Get Tax Return Paperwork

Understanding the Importance of Tax Return Paperwork

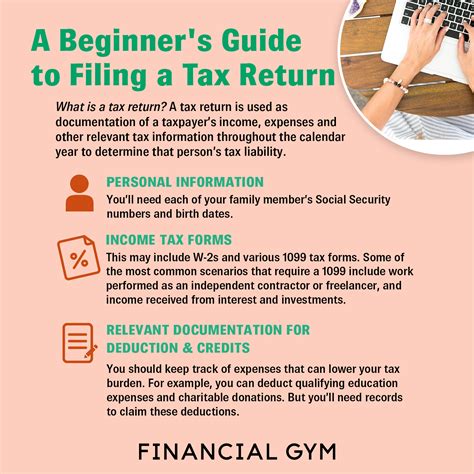

When it comes to filing taxes, having the right paperwork is crucial. Tax return paperwork includes all the necessary documents and forms required to file your taxes accurately. This paperwork can be overwhelming, but it’s essential to understand what you need to ensure you’re taking advantage of all the deductions and credits you’re eligible for. In this post, we’ll guide you through the process of gathering and understanding your tax return paperwork.

Gathering Necessary Documents

To start, you’ll need to gather all the necessary documents, including: * W-2 forms from your employer, showing your income and taxes withheld * 1099 forms for any freelance or contract work * Interest statements from banks and investments (1099-INT) * Dividend statements (1099-DIV) * Charitable donation receipts * Medical expense receipts * Mortgage interest statements (1098)

📝 Note: Make sure to keep all your documents organized and in a safe place, as you'll need them to fill out your tax return forms.

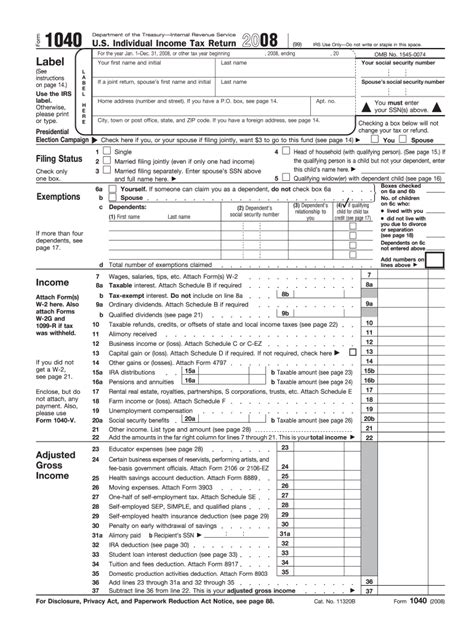

Understanding Tax Forms

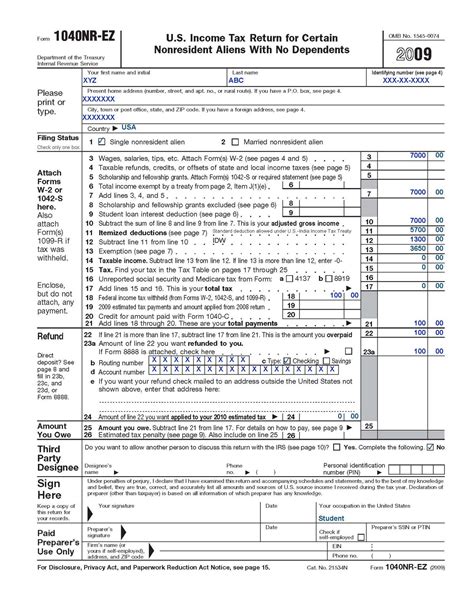

Once you have all your documents, it’s time to understand the different tax forms you’ll need to fill out. The most common forms include: * Form 1040: The standard form for personal income tax returns * Form 1040A: A simplified version of the 1040 form, for those with simpler tax situations * Form 1040EZ: A further simplified version, for those with very basic tax situations * Schedule A: For itemizing deductions, such as charitable donations and medical expenses * Schedule B: For reporting interest and dividend income

Filing Status and Dependents

Your filing status and dependents can also impact your tax return paperwork. Make sure to understand the different filing statuses, including: * Single * Married filing jointly * Married filing separately * Head of household * Qualifying widow(er)

You’ll also need to provide information about your dependents, including their names, social security numbers, and relationship to you.

Tax Credits and Deductions

Tax credits and deductions can help reduce your tax liability. Some common credits and deductions include: * Earned Income Tax Credit (EITC) * Child Tax Credit * Education credits * Charitable donations * Medical expenses * Mortgage interest

📊 Note: Make sure to take advantage of all the credits and deductions you're eligible for, as they can significantly impact your tax refund.

