5 Bankruptcy Paper Tips

Understanding Bankruptcy Papers: A Guide to Filing

When facing financial difficulties, filing for bankruptcy can be a viable option to regain control over your finances. However, the process of filing for bankruptcy can be complex and overwhelming, especially when it comes to dealing with the paperwork involved. In this guide, we will provide you with 5 valuable tips to help you navigate through the bankruptcy papers and ensure a smooth filing process.

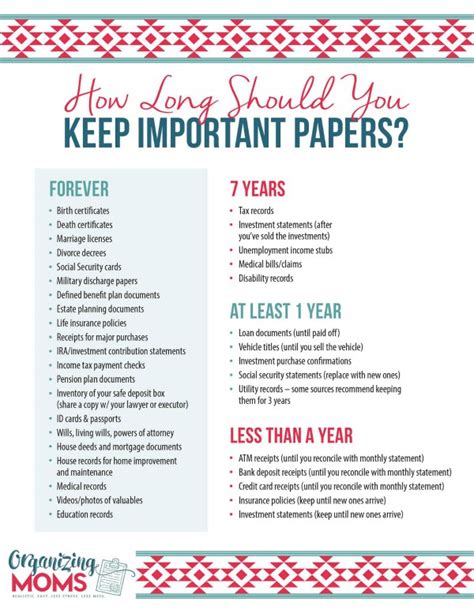

Tip 1: Gather All Necessary Documents

Before starting the filing process, it is essential to gather all the necessary documents. These documents may include:

- Identification documents such as a driver’s license or passport

- Financial documents such as tax returns, pay stubs, and bank statements

- Credit card statements and loan documents

- Any other relevant financial information

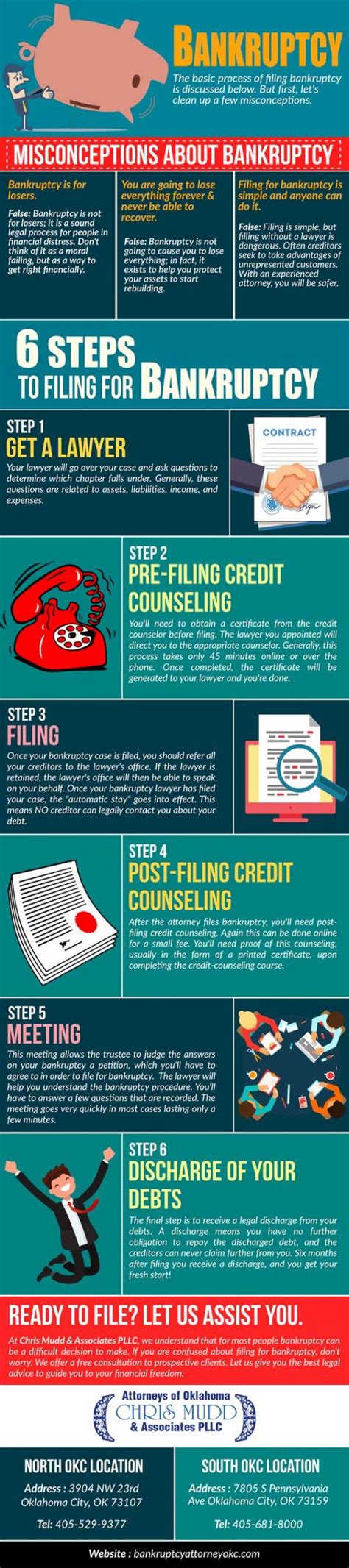

Tip 2: Choose the Right Bankruptcy Chapter

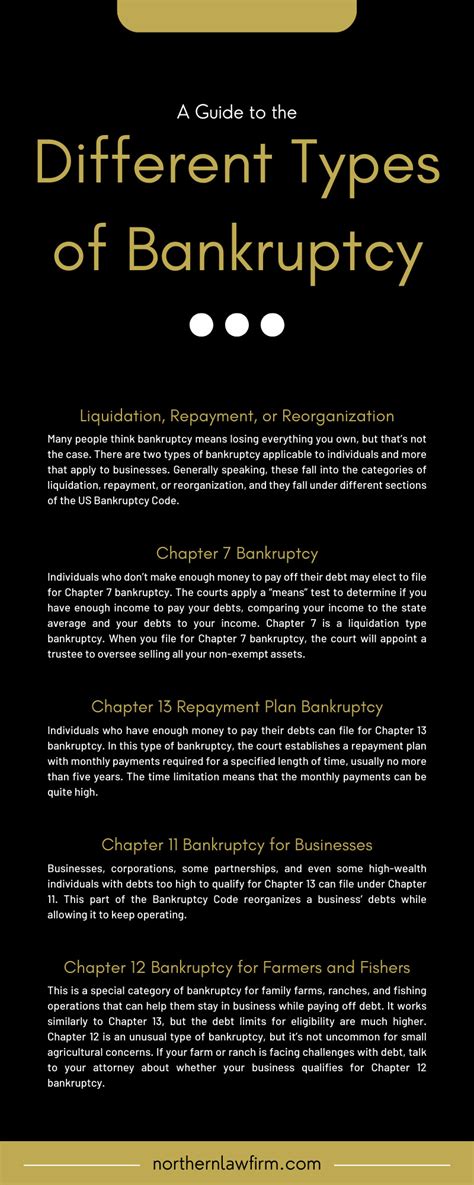

There are several chapters of bankruptcy that individuals can file under, including Chapter 7, Chapter 11, and Chapter 13. Each chapter has its own set of rules and requirements, and choosing the right one will depend on your individual financial situation. It is essential to understand the differences between each chapter and to choose the one that best fits your needs.

