7 Tips Estate Paperwork

Introduction to Estate Paperwork

Estate planning is a crucial aspect of managing one’s assets, ensuring that wishes are respected, and minimizing legal and financial complications for loved ones after one’s passing. A key component of estate planning is the paperwork involved, which can be complex and overwhelming for those unfamiliar with legal and financial terminology. Understanding the different types of estate paperwork and how to navigate them is essential for creating a comprehensive estate plan.

Understanding the Basics of Estate Paperwork

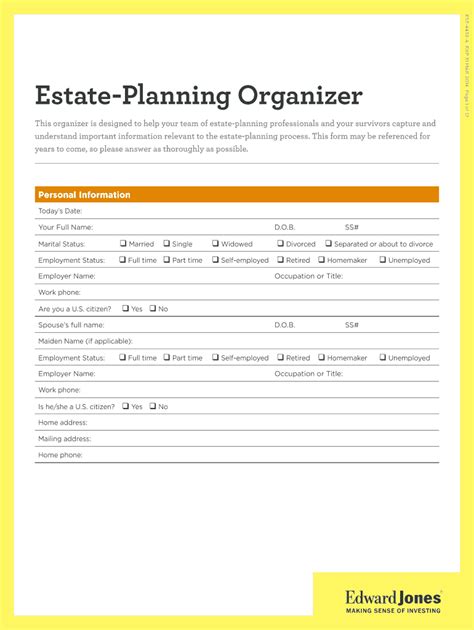

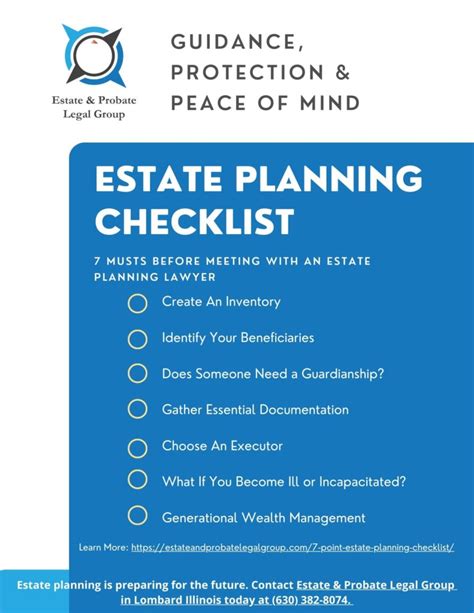

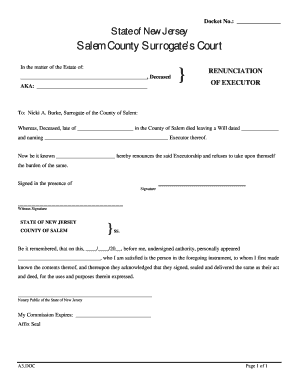

Before diving into the specifics, it’s essential to understand the basics of estate paperwork. This includes wills, trusts, powers of attorney, and beneficiary designations, among others. Each of these documents serves a unique purpose in ensuring that one’s estate is distributed according to their wishes. For instance, a will is a legal document that outlines how a person wants their property to be distributed after their death, while a trust allows for the distribution of assets without going through probate.

