Chapter 13 Paperwork Retention

Introduction to Paperwork Retention

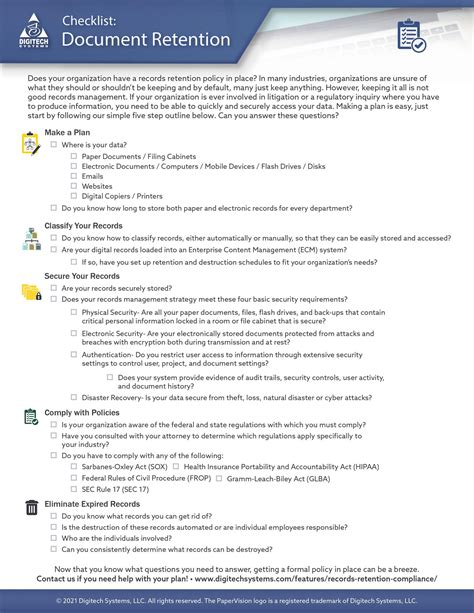

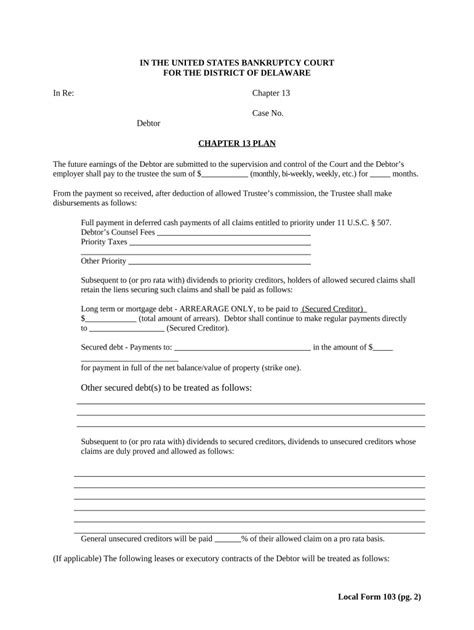

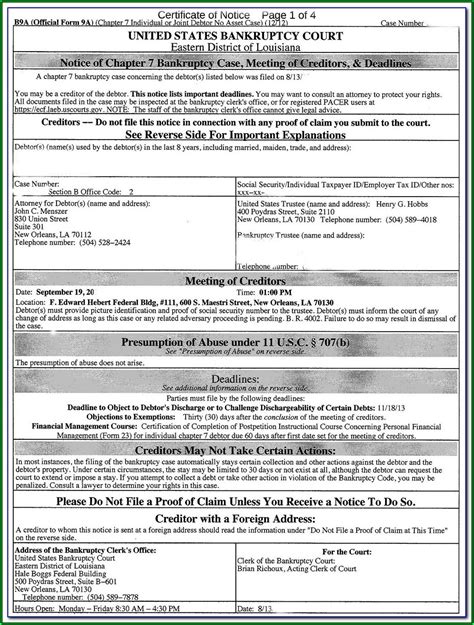

Proper paperwork retention is a crucial aspect of any organization, whether it’s a small business or a large corporation. It involves the systematic management of documents and records, ensuring that they are stored, maintained, and disposed of in a secure and compliant manner. In today’s digital age, the importance of paperwork retention cannot be overstated, as it helps to protect sensitive information, maintain regulatory compliance, and support business operations.

Benefits of Effective Paperwork Retention

Effective paperwork retention offers numerous benefits to organizations, including: * Improved compliance: By retaining documents and records in accordance with regulatory requirements, organizations can minimize the risk of non-compliance and associated penalties. * Enhanced security: Proper paperwork retention helps to protect sensitive information from unauthorized access, theft, or damage. * Increased efficiency: A well-organized paperwork retention system enables employees to quickly locate and retrieve documents, saving time and improving productivity. * Better decision-making: By maintaining accurate and up-to-date records, organizations can make informed decisions and respond to changing circumstances.

