7 Tips Tax Papers

Introduction to Tax Papers

Tax papers are an essential part of our financial lives, and understanding how to manage them effectively can save us time, money, and stress. With the ever-changing tax laws and regulations, it’s crucial to stay organized and informed to avoid any potential issues. In this article, we will explore 7 tips for managing tax papers, including organizing documents, understanding tax forms, and utilizing technology.

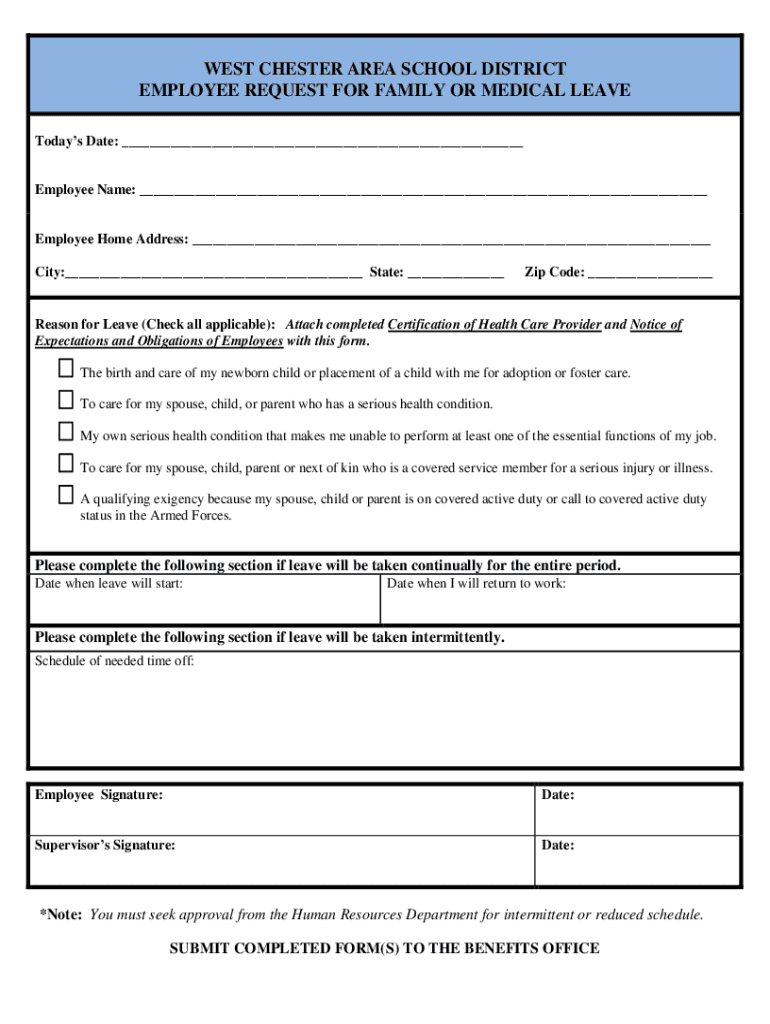

Tip 1: Organize Your Documents

Organizing your tax documents is the first step in managing your tax papers. This includes gathering all relevant documents such as W-2 forms, 1099 forms, receipts, and invoices. Create a designated folder or file to store these documents, and consider using color-coding or labels to categorize them. This will make it easier to find the documents you need when you need them.

