5 Forms with 1065

Introduction to 5 Forms with 1065

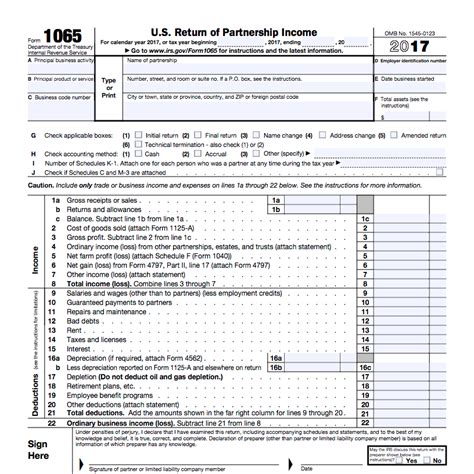

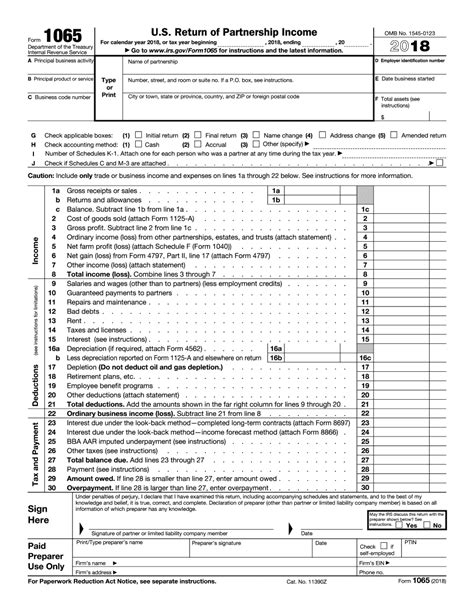

The IRS Form 1065 is a critical document for partnerships, as it reports the income, gains, losses, deductions, and credits from the operation of a partnership. This form is essential for tax purposes, and understanding its components is vital for accurate tax filing. In this article, we will delve into the specifics of 5 forms associated with Form 1065 and explore their significance in the context of partnership taxation.

