Health Insurance Marketplace Checks Paperwork

Understanding the Health Insurance Marketplace

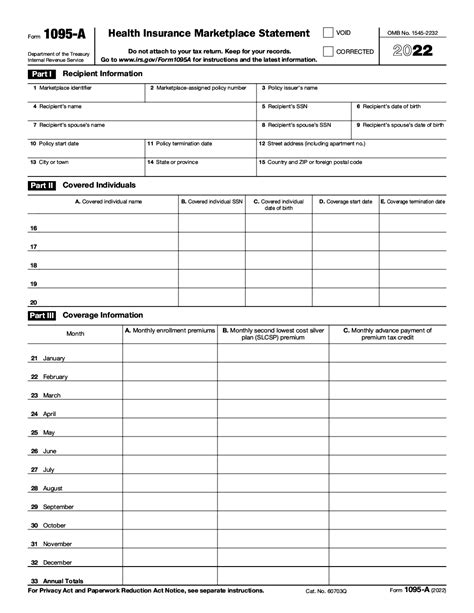

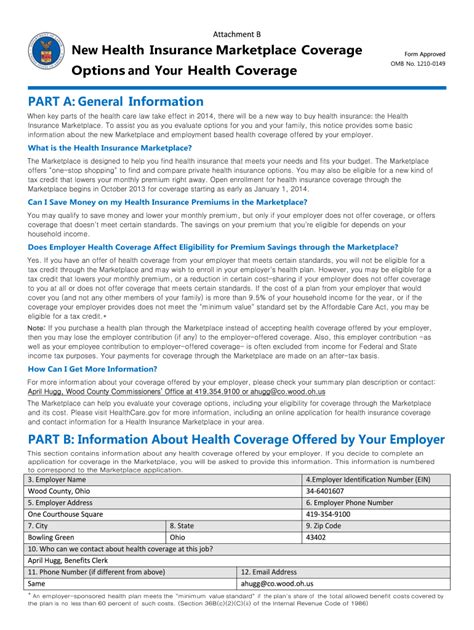

The Health Insurance Marketplace, also known as the health insurance exchange, is a platform where individuals and families can purchase health insurance plans that meet their needs and budget. The marketplace offers a variety of plans from different insurance companies, allowing consumers to compare and choose the best option for themselves. One of the key features of the Health Insurance Marketplace is the ability to check paperwork and verify eligibility for financial assistance, such as subsidies or tax credits.

How the Marketplace Checks Paperwork

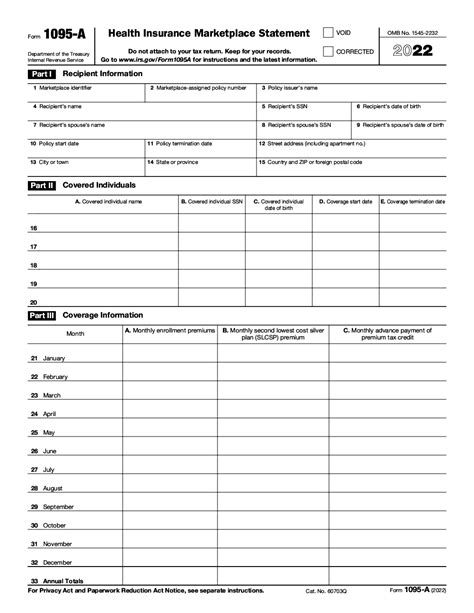

When applying for health insurance through the marketplace, individuals and families are required to provide certain documentation, such as proof of income, citizenship, and identity. The marketplace uses this information to verify eligibility for coverage and determine the amount of financial assistance, if any, that the individual or family is eligible to receive. The marketplace checks paperwork by verifying the information provided against data from other sources, such as the Social Security Administration, the Internal Revenue Service, and other government agencies.