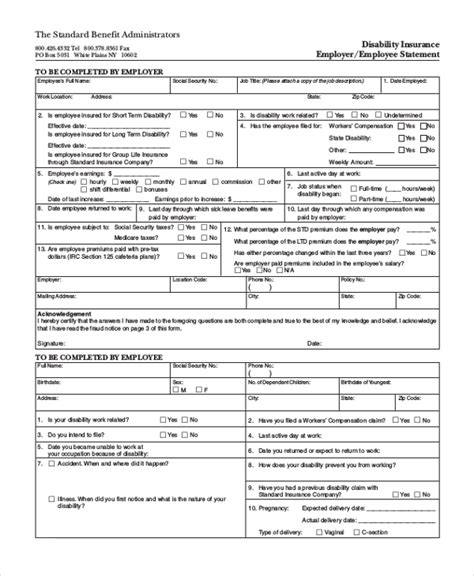

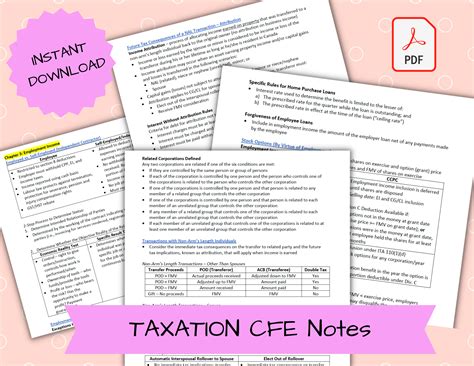

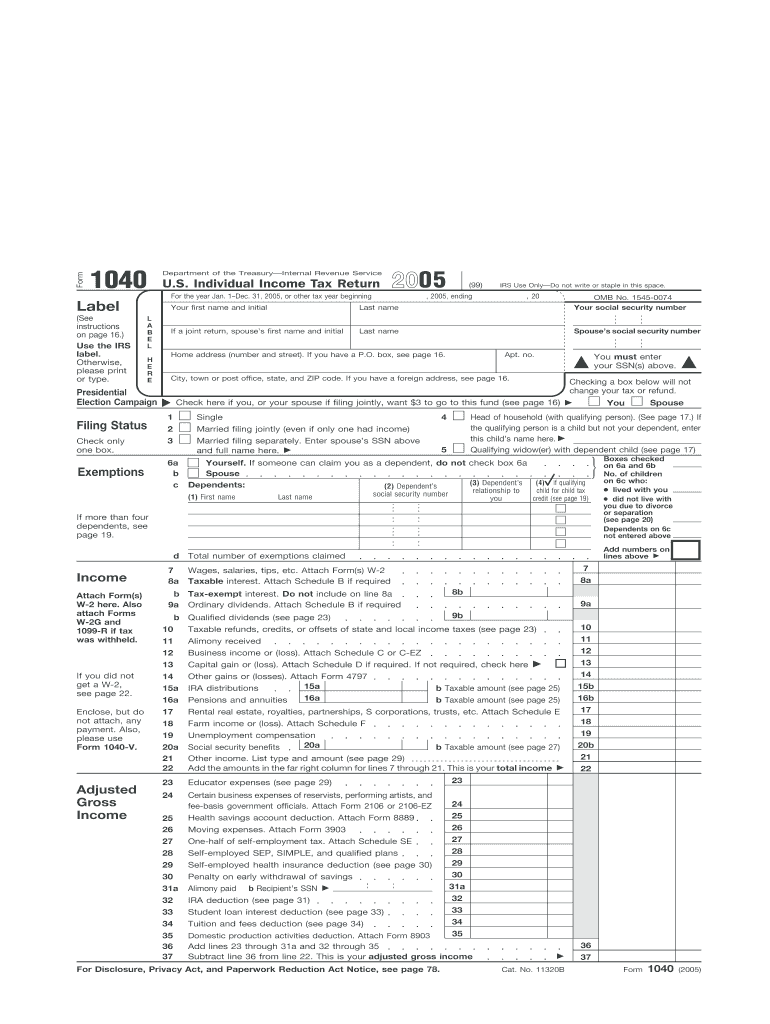

Tip 2: Understand Tax Forms

Understanding tax forms is crucial for accurate and efficient tax preparation. Familiarize yourself with the different types of tax forms, including 1040 forms, Schedule A, and Schedule C. Take the time to read through each form and understand what information is required. This will help you avoid errors and ensure you’re taking advantage of all eligible deductions and credits.

Tip 3: Utilize Technology

Technology can be a powerful tool in managing tax papers. Consider using tax software such as TurboTax or H&R Block to help with tax preparation and filing. These programs can guide you through the process, ensure accuracy, and even help you find deductions and credits you may not have known about. Additionally, consider using digital storage options such as cloud storage or external hard drives to keep your tax documents safe and secure.

Tip 4: Keep Accurate Records

Keeping accurate records is essential for tax purposes. This includes tracking income, expenses, and mileage. Consider using a spreadsheet or accounting software to help with record-keeping. Make sure to update your records regularly and store them in a safe and secure location.

Tip 5: Take Advantage of Deductions and Credits

Deductions and credits can help reduce your tax liability and increase your refund. Take the time to research and understand the different types of deductions and credits available, such as the Earned Income Tax Credit or Child Tax Credit. Consider consulting with a tax professional to ensure you’re taking advantage of all eligible deductions and credits.

Tip 6: Stay Up-to-Date on Tax Laws and Regulations

Tax laws and regulations are constantly changing, and it’s essential to stay up-to-date to avoid any potential issues. Consider following tax news and updates from reputable sources such as the IRS or tax professionals. This will help you stay informed and ensure you’re in compliance with all tax laws and regulations.

Tip 7: Seek Professional Help

Finally, don’t be afraid to seek professional help when it comes to managing tax papers. Tax professionals can provide valuable guidance and support, helping you navigate the complex world of tax preparation and filing. Consider hiring a tax accountant or tax attorney to help with tax preparation, auditing, and representation.

📝 Note: It's essential to stay organized and informed when it comes to managing tax papers. By following these 7 tips, you can ensure you're taking advantage of all eligible deductions and credits, avoiding potential issues, and reducing your tax liability.

In summary, managing tax papers requires organization, understanding, and attention to detail. By following these 7 tips, you can ensure you’re prepared for tax season and make the most of your tax return. Remember to stay informed, seek professional help when needed, and take advantage of all eligible deductions and credits.

What is the best way to organize tax documents?

+

The best way to organize tax documents is to create a designated folder or file and use color-coding or labels to categorize them. This will make it easier to find the documents you need when you need them.

What are the most common tax forms?

+

The most common tax forms include the 1040 form, Schedule A, and Schedule C. It’s essential to familiarize yourself with these forms and understand what information is required.

How can I reduce my tax liability?

+

There are several ways to reduce your tax liability, including taking advantage of deductions and credits, itemizing expenses, and contributing to a retirement account. Consider consulting with a tax professional to determine the best strategy for your situation.