5 Tips Flex Spending

Understanding Flexible Spending Accounts (FSAs)

Flexible Spending Accounts, commonly referred to as FSAs, are a type of savings account that allows individuals to set aside a portion of their income on a pre-tax basis to pay for qualified expenses related to healthcare or childcare. The funds contributed to an FSA are deducted from an employee’s paycheck before taxes, reducing their taxable income and thus lowering their tax liability. FSAs can be a valuable tool for managing out-of-pocket expenses, but they require careful planning due to their use-it-or-lose-it nature, where any unused funds at the end of the plan year are forfeited, unless the plan includes a carryover or grace period provision.

Benefits of Using an FSA

The primary benefit of using an FSA is the ability to pay for necessary expenses with pre-tax dollars, which can result in significant savings. For example, if an individual is in a higher tax bracket, the savings from using an FSA can be substantial. Additionally, FSAs can help budget for predictable expenses, making it easier to manage finances throughout the year. However, it’s crucial to accurately estimate expenses to avoid forfeiting unused funds.

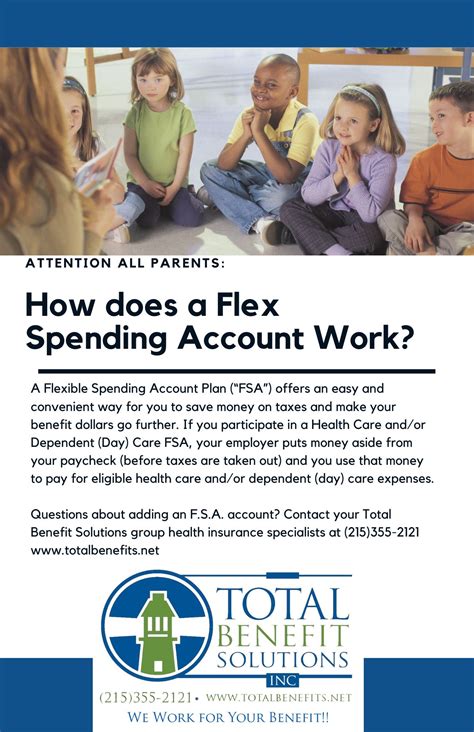

Types of FSAs

There are several types of FSAs, including: - Healthcare FSA: Used for medical expenses not covered by insurance, such as copays, deductibles, and prescription medications. - Dependent Care FSA: Designed for expenses related to the care of dependents, such as childcare or adult day care, allowing individuals to work or attend school. - Limited Expense FSA: A type of healthcare FSA that is limited to dental and vision expenses and can be used in conjunction with a Health Savings Account (HSA).

5 Tips for Maximizing Your FSA Benefits

To get the most out of your FSA, consider the following strategies: - Plan Ahead: Estimate your expenses carefully to avoid overfunding your account. Consider your health insurance deductible, copays, prescription costs, and any planned medical procedures. - Keep Receipts: Always keep receipts for FSA-eligible expenses, as you may need them to substantiate claims. Many FSA providers offer mobile apps or online platforms to upload receipts and manage your account. - Understand Eligible Expenses: Familiarize yourself with what expenses are eligible for reimbursement. This can include items like band-aids, thermometers, and even some over-the-counter medications with a prescription. - Take Advantage of the Grace Period or Carryover: If your plan allows, take advantage of the grace period to incur expenses after the plan year ends or the carryover provision to transfer a limited amount of unused funds to the next year. - Combine with Other Benefits: If you have a Health Savings Account (HSA) and a healthcare FSA, understand how they can be used together, especially if you have a limited expense FSA for dental and vision care.

Managing Your FSA Effectively

Effective management of your FSA involves regular monitoring of your account balance and expenses throughout the year. This ensures that you are on track to use the funds as intended and can make adjustments as needed. Consider setting reminders for when expenses are due or when you need to review your account balance.

💡 Note: Always check with your employer or FSA provider for specific rules and eligibility, as plan details can vary significantly.

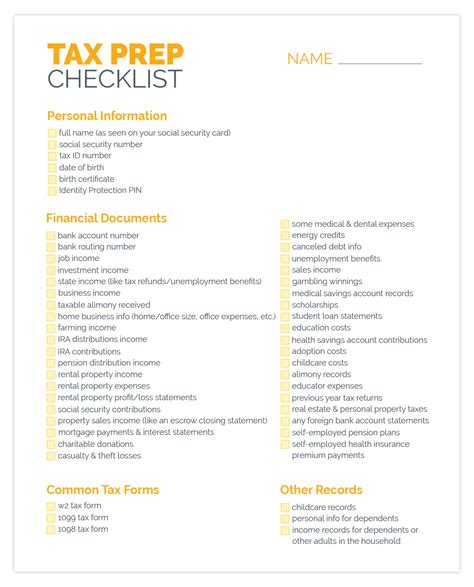

Common FSA Eligible Expenses

Understanding what expenses are eligible for reimbursement can help in maximizing the benefits of your FSA. Common eligible expenses include: - Medical services and procedures - Prescription medications - Over-the-counter medications with a prescription - Dental and vision care - Medical equipment and supplies - Childcare costs for children under 13 (for dependent care FSAs)

| Expense Category | Examples of Eligible Expenses |

|---|---|

| Medical | Doctor visits, hospital stays, lab tests |

| Dental | Teeth cleaning, fillings, orthodontics |

| Vision | Eye exams, glasses, contact lenses |

| Prescriptions | Medications prescribed by a doctor |

| Childcare | Daycare, after-school programs, summer camps |

In summary, FSAs offer a tax-advantaged way to pay for healthcare and dependent care expenses, but they require careful planning to maximize benefits and avoid losing unused funds. By understanding the types of FSAs available, planning ahead, and keeping track of eligible expenses, individuals can make the most of these accounts and reduce their out-of-pocket costs. Whether you’re managing healthcare expenses or childcare costs, an FSA can be a valuable tool in your financial planning strategy.

To wrap things up, the key to successfully utilizing an FSA is to be informed and proactive. By staying on top of your expenses and plan details, you can ensure that you’re getting the most out of your FSA and making the most of your money.

What is the main advantage of using a Flexible Spending Account (FSA)?

+

The main advantage of using an FSA is the ability to set aside pre-tax dollars for qualified expenses, reducing your taxable income and thus lowering your tax liability.

What types of expenses are eligible for reimbursement under a healthcare FSA?

+

Eligible expenses include medical services, prescription medications, dental and vision care, and medical equipment and supplies, among others. Always check with your FSA provider for a comprehensive list.

Can I use my FSA funds for expenses incurred by my dependents?

+

Yes, you can use your FSA funds for qualified expenses incurred by you, your spouse, and your dependents, as defined by the IRS. This includes medical expenses for dependents, as well as childcare costs for dependents under the age of 13, through a dependent care FSA.