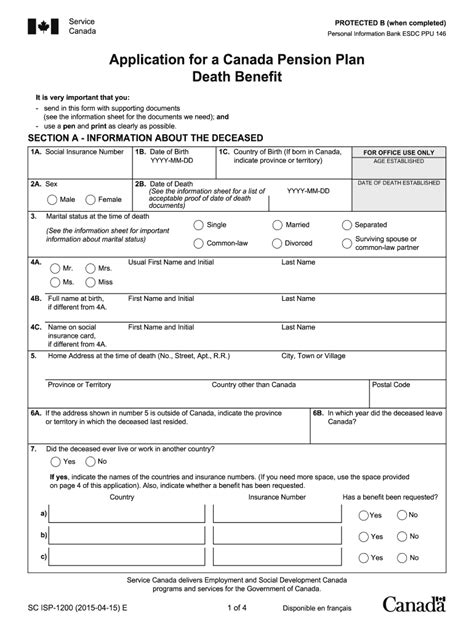

Types of Paperwork Required

The types of paperwork required to apply for health insurance through the marketplace may vary depending on the individual’s or family’s circumstances. Some common types of paperwork that may be required include: * Proof of income, such as pay stubs or tax returns * Proof of citizenship, such as a birth certificate or passport * Proof of identity, such as a driver’s license or state ID * Proof of residency, such as a utility bill or lease agreement * Proof of family relationships, such as a marriage certificate or birth certificate

Importance of Accurate Paperwork

It is essential to provide accurate and complete paperwork when applying for health insurance through the marketplace. Inaccurate or incomplete paperwork can lead to delays or even denials of coverage. Additionally, providing false or misleading information can result in penalties or even prosecution. It is crucial to carefully review and verify all paperwork before submitting it to ensure that it is accurate and complete.

Common Issues with Paperwork

Some common issues that may arise with paperwork when applying for health insurance through the marketplace include: * Incomplete or missing documentation * Inaccurate or inconsistent information * Failure to provide required documentation * Delays in processing paperwork due to high volume or technical issues

💡 Note: It is essential to follow up with the marketplace or insurance company to ensure that paperwork is being processed correctly and to resolve any issues that may arise.

