5 Tips 401k

Understanding the Basics of 401k

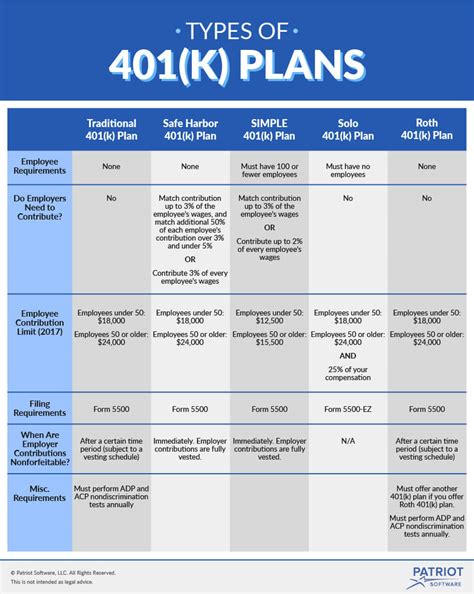

A 401k is a type of retirement savings plan that many employers offer to their employees. It allows workers to contribute a portion of their paycheck to a retirement account on a pre-tax basis, reducing their taxable income for the year. The funds in the account can then be invested in a variety of assets, such as stocks, bonds, and mutual funds, to grow over time. The key benefit of a 401k is that it provides a tax-advantaged way to save for retirement, helping individuals build a nest egg that can support them in their golden years.

Tip 1: Take Advantage of Employer Matching

One of the most significant advantages of a 401k is the potential for employer matching. Many employers offer to match a certain percentage of the employee’s contributions, essentially providing free money that can help the account grow faster. For example, an employer might match 50% of the employee’s contributions up to 6% of their salary. This means that if the employee contributes 6% of their salary to the 401k, the employer will add an additional 3%, resulting in a total contribution of 9%. It’s essential to contribute enough to maximize the employer match, as it can significantly impact the overall growth of the account.

Tip 2: Start Early and Be Consistent

When it comes to saving for retirement, time is of the essence. The earlier you start contributing to a 401k, the more time your money has to grow. Even small, consistent contributions can add up over time, thanks to the power of compound interest. For example, contributing $100 per month to a 401k from age 25 to 65 can result in a significantly larger nest egg than contributing the same amount from age 35 to 65. Developing a habit of regular contributions can help make saving for retirement a priority and ensure that you’re taking advantage of the time available to grow your wealth.

Tip 3: Choose the Right Investments

A 401k typically offers a range of investment options, from conservative to aggressive. It’s essential to choose investments that align with your risk tolerance and retirement goals. For example, if you’re young and have a long time horizon, you may be able to afford to take on more risk and invest in stocks or other aggressive assets. On the other hand, if you’re closer to retirement, you may want to focus on more conservative investments, such as bonds or money market funds. Diversifying your portfolio can also help reduce risk and increase potential returns.

Tip 4: Avoid Withdrawing from Your 401k

While it may be tempting to withdraw from your 401k in times of financial need, it’s generally not a good idea. Withdrawals from a 401k are subject to income tax and may also be subject to a 10% penalty if you’re under the age of 59 1⁄2. This can result in a significant reduction in the amount of money you receive, not to mention the potential impact on your long-term retirement savings. Exploring alternative options, such as a personal loan or emergency fund, can help you avoid withdrawing from your 401k and preserve your retirement savings.

Tip 5: Monitor and Adjust Your Account

Finally, it’s essential to regularly monitor and adjust your 401k account to ensure it remains aligned with your retirement goals. This may involve reviewing your investment portfolio, adjusting your contribution rate, or changing your beneficiary designations. Keeping your account up to date can help you stay on track and make the most of your 401k benefits. Consider scheduling an annual review of your account to ensure you’re taking advantage of all the benefits and features available to you.

| Contribution Rate | Employer Match | Total Contribution |

|---|---|---|

| 3% | 1.5% | 4.5% |

| 6% | 3% | 9% |

| 9% | 4.5% | 13.5% |

📝 Note: The above table illustrates the potential impact of employer matching on your 401k contributions. Be sure to review your employer's matching policy to understand the specific details and maximize your benefits.

In summary, a 401k can be a powerful tool for building a secure retirement, but it’s essential to use it effectively. By taking advantage of employer matching, starting early and being consistent, choosing the right investments, avoiding withdrawals, and monitoring and adjusting your account, you can make the most of your 401k benefits and set yourself up for long-term financial success. With a little planning and discipline, you can create a comfortable and secure retirement that allows you to enjoy the fruits of your labor.

What is the maximum contribution limit for a 401k?

+

The maximum contribution limit for a 401k varies by year and is subject to change. For 2022, the limit is 19,500, or 26,000 if you are 50 or older and eligible for catch-up contributions.

Can I withdraw from my 401k at any time?

+

While you can withdraw from your 401k at any time, it’s generally not recommended. Withdrawals are subject to income tax and may also be subject to a 10% penalty if you’re under the age of 59 1⁄2. It’s essential to explore alternative options and consider the potential long-term impact on your retirement savings before making a withdrawal.

How do I choose the right investments for my 401k?

+

Choosing the right investments for your 401k depends on your individual circumstances, including your risk tolerance, retirement goals, and time horizon. Consider consulting with a financial advisor or using online resources to help you make informed decisions and create a diversified portfolio that aligns with your needs.