Genworth Accepts Faxed Transfer Paperwork

Introduction to Genworth’s Faxed Transfer Paperwork Policy

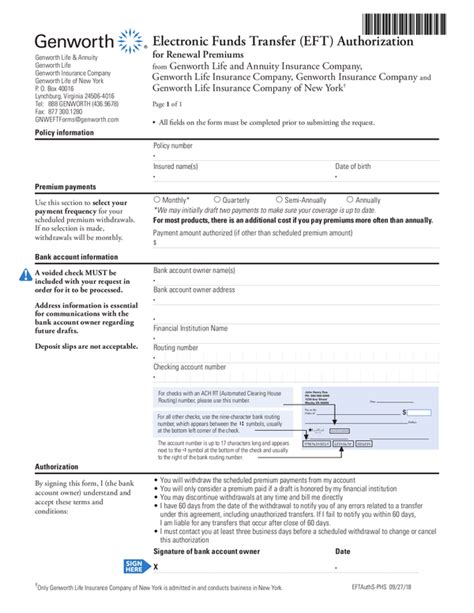

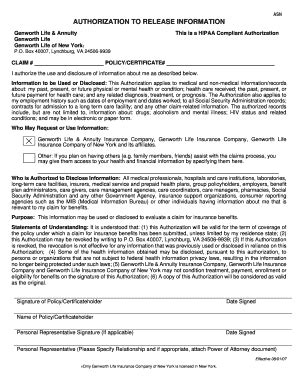

Genworth, a leading provider of long-term care insurance and other financial products, has established a policy that allows for the acceptance of faxed transfer paperwork. This policy is designed to provide customers with a convenient and efficient way to transfer their policies or make changes to their existing coverage. In this article, we will explore the details of Genworth’s faxed transfer paperwork policy, including the benefits, requirements, and potential drawbacks.

Benefits of Faxed Transfer Paperwork

The ability to fax transfer paperwork offers several benefits to Genworth customers. These benefits include: * Convenience: Faxed transfer paperwork can be submitted from anywhere, at any time, as long as there is access to a fax machine or a digital fax service. * Speed: Faxed documents are typically received and processed quickly, which can help to expedite the transfer process. * Reduced Errors: Faxed documents can help to reduce errors that may occur when transferring paperwork, as they provide a clear and legible copy of the original document. * Increased Efficiency: Faxed transfer paperwork can help to streamline the transfer process, reducing the need for physical mail or in-person visits.

