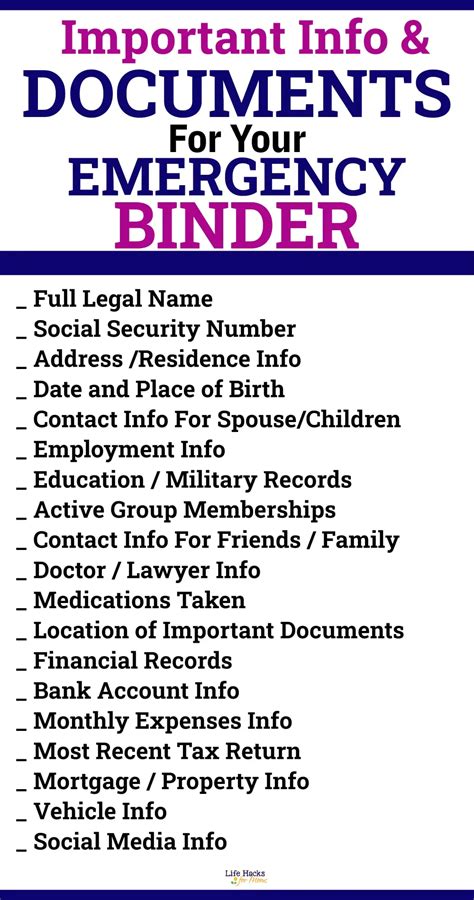

5 Emergency Papers

Introduction to Emergency Papers

In today’s world, being prepared for any situation is crucial, and having the right documents in place can make a significant difference. Emergency papers are essential documents that can help individuals and families navigate through difficult times, such as natural disasters, medical emergencies, or financial crises. In this article, we will discuss five emergency papers that everyone should have, and provide guidance on how to create and maintain them.

1. Last Will and Testament

A last will and testament is a legal document that outlines how a person’s assets and properties should be distributed after their death. It is a critical emergency paper that ensures the wishes of the deceased are respected and their loved ones are taken care of. A will typically includes:

- Appointment of an executor to manage the estate

- Designation of beneficiaries for assets and properties

- Instructions for funeral arrangements

- Provisions for minor children or dependents

2. Durable Power of Attorney

A durable power of attorney is a document that grants someone the authority to make decisions on behalf of another person, usually in the event of incapacity or disability. This emergency paper is essential for:

- Managing financial affairs, such as paying bills and taxes

- Making medical decisions, including end-of-life care

- Handling business or investment matters

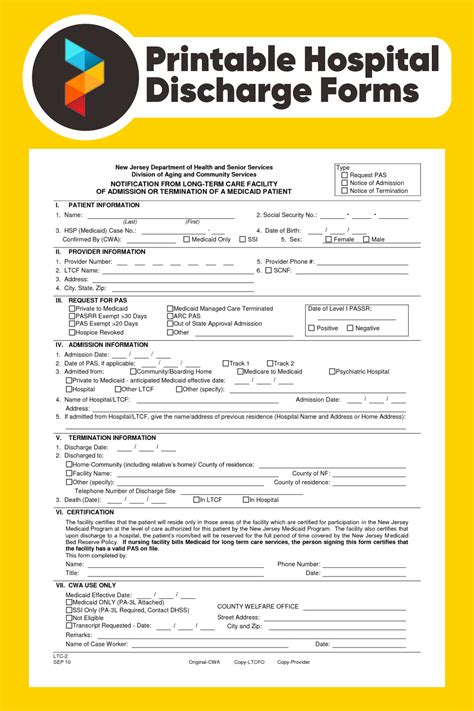

3. Living Will or Advance Directive

A living will or advance directive is a document that outlines a person’s wishes for medical treatment in the event of a life-threatening illness or injury. This emergency paper is vital for:

- Specifying preferences for life-sustaining treatments, such as ventilation or feeding tubes

