Mortgage Company Loses Paperwork

Introduction to Mortgage Company Issues

A mortgage company losing paperwork is a serious issue that can have significant consequences for both the company and its clients. In today’s digital age, it’s surprising that such mistakes can still occur, but they do, and when they do, it’s crucial to understand the implications and how to navigate through the problem. This situation can lead to delays in mortgage applications, financial losses, and damage to the company’s reputation. In this article, we will explore the reasons why a mortgage company might lose paperwork, the potential consequences, and most importantly, what can be done to prevent such situations or mitigate their effects when they happen.

Reasons for Lost Paperwork

There are several reasons why a mortgage company might lose paperwork. These include: - Human Error: Mistakes made by employees, such as misfiling documents or failing to scan and upload them to the system, can lead to lost paperwork. - Inadequate Systems: Companies with outdated or inefficient document management systems are more prone to losing paperwork. - Natural Disasters: Events like floods, fires, or earthquakes can destroy physical documents if they are not properly backed up digitally. - Cyber Attacks: In the case of digital documents, cyber attacks can lead to data loss if the company’s systems are not adequately secured.

Consequences of Lost Paperwork

The consequences of a mortgage company losing paperwork can be severe. Some of these consequences include: - Delays in Mortgage Processing: Lost paperwork can significantly delay the mortgage application process, leading to frustration for the clients and potential financial losses if interest rates change or if the client misses out on purchasing their desired property. - Financial Penalties: Depending on the nature of the lost documents, the company might face financial penalties or legal action from regulatory bodies or clients. - Reputation Damage: Incidents of lost paperwork can erode client trust and damage the company’s reputation in the industry, potentially leading to a loss of business.

Prevention and Mitigation Strategies

While mistakes can happen, there are several strategies that mortgage companies can implement to prevent or mitigate the effects of lost paperwork: - Digital Document Management: Implementing a robust and secure digital document management system can significantly reduce the risk of lost paperwork. All physical documents should be scanned and uploaded to the system as soon as possible. - Regular Backups: Ensuring that digital documents are regularly backed up, both locally and in the cloud, can prevent data loss in case of technical failures or cyber attacks. - Employee Training: Providing employees with thorough training on document handling and management can reduce the likelihood of human error. - Quality Control Checks: Regular quality control checks can help identify and rectify any discrepancies or missing documents before they become major issues.

Client Protection Measures

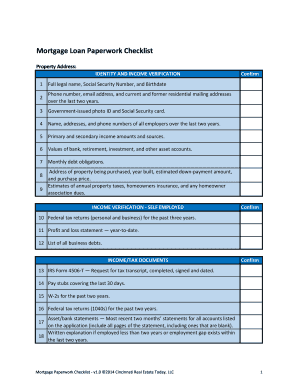

For clients, it’s essential to be proactive when dealing with a mortgage company to minimize the risk of lost paperwork affecting their application. Some measures include: - Keep Personal Records: Clients should keep their own copies of all documents submitted to the mortgage company. - Regular Communication: Maintaining open communication with the mortgage company can help identify any issues early on. - Understanding the Process: Having a clear understanding of the mortgage application process and the documents required can help clients prepare and follow up more effectively.

| Document Type | Importance | Recommended Action |

|---|---|---|

| Identification Documents | High | Ensure digital copies are securely stored |

| Income Proof | High | Regularly update and verify documents |

| Credit Reports | High | Monitor credit score and report any discrepancies |

💡 Note: Clients should always verify the security and reliability of the document management system used by their mortgage company to ensure their documents are safe.

In the end, the key to handling situations where a mortgage company loses paperwork lies in prevention, quick action, and open communication. By understanding the potential reasons for lost paperwork, the consequences, and the strategies for prevention and mitigation, both mortgage companies and their clients can work together to minimize risks and ensure a smoother mortgage application process. The future of mortgage applications will likely be shaped by advancements in digital technology, offering even more secure and efficient ways to manage documents and reduce the likelihood of lost paperwork. As the industry evolves, it’s crucial for companies and clients alike to adapt and embrace these changes to create a more reliable and customer-centric mortgage application experience.