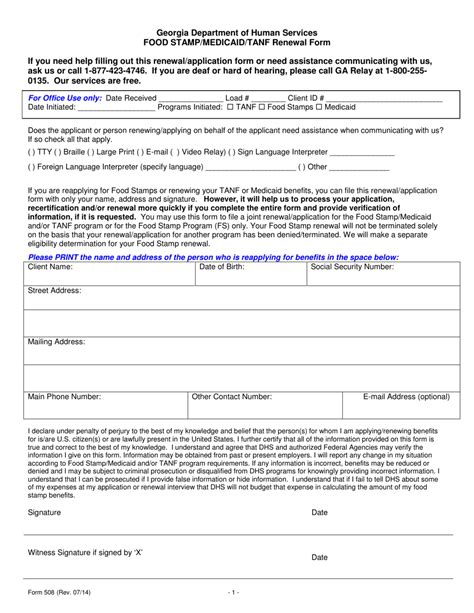

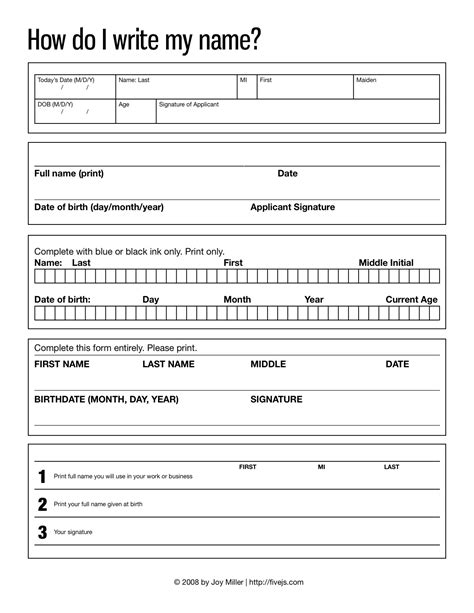

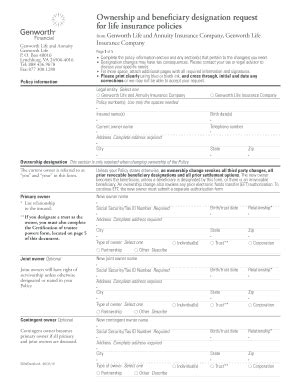

Requirements for Faxed Transfer Paperwork

To ensure that faxed transfer paperwork is accepted and processed correctly, Genworth has established certain requirements. These requirements include: * Clear and Legible Documents: All faxed documents must be clear and legible, with no torn or damaged pages. * Complete and Accurate Information: All required information must be complete and accurate, including policy numbers, names, and addresses. * Authorized Signatures: All faxed documents must include authorized signatures, as required by Genworth’s policies and procedures. * Cover Sheet: A cover sheet must be included with all faxed documents, providing contact information and a brief description of the documents being submitted.

Potential Drawbacks of Faxed Transfer Paperwork

While faxed transfer paperwork offers several benefits, there are also potential drawbacks to consider. These drawbacks include: * Security Risks: Faxed documents may be subject to security risks, such as interception or unauthorized access. * Technical Issues: Faxed documents may be affected by technical issues, such as poor fax quality or equipment malfunctions. * Delays: Faxed documents may be delayed or lost in transit, which can cause delays in the transfer process. * Environmental Impact: Faxed documents may contribute to paper waste and environmental degradation, particularly if they are not properly recycled.

Alternative Methods for Transfer Paperwork

In addition to faxed transfer paperwork, Genworth also accepts other methods for transferring policies or making changes to existing coverage. These methods include: * Mail: Transfer paperwork can be submitted by mail, using a secure and trackable shipping method. * Email: Transfer paperwork can be submitted by email, using a secure and encrypted attachment. * In-Person: Transfer paperwork can be submitted in person, at a Genworth office or authorized agent location. * Online: Transfer paperwork can be submitted online, using Genworth’s secure website and electronic submission process.

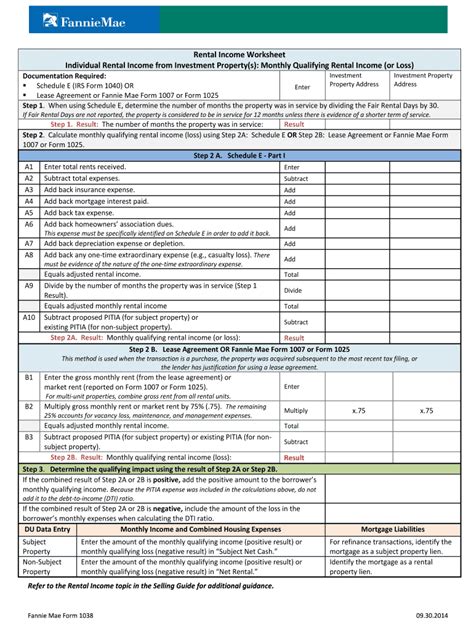

| Method | Benefits | Drawbacks |

|---|---|---|

| Fax | Convenient, fast, and efficient | Security risks, technical issues, and environmental impact |

| Secure and trackable | Slow and prone to delays | |

| Fast and convenient | Security risks and technical issues | |

| In-Person | Secure and personalized | Time-consuming and limited availability |

| Online | Fast, convenient, and secure | Technical issues and limited accessibility |

📝 Note: It is essential to carefully review and understand the requirements and potential drawbacks of each method before submitting transfer paperwork.

As the insurance industry continues to evolve, it is likely that new methods for transferring policies and making changes to existing coverage will emerge. These methods may include the use of mobile apps, digital wallets, and other innovative technologies. Regardless of the method chosen, it is crucial to ensure that all transfer paperwork is accurate, complete, and securely submitted to avoid any delays or complications.

In summary, Genworth’s policy of accepting faxed transfer paperwork provides customers with a convenient and efficient way to transfer their policies or make changes to their existing coverage. While there are potential drawbacks to consider, the benefits of faxed transfer paperwork make it a viable option for many customers. By understanding the requirements and potential drawbacks of each method, customers can make informed decisions about how to submit their transfer paperwork and ensure a smooth and efficient transfer process. Ultimately, the key to a successful transfer is to carefully review and understand the requirements and potential drawbacks of each method, and to choose the method that best meets your individual needs and preferences.