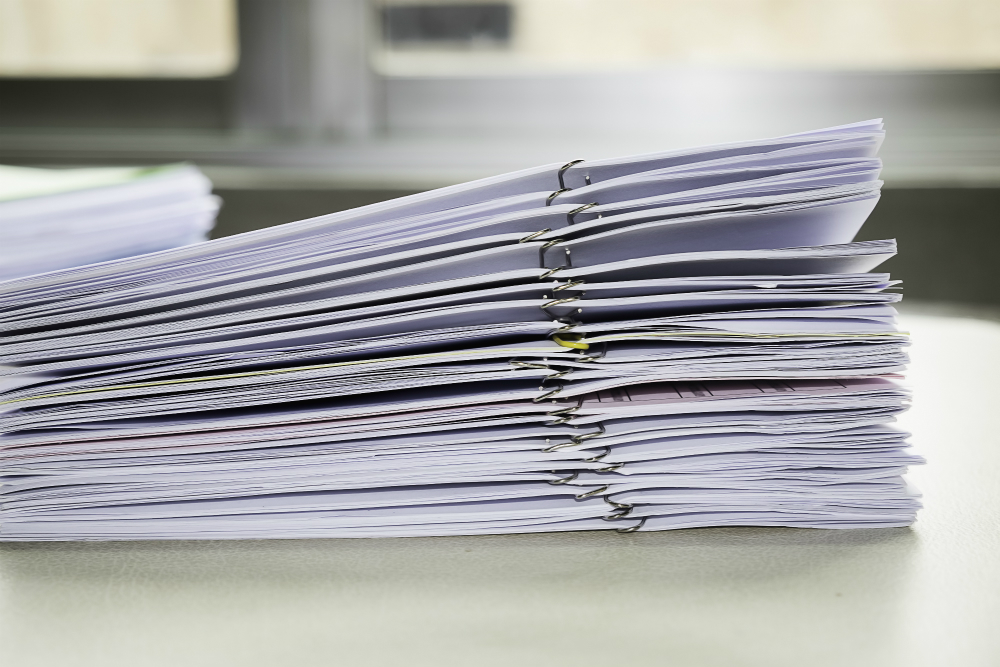

Paperwork

5 Tax Paperwork Facts

Introduction to Tax Paperwork

When it comes to tax season, one of the most daunting tasks for individuals and businesses alike is dealing with the complexity of tax paperwork. The process of gathering, filling out, and submitting the necessary forms can be overwhelming, especially for those who are not familiar with the intricacies of tax law. In this article, we will delve into five key facts about tax paperwork that everyone should know to make the process smoother and less stressful.

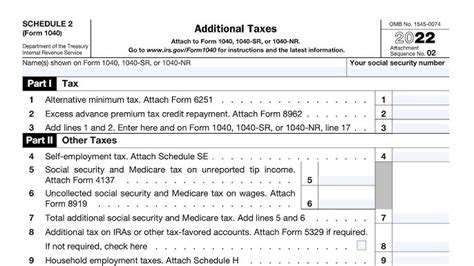

Understanding Tax Forms

Tax paperwork involves a variety of forms, each serving a different purpose. The most common form for individuals is the Form 1040, which is used to report income and claim deductions and credits. Businesses, on the other hand, use Form 1120 for corporations or Form 1065 for partnerships. Understanding which forms are required and how to fill them out accurately is crucial for a successful tax filing process. It’s also important to note that the IRS provides detailed instructions for each form, which can be a valuable resource for those looking to navigate the process on their own.

Deadlines and Penalties

One of the critical aspects of tax paperwork is meeting the deadlines. For individuals, the typical deadline is April 15th of each year, while businesses may have different deadlines depending on their structure and fiscal year-end. Missing these deadlines can result in penalties and interest on the amount owed, which can significantly increase the overall tax liability. It’s essential to plan ahead and ensure that all necessary paperwork is completed and submitted on time to avoid these additional costs.

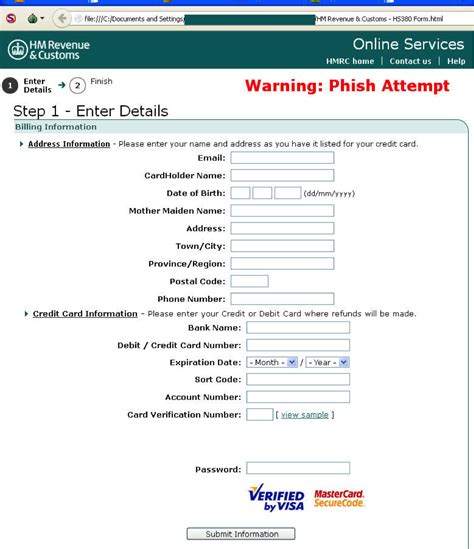

Digital Filing and Security

In recent years, there has been a shift towards digital filing of tax paperwork, offering convenience and faster processing times. The IRS, along with tax preparation software, provides secure platforms for electronic submissions. However, with the convenience of digital filing comes the concern of security and identity theft. It’s vital to use reputable tax preparation services and to follow best practices for protecting personal and financial information online.

Tax Deductions and Credits

Tax deductions and credits are essential components of tax paperwork, as they can significantly reduce the amount of tax owed. Deductions lower taxable income, while credits directly reduce the tax amount. Common deductions include charitable donations, mortgage interest, and business expenses, while credits might include the Earned Income Tax Credit (EITC) or education credits. Accurately identifying and claiming eligible deductions and credits can make a substantial difference in the final tax bill.

Professional Assistance

Given the complexity of tax laws and the potential for costly mistakes, many individuals and businesses opt for professional assistance with their tax paperwork. Tax professionals, such as CPAs or enrolled agents, can provide expert guidance, ensure compliance with all tax laws, and help maximize deductions and credits. Additionally, tax preparation software can be a useful tool for those who prefer to handle their taxes independently but need assistance with the process.

📝 Note: When seeking professional help, it's crucial to choose a reputable and experienced tax professional to ensure the quality of service and to protect against potential scams.

In the end, navigating tax paperwork successfully requires a combination of understanding the necessary forms, meeting deadlines, leveraging digital filing options securely, maximizing deductions and credits, and knowing when to seek professional help. By being informed and prepared, individuals and businesses can make the tax season less daunting and ensure they are in compliance with all tax regulations. The key to a smooth tax filing process is planning, awareness, and taking advantage of the resources available to manage tax paperwork effectively.