5 Loan Completion Papers

Introduction to Loan Completion Papers

When an individual or business applies for a loan, there are several steps involved in the process. One of the critical phases is the completion of loan papers, which is a comprehensive set of documents that outline the terms and conditions of the loan. These papers are essential as they provide a clear understanding of the borrower’s obligations and the lender’s expectations. In this article, we will delve into the world of loan completion papers, exploring their importance, types, and the information they typically contain.

Types of Loan Completion Papers

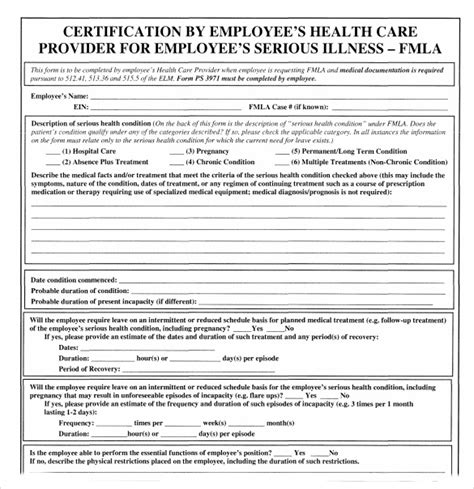

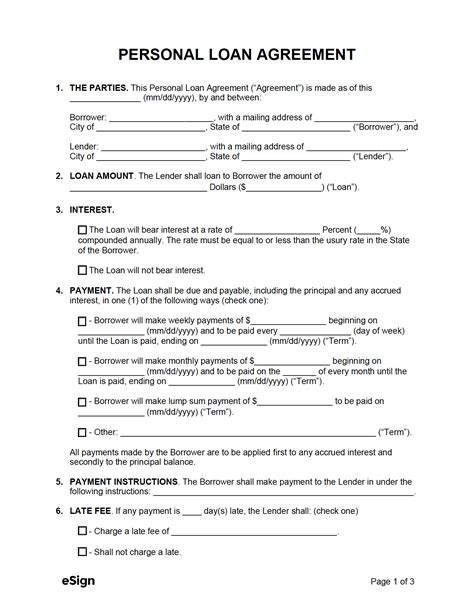

There are several types of loan completion papers, each serving a unique purpose. Some of the most common types include: * Loan Agreement: This is the primary document that outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment terms, and any other relevant details. * Promissory Note: This document is a promise by the borrower to repay the loan, and it typically includes the loan amount, interest rate, and repayment schedule. * Security Agreement: This document is used to secure the loan with collateral, such as property or assets. * Guaranty Agreement: This document is used when a third party guarantees the loan, agreeing to repay the loan if the borrower defaults. * Mortgage Deed: This document is used for mortgages, where the borrower grants the lender a lien on the property as security for the loan.

Information Contained in Loan Completion Papers

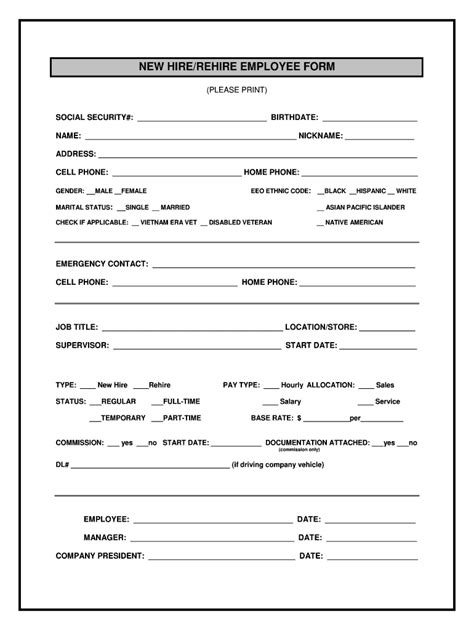

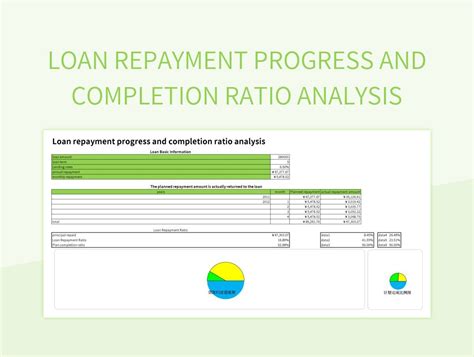

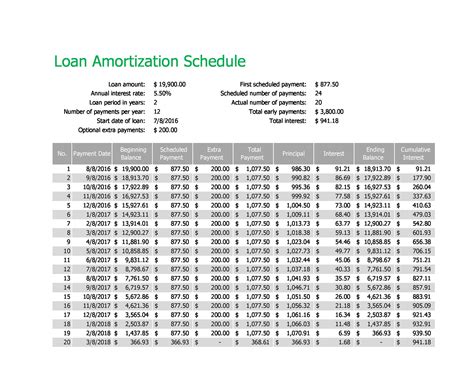

Loan completion papers typically contain a wealth of information, including: * Loan Details: The loan amount, interest rate, repayment terms, and any fees associated with the loan. * Borrower Information: The borrower’s name, address, and contact information. * Lender Information: The lender’s name, address, and contact information. * Repayment Schedule: A detailed schedule outlining the repayment terms, including the payment amount, frequency, and due date. * Default Provisions: The consequences of defaulting on the loan, including late payment fees, acceleration clauses, and foreclosure procedures. * Security Information: Details about the collateral securing the loan, including the type, value, and location of the collateral.