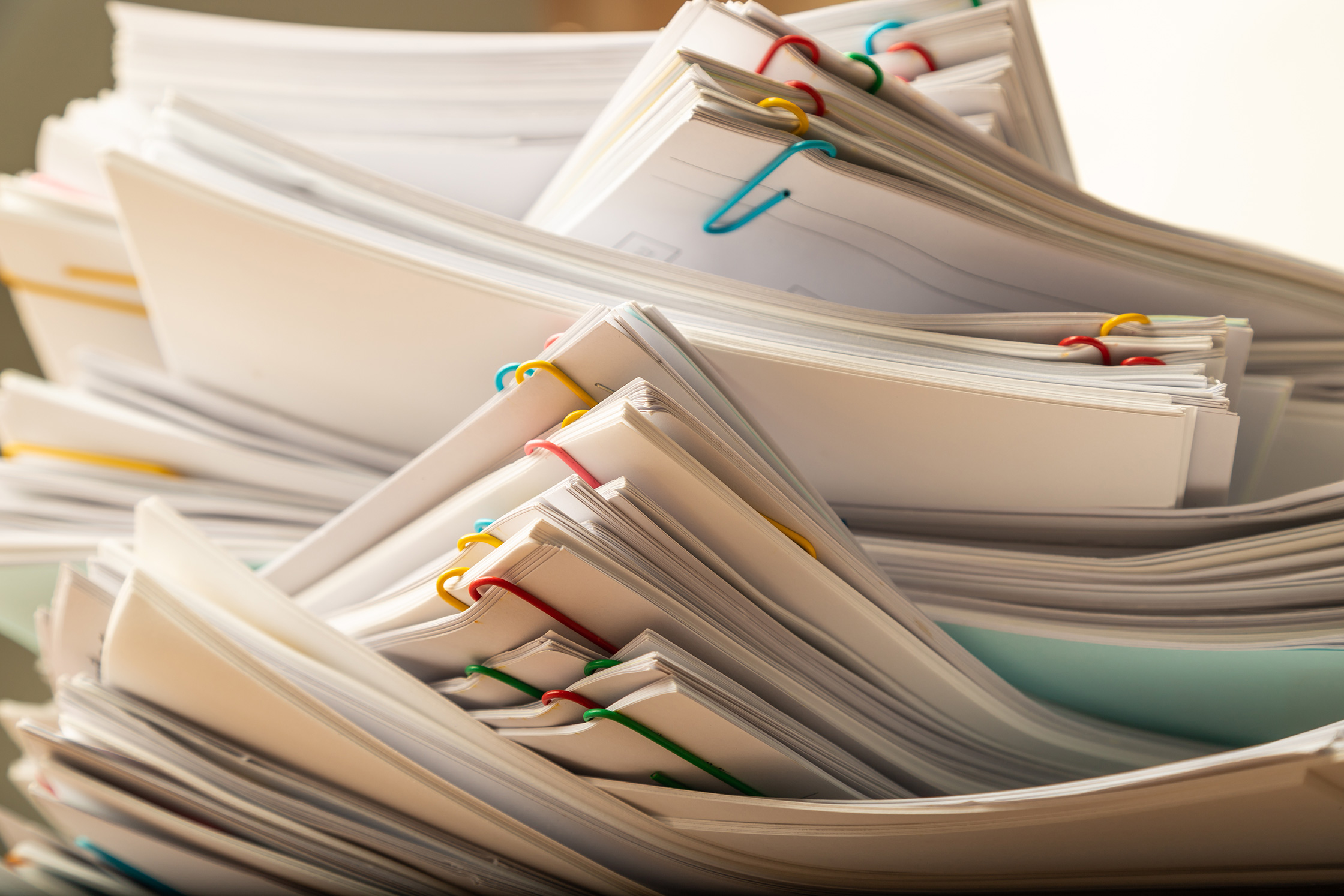

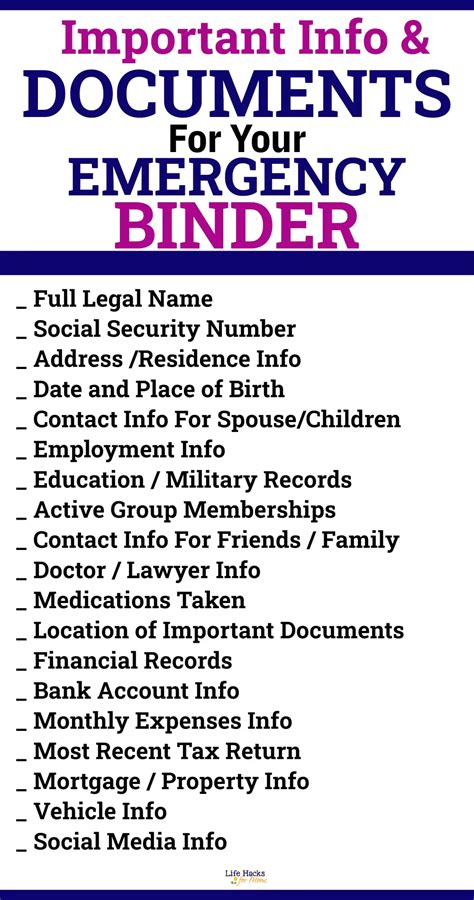

Tips for Managing Estate Paperwork

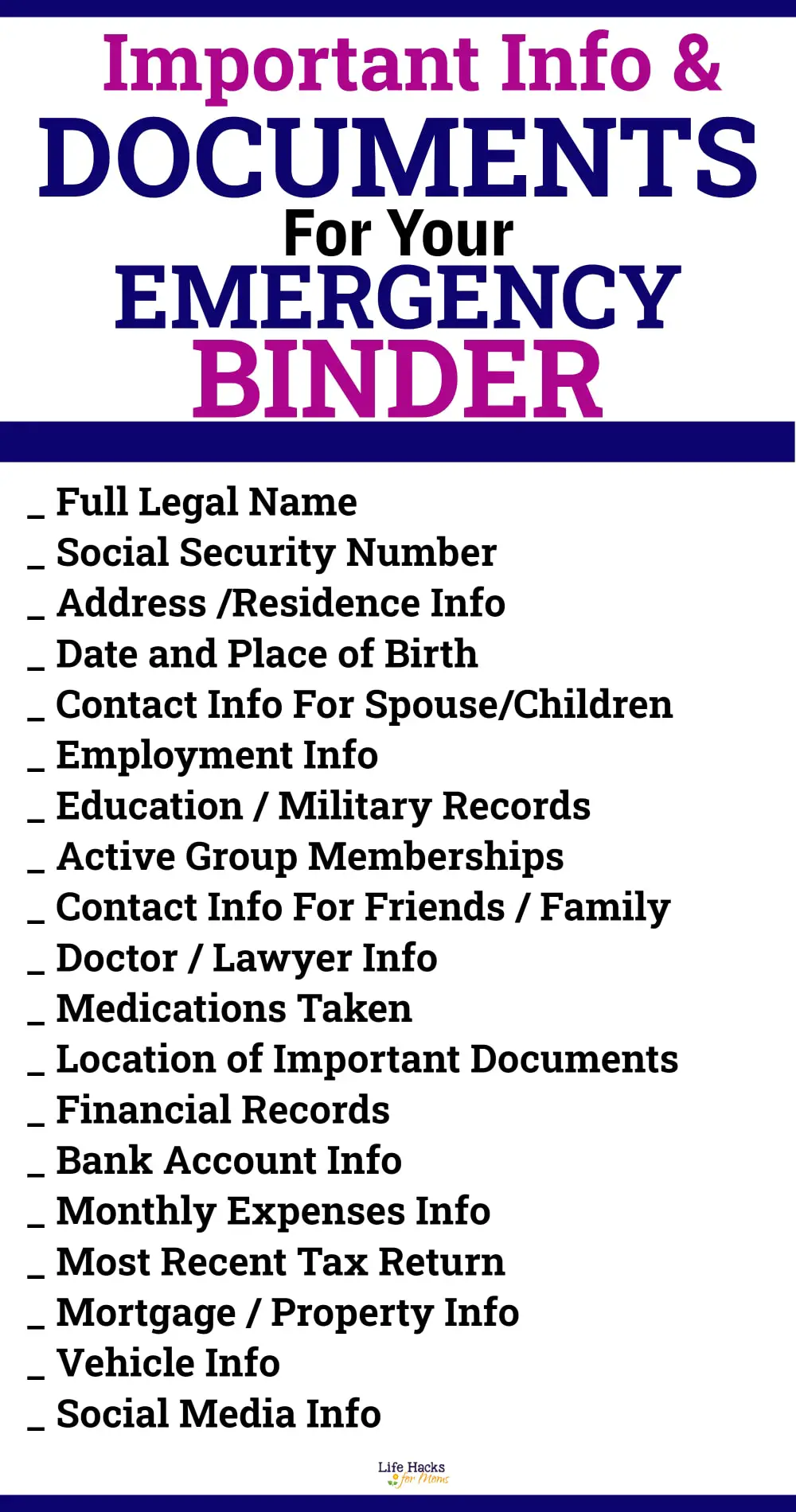

Here are seven tips for managing estate paperwork effectively: - Keep Documents Organized: Ensure all estate documents are kept in a secure, easily accessible location. This could be a safe deposit box or a fireproof safe at home. - Review and Update Regularly: Estate plans should be reviewed and updated every few years or when significant life changes occur, such as marriage, divorce, or the birth of a child. - Consider Digital Storage: In addition to physical copies, consider scanning documents and storing them digitally with a secure service. This can provide an extra layer of protection against loss or damage. - Communicate with Beneficiaries: It’s crucial to communicate the location and contents of estate documents to beneficiaries and executors to avoid confusion and potential disputes. - Seek Professional Advice: Given the complexity of estate law, consulting with an attorney or financial advisor can help ensure that all paperwork is correctly filled out and filed. - Understand Tax Implications: Estate planning involves understanding the tax implications of transferring assets. This can include estate taxes, gift taxes, and income taxes on assets. - Maintain Privacy: Be mindful of who has access to estate documents, as they contain sensitive personal and financial information.

Common Estate Paperwork Mistakes to Avoid