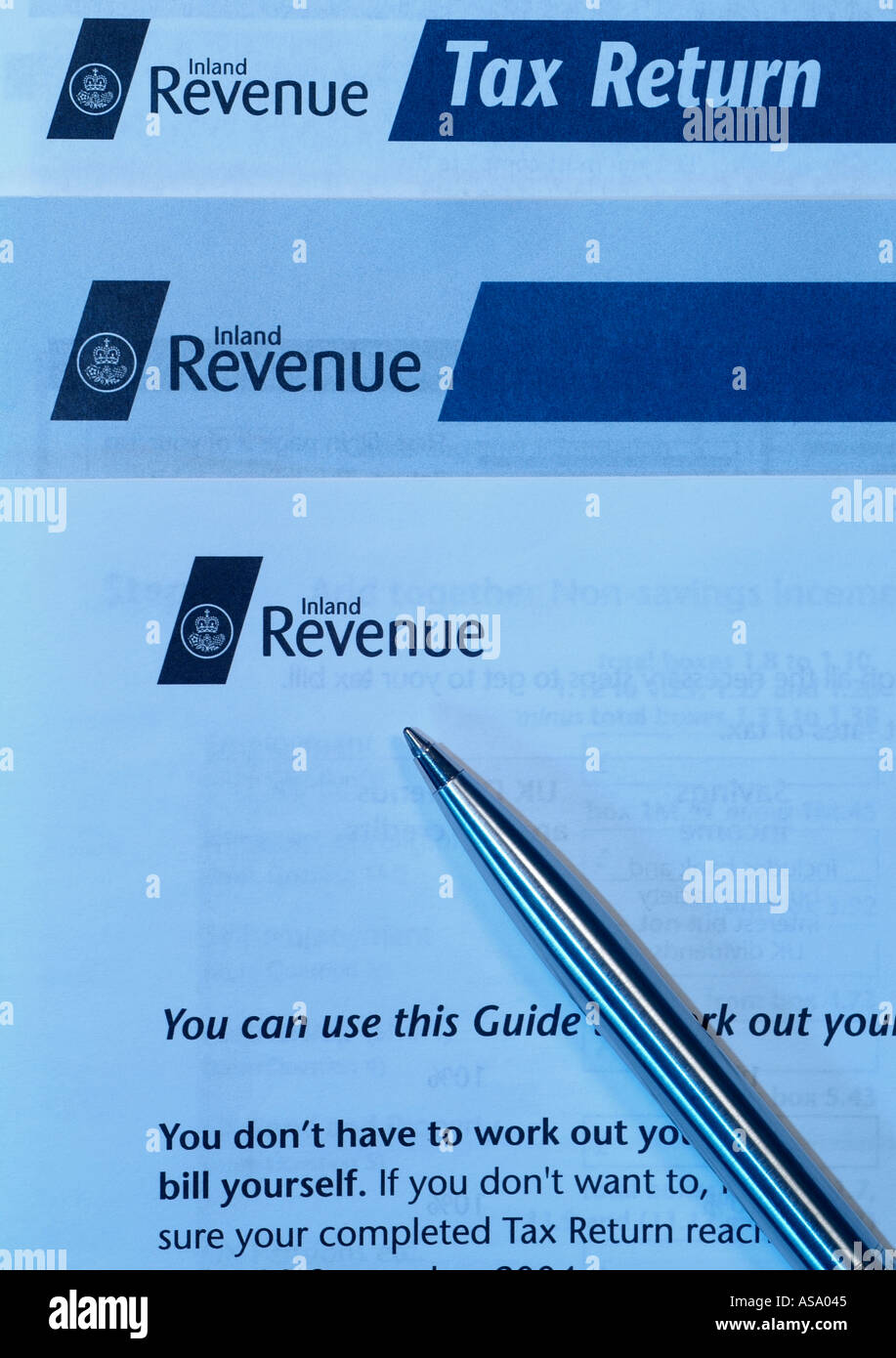

Seeking Professional Help

If you’re feeling overwhelmed by the tax return paperwork, consider seeking professional help. A tax professional can guide you through the process, ensure you’re taking advantage of all the credits and deductions you’re eligible for, and help you avoid any mistakes.

| Service | Cost | Benefits |

|---|---|---|

| Tax preparation software | $20-$100 | Guided tax preparation, accurate calculations |

| Tax professional | $100-$500 | Personalized guidance, expert knowledge |

| Tax consulting firm | $500-$2,000 | Comprehensive tax planning, expert advice |

As you can see, there are various options available to help you with your tax return paperwork. Whether you choose to do it yourself or seek professional help, make sure to take the time to understand the process and ensure you’re taking advantage of all the credits and deductions you’re eligible for.

In the end, having the right tax return paperwork and understanding the process can make a significant difference in your tax refund. By following these steps and seeking help when needed, you can ensure you’re getting the most out of your tax return.

What is the deadline for filing taxes?

+

The deadline for filing taxes is typically April 15th of each year, but it may vary depending on your location and other factors.

Do I need to file taxes if I’m not working?

+

Even if you’re not working, you may still need to file taxes if you have other sources of income, such as investments or unemployment benefits.

Can I file taxes online?

+

Yes, you can file taxes online using tax preparation software or by visiting the IRS website.