Paperwork

Tax Return Paperwork Needed

Introduction to Tax Return Paperwork

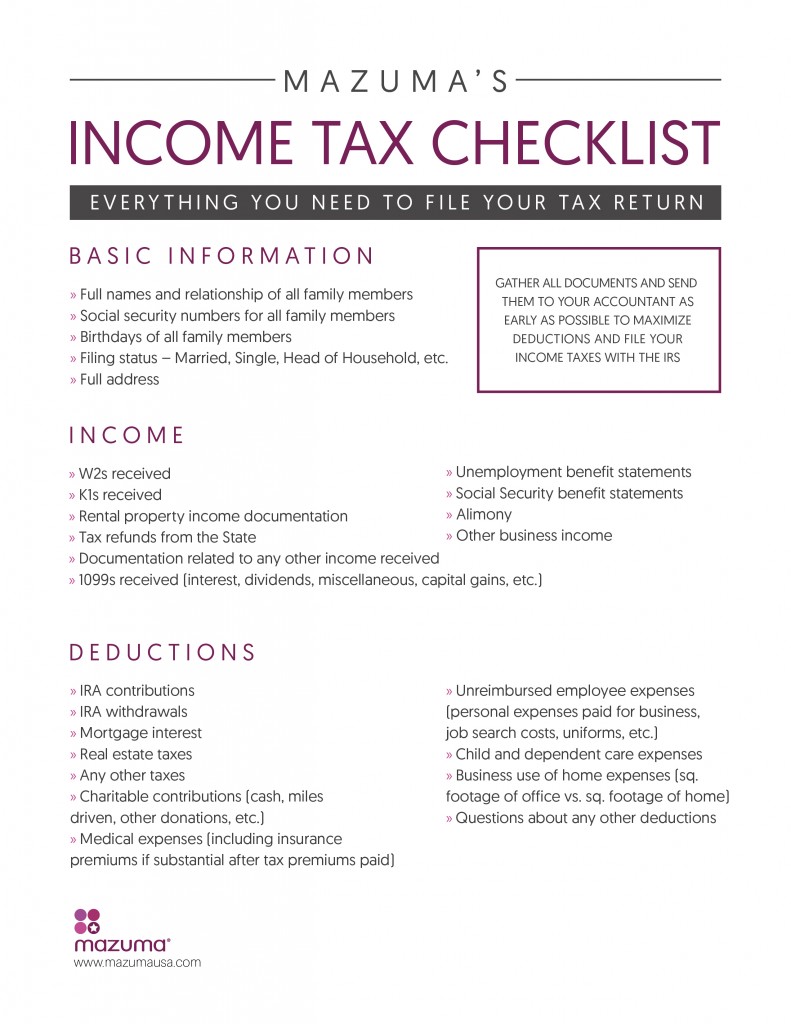

When it comes to filing taxes, one of the most critical aspects is gathering all the necessary paperwork. This process can be overwhelming, especially for those who are new to filing taxes or have complex financial situations. The key to a smooth and successful tax filing experience is being well-prepared with all the required documents. In this article, we will delve into the world of tax return paperwork, exploring what you need, why you need it, and how to organize it efficiently.

