5 Tips Pennymacusa Tax Paperwork Delay

Introduction to Pennymacusa Tax Paperwork Delay

Dealing with tax paperwork delays can be a frustrating experience, especially when it involves financial institutions like Pennymacusa. The process of managing and resolving these delays requires a combination of understanding the reasons behind them, knowing how to communicate effectively with the institution, and being proactive in resolving the issue. In this context, Pennymacusa, a leading financial services company, may experience delays in tax paperwork due to various reasons such as high volumes of requests, technical issues, or incomplete information provided by clients. This article aims to provide 5 tips to help navigate through Pennymacusa tax paperwork delays efficiently.

Understanding the Reasons for Delay

Before diving into the tips for managing delays, it’s essential to understand the common reasons why Pennymacusa tax paperwork might be delayed. These can include: - High Volume of Requests: During peak tax seasons, institutions like Pennymacusa receive a high volume of requests for tax paperwork, which can lead to delays. - Technical Issues: Sometimes, technical glitches or system updates can cause delays in processing and sending out tax documents. - Incomplete Information: If the information provided by the client is incomplete or incorrect, it can lead to delays as the institution may need to request additional information.

Tip 1: Plan Ahead

Planning ahead is crucial to avoid last-minute rushes and potential delays. Clients should: - Mark Important Dates: Keep track of important tax deadlines and plan accordingly. - Gather Necessary Information: Ensure all required information is readily available to avoid any last-minute scrambles. - Submit Requests Early: Submitting requests for tax paperwork well in advance can help mitigate the risk of delays.

Tip 2: Effective Communication

Effective communication is key to resolving delays. Clients should: - Contact Pennymacusa Proactively: If there’s a delay, don’t hesitate to reach out to Pennymacusa’s customer service. - Provide Complete Information: Ensure that all information provided is complete and accurate to avoid further delays. - Follow Up: If necessary, follow up on the status of the tax paperwork to ensure it’s being processed.

Tip 3: Utilize Online Resources

Many financial institutions, including Pennymacusa, offer online resources and portals where clients can access their tax documents directly. Clients should: - Check Online Portals: Regularly check the online portal for any updates on tax paperwork. - Download Documents: If available, download tax documents directly from the portal to avoid waiting for postal mail.

Tip 4: Seek Professional Advice

In cases where delays are causing significant issues, such as impacting tax filing deadlines, seeking professional advice can be beneficial. - Consult a Tax Professional: A tax professional can provide guidance on how to navigate through the delay and meet tax obligations on time. - Explore Alternative Solutions: Depending on the situation, there might be alternative solutions or temporary fixes that a professional can advise on.

Tip 5: Stay Organized

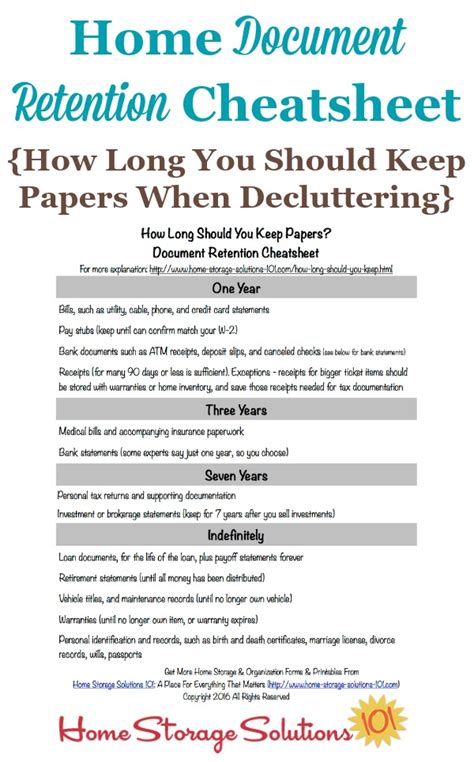

Staying organized is vital for managing tax paperwork efficiently. Clients should: - Keep Records: Maintain accurate and detailed records of all communications and submissions related to tax paperwork. - Set Reminders: Set reminders for follow-ups and important deadlines. - Review and Verify: Always review and verify the information on the tax documents once received to ensure accuracy and completeness.

📝 Note: Keeping a record of all correspondence and submissions can significantly help in tracking the progress and resolving any discrepancies that may arise during the process.

In the end, managing Pennymacusa tax paperwork delays requires a proactive approach, effective communication, and a good understanding of the processes involved. By following these tips and staying informed, clients can better navigate through delays and ensure their tax obligations are met in a timely manner. The key is to plan ahead, communicate clearly, and utilize all available resources to minimize the impact of delays. Whether it’s through planning, seeking professional advice, or utilizing online resources, being proactive is the first step towards resolving tax paperwork delays efficiently.