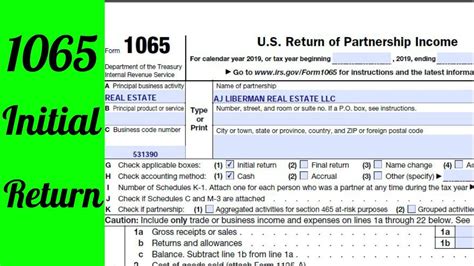

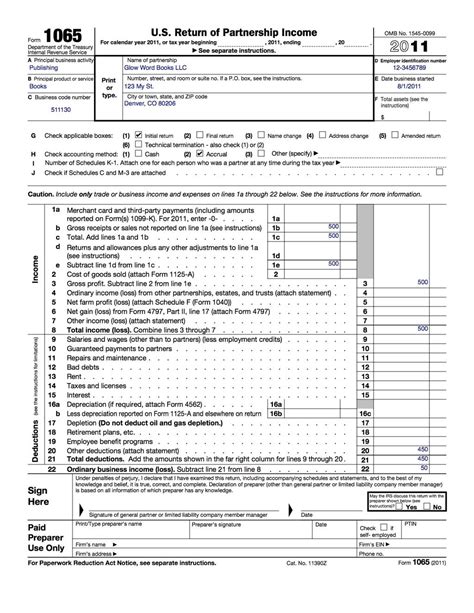

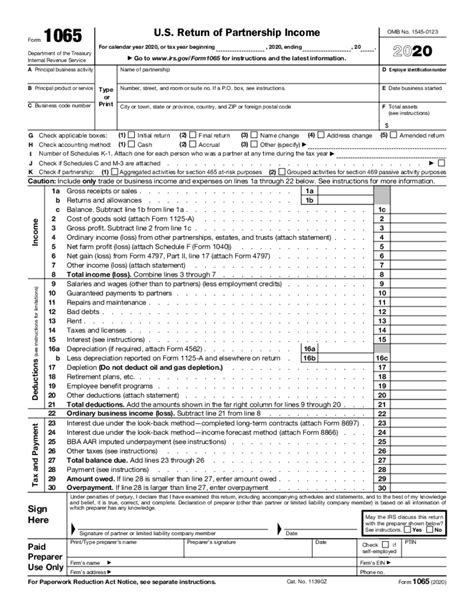

Understanding Form 1065

Before diving into the 5 forms, it’s crucial to grasp the basics of Form 1065. This form, also known as the U.S. Return of Partnership Income, is filed by partnerships to report their financial activities to the IRS. Partnerships use this form to detail their income, expenses, gains, and losses, which are then allocated among the partners according to their partnership agreement. The information from Form 1065 is used by the partners to report their share of the partnership’s income on their personal tax returns.

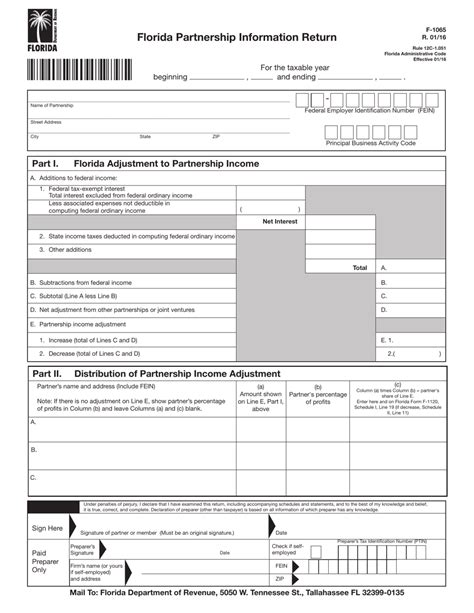

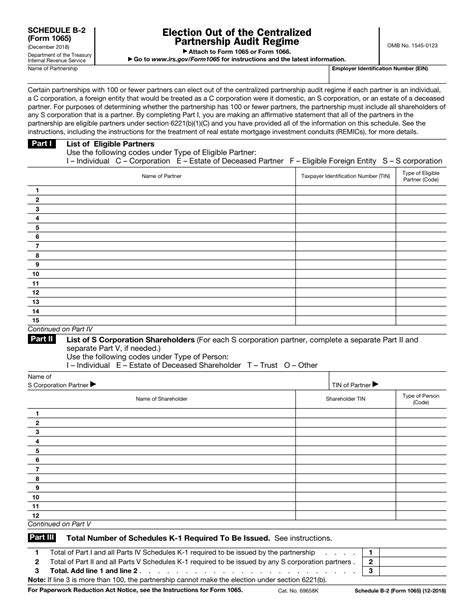

Form 1: Form 1065

- Form 1065 itself is the primary document for reporting partnership income. It includes several schedules where partnerships report different types of income and expenses, such as: - Schedule K: Reports the partnership’s total income, deductions, and credits. - Schedule K-1: Breaks down each partner’s share of the partnership’s income, deductions, and credits, which each partner uses to complete their personal tax return.