Importance of Loan Completion Papers

Loan completion papers are essential for both lenders and borrowers. They provide a clear understanding of the loan terms and conditions, helping to prevent misunderstandings and disputes. These papers also serve as a legal contract, outlining the obligations and responsibilities of both parties. By signing the loan completion papers, the borrower acknowledges their commitment to repay the loan, and the lender acknowledges their commitment to provide the loan funds.

📝 Note: It is crucial for borrowers to carefully review the loan completion papers before signing, ensuring they understand the terms and conditions of the loan.

Benefits of Loan Completion Papers

The benefits of loan completion papers are numerous, including: * Clear Understanding: They provide a clear understanding of the loan terms and conditions, helping to prevent misunderstandings and disputes. * Legal Protection: They serve as a legal contract, outlining the obligations and responsibilities of both parties. * Accountability: They hold both parties accountable for their actions, ensuring that the borrower repays the loan and the lender provides the loan funds. * Security: They provide security for the lender, outlining the consequences of defaulting on the loan.

Challenges and Limitations of Loan Completion Papers

While loan completion papers are essential, they can also present challenges and limitations, including: * Complexity: They can be complex and difficult to understand, especially for borrowers who are not familiar with legal terminology. * Time-Consuming: They can be time-consuming to prepare and review, delaying the loan process. * Costly: They can be costly to prepare and execute, especially if they require the services of a lawyer or other professional.

Best Practices for Loan Completion Papers

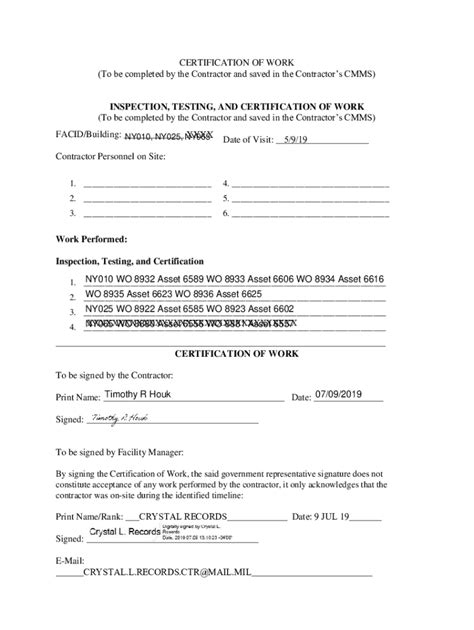

To ensure that loan completion papers are effective, it is essential to follow best practices, including: * Clear and Concise Language: Using clear and concise language to avoid misunderstandings and disputes. * Thorough Review: Thoroughly reviewing the papers to ensure that they are accurate and complete. * Legal Compliance: Ensuring that the papers comply with all relevant laws and regulations. * Signature and Dating: Signing and dating the papers to acknowledge their authenticity and validity.

| Loan Completion Paper | Purpose | Information Contained |

|---|---|---|

| Loan Agreement | Outlines the terms and conditions of the loan | Loan amount, interest rate, repayment terms, and fees |

| Promissory Note | Promises to repay the loan | Loan amount, interest rate, and repayment schedule |

| Security Agreement | Secures the loan with collateral | Type, value, and location of collateral |

| Guaranty Agreement | Guarantees the loan with a third party | Guarantor's name, address, and contact information |

| Mortgage Deed | Grants a lien on the property as security for the loan | Property description, value, and location |

In summary, loan completion papers are a critical component of the loan process, providing a clear understanding of the loan terms and conditions. They serve as a legal contract, outlining the obligations and responsibilities of both parties, and provide security for the lender. By following best practices and ensuring that the papers are clear, concise, and compliant with all relevant laws and regulations, lenders and borrowers can ensure a smooth and successful loan process.

What is the purpose of loan completion papers?

+

Loan completion papers provide a clear understanding of the loan terms and conditions, serving as a legal contract that outlines the obligations and responsibilities of both parties.

What types of loan completion papers are there?

+

There are several types of loan completion papers, including loan agreements, promissory notes, security agreements, guaranty agreements, and mortgage deeds.

What information is typically contained in loan completion papers?

+

Loan completion papers typically contain information such as loan details, borrower information, lender information, repayment schedule, default provisions, and security information.