Loan Interest and Fees Disclosure Required

Understanding Loan Interest and Fees Disclosure

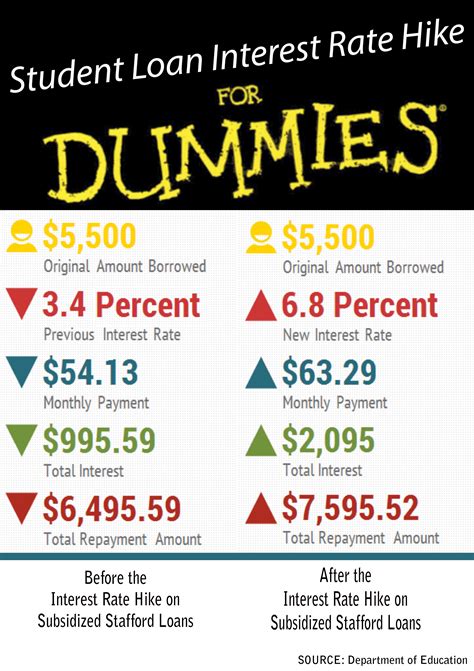

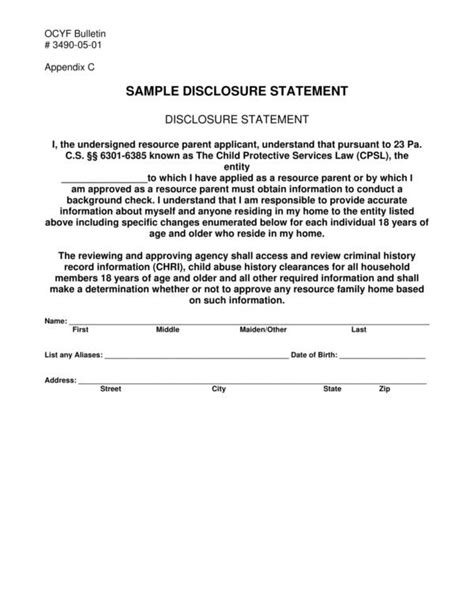

When applying for a loan, it’s essential to understand the terms and conditions, including the interest rates and fees associated with the loan. Lenders are required to disclose this information to borrowers, ensuring transparency and fairness in the lending process. This disclosure is crucial in helping borrowers make informed decisions about their loan options. In this blog post, we’ll delve into the world of loan interest and fees disclosure, exploring the requirements, benefits, and potential pitfalls.

What is Loan Interest and Fees Disclosure?

