House Buying Bid Paperwork Bank Info Required

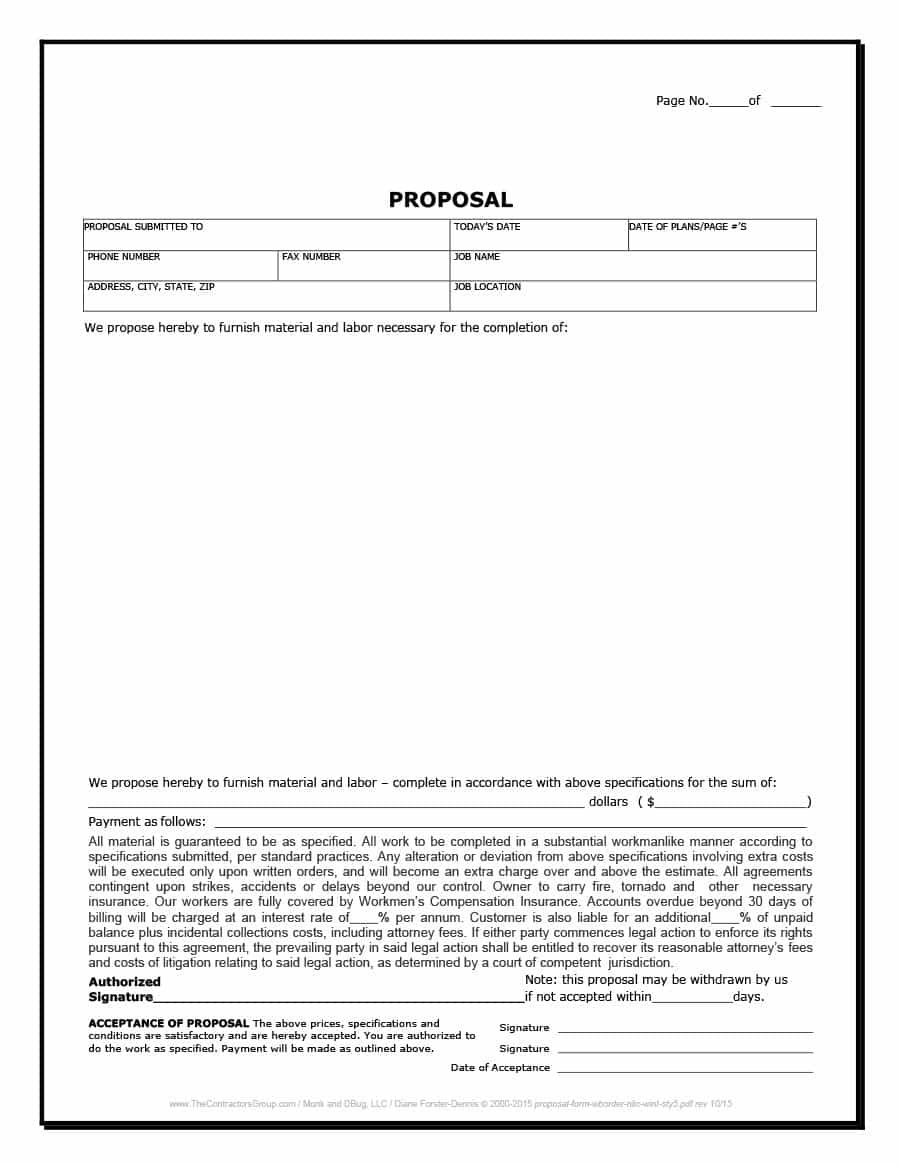

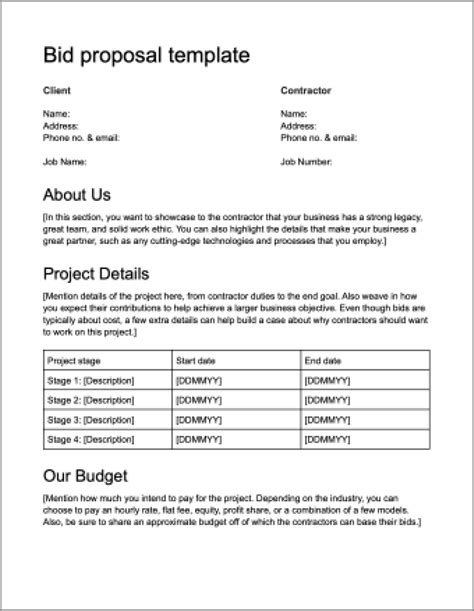

Introduction to House Buying Bid Paperwork

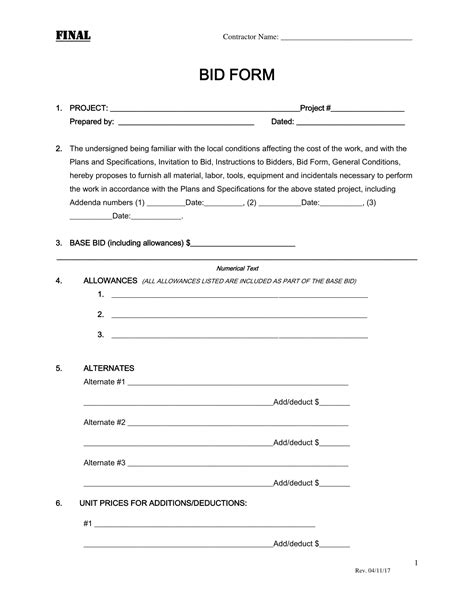

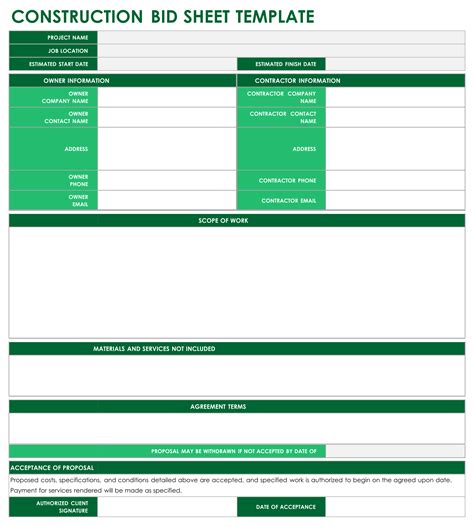

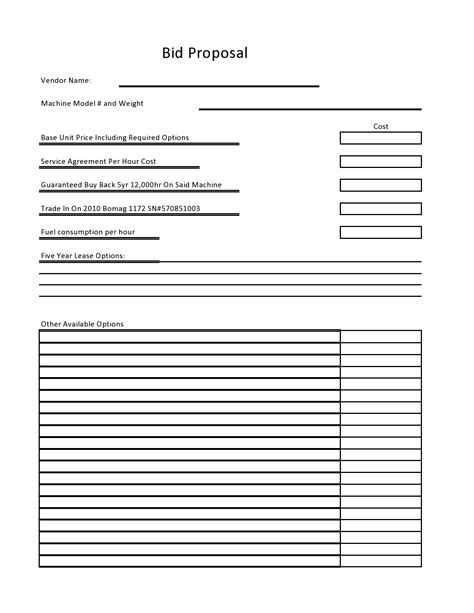

When it comes to purchasing a house, the process can be complex and involves a significant amount of paperwork. One of the critical steps in this process is submitting a bid on a property. This bid, also known as an offer, is a formal proposal to purchase the house under specified terms and conditions. As part of this process, buyers are often required to provide certain financial information to demonstrate their ability to secure financing. This includes providing bank information, which is a sensitive topic and requires careful handling to ensure privacy and security.

Understanding the Requirement for Bank Information

The requirement for bank information as part of the house buying bid paperwork serves several purposes. Firstly, it helps the seller understand the buyer’s financial capability and the likelihood of the sale going through. Sellers want to ensure that the buyer can secure the necessary financing to complete the purchase. By providing bank statements or proof of funds, buyers can demonstrate their financial stability and sincerity in their offer. This step is particularly important in competitive markets where multiple bids are common, and sellers need to distinguish between serious and less serious buyers.

