Fill FAFSA Forms

Introduction to FAFSA Forms

The Free Application for Federal Student Aid (FAFSA) is a crucial document that students in the United States must fill out to determine their eligibility for financial aid for college or graduate school. The FAFSA form is used to assess the student’s financial need and to allocate federal, state, and institutional aid. In this article, we will guide you through the process of filling out FAFSA forms, highlighting the key steps and requirements.

Who Should Fill Out the FAFSA Form?

The FAFSA form is designed for students who are planning to attend college or graduate school and are seeking financial assistance to cover their educational expenses. This includes:

- High school students who are planning to attend college

- Current college students who are seeking financial aid for the upcoming academic year

- Graduate students who are pursuing a master’s or doctoral degree

- Parents who are seeking financial aid for their dependent students

Gathering Required Documents

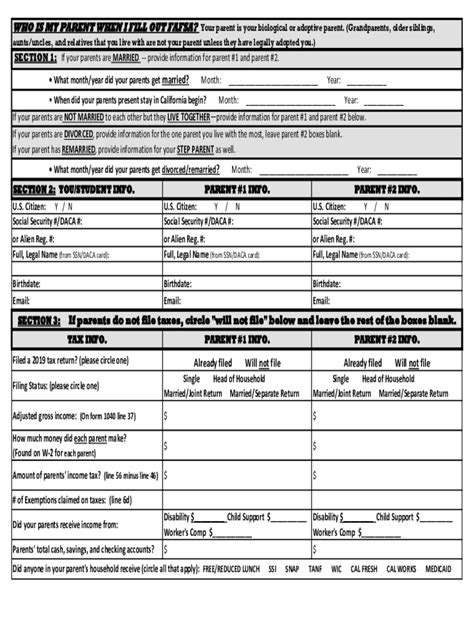

Before filling out the FAFSA form, it is essential to gather all the necessary documents to ensure that you have all the required information. The following documents are typically required:

- Social Security number or Alien Registration number

- Driver’s license or state ID

- W-2 forms and tax returns (for yourself and your parents, if applicable)

- Untaxed income records (such as child support or interest income)

- Asset information (such as savings and investment accounts)

- Lists of colleges or universities you are interested in attending

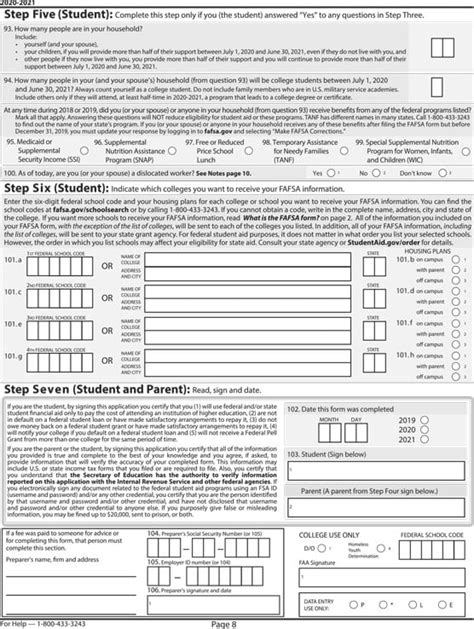

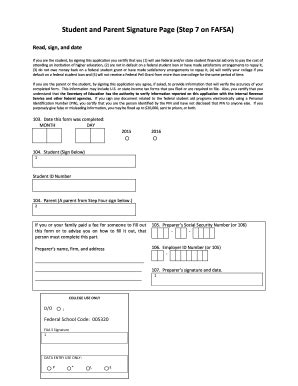

Filling Out the FAFSA Form

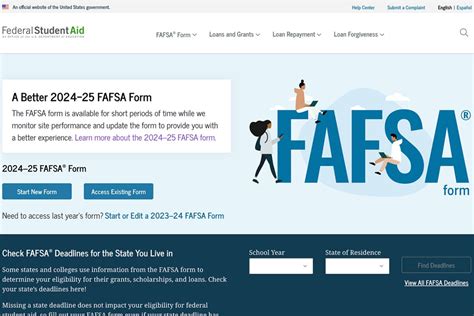

The FAFSA form can be completed online or by mail. We recommend completing the form online, as it is faster and more convenient. Here’s a step-by-step guide to filling out the FAFSA form:

- Create an FSA ID: The first step is to create an FSA ID, which is a username and password that you will use to log in to the FAFSA website.

