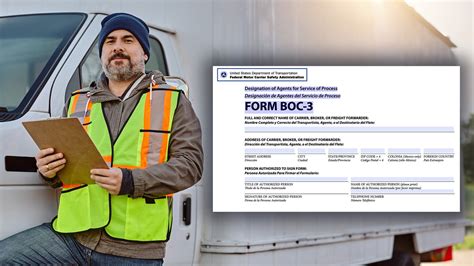

Complete File BOC with Additional Paperwork

Understanding the Process of Completing a File BOC with Additional Paperwork

Completing a File BOC, which stands for Bank Owned Certificate, often requires additional paperwork to ensure all necessary documents are in order. This process is crucial for banks and financial institutions when dealing with properties that have been repossessed due to non-payment of mortgages. The BOC serves as proof of ownership, and any additional paperwork must be thoroughly completed to avoid legal or administrative issues. In this blog post, we will delve into the steps and considerations involved in completing a File BOC with the necessary additional paperwork.

Steps to Complete a File BOC

The process of completing a File BOC involves several key steps: - Obtaining the Necessary Documents: The first step is to gather all relevant documents related to the property, including the deed, title reports, and any outstanding liens or mortgages. - Reviewing Property Records: It is essential to review the property records to ensure there are no unexpected liens or encumbrances on the property. - Preparing the BOC Form: The BOC form must be filled out accurately, including details about the property, the previous owner, and the reason for the repossession. - Submission and Approval: Once all documents and the BOC form are prepared, they must be submitted to the relevant authorities for approval.

Additional Paperwork Requirements

In addition to the BOC form, several other documents may be required, depending on the jurisdiction and the specific circumstances of the property repossession. These can include: - Affidavits of Repossession: These documents provide sworn statements regarding the repossession process. - Notice of Default: A record that the previous owner was notified of their default on the mortgage. - Deed of Reconveyance: If the property was previously sold, this deed transfers the title back to the bank. - Inspection Reports: Especially if the property is being sold or transferred, to ensure it is in a satisfactory condition.

Importance of Accuracy and Compliance

Accuracy and compliance with all legal and regulatory requirements are paramount when completing a File BOC and the associated paperwork. Any mistakes or omissions can lead to significant delays or even legal challenges. It is highly recommended that banks and financial institutions work closely with legal professionals who specialize in real estate law to ensure all processes are correctly followed.

Challenges and Considerations

Several challenges and considerations arise during the process of completing a File BOC with additional paperwork. These include: - Timeliness: Ensuring that all documents are submitted in a timely manner to avoid delays. - Compliance with Local Laws: Different jurisdictions may have specific requirements or regulations that must be adhered to. - Communication with Previous Owners: In some cases, communication with the previous owners may be necessary, which can be challenging.

| Document Type | Description |

|---|---|

| BOC Form | Proof of bank ownership after repossession. |

| Affidavit of Repossession | Sworn statement regarding the repossession process. |

| Notice of Default | Notification to the previous owner of default on the mortgage. |

| Deed of Reconveyance | Transfers title back to the bank if previously sold. |

📝 Note: The specific documents required can vary significantly depending on the jurisdiction and the circumstances of the property's repossession.

Best Practices for Efficient Completion

To efficiently complete a File BOC with the necessary additional paperwork, consider the following best practices: - Use Checklist Templates: To ensure all required documents are accounted for. - Consult Legal Experts: Especially for complex cases or when dealing with properties in multiple jurisdictions. - Maintain Clear Records: Keeping accurate and detailed records of all communications, submissions, and approvals.

In wrapping up the discussion on completing a File BOC with additional paperwork, it’s clear that the process involves meticulous attention to detail, adherence to legal requirements, and efficient management of documents. By understanding the steps involved, the importance of accuracy, and leveraging best practices, banks and financial institutions can navigate this complex process with greater ease, ensuring compliance and minimizing potential issues. The key to a successful outcome lies in thorough preparation, precise execution, and a commitment to maintaining the highest standards of professionalism and compliance throughout the entire process.

What is the primary purpose of a File BOC?

+

The primary purpose of a File BOC is to serve as proof of bank ownership of a property after it has been repossessed due to non-payment of the mortgage.

What kind of additional paperwork is typically required?

+

Additional paperwork may include affidavits of repossession, notices of default, deeds of reconveyance, and inspection reports, depending on the jurisdiction and specific circumstances of the property repossession.

Why is accuracy and compliance important in the process?

+

Accuracy and compliance are crucial to avoid delays, legal challenges, and to ensure that the bank’s ownership of the property is legally recognized.