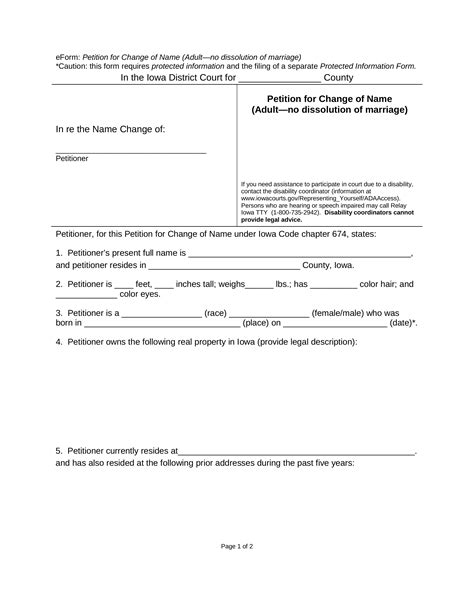

Paperwork

Efile Signing Requirements

Efile Signing Requirements: Understanding the Process

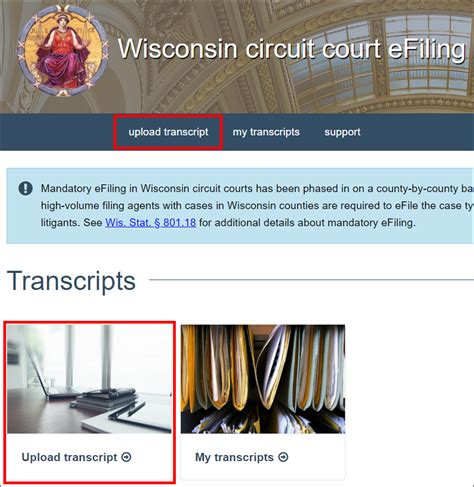

The electronic filing (efile) system has revolutionized the way individuals and businesses submit their tax returns, making the process more efficient and convenient. However, to ensure the authenticity and security of these submissions, certain efile signing requirements must be met. In this article, we will delve into the world of efile signing, exploring the requirements, benefits, and best practices associated with this process.

Benefits of Efile Signing

Before we dive into the specifics of efile signing requirements, it’s essential to understand the benefits of using this system. Some of the key advantages include: * Faster Refunds: Efiled tax returns are processed significantly faster than paper returns, resulting in quicker refunds. * Increased Accuracy: The efile system reduces the likelihood of errors, as it performs automatic checks and calculations. * Environmental Benefits: By reducing the need for paper, efile helps minimize the environmental impact of tax filing. * Convenience: Efile allows individuals and businesses to submit their tax returns from the comfort of their own homes or offices, 24⁄7.