Understanding Tax Return Paperwork

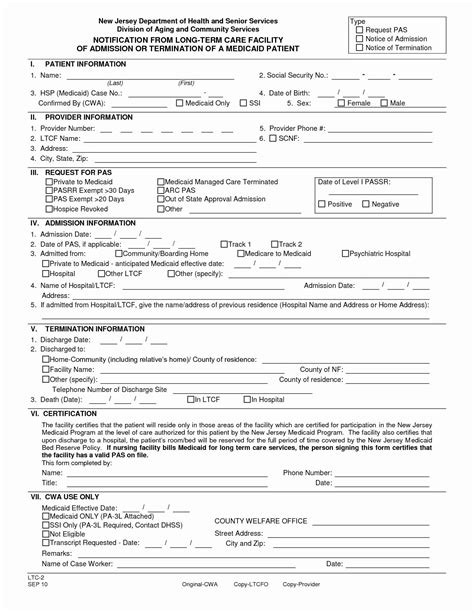

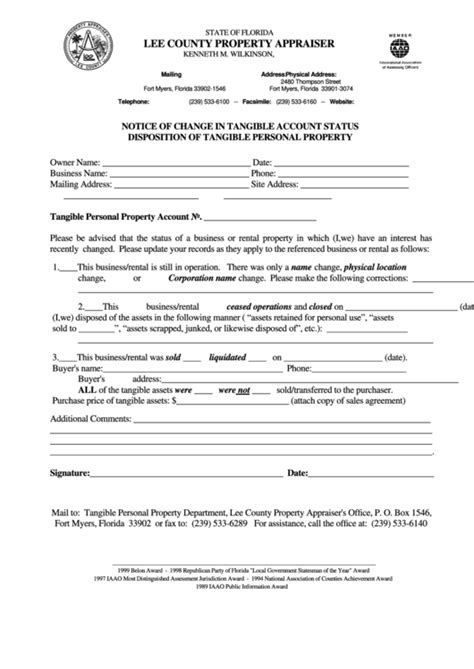

Tax return paperwork encompasses a wide range of documents that provide detailed information about your income, deductions, and credits. These documents are essential for accurately filling out your tax return forms, which are then submitted to the tax authorities. The primary goal of tax return paperwork is to ensure transparency and compliance with tax laws, allowing you to claim the deductions and credits you are eligible for while avoiding any potential penalties for underreporting income or overstating deductions.

