401k Rollover Spousal Signature Required

Understanding the 401k Rollover Process

When it comes to managing your retirement savings, a 401k rollover can be a strategic move, allowing you to consolidate your accounts and potentially reduce fees. However, the process involves several steps and considerations, one of which is the requirement for a spousal signature in certain situations. Understanding the nuances of 401k rollovers is crucial for making informed decisions about your financial future.

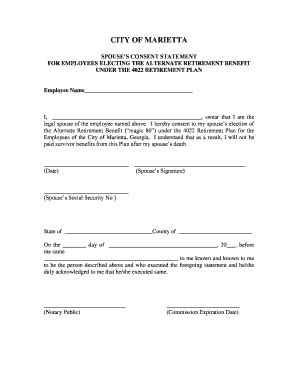

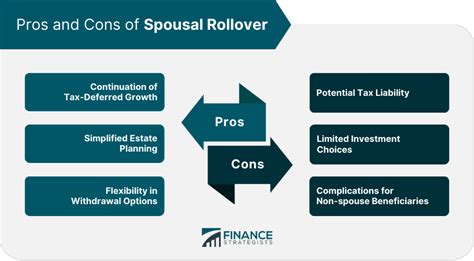

Why a Spousal Signature Might Be Required

In the context of 401k plans, a spousal signature is typically required for actions that affect the spouse’s rights under the plan. This is because spouses have certain rights to the assets in these retirement accounts, particularly in the event of the account holder’s death. The Employee Retirement Income Security Act of 1974 (ERISA) provides spouses with automatic beneficiary rights, which can only be waived with the spouse’s consent. Therefore, if you’re considering a 401k rollover and you’re married, your spouse’s signature might be necessary, especially if you want to name someone else as the beneficiary or if the rollover involves waiving spousal rights.

When Is a Spousal Signature Necessary?

A spousal signature is necessary in the following scenarios: - Waiving Spousal Benefits: If you want to name a beneficiary other than your spouse, your spouse must sign a waiver. This is a common requirement because, by default, your spouse is entitled to a significant portion of your 401k assets if you pass away. - Certain Rollover Transactions: Depending on the type of rollover and the specific rules of your 401k plan, a spousal signature might be required to ensure that the spouse’s rights are protected. - Loans and Hardship Withdrawals: Though less common, some transactions involving your 401k, such as loans or hardship withdrawals, might require spousal consent, especially if they could impact the spouse’s potential benefits.

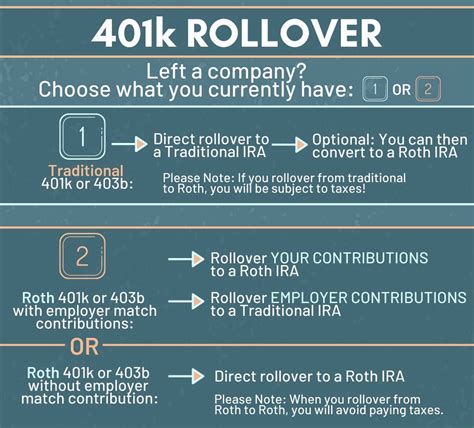

Steps for a 401k Rollover

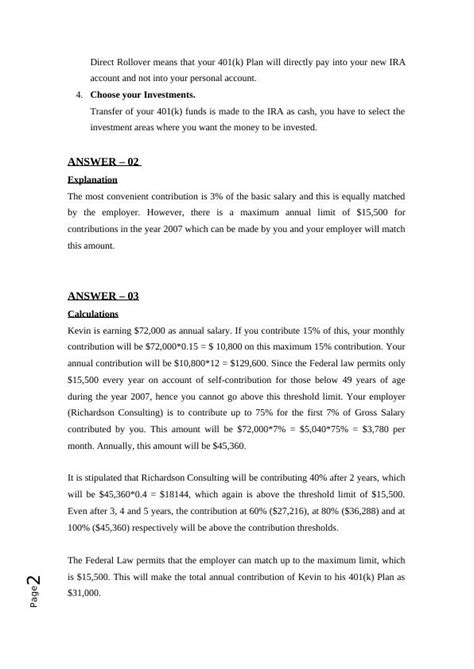

To initiate a 401k rollover, follow these steps: - Choose Your Rollover Type: Decide whether you want to do a direct rollover (trustee-to-trustee transfer) or an indirect rollover (60-day rollover). Each has its own set of rules and potential implications. - Open an IRA: If you’re rolling over your 401k into an IRA, you’ll need to open an IRA account with a financial institution. - Initiate the Rollover: Contact your 401k plan administrator to start the rollover process. They will guide you through the necessary steps, which may include obtaining a spousal signature. - Complete Any Necessary Forms: This includes the rollover request form and, if applicable, the spousal consent form.

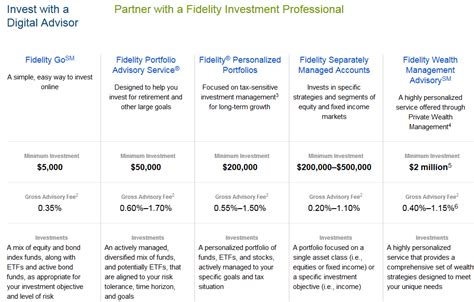

Benefits of a 401k Rollover

A 401k rollover can offer several benefits, including: - Consolidation of Accounts: Simplifying your financial landscape by combining multiple retirement accounts. - Broader Investment Options: IRAs often provide more investment choices than 401k plans. - Potential Fee Reductions: You might be able to reduce the fees associated with your retirement accounts. - Improved Management: Having all your retirement savings in one place can make it easier to manage your investments.

Potential Drawbacks

While a 401k rollover can be beneficial, there are also potential drawbacks to consider: - Loss of Creditor Protection: 401k plans generally offer stronger creditor protection than IRAs. - Loan Provisions: If you might need to borrow from your retirement account, a 401k plan might be more favorable. - Required Minimum Distributions (RMDs): Understanding how RMDs apply to your situation, as they can vary between 401k plans and IRAs.

💡 Note: It's essential to consult with a financial advisor to understand how a 401k rollover will impact your specific situation, especially considering the potential need for a spousal signature and the implications of such a transaction on your retirement planning.

Conclusion and Next Steps

In conclusion, navigating the process of a 401k rollover requires careful consideration of several factors, including the potential need for a spousal signature. By understanding the reasons behind this requirement and the steps involved in a 401k rollover, you can make more informed decisions about your retirement savings. Always consult with financial and legal professionals to ensure that you’re making the best choices for your financial future.

Do I always need a spousal signature for a 401k rollover?

+

No, a spousal signature is not always required. However, it is necessary in situations where the spouse’s rights under the plan are affected, such as when naming a different beneficiary or in certain types of rollovers.

What are the benefits of consolidating my 401k accounts through a rollover?

+

Consolidating your 401k accounts can simplify your financial management, potentially reduce fees, and provide broader investment options. It’s a way to streamline your retirement savings and make it easier to keep track of your investments.

How do I initiate a 401k rollover, and what forms do I need to complete?

+

To initiate a 401k rollover, you’ll typically need to contact your 401k plan administrator. They will guide you through the process, which may include completing a rollover request form and, if necessary, obtaining a spousal consent form. The specific steps can vary depending on the type of rollover you’re doing and the rules of your 401k plan.