5 FHA Loan Papers

Introduction to FHA Loan Papers

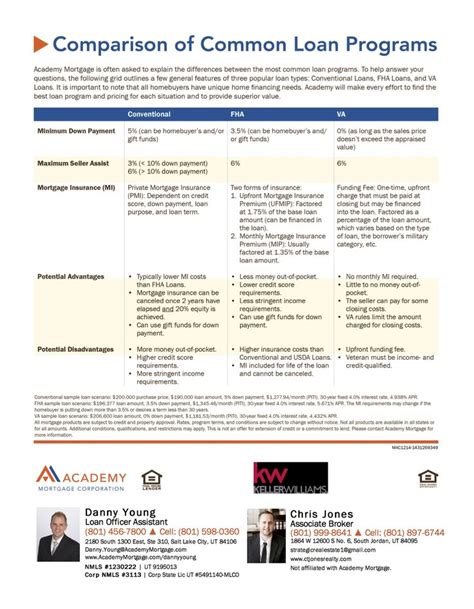

When it comes to purchasing a home, one of the most popular and accessible options for many Americans is the Federal Housing Administration (FHA) loan. These loans are insured by the FHA, a part of the U.S. Department of Housing and Urban Development (HUD), and offer more lenient qualification requirements compared to conventional loans. However, like any mortgage, the process involves a significant amount of paperwork. Understanding the key documents involved in an FHA loan can help simplify the process for potential homeowners.

Understanding FHA Loans

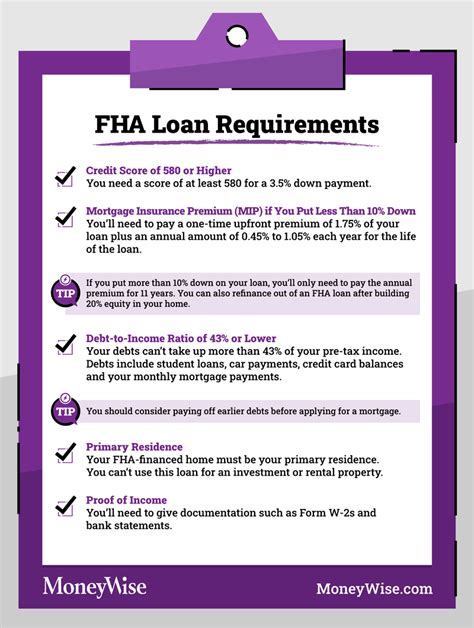

Before diving into the paperwork, it’s essential to have a basic understanding of how FHA loans work. FHA loans are designed to help low- to moderate-income families purchase homes. They require a lower down payment and have less stringent credit score requirements, making them more accessible. However, borrowers pay for mortgage insurance, which protects the lender in case the borrower defaults on the loan.

5 Key FHA Loan Papers

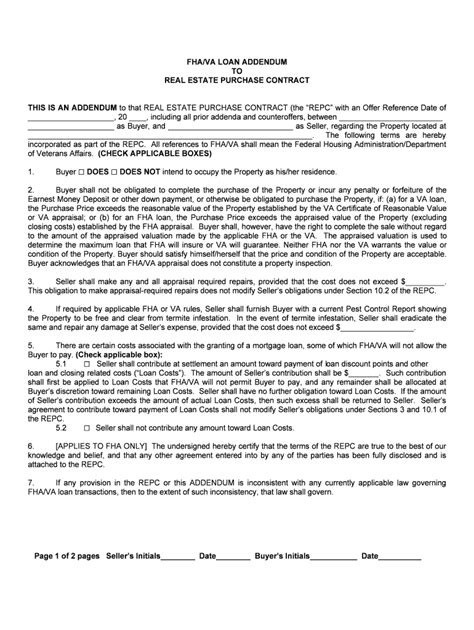

The process of obtaining an FHA loan involves several critical documents. Here are five key papers you’ll encounter:

Pre-Approval Letter: This is the first step in the home-buying process. It’s a letter from a lender stating the amount they are willing to lend you, based on a preliminary review of your credit and financial situation. It’s not a guarantee, but it gives you an idea of your budget and is often required by sellers to consider your offer.