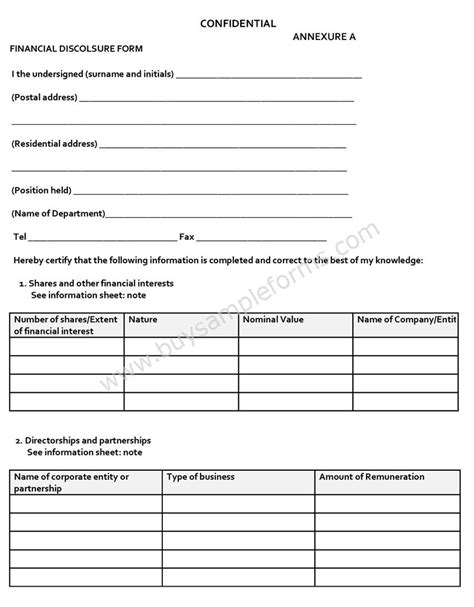

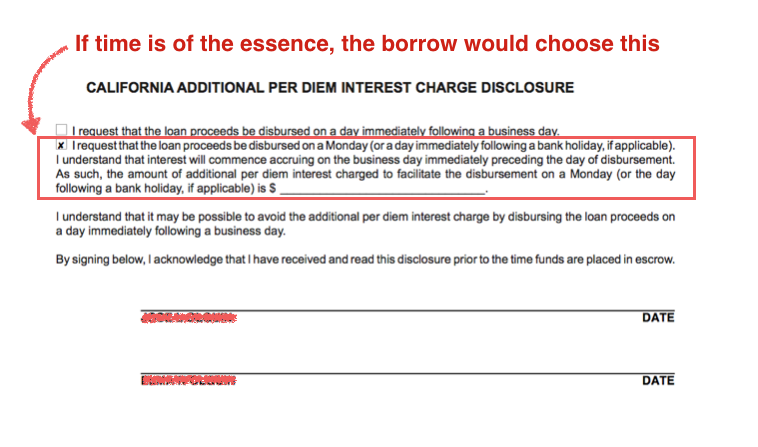

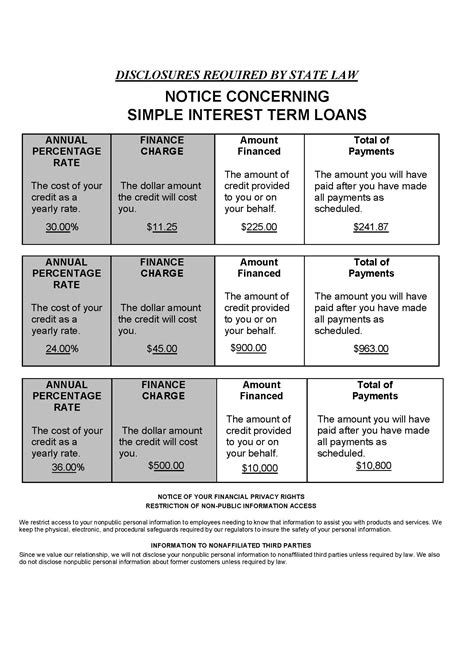

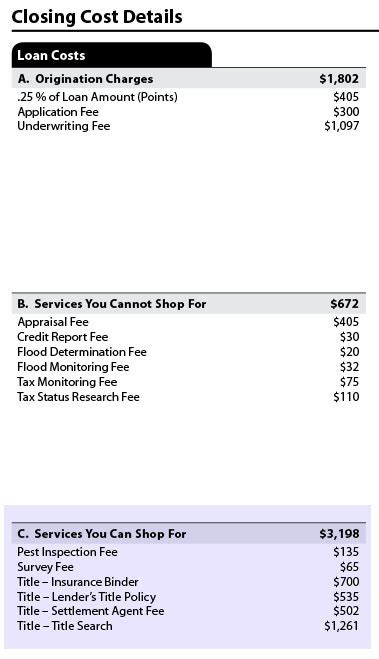

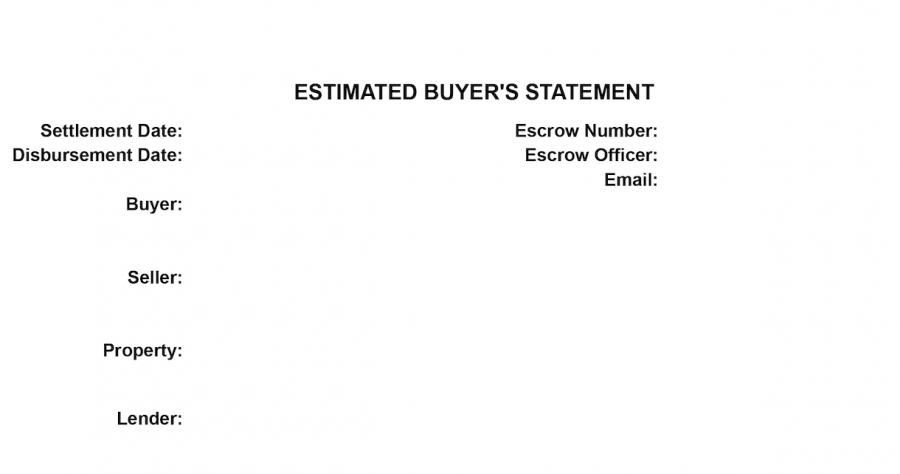

Loan interest and fees disclosure refers to the process of lenders providing borrowers with clear and concise information about the interest rates, fees, and other charges associated with a loan. This disclosure is typically provided in the loan agreement or contract and must be presented in a way that is easy for borrowers to understand. The disclosure should include the following information: * The interest rate and how it is calculated * Any fees associated with the loan, such as origination fees or late payment fees * The total cost of the loan, including interest and fees * The repayment terms and schedule