Verifying Eligibility for Financial Assistance

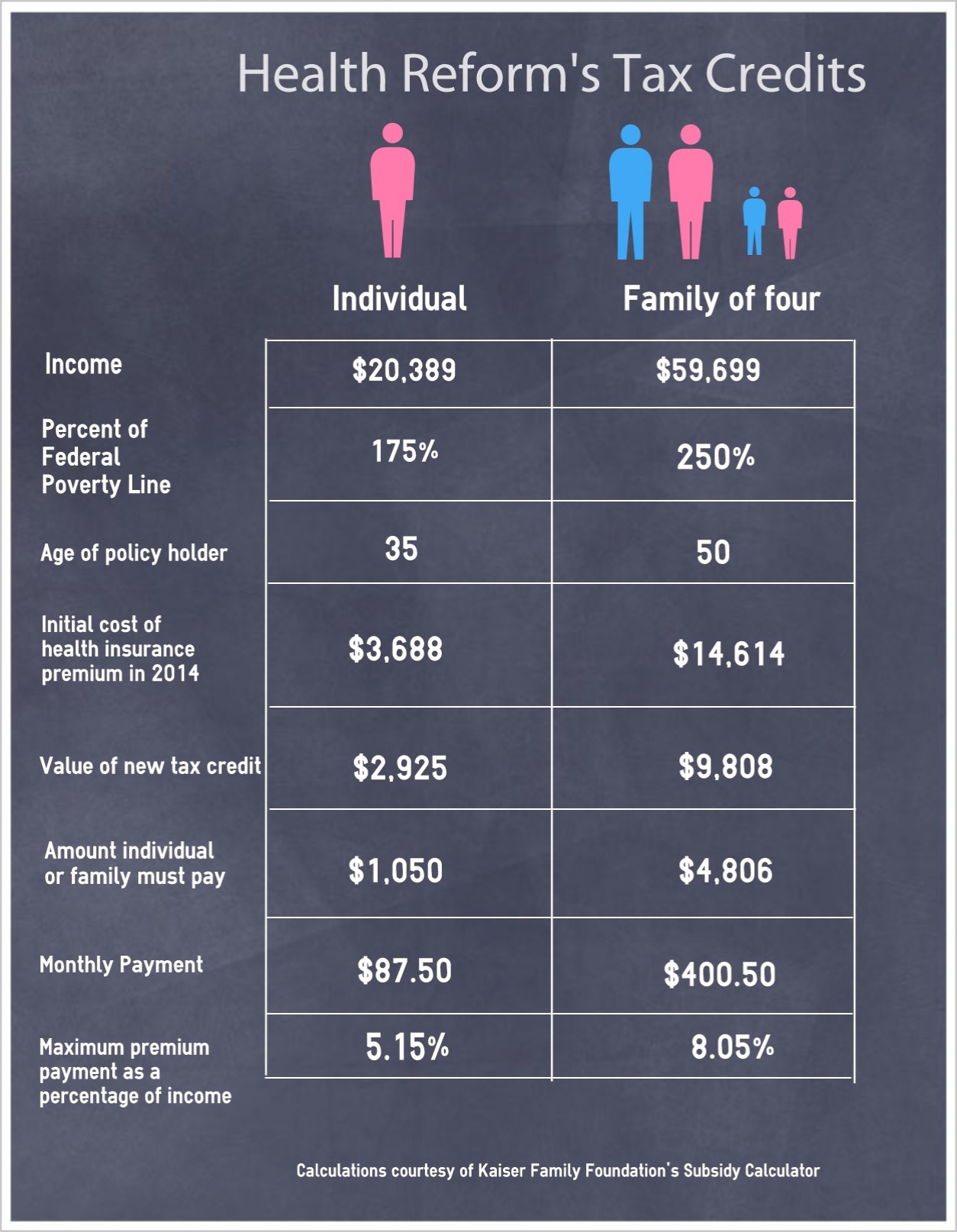

The marketplace uses the paperwork provided to verify eligibility for financial assistance, such as subsidies or tax credits. The amount of financial assistance available depends on the individual’s or family’s income, family size, and other factors. The marketplace uses a formula to determine the amount of financial assistance, taking into account the cost of the health insurance plan and the individual’s or family’s income.

Table of Eligibility for Financial Assistance

The following table provides a general overview of the eligibility for financial assistance:

| Income Level | Family Size | Eligibility for Financial Assistance |

|---|---|---|

| 100-400% of FPL | 1-8 | Eligible for subsidies or tax credits |

| 0-100% of FPL | 1-8 | Eligible for Medicaid or CHIP |

| Above 400% of FPL | 1-8 | Ineligible for financial assistance |

Conclusion and Final Thoughts

In conclusion, the Health Insurance Marketplace plays a crucial role in providing individuals and families with access to affordable health insurance. The marketplace checks paperwork to verify eligibility for coverage and financial assistance, ensuring that individuals and families receive the correct amount of support. By understanding the types of paperwork required, the importance of accurate paperwork, and the common issues that may arise, individuals and families can navigate the application process with confidence. Ultimately, the Health Insurance Marketplace provides a vital service, enabling individuals and families to access quality healthcare and financial assistance when needed.

What types of paperwork are required to apply for health insurance through the marketplace?

+

The types of paperwork required may vary depending on the individual’s or family’s circumstances, but common types of paperwork include proof of income, citizenship, identity, residency, and family relationships.

How does the marketplace verify eligibility for financial assistance?

+

The marketplace uses a formula to determine the amount of financial assistance, taking into account the cost of the health insurance plan and the individual’s or family’s income. The marketplace also verifies eligibility by checking paperwork against data from other sources, such as the Social Security Administration and the Internal Revenue Service.

What happens if I provide inaccurate or incomplete paperwork?

+

Inaccurate or incomplete paperwork can lead to delays or even denials of coverage. It is essential to carefully review and verify all paperwork before submitting it to ensure that it is accurate and complete.