| Chapter | Description |

|---|---|

| Chapter 7 | Liquidation bankruptcy, where non-exempt assets are sold to pay off creditors |

| Chapter 11 | Reorganization bankruptcy, where businesses can restructure their debts |

| Chapter 13 | Reorganization bankruptcy, where individuals can create a repayment plan to pay off debts |

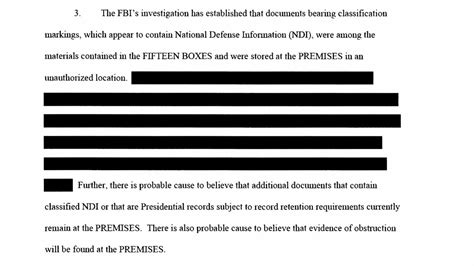

Tip 3: Complete the Bankruptcy Forms Accurately

The bankruptcy forms can be lengthy and complex, and it is essential to complete them accurately to avoid any errors or omissions. The forms will require you to provide detailed information about your financial situation, including your income, expenses, assets, and debts. It is essential to be honest and transparent when completing the forms, as any inaccuracies or omissions can lead to delays or even dismissal of your case.

📝 Note: It is recommended to seek the help of a bankruptcy attorney to ensure that the forms are completed accurately and correctly.

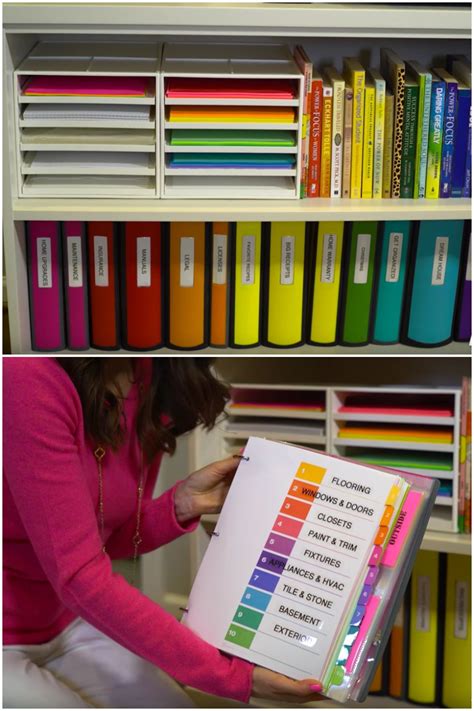

Tip 4: File the Papers in the Correct Court

Once you have completed the bankruptcy forms, you will need to file them in the correct court. The court where you file will depend on your location and the type of bankruptcy you are filing. It is essential to ensure that you file in the correct court to avoid any delays or dismissal of your case.

- Research the correct court to file in

- Ensure that you have all the necessary documents and forms

- File the papers in person or by mail, depending on the court’s requirements

Tip 5: Follow Up with the Court

After filing the bankruptcy papers, it is essential to follow up with the court to ensure that your case is proceeding smoothly. You may need to attend a meeting of creditors, where you will be required to answer questions about your financial situation. You may also need to provide additional documentation or information to the court.

📝 Note: It is essential to stay organized and keep track of any deadlines or requirements to avoid any delays or dismissal of your case.

In summary, filing for bankruptcy requires careful planning and attention to detail. By gathering all necessary documents, choosing the right bankruptcy chapter, completing the forms accurately, filing in the correct court, and following up with the court, you can ensure a smooth and successful filing process. It is essential to seek the help of a bankruptcy attorney to guide you through the process and ensure that your rights are protected.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

+

Chapter 7 bankruptcy is a liquidation bankruptcy, where non-exempt assets are sold to pay off creditors. Chapter 13 bankruptcy is a reorganization bankruptcy, where individuals can create a repayment plan to pay off debts.

How long does the bankruptcy filing process take?

+

The length of the bankruptcy filing process can vary depending on the complexity of the case and the court’s schedule. On average, it can take several months to a year or more to complete the process.

Can I file for bankruptcy on my own, or do I need an attorney?

+

While it is possible to file for bankruptcy on your own, it is highly recommended to seek the help of a bankruptcy attorney. An attorney can guide you through the process, ensure that your rights are protected, and help you to avoid any errors or omissions that can lead to delays or dismissal of your case.