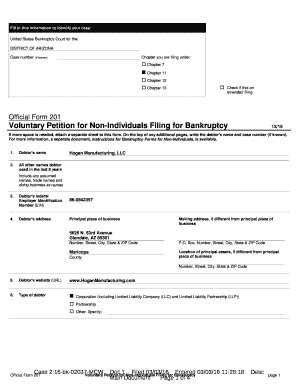

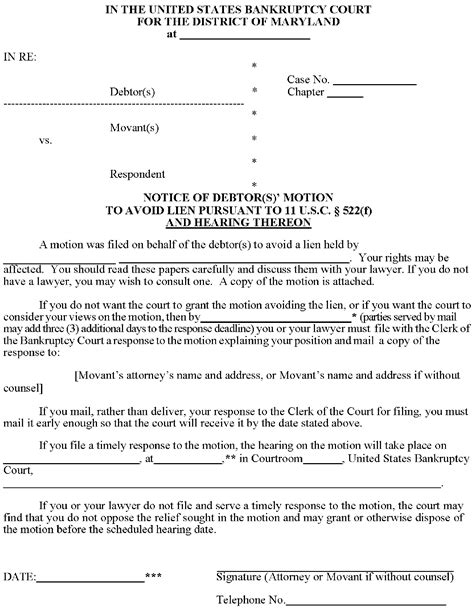

Types of Documents to Retain

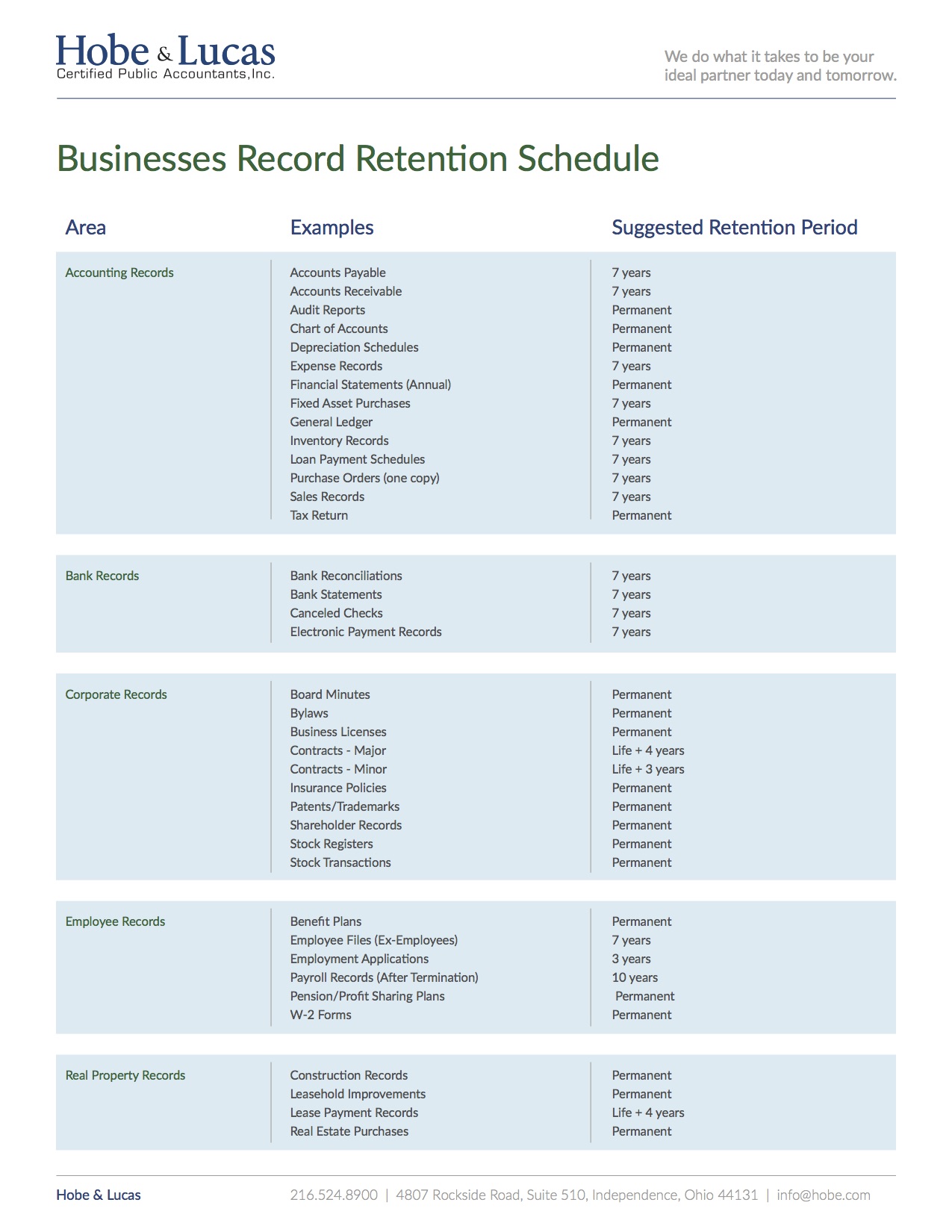

The types of documents to retain vary depending on the organization, industry, and regulatory requirements. Some common examples include: * Financial records: invoices, receipts, bank statements, and tax returns * Employee records: personnel files, payroll records, and benefits information * Customer records: contracts, agreements, and communication logs * Business records: meeting minutes, board resolutions, and company policies * Regulatory records: compliance documents, permits, and licenses

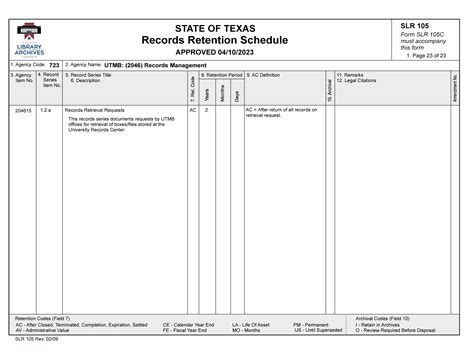

Retention Periods

Retention periods refer to the length of time that documents and records must be kept. These periods vary depending on the type of document, regulatory requirements, and organizational policies. Some common retention periods include: * Short-term retention: 1-3 years for documents such as invoices and receipts * Medium-term retention: 5-7 years for documents such as employee records and customer contracts * Long-term retention: 10-20 years or permanently for documents such as business records and regulatory compliance documents

Storage and Maintenance

Proper storage and maintenance of documents and records are critical to ensuring their integrity and accessibility. Some best practices include: * Secure storage: storing documents in a secure, climate-controlled environment * Organization: maintaining a logical and consistent filing system * Backup: creating backup copies of electronic documents and storing them in a separate location * Access controls: restricting access to authorized personnel and implementing user authentication and authorization protocols

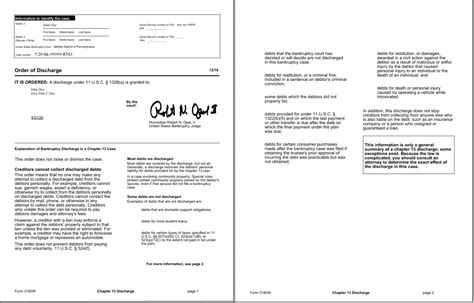

Destruction and Disposal

