Paperwork

IRS Installment Agreement Paperwork

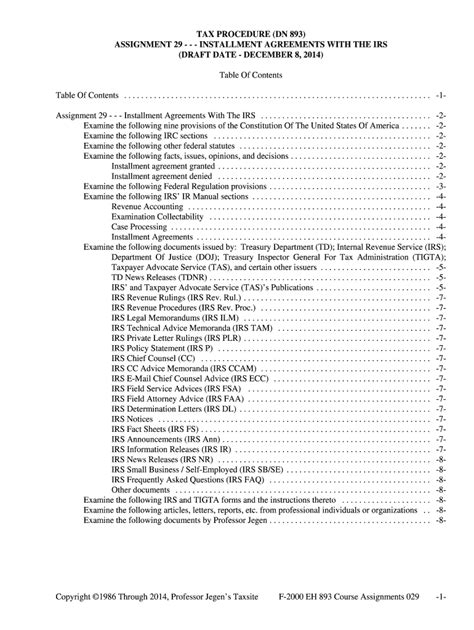

Introduction to IRS Installment Agreements

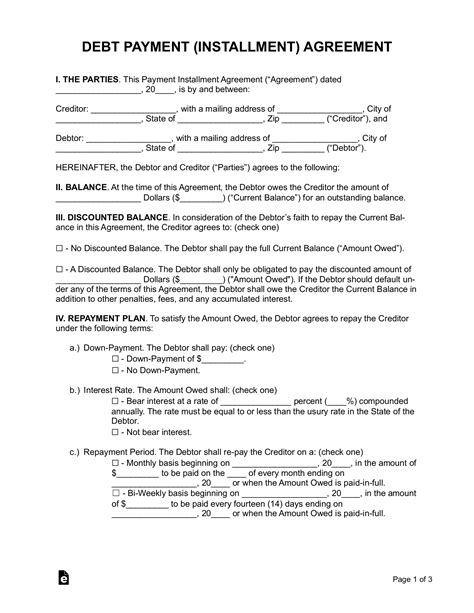

The Internal Revenue Service (IRS) offers various options for taxpayers who are unable to pay their tax debt in full. One of these options is an Installment Agreement, which allows taxpayers to make monthly payments towards their tax debt. This agreement can help taxpayers avoid further penalties and interest, as well as prevent the IRS from taking more severe collection actions, such as levies or liens. In this blog post, we will delve into the details of IRS Installment Agreements, including the necessary paperwork and steps to apply.

Eligibility for an IRS Installment Agreement

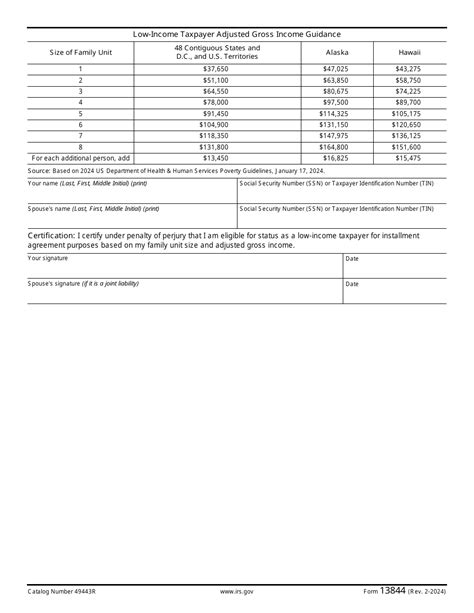

To be eligible for an IRS Installment Agreement, taxpayers must meet certain requirements. These include: * Owning a total tax debt of $50,000 or less, including interest and penalties * Having filed all required tax returns * Not having an open bankruptcy case * Not having had a previous Installment Agreement that was terminated Taxpayers who meet these requirements can apply for an Installment Agreement, which will allow them to make monthly payments towards their tax debt.