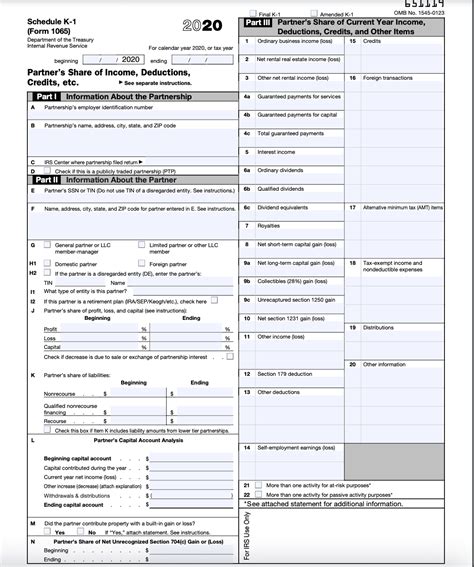

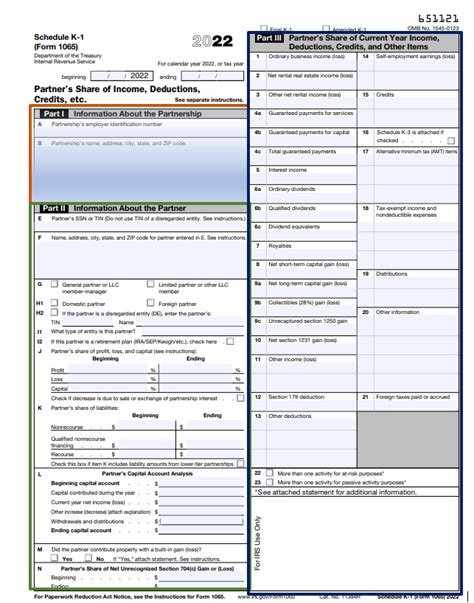

Form 2: Schedule K-1 (Form 1065)

- Schedule K-1 is a crucial component of Form 1065, as it details the distribution of income, deductions, and credits among the partners. Each partner receives a Schedule K-1 from the partnership, which they then use to report their share of the partnership’s items on their personal tax return (Form 1040).

Form 3: Form 8960

- Form 8960, Net Investment Income Tax, is relevant for partners who have net investment income from their partnership interests. This form calculates the net investment income tax, which is a 3.8% tax on certain net investment income above threshold amounts.

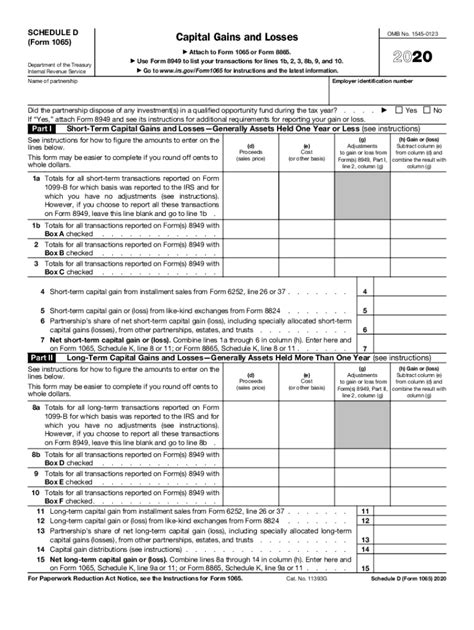

Form 4: Form 8949

- Form 8949, Sales and Other Dispositions of Capital Assets, is used by partnerships to report sales and exchanges of capital assets, which include stocks, bonds, and real estate. This form is necessary for calculating gains and losses from these transactions.

Form 5: Form 4797

- Form 4797, Sales of Business Property, is utilized to report the sale or exchange of business property, such as equipment, vehicles, and real estate used in the business. This form helps calculate gains or losses from these transactions and determines any depreciation recapture.

Importance of Accurate Reporting

Accurate and timely reporting on these forms is crucial for partnerships to comply with IRS regulations and avoid penalties. Each form plays a vital role in the tax filing process, from the initial reporting of partnership income on Form 1065 to the detailed breakdown of partner shares on Schedule K-1, and the calculation of specific taxes and gains/losses on the other associated forms.

📝 Note: It's essential for partnerships to maintain detailed records and consult with tax professionals to ensure compliance with all tax laws and regulations.

As we summarize the key points, it’s clear that understanding and correctly filing the forms associated with Form 1065 is essential for partnerships to navigate the complexities of tax reporting. From the primary Form 1065 to the detailed Schedule K-1 and the various forms for calculating specific taxes and reporting asset sales, each document serves a critical purpose in the partnership tax filing process. By grasping the significance and proper use of these forms, partnerships can ensure they are meeting their tax obligations accurately and efficiently.

What is the purpose of Form 1065?

+

Form 1065 is used by partnerships to report their income, gains, losses, deductions, and credits to the IRS.

Why is Schedule K-1 important?

+

Schedule K-1 is important because it breaks down each partner’s share of the partnership’s income, deductions, and credits, which they then report on their personal tax returns.

What types of income are reported on Form 8960?

+

Form 8960 is used to calculate the Net Investment Income Tax, which applies to certain types of net investment income, such as dividends, capital gains, and rental income, above specific threshold amounts.