5 Tax Deadline Tips

Understanding Tax Deadlines

As the tax season approaches, it’s essential to stay on top of your financial obligations to avoid any last-minute rush or potential penalties. The tax deadline is a critical date that taxpayers must adhere to, and being aware of the key aspects surrounding this deadline can help individuals and businesses navigate the tax filing process more efficiently. In this post, we’ll delve into five crucial tax deadline tips that can help you stay organized and ensure compliance with tax regulations.

Tip 1: Mark Your Calendar

The first step in managing your tax obligations is to be aware of the tax deadline. In the United States, for instance, the typical deadline for filing individual tax returns is April 15th. However, this date can vary from year to year, especially if the 15th falls on a weekend or a federal holiday. It’s also important to note that deadlines can differ for businesses, with March 15th often being the deadline for S corporations and partnerships, and April 15th for C corporations. Marking these dates on your calendar and setting reminders can help you stay ahead of the game.

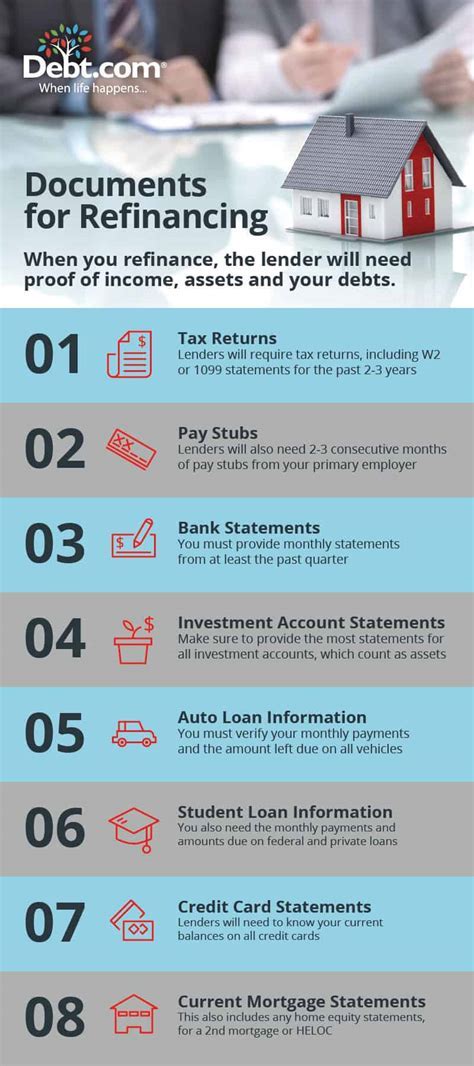

Tip 2: Gather Necessary Documents

To file your taxes efficiently, you’ll need to gather all the necessary documents. This includes: - W-2 forms from your employer - 1099 forms for any freelance or contract work - Interest statements from banks and investments - Charitable donation receipts - Medical expense records Having these documents ready can streamline the tax preparation process and help you avoid delays. Consider organizing them in a secure, easily accessible location, such as a digital storage service or a physical file folder.

Tip 3: Choose the Right Filing Status

Your filing status can significantly impact your tax obligations and benefits. The most common filing statuses include: - Single - Married Filing Jointly - Married Filing Separately - Head of Household - Qualifying Widow(er) Each status has its own set of rules and deductions. For example, married couples may choose to file jointly or separately, depending on which option provides the most tax benefits. Understanding the differences between these statuses can help you make an informed decision and potentially reduce your tax liability.

Tip 4: Consider Tax Deductions and Credits

Tax deductions and credits can help minimize your tax bill. Deductions reduce your taxable income, while credits directly reduce the amount of tax you owe. Some common deductions include: - Home office expenses for those who work from home - Student loan interest - Charitable donations - Medical expenses that exceed a certain percentage of your income Credits, on the other hand, might include: - Earned Income Tax Credit (EITC) for low-to-moderate-income workers - Child Tax Credit for families with qualifying children - Education credits for tuition and related expenses Being aware of these deductions and credits can help you claim what you’re eligible for and reduce your tax liability.

Tip 5: Seek Professional Help if Needed

Lastly, don’t hesitate to seek professional help if you’re unsure about any aspect of the tax filing process. Tax professionals can provide guidance on complex tax issues, help you navigate tax law changes, and ensure you’re taking advantage of all the deductions and credits you’re eligible for. They can also help you avoid common mistakes that could lead to delays or audits. When selecting a tax professional, consider their experience, certifications (such as CPA or EA), and reviews from previous clients.

📝 Note: Staying informed about tax law changes and updates can also help you navigate the tax filing process more efficiently. Regularly check the official IRS website or consult with a tax professional to ensure you have the most current information.

As you prepare for the tax deadline, remember that staying organized, informed, and seeking help when needed are key to a successful tax filing experience. By following these tips, you can ensure compliance with tax regulations, minimize your tax liability, and avoid potential penalties. Ultimately, understanding and managing your tax obligations is a crucial part of financial planning, and taking the time to get it right can have long-term benefits for your financial health.

What is the typical deadline for filing individual tax returns in the United States?

+

The typical deadline for filing individual tax returns in the United States is April 15th, but this date can vary if it falls on a weekend or a federal holiday.

What documents do I need to gather for tax filing?

+

You’ll need documents such as W-2 forms, 1099 forms, interest statements, charitable donation receipts, and medical expense records to file your taxes efficiently.

What are the benefits of seeking professional help for tax filing?

+

Seeking professional help can provide guidance on complex tax issues, help navigate tax law changes, ensure you’re taking advantage of all eligible deductions and credits, and avoid common mistakes that could lead to delays or audits.