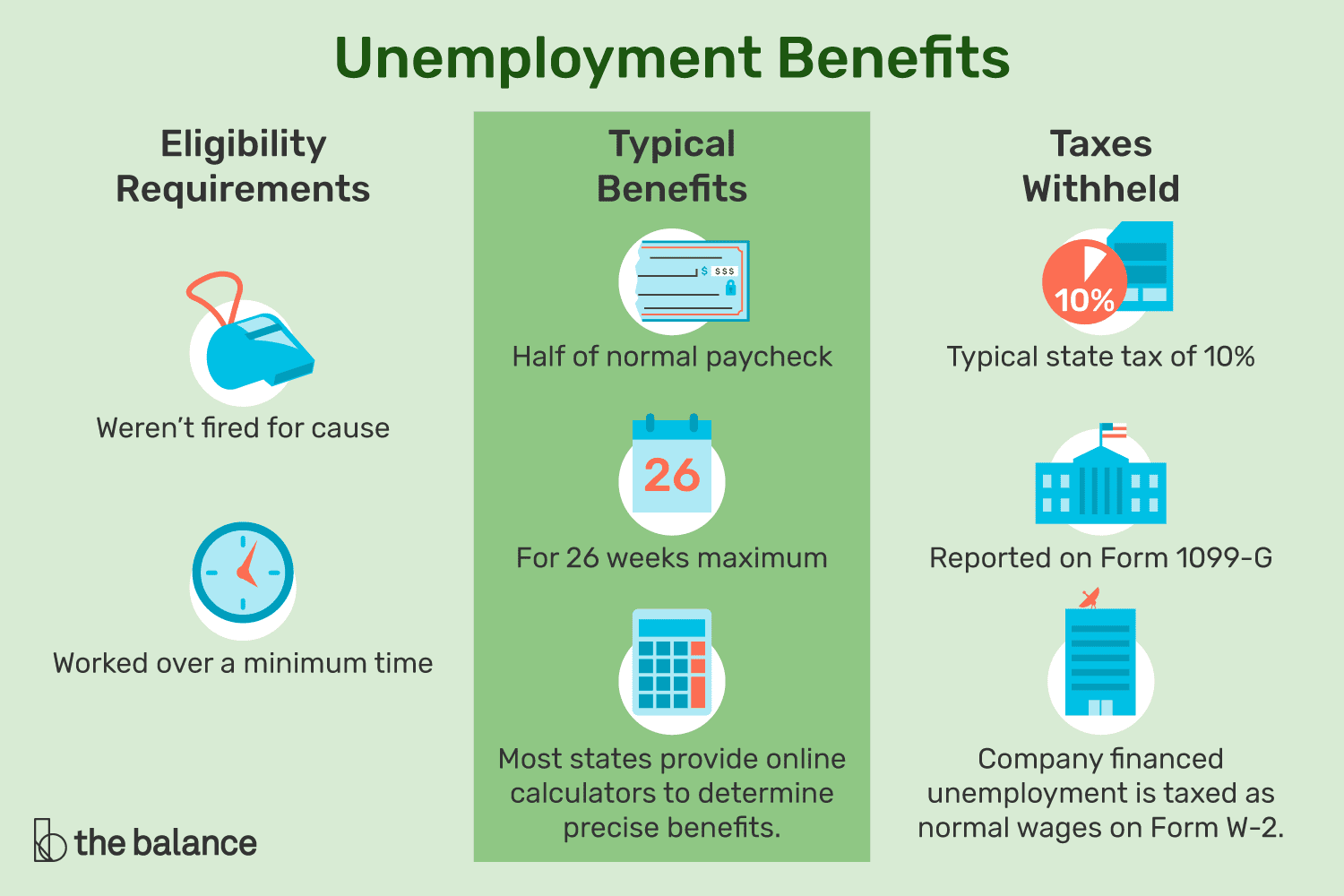

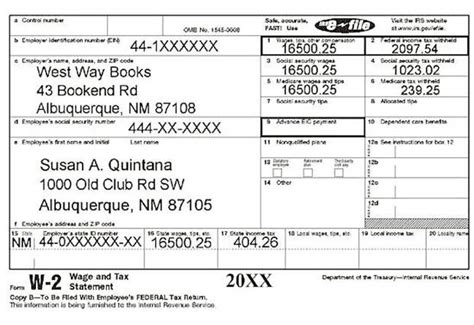

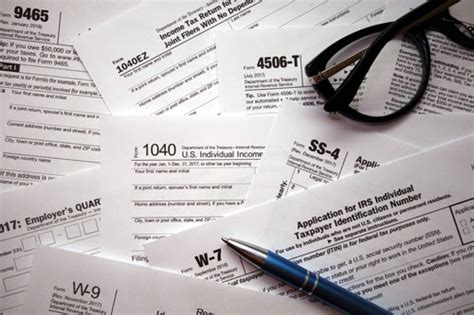

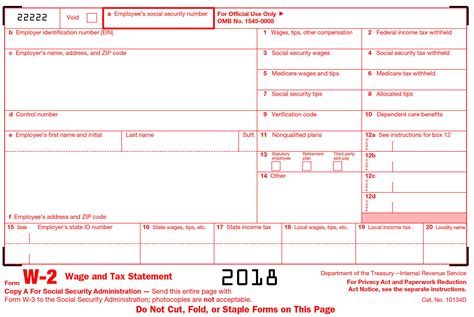

Before we dive into the steps to recover lost tax paperwork, it’s essential to understand the importance of these documents. Your tax paperwork, including your W-2 forms, 1099 forms, and other supporting documents, are crucial for filing your tax return. These documents provide the necessary information for calculating your tax liability, claiming deductions and credits, and ensuring you receive any refunds you’re eligible for. Without these documents, you may face delays or even penalties when filing your taxes.

Steps to Recover Lost Tax Paperwork

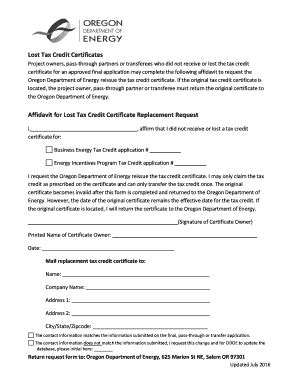

If you’ve lost your tax paperwork, don’t panic. Here are the steps you can take to recover your lost documents: * Contact your employer: If you’ve lost your W-2 form, contact your employer’s HR or payroll department to request a duplicate copy. They may be able to provide you with a replacement form or direct you to the IRS website to access your form online. * Contact the IRS: If you’re unable to obtain a duplicate W-2 form from your employer, you can contact the IRS directly. They may be able to provide you with a transcript of your W-2 form, which can be used to file your tax return. * Gather other supporting documents: In addition to your W-2 form, you may have other supporting documents, such as 1099 forms, interest statements, or charitable donation receipts. Gather these documents to ensure you have everything you need to file your tax return. * Use online resources: The IRS website offers a range of online resources, including the IRS Tax Transcript tool, which allows you to access your tax information online.

📝 Note: When requesting duplicate documents, be prepared to provide identification and other verifying information to ensure the security of your tax information.

Tips for Avoiding Lost Tax Paperwork in the Future

To avoid the stress and hassle of lost tax paperwork in the future, consider the following tips: * Create a centralized filing system: Designate a specific folder or file to store all your tax-related documents, including your W-2 forms, 1099 forms, and other supporting documents. * Go digital: Consider scanning your tax documents and storing them electronically. This can help you keep track of your documents and reduce the risk of loss or damage. * Set reminders: Mark your calendar to remind you when your tax documents are due to arrive, and follow up with your employer or the IRS if you haven’t received them. * Stay organized: Keep all your tax-related documents in one place, and consider using a tax preparation software to help you stay organized and on track.