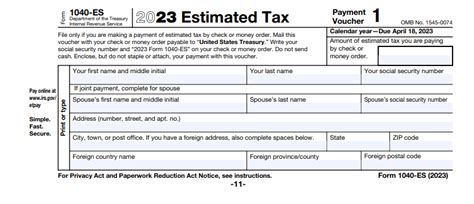

Efile Signing Requirements

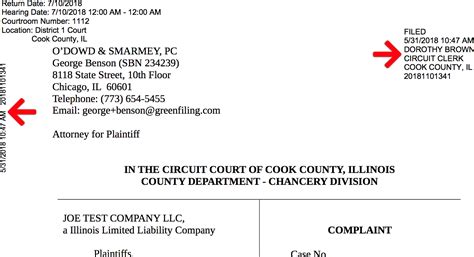

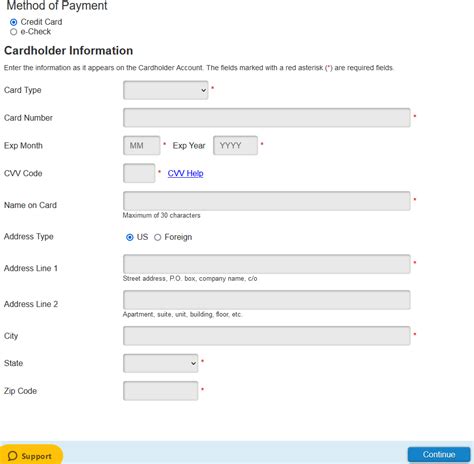

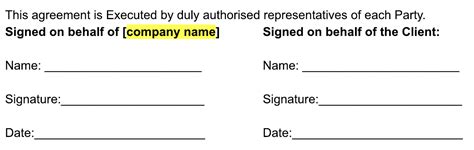

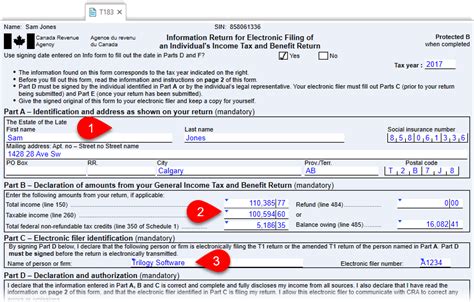

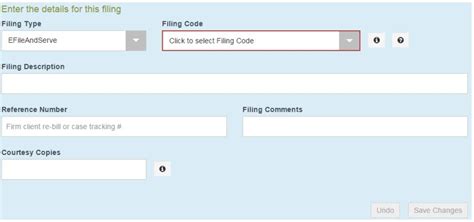

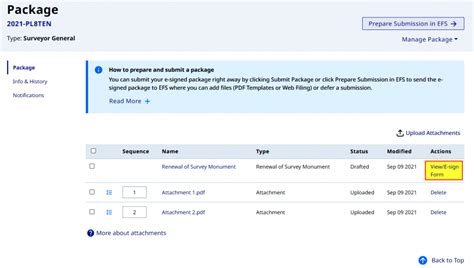

To efile a tax return, certain signing requirements must be met. These requirements vary depending on the type of tax return being filed and the role of the individual or business. Some of the key efile signing requirements include: * Electronic Signature: An electronic signature is required to authenticate the tax return. This can be done using a Self-Select PIN or an Electronic Filing PIN. * Identification Number: A valid identification number, such as a Social Security Number (SSN) or Employer Identification Number (EIN), is required to verify the identity of the individual or business. * Taxpayer Identification: The taxpayer’s name, address, and date of birth must be provided to ensure accurate identification. * Signature Date: The date of signing must be included to confirm the authenticity of the electronic signature.

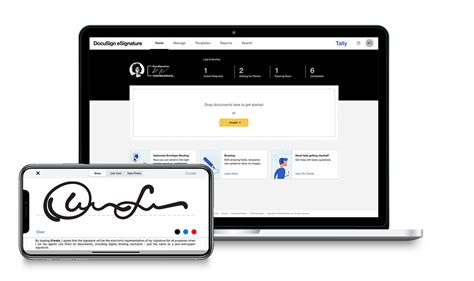

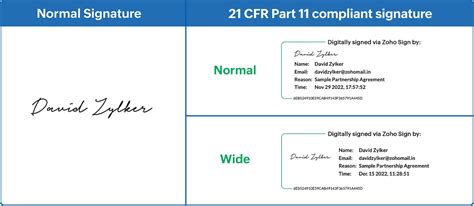

Types of Electronic Signatures

There are several types of electronic signatures that can be used to meet efile signing requirements. These include: * Self-Select PIN: A self-select PIN is a five-digit number chosen by the taxpayer to authenticate their electronic signature. * Electronic Filing PIN: An electronic filing PIN is a six-digit number assigned by the IRS to authenticate the taxpayer’s electronic signature. * Digital Signature: A digital signature uses encryption technology to authenticate the taxpayer’s identity and ensure the integrity of the electronic signature.

Best Practices for Efile Signing

To ensure a smooth and secure efile signing process, it’s essential to follow best practices. Some of these include: * Use a Secure Connection: Always use a secure internet connection to protect sensitive information. * Keep Software Up-to-Date: Ensure that all tax preparation software is up-to-date to prevent compatibility issues. * Use Strong Passwords: Use strong, unique passwords to protect access to tax preparation software and electronic signatures. * Verify Identity: Verify the identity of the taxpayer and any authorized representatives to prevent unauthorized access.

📝 Note: It's essential to follow all efile signing requirements and best practices to ensure the security and authenticity of electronic tax returns.

Common Efile Signing Errors

Despite the benefits of efile signing, errors can still occur. Some common errors include: * Incorrect Electronic Signature: An incorrect electronic signature can result in rejection of the tax return. * Invalid Identification Number: An invalid identification number can prevent the tax return from being processed. * Missing Signature Date: A missing signature date can raise questions about the authenticity of the electronic signature.

Resolving Efile Signing Issues

If issues arise during the efile signing process, it’s essential to resolve them promptly. Some steps to resolve common issues include: * Contacting the IRS: Contacting the IRS can help resolve issues related to electronic signatures and identification numbers. * Updating Tax Preparation Software: Updating tax preparation software can help resolve compatibility issues and ensure that all efile signing requirements are met. * Re-Submitting the Tax Return: Re-submitting the tax return with corrected information can help resolve errors and ensure timely processing.

Conclusion and Final Thoughts

In conclusion, efile signing requirements are an essential part of the electronic tax filing process. By understanding the benefits, requirements, and best practices associated with efile signing, individuals and businesses can ensure a smooth and secure tax filing experience. Whether you’re a seasoned tax professional or an individual filing your own tax return, it’s essential to follow all efile signing requirements and best practices to ensure the authenticity and security of your electronic tax return.

What is an electronic signature, and how is it used in efile signing?

+

An electronic signature is a digital authentication method used to verify the identity of the taxpayer and authenticate the tax return. It can be done using a self-select PIN, electronic filing PIN, or digital signature.

What are the benefits of using efile signing for tax returns?

+

The benefits of using efile signing for tax returns include faster refunds, increased accuracy, environmental benefits, and convenience.

How do I resolve common efile signing errors, such as incorrect electronic signatures or invalid identification numbers?

+

To resolve common efile signing errors, contact the IRS, update tax preparation software, or re-submit the tax return with corrected information.