Paperwork

Closing Cost Paperwork Needed

Introduction to Closing Cost Paperwork

When purchasing or refinancing a home, one of the most critical steps in the process is the closing. This is where the buyer and seller sign the final documents, and the ownership of the property is transferred. However, before reaching this stage, it’s essential to understand the various closing cost paperwork needed to complete the transaction. In this article, we will delve into the world of closing costs, exploring the necessary documents, fees associated with each, and the importance of carefully reviewing these papers to avoid any last-minute surprises.

Understanding Closing Costs

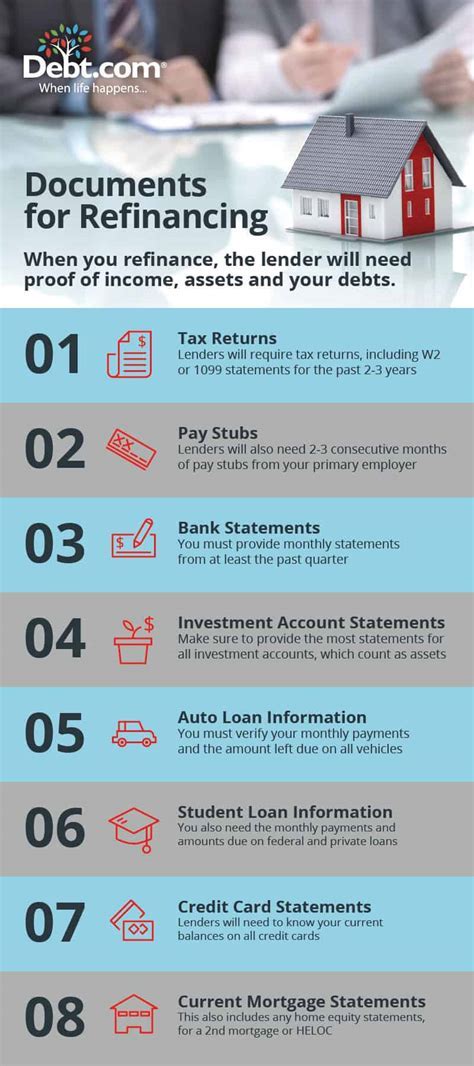

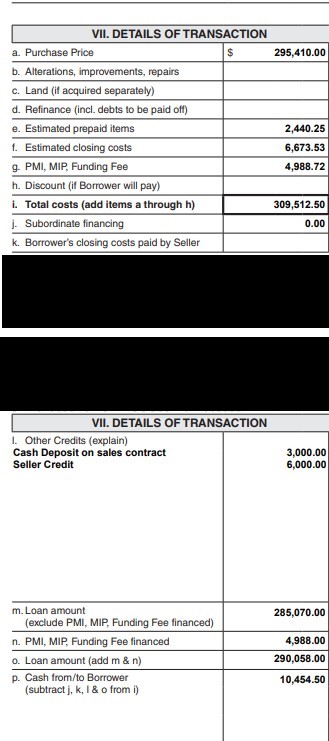

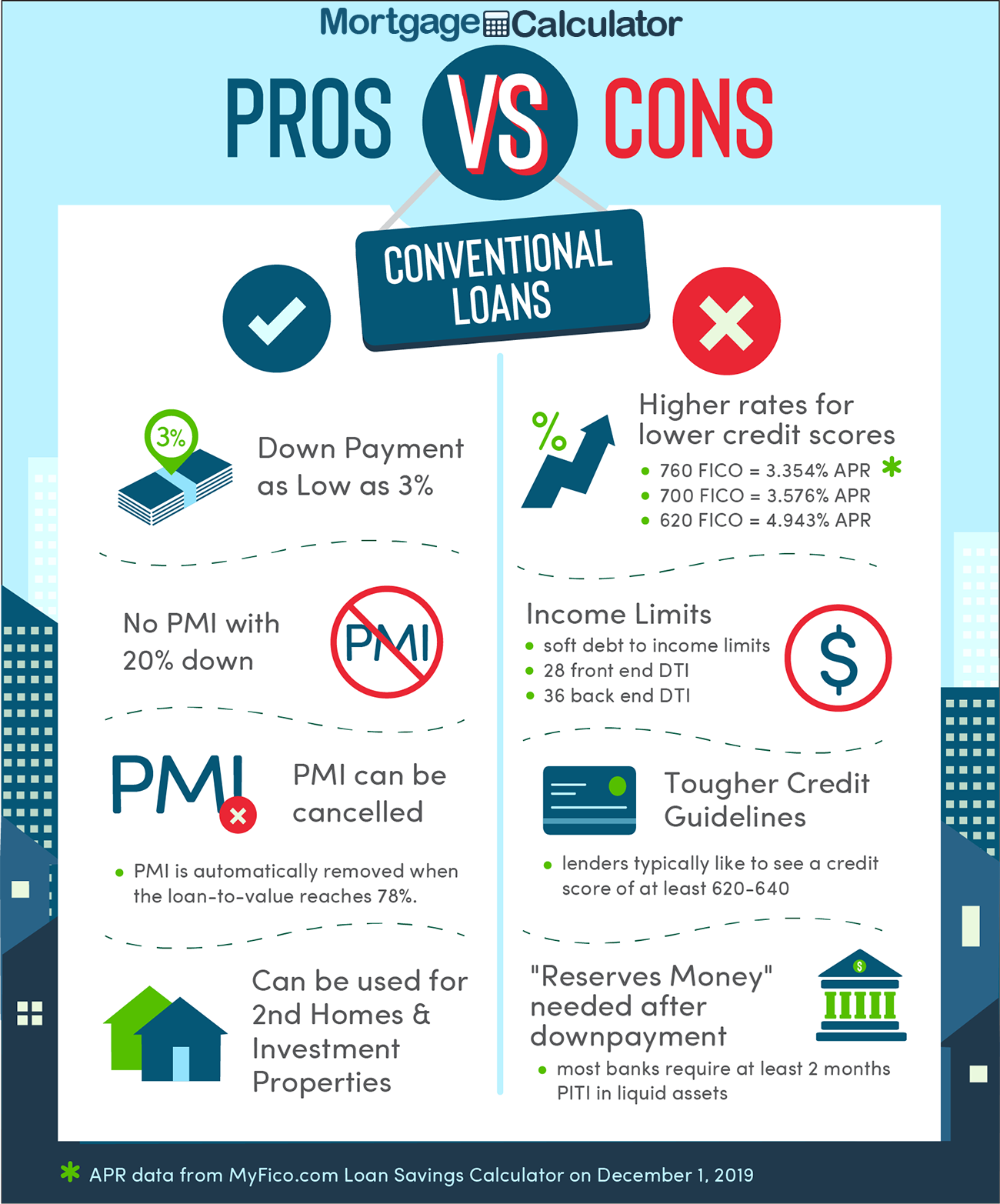

Closing costs are fees paid at the closing of a real estate transaction. These costs can vary widely depending on the location, type of property, and other factors. On average, homebuyers can expect to pay between 2% to 5% of the purchase price in closing costs. For a 200,000 home, this translates to 4,000 to $10,000. It’s crucial for buyers to factor these costs into their budget to avoid financial strain.