Several common mistakes can lead to unnecessary complications in estate planning. These include: * Failing to update beneficiaries: Outdated beneficiary designations can lead to assets being distributed to unintended recipients. * Not having a will or trust: Without these documents, the distribution of assets will be determined by state law, which may not align with one’s wishes. * Incorrectly filling out forms: Small mistakes on legal documents can render them invalid or lead to misunderstandings. * Not considering all assets: All assets, including digital assets, should be accounted for in an estate plan.

📝 Note: It's essential to approach estate planning with a thorough understanding of the legal and financial implications involved. Consulting with professionals can provide peace of mind and ensure that one's wishes are carried out.

Estate Planning for Digital Assets

In today’s digital age, estate planning must also consider digital assets, such as social media accounts, email, and cryptocurrency. This involves: * Identifying all digital assets * Determining how each asset should be managed after one’s passing * Including instructions for digital assets in the estate plan * Ensuring that executors or beneficiaries have the necessary access information

| Type of Digital Asset | Considerations for Estate Planning |

|---|---|

| Social Media Accounts | Instructions for memorials, closures, or maintaining accounts |

| Email and Messaging Services | Access information and instructions for handling communications |

| Cryptocurrency and Digital Wallets | Secure access information and instructions for distribution or management |

As estate planning continues to evolve, considering all types of assets, including digital ones, is crucial for a comprehensive plan.

Estate planning is a multifaceted process that involves careful consideration of one’s assets, wishes, and the legal and financial implications of transferring those assets. By understanding the basics of estate paperwork, avoiding common mistakes, and staying informed about developments in estate planning, individuals can ensure that their estates are managed according to their desires, providing peace of mind for themselves and their loved ones.

What is the primary purpose of a will in estate planning?

+

The primary purpose of a will is to outline how a person wants their property to be distributed after their death, ensuring their wishes are respected.

Why is it important to review and update estate documents regularly?

+

Reviewing and updating estate documents regularly ensures they remain relevant and effective, reflecting any changes in personal circumstances, assets, or wishes.

How does digital asset management fit into estate planning?

+

Digital asset management involves identifying, managing, and including instructions for digital assets in the estate plan, ensuring they are handled according to one’s wishes after their passing.