5 Tips Survivor Benefits

Understanding Survivor Benefits: A Comprehensive Guide

When a loved one passes away, the emotional turmoil can be overwhelming, and navigating the complex world of survivor benefits can add to the stress. It’s essential to understand the various types of benefits available to ensure that you and your family receive the support you need during this challenging time. In this article, we’ll delve into the world of survivor benefits, exploring five crucial tips to help you make informed decisions.

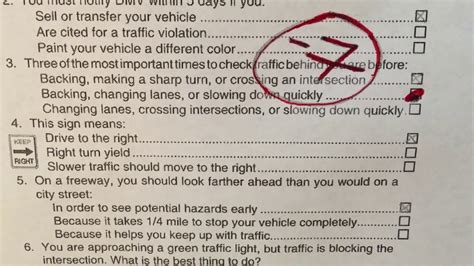

Tip 1: Know Your Eligibility

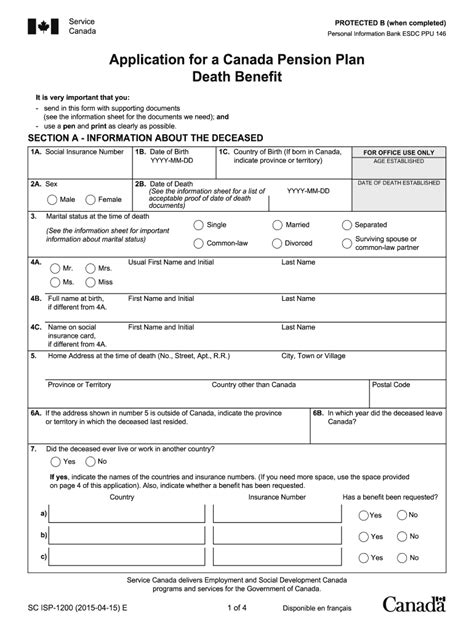

To receive survivor benefits, you must first determine your eligibility. This typically depends on the deceased person’s employment history, age, and the type of benefit they were receiving. For instance, Social Security survivor benefits are available to the spouses and children of deceased workers who have paid Social Security taxes. It’s crucial to gather all necessary documents, including the deceased person’s Social Security number, birth and death certificates, and marriage certificates, to facilitate the application process.