- Start the application: Once you have created your FSA ID, you can start the FAFSA application. You will need to provide personal and financial information.

- List colleges: You will need to list the colleges or universities you are interested in attending. The FAFSA form allows you to list up to 10 schools.

- Submit the application: Once you have completed the FAFSA form, review it carefully and submit it. You will receive a confirmation email once your application has been processed.

FAFSA Deadlines

The FAFSA deadlines vary depending on the state and the colleges or universities you are applying to. It is essential to check the deadlines for the schools you are interested in attending and to submit your application on time. Some states have earlier deadlines, while others may have later deadlines. Additionally, some colleges or universities may have their own deadlines for financial aid applications.

Types of FAFSA Forms

There are several types of FAFSA forms, including:

- Renewal FAFSA: This form is for students who have previously completed the FAFSA form and are renewing their application for the upcoming academic year.

- Initial FAFSA: This form is for students who are completing the FAFSA form for the first time.

- Correction FAFSA: This form is for students who need to make corrections to their previously submitted FAFSA form.

Common Mistakes to Avoid

When filling out the FAFSA form, it is essential to avoid common mistakes that can delay or reject your application. Some of the most common mistakes include:

- Incorrect Social Security number or Alien Registration number

- Inconsistent or incomplete information

- Failure to list all required colleges or universities

- Missed deadlines

💡 Note: It is essential to review your FAFSA application carefully before submitting it to ensure that all information is accurate and complete.

Next Steps After Submitting the FAFSA Form

After submitting the FAFSA form, you will receive a Student Aid Report (SAR) that summarizes the information you provided on the FAFSA form. The SAR will also indicate your Expected Family Contribution (EFC), which is the amount that the federal government expects your family to contribute towards your educational expenses. The EFC is used to determine your eligibility for federal, state, and institutional aid.

Table: FAFSA Form Requirements

| Requirement | Description |

|---|---|

| Social Security number or Alien Registration number | Required for all applicants |

| Driver’s license or state ID | Required for all applicants |

| W-2 forms and tax returns | Required for all applicants (and parents, if applicable) |

| Untaxed income records | Required for all applicants (and parents, if applicable) |

| Asset information | Required for all applicants (and parents, if applicable) |

In summary, filling out the FAFSA form is a critical step in determining your eligibility for financial aid for college or graduate school. By gathering all the necessary documents, completing the form accurately and on time, and avoiding common mistakes, you can ensure that you receive the financial assistance you need to pursue your educational goals.

What is the FAFSA form?

+

The FAFSA form is the Free Application for Federal Student Aid, which is used to determine a student’s eligibility for financial aid for college or graduate school.

Who should fill out the FAFSA form?

+

The FAFSA form is designed for students who are planning to attend college or graduate school and are seeking financial assistance to cover their educational expenses.

What documents are required to fill out the FAFSA form?

+

The required documents include Social Security number or Alien Registration number, driver’s license or state ID, W-2 forms and tax returns, untaxed income records, and asset information.

How do I submit the FAFSA form?

+

The FAFSA form can be completed online or by mail. We recommend completing the form online, as it is faster and more convenient.

What happens after I submit the FAFSA form?

+

After submitting the FAFSA form, you will receive a Student Aid Report (SAR) that summarizes the information you provided on the FAFSA form. The SAR will also indicate your Expected Family Contribution (EFC), which is used to determine your eligibility for federal, state, and institutional aid.