Steps to Apply for an IRS Installment Agreement

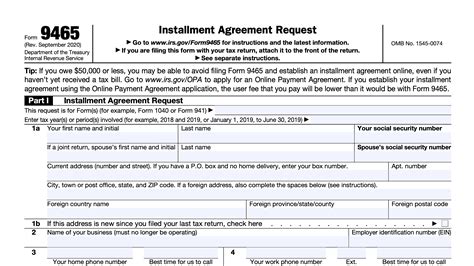

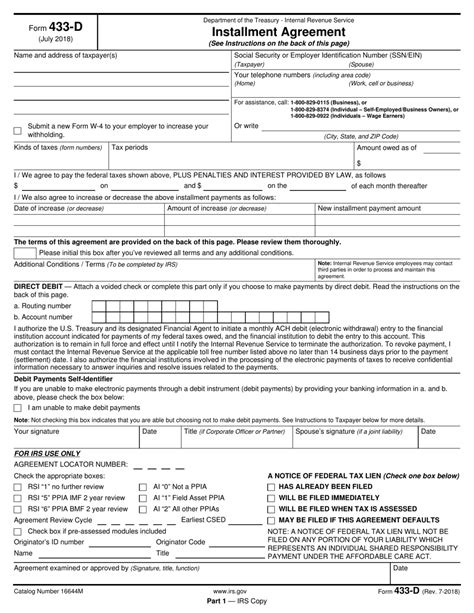

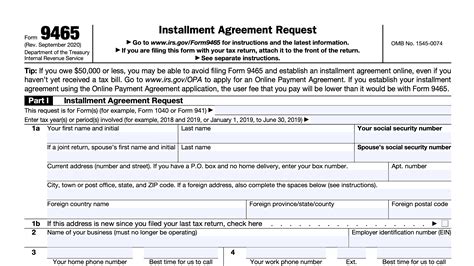

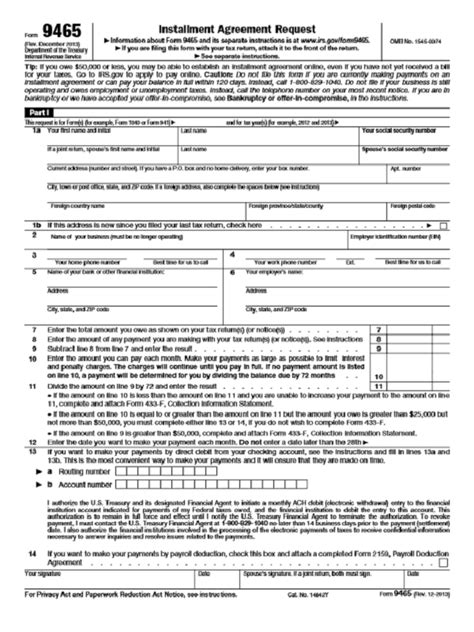

To apply for an IRS Installment Agreement, taxpayers must follow these steps: * File Form 433-F: This form is used to provide financial information to the IRS, including income, expenses, and assets. * Submit Form 9465: This form is used to apply for an Installment Agreement and propose a monthly payment amount. * Pay the required down payment: In some cases, the IRS may require a down payment to accompany the Installment Agreement application. * Wait for IRS approval: The IRS will review the application and notify the taxpayer of their decision.

