5 Tips TurboTax 1065

Introduction to TurboTax 1065

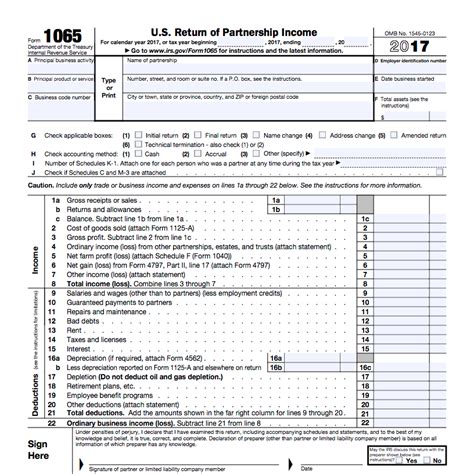

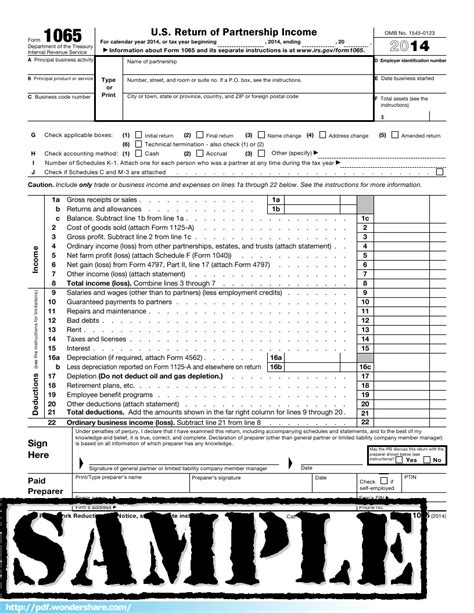

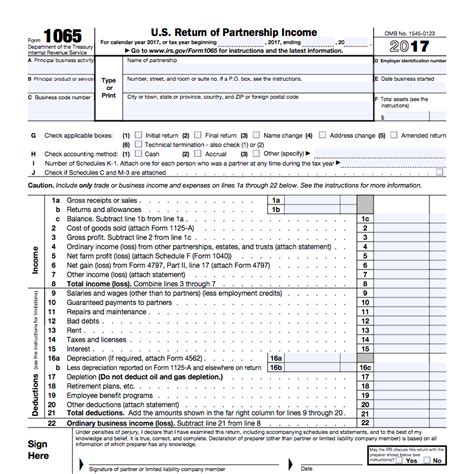

TurboTax 1065 is a tax preparation software designed specifically for partnerships, including limited liability companies (LLCs) that are treated as partnerships for tax purposes. The software helps partnerships prepare and file their tax returns, specifically Form 1065, which is the U.S. Return of Partnership Income. This form is used to report the income, gains, losses, deductions, and credits of a partnership. Understanding how to effectively use TurboTax 1065 can simplify the tax preparation process and ensure compliance with IRS regulations.

Understanding Form 1065

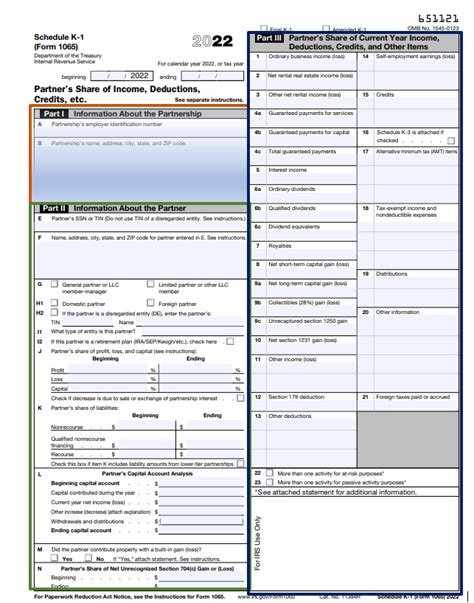

Before diving into the tips for using TurboTax 1065, it’s essential to have a basic understanding of Form 1065 and what it entails. This form requires partnerships to report their financial activities for the tax year, including income from various sources, expenses, and the distribution of profits and losses among partners. The form also requires the calculation of each partner’s share of the partnership’s income, deductions, and credits.

