Paperwork

5 Refinance Papers

Understanding the Refinance Process

When considering refinancing a home, it’s essential to understand the process and the documents involved. Refinancing can be a great way to lower monthly mortgage payments, switch from an adjustable-rate to a fixed-rate loan, or tap into home equity. However, it requires careful consideration and a thorough understanding of the refinance papers involved. In this article, we will delve into the world of refinance papers, exploring what they are, why they are necessary, and how to navigate the process.

Types of Refinance Papers

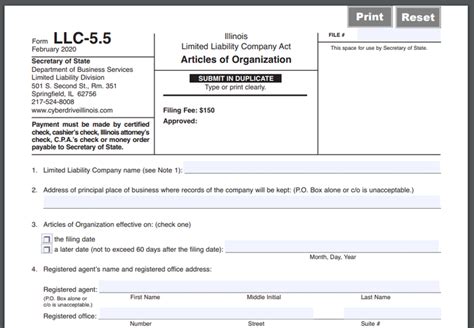

There are several types of refinance papers that homeowners may encounter during the refinance process. These include: * Application: The initial application for refinancing, which includes personal and financial information. * Good Faith Estimate (GFE): A document that outlines the estimated costs associated with the refinance, including fees and charges. * Truth-in-Lending (TIL) Disclosure: A document that provides a clear and concise explanation of the loan terms, including the annual percentage rate (APR) and the total cost of the loan. * Appraisal Report: A document that provides an independent assessment of the property’s value. * Loan Estimate: A document that outlines the final loan terms, including the interest rate, loan amount, and repayment terms.

The Refinance Process

The refinance process typically involves several steps, including: * Pre-approval: The lender reviews the homeowner’s creditworthiness and provides a pre-approval letter outlining the loan amount and terms. * Application: The homeowner submits a formal application for refinancing, providing personal and financial information. * Processing: The lender reviews the application and orders an appraisal of the property. * Underwriting: The lender reviews the application and makes a final decision on the loan. * Closing: The homeowner signs the final loan documents, and the refinance is complete.

Refinance Paper Requirements

The refinance paper requirements may vary depending on the lender and the type of loan. However, some common requirements include: * Identification: A valid government-issued ID, such as a driver’s license or passport. * Income Verification: Pay stubs, W-2 forms, or tax returns to verify income. * Credit Report: A credit report to assess creditworthiness. * Property Information: Information about the property, including the address, value, and loan balance.

| Document | Description |

|---|---|

| Application | Initial application for refinancing |

| Good Faith Estimate (GFE) | Estimated costs associated with the refinance |

| Truth-in-Lending (TIL) Disclosure | Clear and concise explanation of the loan terms |

| Appraisal Report | Independent assessment of the property's value |

| Loan Estimate | Final loan terms, including interest rate and repayment terms |

📝 Note: It's essential to carefully review all refinance papers to ensure accuracy and completeness.

Conclusion and Final Thoughts

In conclusion, refinancing a home can be a complex process, but understanding the refinance papers involved can help homeowners navigate the process with confidence. By carefully reviewing the application, Good Faith Estimate, Truth-in-Lending Disclosure, appraisal report, and loan estimate, homeowners can make informed decisions about their refinancing options. Remember to always ask questions and seek clarification if needed, and don’t hesitate to seek professional advice if necessary.

What is the purpose of the Good Faith Estimate?

+

The Good Faith Estimate provides an estimate of the costs associated with the refinance, including fees and charges.

What is the difference between a fixed-rate and adjustable-rate loan?

+

A fixed-rate loan has a fixed interest rate for the life of the loan, while an adjustable-rate loan has an interest rate that may change over time.

How long does the refinance process typically take?

+

The refinance process typically takes several weeks to several months, depending on the complexity of the loan and the lender’s requirements.