- Designating a healthcare proxy to make decisions on behalf of the individual

- Providing instructions for organ donation or autopsy

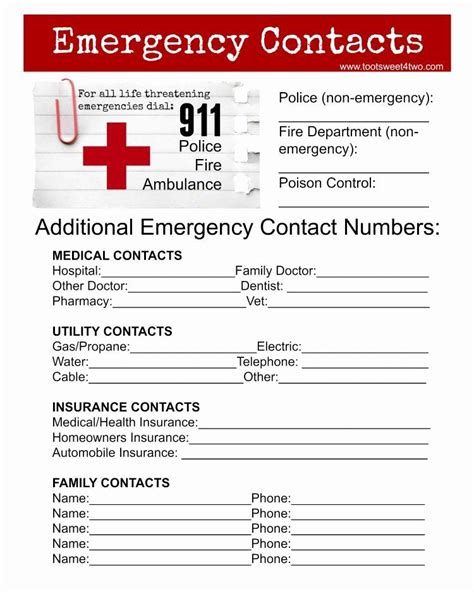

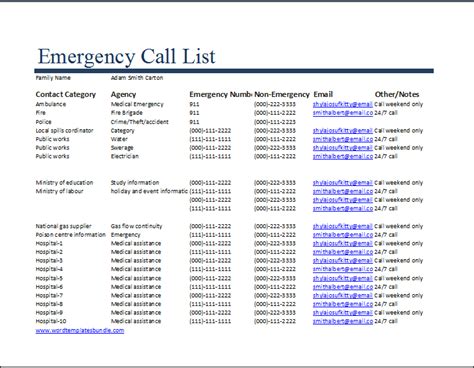

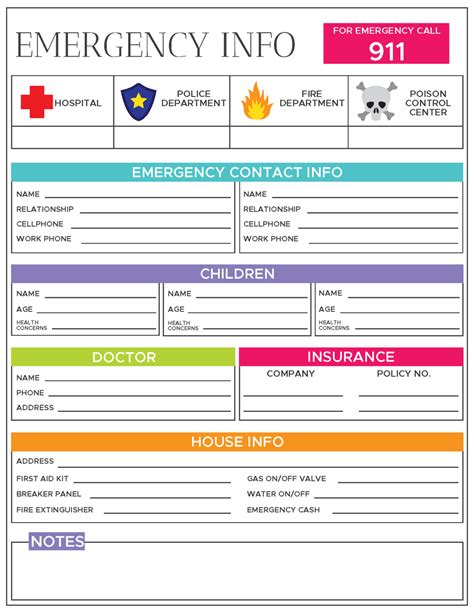

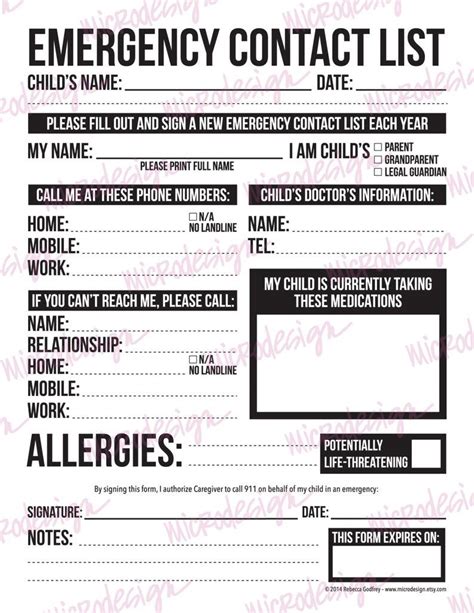

4. Emergency Contact Information

Emergency contact information is a critical document that provides essential details in the event of an emergency. This emergency paper should include:

- Contact information for family members, friends, or neighbors

- Medical information, such as allergies, medications, or medical conditions

- Insurance details, including policy numbers and provider contact information

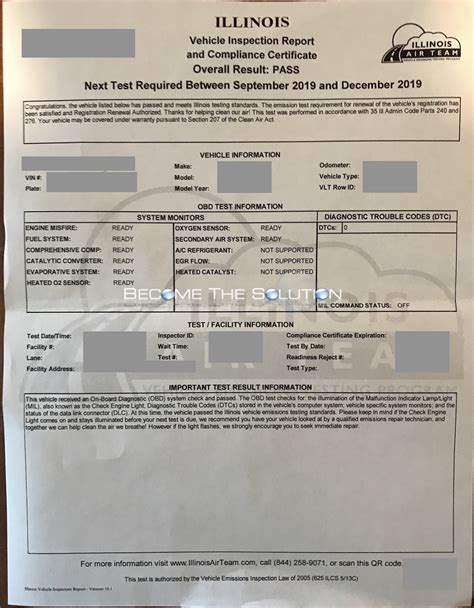

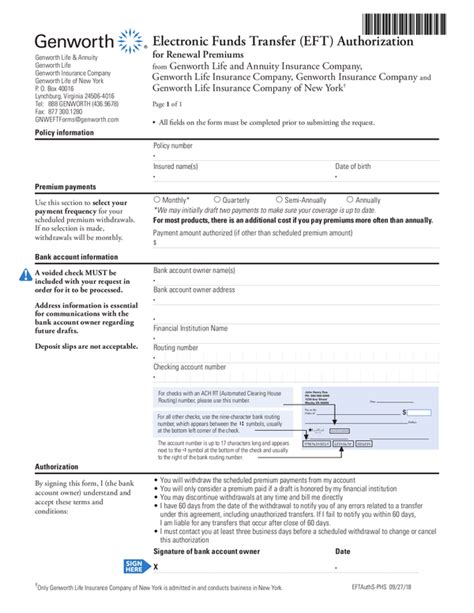

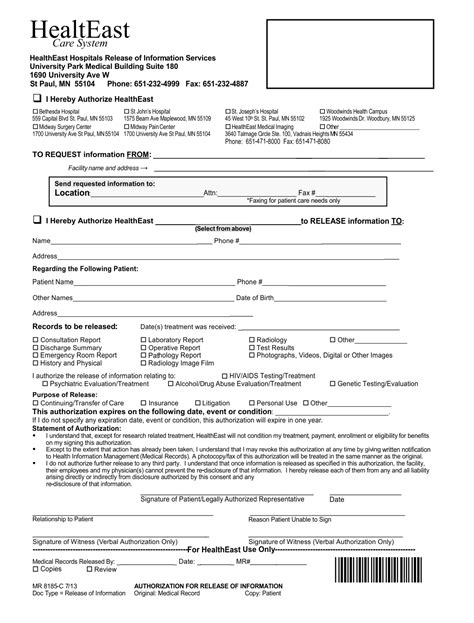

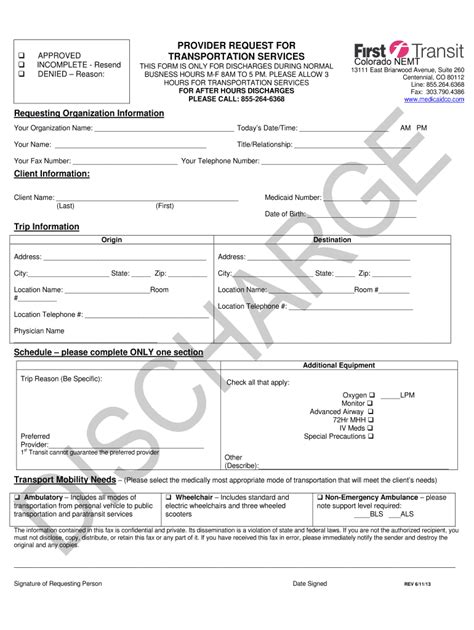

5. Insurance Policies and Documents

Insurance policies and documents are essential emergency papers that provide financial protection in the event of unforeseen circumstances. These may include:

- Life insurance policies

- Health insurance policies

- Disability insurance policies

- Home or renters insurance policies

💡 Note: It is essential to review and update these emergency papers regularly to ensure they remain relevant and effective.

To maintain these emergency papers, it is recommended to:

- Store them in a safe and secure location, such as a fireproof safe or a secure online storage service

- Provide copies to trusted individuals, such as family members or attorneys

- Review and update the documents regularly, or as circumstances change

In terms of storage, a table can be used to organize the emergency papers, as shown below:

| Document | Location | Copy Provided To |

|---|---|---|

| Last Will and Testament | Fireproof safe | Attorney, family member |

| Durable Power of Attorney | Secure online storage | Power of attorney, family member |

| Living Will or Advance Directive | Medical records | Healthcare provider, family member |

| Emergency Contact Information | Wallet, phone | Emergency contact, family member |

| Insurance Policies and Documents | File cabinet, secure online storage | Insurance provider, family member |

In the end, having these five emergency papers in place can provide peace of mind and financial security for individuals and families. By understanding the importance of these documents and taking steps to create and maintain them, everyone can be better prepared for life’s unexpected events.

What is the purpose of a last will and testament?

+

A last will and testament is a legal document that outlines how a person’s assets and properties should be distributed after their death.

Who should be appointed as a power of attorney?

+

A trusted individual, such as a family member or close friend, should be appointed as a power of attorney to make decisions on behalf of the individual.

What information should be included in emergency contact information?

+

Emergency contact information should include contact details for family members, friends, or neighbors, as well as medical information and insurance details.