Benefits of Loan Interest and Fees Disclosure

The disclosure of loan interest and fees provides numerous benefits to borrowers, including: * Increased transparency: Borrowers have a clear understanding of the costs associated with the loan, allowing them to make informed decisions. * Comparability: Borrowers can compare loan options from different lenders, making it easier to choose the best loan for their needs. * Protection from unfair practices: Disclosure requirements help prevent lenders from engaging in unfair or deceptive practices, such as hiding fees or charges. * Improved financial planning: With a clear understanding of the loan costs, borrowers can better plan their finances and make informed decisions about their loan repayment.

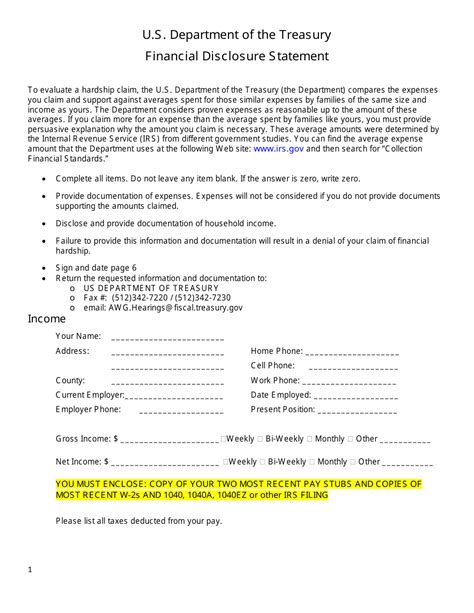

Requirements for Loan Interest and Fees Disclosure

Lenders are required to disclose loan interest and fees information in accordance with relevant laws and regulations. In the United States, for example, the Truth in Lending Act (TILA) requires lenders to provide borrowers with clear and concise disclosures about the terms and conditions of the loan. The disclosure must include the following information:

| Disclosure Requirement | Description |

|---|---|

| Interest Rate | The annual percentage rate (APR) and how it is calculated |

| Fees | Any fees associated with the loan, such as origination fees or late payment fees |

| Total Cost | The total cost of the loan, including interest and fees |

| Repayment Terms | The repayment schedule and any conditions that may affect the repayment terms |

Potential Pitfalls of Loan Interest and Fees Disclosure

While loan interest and fees disclosure is essential for transparency and fairness, there are potential pitfalls that borrowers should be aware of: * Complexity: Loan disclosures can be complex and difficult to understand, making it challenging for borrowers to make informed decisions. * Hidden fees: Some lenders may hide fees or charges in the fine print, making it essential for borrowers to carefully review the loan agreement. * Lack of standardization: Disclosure requirements may vary between lenders and jurisdictions, making it challenging for borrowers to compare loan options.

📝 Note: Borrowers should carefully review the loan agreement and disclosure statement to ensure they understand the terms and conditions of the loan.

As we summarize the key points, it’s clear that loan interest and fees disclosure is a critical aspect of the lending process. By understanding the requirements and benefits of disclosure, borrowers can make informed decisions about their loan options and avoid potential pitfalls. With transparency and fairness in mind, lenders can provide borrowers with the information they need to navigate the complex world of lending.

What is the purpose of loan interest and fees disclosure?

+

The purpose of loan interest and fees disclosure is to provide borrowers with clear and concise information about the costs associated with a loan, allowing them to make informed decisions.

What information must be included in the loan interest and fees disclosure?

+

The disclosure must include the interest rate, fees, total cost, and repayment terms, among other information.

Why is it essential for borrowers to carefully review the loan agreement and disclosure statement?

+

It’s essential for borrowers to carefully review the loan agreement and disclosure statement to ensure they understand the terms and conditions of the loan, including any fees or charges that may be associated with it.