When documents and records reach the end of their retention period, they must be properly destroyed and disposed of. Some best practices include: * Secure destruction: using a secure destruction method such as shredding or incineration * Certification: obtaining certification of destruction from a reputable vendor * Environmental considerations: ensuring that destruction and disposal methods are environmentally friendly

🚨 Note: Organizations should consult with regulatory authorities and industry experts to ensure compliance with applicable laws and regulations regarding paperwork retention.

Conclusion and Final Thoughts

In conclusion, effective paperwork retention is essential for organizations to maintain regulatory compliance, protect sensitive information, and support business operations. By understanding the benefits, types of documents to retain, retention periods, storage and maintenance requirements, and destruction and disposal methods, organizations can develop a comprehensive paperwork retention strategy that meets their unique needs and requirements. Ultimately, a well-designed paperwork retention system can help organizations to reduce risks, improve efficiency, and make informed decisions.

What are the benefits of effective paperwork retention?

+

Effective paperwork retention offers numerous benefits, including improved compliance, enhanced security, increased efficiency, and better decision-making.

What types of documents should be retained?

+

The types of documents to retain vary depending on the organization, industry, and regulatory requirements, but common examples include financial records, employee records, customer records, business records, and regulatory records.

How long should documents be retained?

+

Retention periods vary depending on the type of document, regulatory requirements, and organizational policies, but common retention periods include short-term, medium-term, and long-term retention.