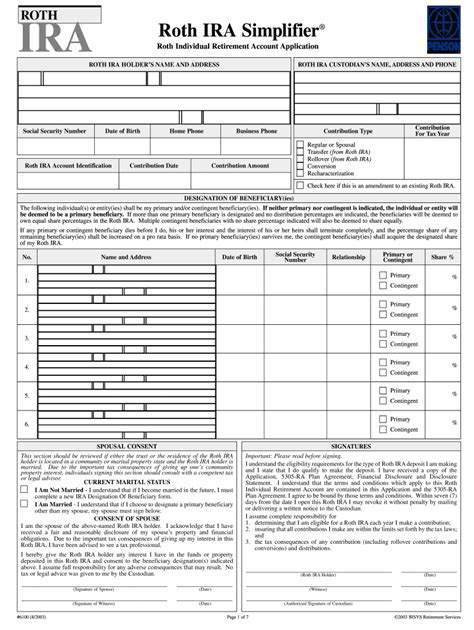

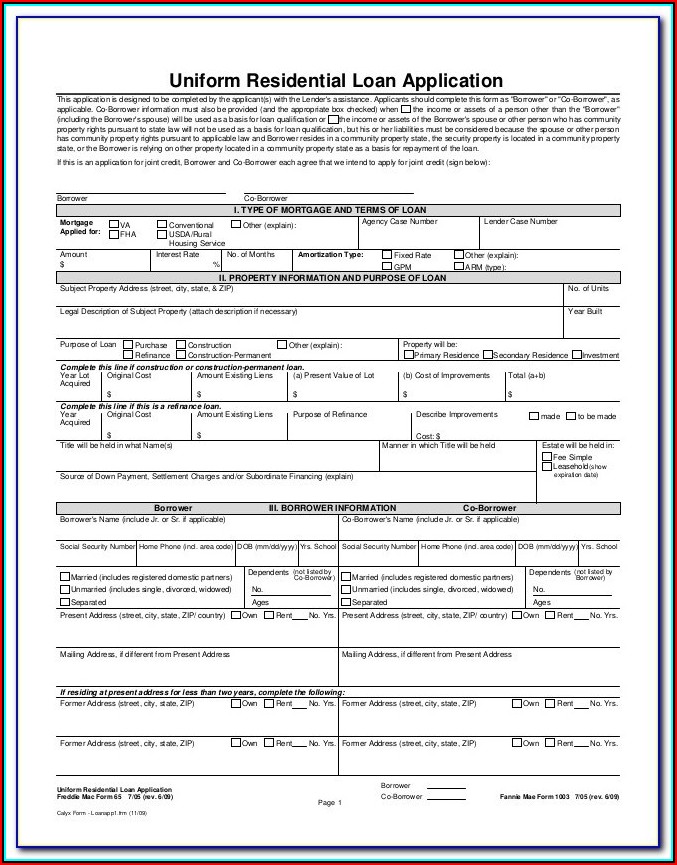

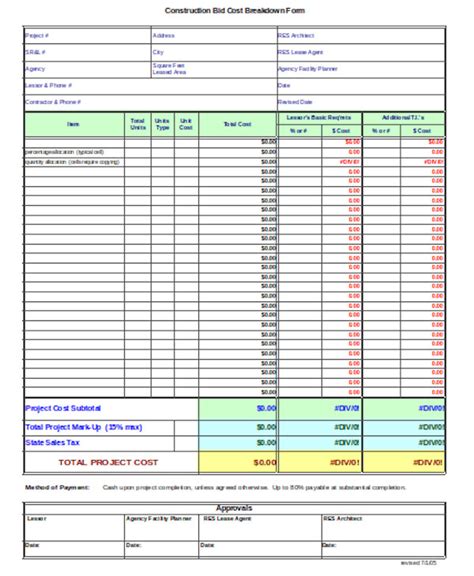

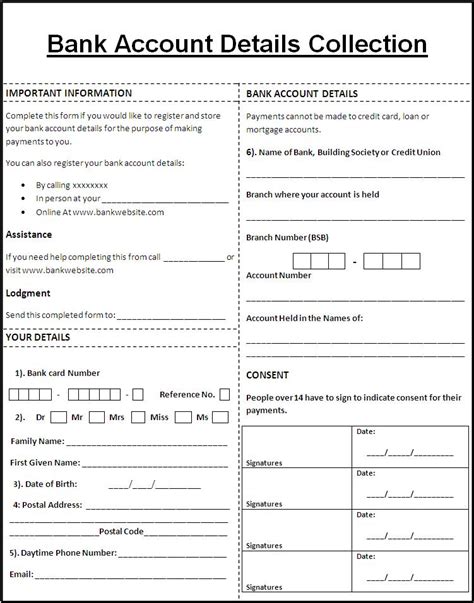

Types of Bank Information Required

The types of bank information required can vary depending on the specific circumstances of the sale and the preferences of the seller or their agent. Commonly, buyers are asked to provide: - Proof of Funds: This is a document from the buyer’s bank stating that they have sufficient funds to cover the purchase price. It’s especially relevant for cash buyers. - Pre-Approval Letter: For buyers who intend to secure a mortgage, a pre-approval letter from a lender indicating the amount they are eligible to borrow is often required. - Bank Statements: Sometimes, buyers may be asked to provide recent bank statements to show their income and savings history.

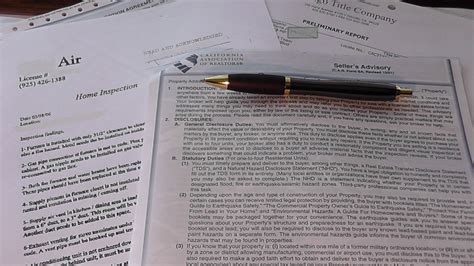

Ensuring Security and Privacy of Bank Information

Given the sensitive nature of bank information, it’s crucial for buyers to ensure that their data is handled securely and privately. Here are some tips: - Work with Reputable Agents: Ensure that the real estate agent and other parties involved in the transaction are reputable and have a history of handling sensitive information securely. - Use Secure Communication Channels: When sending bank information, use secure and encrypted communication methods to protect against unauthorized access. - Limit Shared Information: Only share the specific information requested and avoid providing more than is necessary.

Preparation is Key

To streamline the bidding process, buyers should prepare their financial documents in advance. This includes: - Gathering Bank Statements: Ensure that bank statements are up to date and reflect the buyer’s current financial situation. - Obtaining a Pre-Approval Letter: For those requiring a mortgage, getting pre-approved before starting the house hunt can make the bidding process smoother. - Understanding the Seller’s Requirements: Clarify what specific financial documents the seller requires to avoid last-minute scrambles.

📝 Note: It's essential to review the terms of the bid carefully, including any conditions related to the provision of bank information, to ensure that the buyer's privacy and financial security are protected.

Conclusion of the House Buying Process

In conclusion, the process of buying a house involves a myriad of steps, each critical to the success of the transaction. The requirement for bank information as part of the bid paperwork is a standard practice that helps facilitate the sale by providing assurance of the buyer’s financial capability. By understanding what information is required, preparing in advance, and taking steps to protect their privacy and security, buyers can navigate this aspect of the house buying process with confidence. Ultimately, a well-prepared buyer is better positioned to make a successful bid and achieve their goal of purchasing a new home.

What is the purpose of providing bank information when buying a house?

+

The purpose of providing bank information is to demonstrate the buyer’s financial capability and sincerity in their offer, giving the seller confidence in the buyer’s ability to secure financing and complete the purchase.

What types of bank information might a buyer be required to provide?

+

Buyers may be required to provide proof of funds, a pre-approval letter from a lender, or recent bank statements to show their income and savings history.

How can buyers protect their bank information during the house buying process?

+

Buyers can protect their bank information by working with reputable agents, using secure communication channels, and limiting the amount of information they share to only what is necessary for the transaction.