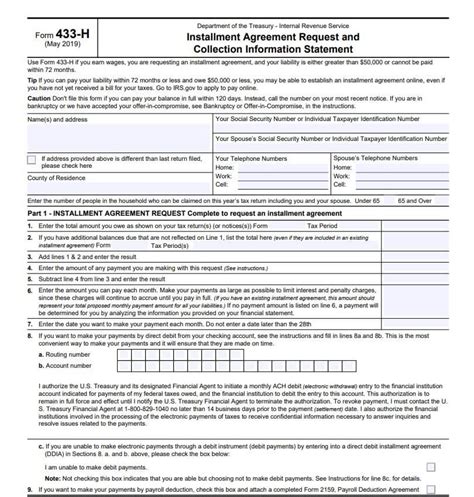

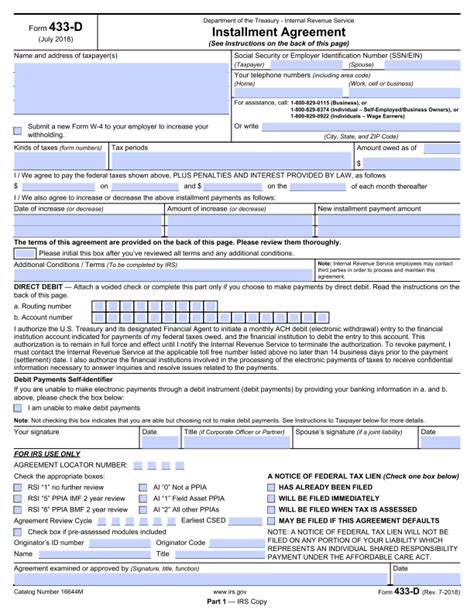

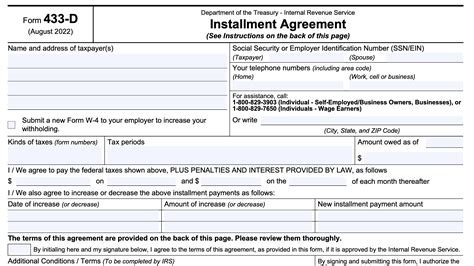

Required Paperwork for an IRS Installment Agreement

To apply for an IRS Installment Agreement, taxpayers must submit the following paperwork:

| Form | Description |

|---|---|

| Form 433-F | Collection Information Statement |

| Form 9465 | Installment Agreement Request |

| Form W-4 | Employee’s Withholding Certificate (if applicable) |

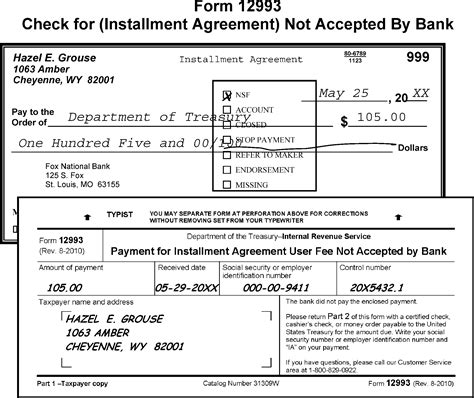

Maintaining an IRS Installment Agreement

Once an Installment Agreement is in place, taxpayers must make timely monthly payments to avoid default. Taxpayers must also: * File all required tax returns on time * Pay all taxes due on time * Notify the IRS of any changes to their financial situation Failure to comply with these requirements can result in the termination of the Installment Agreement and further collection actions by the IRS.

📝 Note: Taxpayers who are experiencing financial difficulties may want to consider consulting with a tax professional or seeking assistance from the IRS Taxpayer Advocate Service.

Benefits of an IRS Installment Agreement

An IRS Installment Agreement can provide several benefits to taxpayers, including: * Avoiding further penalties and interest * Preventing levies and liens * Making monthly payments that are manageable and affordable * Avoiding bankruptcy and other severe collection actions

Conclusion

In summary, an IRS Installment Agreement is a valuable option for taxpayers who are unable to pay their tax debt in full. By following the necessary steps and submitting the required paperwork, taxpayers can make monthly payments towards their tax debt and avoid further penalties and interest. It is essential for taxpayers to understand the eligibility requirements, application process, and maintenance requirements of an Installment Agreement to ensure a successful outcome.

What is the maximum amount of tax debt that can be included in an Installment Agreement?

+

The maximum amount of tax debt that can be included in an Installment Agreement is $50,000, including interest and penalties.

How long does it take to process an Installment Agreement application?

+

The processing time for an Installment Agreement application can vary, but it typically takes several weeks to several months.

Can I appeal an IRS decision to reject my Installment Agreement application?

+

Yes, taxpayers can appeal an IRS decision to reject their Installment Agreement application by filing a written protest with the IRS Appeals Office.