5 Tips for Using TurboTax 1065

Here are five tips to help partnerships navigate the process of preparing and filing Form 1065 with TurboTax 1065:

- Gather All Necessary Information: Before starting the tax preparation process, ensure you have all the required documents and information. This includes the partnership’s financial statements, records of income and expenses, capital contributions, and distributions to partners. Having everything organized will make the process smoother and reduce the likelihood of errors.

- Understand Partnership Income and Expenses: Accurately categorizing income and expenses is crucial. TurboTax 1065 guides you through this process, but it’s essential to understand the distinctions between different types of income (such as ordinary business income, capital gains, and interest income) and expenses (like operating expenses, depreciation, and interest paid).

- Allocate Income and Expenses Among Partners: The software helps in calculating each partner’s share of income, deductions, and credits based on the partnership agreement. Ensure that the allocation is correctly reflected in the tax return, as this affects each partner’s individual tax liability.

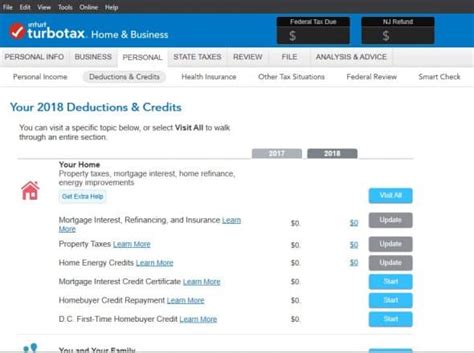

- Leverage TurboTax 1065’s Audit Support: One of the benefits of using TurboTax 1065 is its audit support. If the IRS audits the partnership’s return, TurboTax provides free audit guidance and representation. This can be a significant advantage in navigating what can be a complex and intimidating process.

- Stay Up-to-Date with Tax Law Changes: Tax laws and regulations are subject to change. TurboTax 1065 is regularly updated to reflect these changes, ensuring that the partnership’s tax return is compliant with the latest IRS requirements. Staying informed about these updates and how they affect the partnership is crucial for avoiding potential issues.

Benefits of Using TurboTax 1065

Using TurboTax 1065 offers several benefits, including: - Accuracy and Compliance: The software ensures that the partnership’s tax return is accurate and compliant with IRS regulations, reducing the risk of errors and audits. - Simplified Process: TurboTax 1065 guides users through the tax preparation process, making it easier to understand and complete Form 1065. - Time Savings: By automating many aspects of tax preparation, TurboTax 1065 saves time, allowing partnerships to focus on their core business activities. - Audit Support: The software provides valuable support in case of an IRS audit, offering guidance and representation.

| Feature | Description |

|---|---|

| Automatic Calculations | TurboTax 1065 automatically calculates each partner's share of income, deductions, and credits based on the partnership agreement. |

| Audit Support | The software provides free audit guidance and representation if the IRS audits the partnership's return. |

| Regular Updates | TurboTax 1065 is regularly updated to reflect changes in tax laws and regulations, ensuring compliance with the latest IRS requirements. |

📝 Note: It's essential to consult with a tax professional if the partnership has complex tax situations or specific questions about using TurboTax 1065.

In summary, TurboTax 1065 is a valuable tool for partnerships preparing and filing Form 1065. By following the tips outlined above and leveraging the software’s features, partnerships can ensure accurate and compliant tax returns, simplify their tax preparation process, and save time. Understanding the benefits and how to effectively use TurboTax 1065 can help partnerships navigate the complexities of tax preparation with confidence.

What is TurboTax 1065 used for?

+

TurboTax 1065 is used for preparing and filing Form 1065, the U.S. Return of Partnership Income, for partnerships and limited liability companies treated as partnerships for tax purposes.

What are the benefits of using TurboTax 1065?

+

The benefits include accuracy and compliance with IRS regulations, a simplified tax preparation process, time savings, and audit support in case of an IRS audit.

Does TurboTax 1065 provide audit support?

+

Yes, TurboTax 1065 provides free audit guidance and representation if the IRS audits the partnership’s return.