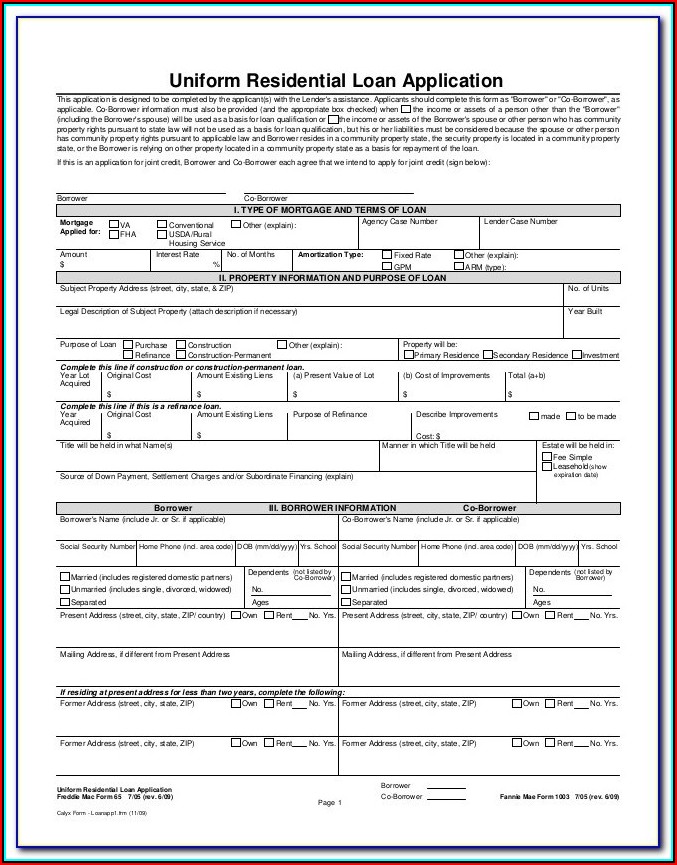

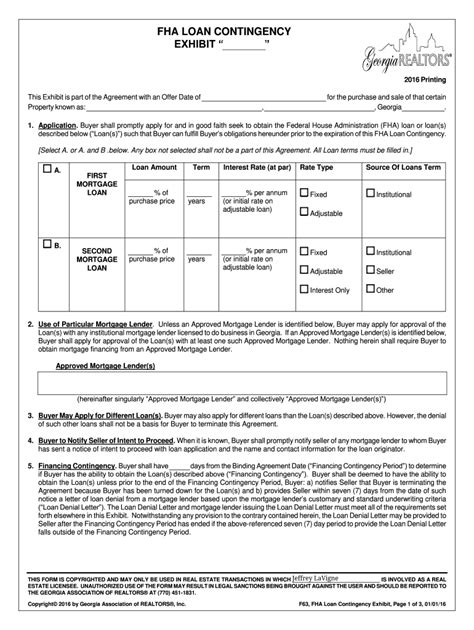

Loan Application (URLA - Uniform Residential Loan Application): Once you’ve found a home, you’ll need to fill out a formal loan application. This detailed form asks for information about your employment, income, debts, and credit history. It’s used by the lender to assess your creditworthiness and determine how much they can lend you.

Good Faith Estimate (GFE): Although the Good Faith Estimate has been replaced by the Loan Estimate as part of the Know Before You Owe mortgage disclosure rule, understanding its purpose is still valuable. The Loan Estimate provides a detailed breakdown of the loan’s terms, including the interest rate, monthly payments, and closing costs, helping you understand the total cost of the loan.

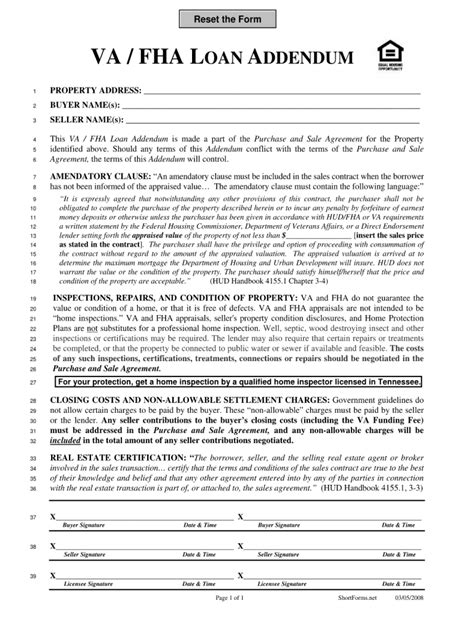

Title Report and Title Insurance: The title report verifies the ownership of the property and checks for any liens or unexpected ownership claims. Title insurance protects you and the lender from any potential issues with the property’s title that might arise after the purchase.

Closing Disclosure (CD): This document is provided at least three business days before the loan closes. It outlines the final terms of the loan, including the loan amount, interest rate, monthly payments, and all costs associated with the loan. It’s your last chance to review and understand the loan terms before signing.

Additional Documents

In addition to these primary documents, you may need to provide other paperwork, such as: - Pay stubs and W-2 forms to verify your income. - Bank statements to show your savings and assets. - Identification documents, like a driver’s license or passport. - Appraisal report, which is an assessment of the property’s value.

Notes on the Process

📝 Note: The process of applying for an FHA loan can seem overwhelming due to the amount of paperwork involved. However, understanding the purpose and importance of each document can make the process smoother. It’s also crucial to work with a lender who is experienced in FHA loans to guide you through the paperwork efficiently.

Enhancing Readability with Visual Aids

To better understand the flow of documents, consider the following table:

| Document | Purpose |

|---|---|

| Pre-Approval Letter | Initial loan amount determination |

| Loan Application | Detailed financial and employment information |

| Loan Estimate | Breakdown of loan terms and costs |

| Title Report and Insurance | Verification of property ownership and protection against title issues |

| Closing Disclosure | Final review of loan terms before closing |

In the end, navigating the process of an FHA loan requires patience, understanding, and the right guidance. By familiarizing yourself with the key documents involved, you can better prepare yourself for the journey to homeownership.

What is the minimum credit score required for an FHA loan?

+

The minimum credit score for an FHA loan is 500, but to qualify for the lowest down payment, a score of 580 or higher is required.

How long does the FHA loan process typically take?

+

The process can vary, but it typically takes about 30 to 60 days from application to closing.

Can I use gift funds for the down payment on an FHA loan?

+

Yes, gift funds can be used for the down payment and closing costs on an FHA loan, but they must be properly documented and come from an approved source.