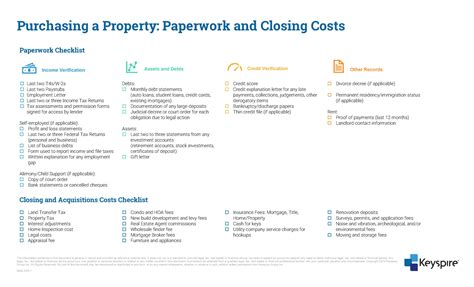

Necessary Paperwork for Closing

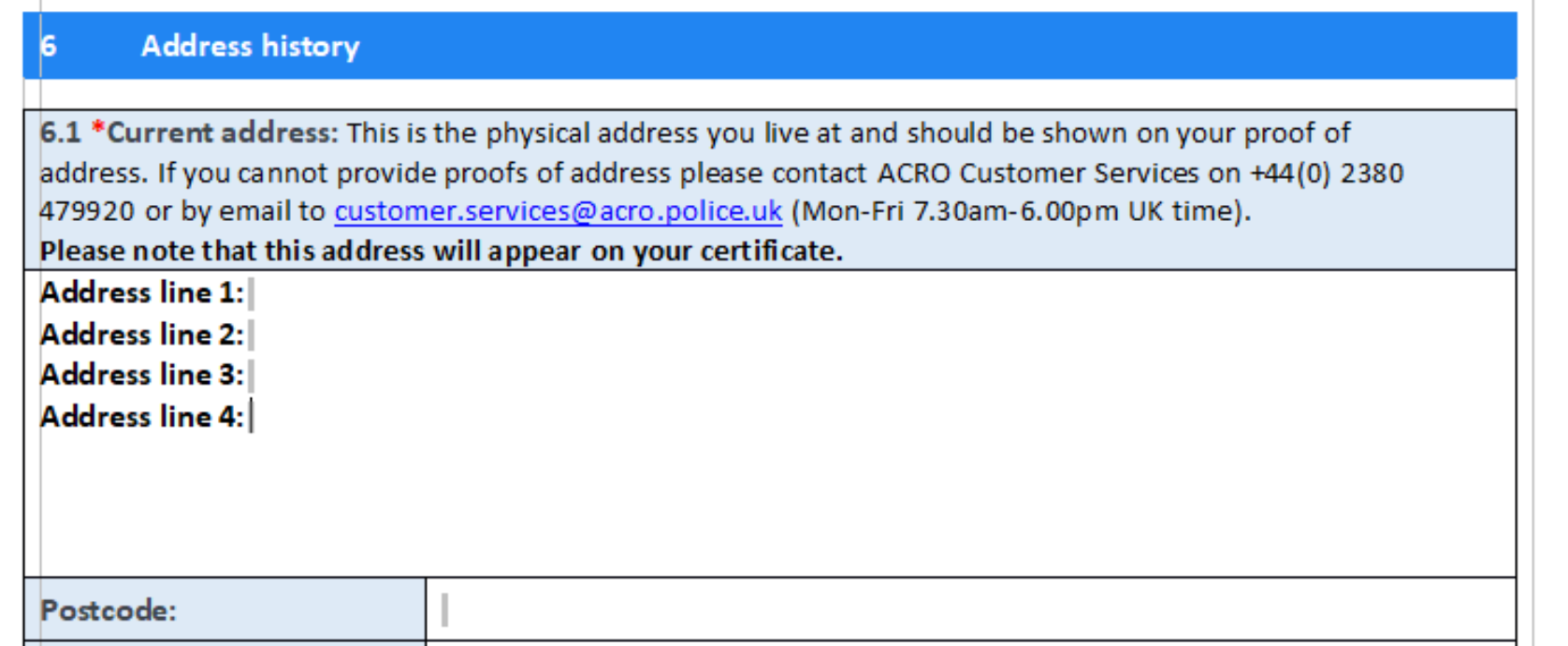

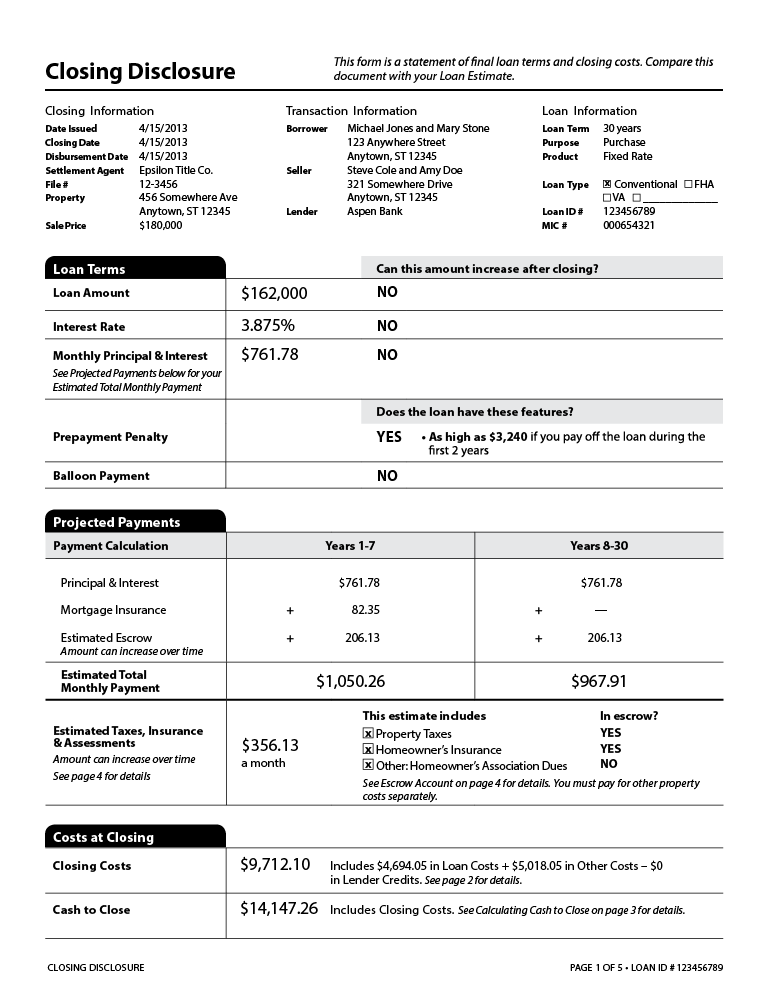

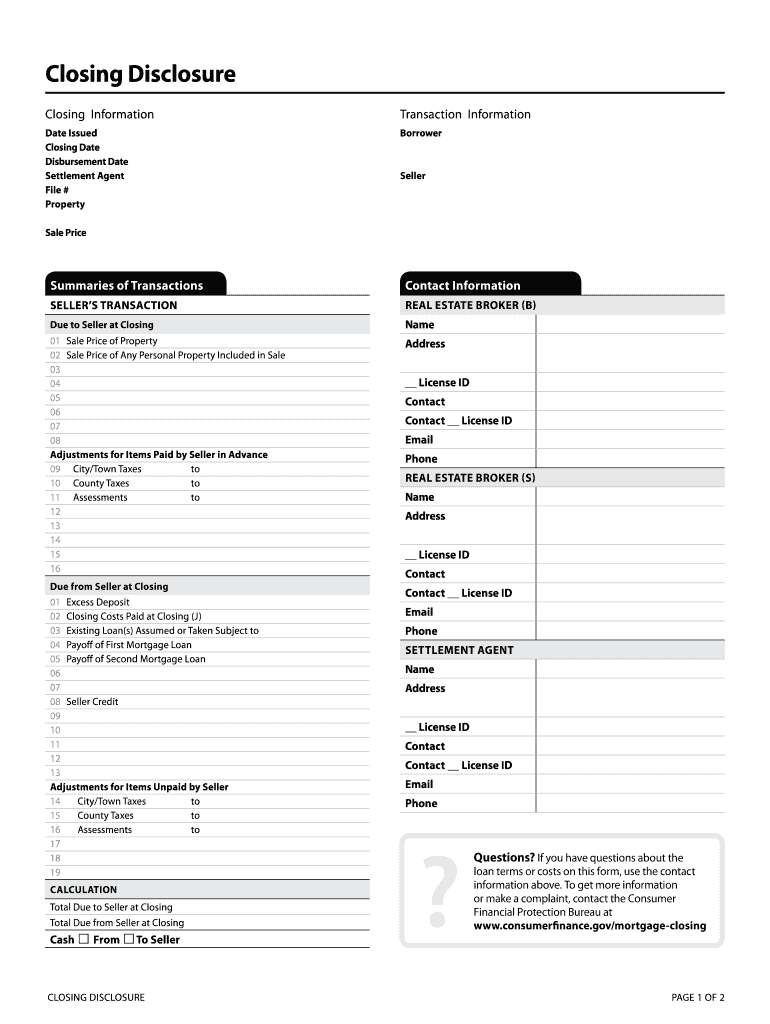

Several documents are required for the closing process. These include: - Deed: This document transfers the ownership of the property from the seller to the buyer. - Mortgage Note: This is the borrower’s promise to repay the loan. - Mortgage Deed (or Deed of Trust): This document secures the mortgage note and gives the lender a claim on the property if the borrower defaults. - Title Report and Insurance: A title report verifies the seller’s right to sell the property, and title insurance protects against any errors in the title search. - Loan Estimate and Closing Disclosure: These documents outline the terms of the loan and the closing costs. - Identification Documents: Buyers and sellers will need to provide identification to verify their identities.