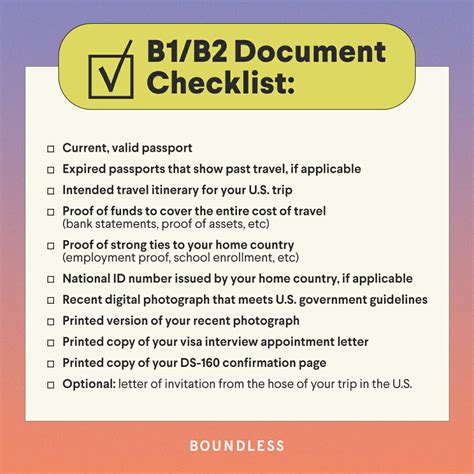

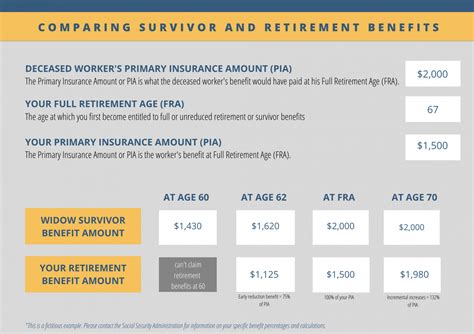

Tip 2: Understand the Types of Benefits

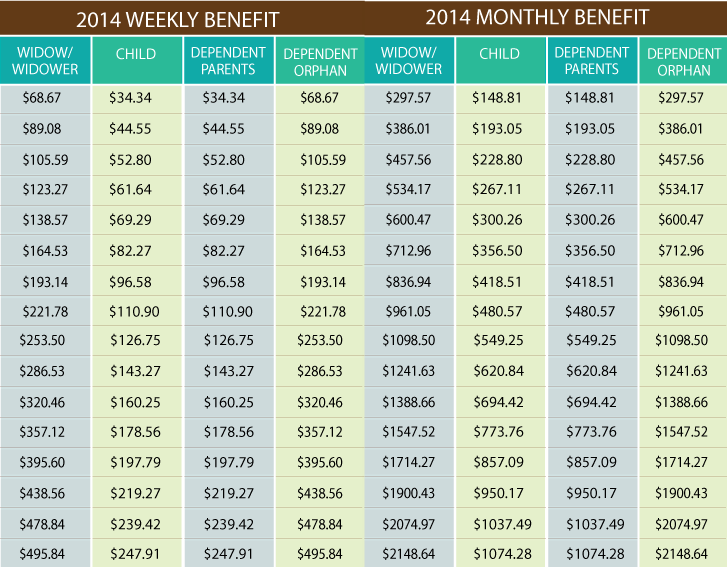

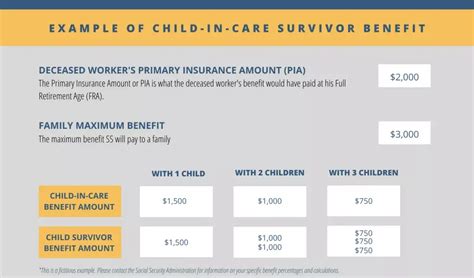

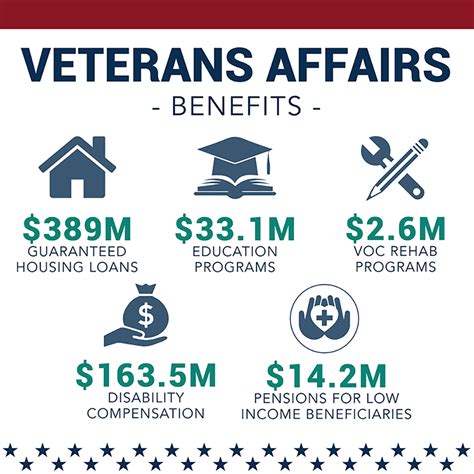

There are several types of survivor benefits, each with its own set of rules and eligibility criteria. These include: * Social Security survivor benefits: Available to spouses, children, and dependent parents of deceased workers. * Life insurance benefits: Paid out to beneficiaries named in the policy. * Pension benefits: Offered to spouses and dependents of retired workers. * Veterans benefits: Available to spouses and children of deceased veterans. * Workers’ compensation benefits: Paid to dependents of workers who died on the job.

Tip 3: Apply for Benefits Promptly

It’s essential to apply for survivor benefits as soon as possible after the deceased person’s passing. Delayed applications can result in reduced or forfeited benefits. You can apply for benefits online, by phone, or in person at your local Social Security office. Be prepared to provide detailed information about the deceased person and your relationship to them.

Tip 4: Manage Your Benefits Wisely

Once you begin receiving survivor benefits, it’s crucial to manage them wisely. This includes: * Understanding tax implications: Some survivor benefits are taxable, while others are not. * Coordinating with other benefits: If you’re receiving multiple benefits, ensure you’re not exceeding income limits or violating eligibility rules. * Planning for the future: Consider seeking the advice of a financial advisor to ensure you’re making the most of your benefits and planning for long-term financial stability.

Tip 5: Seek Professional Guidance

Navigating the complex world of survivor benefits can be overwhelming, especially during a time of grief. Consider seeking the guidance of a professional advisor, such as a financial planner or an attorney specializing in elder law. They can help you: * Understand your eligibility and the types of benefits available to you. * Apply for benefits and ensure you’re receiving the maximum amount you’re entitled to. * Manage your benefits and plan for long-term financial stability.

💡 Note: It's essential to keep detailed records of your application and benefits, including correspondence and payment schedules, to ensure you're receiving the correct amount and to facilitate any future changes or updates.

In summary, understanding and navigating survivor benefits requires careful planning, attention to detail, and a willingness to seek professional guidance when needed. By following these five tips, you can ensure that you and your family receive the support you need during a difficult time.

What are the eligibility criteria for Social Security survivor benefits?

+

To be eligible for Social Security survivor benefits, you must be the spouse, child, or dependent parent of a deceased worker who has paid Social Security taxes. The deceased person must have worked and earned enough credits to be eligible for benefits.

How do I apply for survivor benefits?

+

You can apply for survivor benefits online, by phone, or in person at your local Social Security office. You’ll need to provide detailed information about the deceased person and your relationship to them, as well as supporting documents such as birth and death certificates.

Are survivor benefits taxable?

+

Some survivor benefits are taxable, while others are not. It’s essential to understand the tax implications of your benefits to ensure you’re not caught off guard by unexpected tax liabilities.