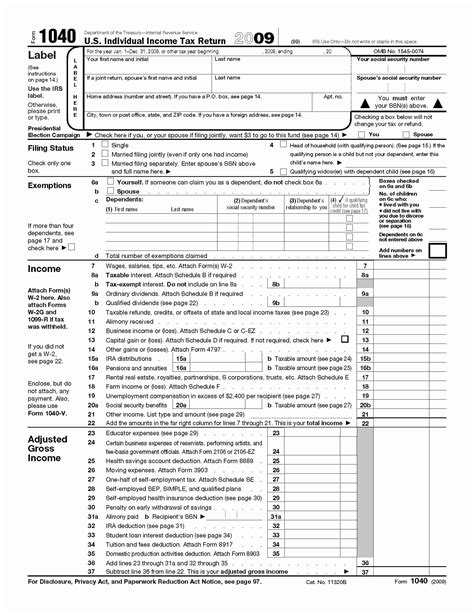

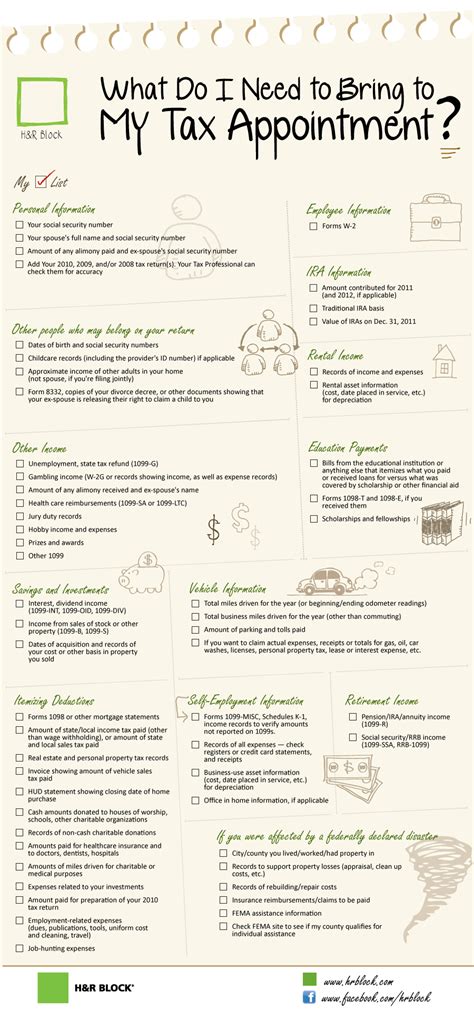

Types of Tax Return Paperwork

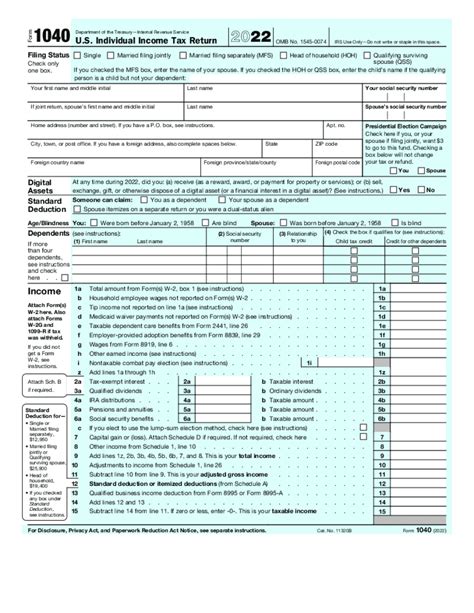

There are several types of paperwork that you may need to file your taxes, depending on your individual circumstances. Here are some of the most common ones: - W-2 Forms: These are provided by your employer to report your income and the taxes withheld from your paycheck. - 1099 Forms: If you are self-employed or have income from freelance work, interest, dividends, or capital gains, you will receive 1099 forms to report these incomes. - Interest Statements (1099-INT): Banks and other financial institutions will send you these forms to report the interest you earned on your accounts. - Dividend Statements (1099-DIV): For reporting dividends earned from investments. - Capital Gains Statements: These are crucial for reporting profits or losses from the sale of assets, such as stocks, bonds, or real estate. - Charitable Donation Receipts: Necessary for claiming deductions on charitable donations. - Medical Expense Receipts: For deducting medical expenses that exceed a certain percentage of your adjusted gross income. - Mortgage Interest Statements (1098): Provided by your lender to report the interest paid on your mortgage, which can be deductible. - Education Expenses: Forms like the 1098-T for tuition payments, which can qualify for education credits.

Organizing Your Tax Return Paperwork

Organizing your tax paperwork is crucial for a stress-free tax filing experience. Here are some tips to help you keep everything in order: - Create a Dedicated Folder: Designate a specific folder or file where you will keep all your tax-related documents throughout the year. - Categorize Documents: Separate your documents into categories, such as income, deductions, and credits, to make them easier to find and reference. - Digital Copies: Consider scanning your documents and saving them digitally. This can help protect against loss or damage and make it easier to share documents with your tax preparer. - Keep Receipts: Throughout the year, keep receipts for any purchases that could be deductible, such as business expenses, medical expenses, or charitable donations.

Tax Filing Options

Once you have all your paperwork organized, you can proceed to file your taxes. There are several options available: - Manual Filing: You can fill out the tax forms manually and mail them to the tax authority. However, this method is more prone to errors and is generally less recommended. - Tax Software: Utilizing tax preparation software is a popular option. These programs guide you through the filing process, perform calculations, and check for errors, making the process much smoother. - Professional Tax Preparers: If your tax situation is complex or you are not comfortable filing your taxes yourself, you can hire a professional tax preparer. They can ensure your return is accurate and that you claim all the deductions and credits you are eligible for.

Benefits of Accurate Tax Return Paperwork

Accurate and complete tax return paperwork offers several benefits: - Avoid Penalties: By reporting all your income and claiming only the deductions and credits you are eligible for, you can avoid penalties and interest for underpayment or errors. - Maximize Refunds: Ensuring you claim all eligible deductions and credits can maximize your refund. - Simplify Audits: In the event of an audit, having well-organized and accurate paperwork can make the process much less stressful and reduce the risk of additional taxes or penalties.

📝 Note: It's essential to keep your tax return paperwork for at least three years in case of an audit. Digital storage can be a convenient and secure way to keep these records.

Conclusion and Next Steps

In conclusion, tax return paperwork is a critical component of the tax filing process. By understanding what documents you need, organizing them efficiently, and choosing the right filing option for your situation, you can ensure a smooth and successful tax filing experience. Remember, accuracy and completeness are key to avoiding penalties and maximizing your refund. Take the time to review your paperwork carefully, and don’t hesitate to seek professional help if you’re unsure about any aspect of the process.

What is the deadline for filing taxes?

+

The deadline for filing taxes typically falls on April 15th of each year, but it can vary if this date falls on a weekend or a federal holiday.

Do I need to file taxes if I don’t owe anything?

+

Yes, even if you don’t owe taxes, you may still need to file a tax return to report your income and claim any refunds you are due, such as for withholding or credits.

Can I file my taxes electronically?

+

Yes, electronic filing (e-filing) is a convenient and efficient way to submit your tax return. It also reduces errors and provides faster refunds.