Reviewing Closing Cost Paperwork

Carefully reviewing the closing cost paperwork is vital. Buyers should look for any errors in the documents, ensure that all fees are as expected, and understand the terms of the loan. This review process should ideally start before the closing date to allow time for any discrepancies to be addressed.

Steps to Prepare for Closing

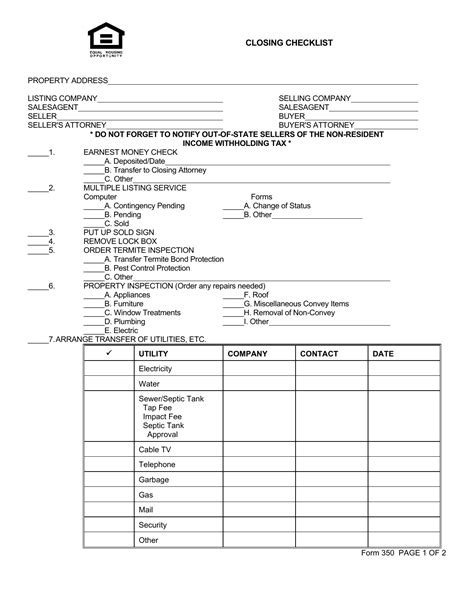

To prepare for closing, follow these steps: - Review the Loan Estimate: Understand the fees associated with your loan. - Conduct a Final Walk-Through: Ensure the property is in the expected condition. - Gather Necessary Documents: Have all identification and financial documents ready. - Understand the Closing Process: Know what to expect during the closing meeting.

Importance of Timing

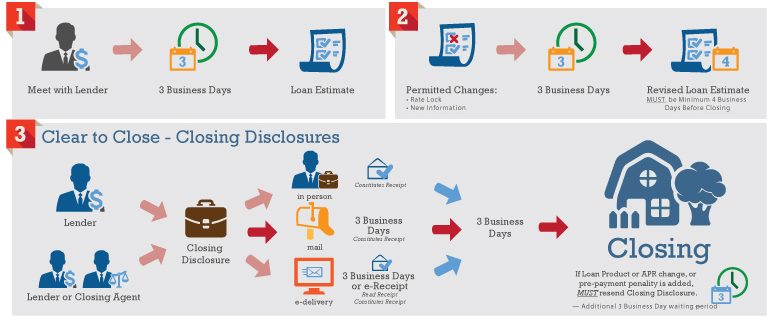

The timing of the closing process is critical. Delays can lead to additional costs or even the loss of the property. Buyers should stay in close communication with their lender, real estate agent, and attorney (if applicable) to ensure everything proceeds smoothly.

Common Issues and Solutions

Common issues that may arise during the closing process include errors in documentation, delays in funding, and unexpected increases in fees. To mitigate these risks, maintain open communication with all parties involved, review documents carefully, and plan ahead for any potential issues.

📝 Note: Keeping detailed records of all communications and documents can help resolve issues more efficiently.

Conclusion and Final Thoughts

In conclusion, the closing cost paperwork is a critical component of any real estate transaction. Understanding the necessary documents, associated fees, and the importance of timely review can make the difference between a smooth closing and a stressful, costly experience. By being prepared and knowledgeable, buyers can navigate the closing process with confidence, securing their new home without unnecessary complications.

What are closing costs, and how are they calculated?

+

Closing costs are fees associated with the home buying and refinancing process. They are calculated based on the purchase price of the home, the location, and the type of property, among other factors.

Why is it important to review closing cost paperwork carefully?

+

Reviewing the paperwork carefully helps in identifying any errors, understanding the terms of the loan, and ensuring that all fees are as expected, thus avoiding last-minute surprises.

What happens during the closing meeting?

+

During the closing meeting, the buyer and seller sign the final documents, including the deed and mortgage documents, and the ownership of the property is officially transferred.