Common Mistakes to Avoid

When dealing with lost tax paperwork, there are several common mistakes to avoid: * Waiting too long to request duplicate documents: Don’t delay in requesting duplicate documents, as this can cause delays in filing your tax return. * Not keeping accurate records: Failing to keep accurate records of your income, deductions, and credits can lead to errors or omissions on your tax return. * Not seeking professional help: If you’re struggling to recover your lost tax paperwork or need help with your tax return, consider seeking the assistance of a tax professional.

| Document | Description |

|---|---|

| W-2 form | Reports your income and taxes withheld from your employer |

| 1099 form | Reports your income from freelance work, investments, or other sources |

| Interest statements | Reports the interest earned on your bank accounts or investments |

In summary, losing tax paperwork can be a stressful experience, but there are steps you can take to recover your lost documents and get back on track with your taxes. By understanding the importance of tax paperwork, following the steps to recover lost documents, and avoiding common mistakes, you can ensure a smooth and successful tax filing experience.

To wrap things up, it’s essential to stay organized, keep accurate records, and seek professional help when needed. By taking these steps, you can avoid the hassle of lost tax paperwork and ensure you’re taking advantage of all the deductions and credits you’re eligible for.

What should I do if I lost my W-2 form?

+

Contact your employer’s HR or payroll department to request a duplicate copy of your W-2 form. If you’re unable to obtain a duplicate from your employer, you can contact the IRS directly for assistance.

How can I avoid losing my tax paperwork in the future?

+

Consider creating a centralized filing system, going digital by scanning your tax documents, setting reminders, and staying organized. These tips can help you keep track of your tax paperwork and reduce the risk of loss or damage.

What are the consequences of not filing my tax return on time?

+

Failing to file your tax return on time can result in penalties, interest, and even delayed refunds. It’s essential to file your tax return as soon as possible to avoid these consequences and ensure you’re taking advantage of all the deductions and credits you’re eligible for.