New Hire Paperwork Essentials

Introduction to New Hire Paperwork

When a new employee joins an organization, there are numerous documents and forms that need to be completed to ensure a smooth onboarding process. This paperwork is essential for various reasons, including compliance with laws and regulations, employee benefits, and tax purposes. In this blog post, we will delve into the world of new hire paperwork, exploring the essential documents, forms, and procedures that employers and employees need to be aware of.

Pre-Employment Documents

Before an employee starts working, there are several documents that need to be completed. These include: * Job application form: This form provides basic information about the applicant, including their name, address, contact details, and employment history. * Resume and cover letter: These documents provide a detailed overview of the applicant’s skills, qualifications, and experience. * Reference checks: Employers may contact the applicant’s previous employers or references to verify their employment history and performance. * Background checks: Depending on the industry or job requirements, employers may conduct background checks to ensure the applicant’s suitability for the role.

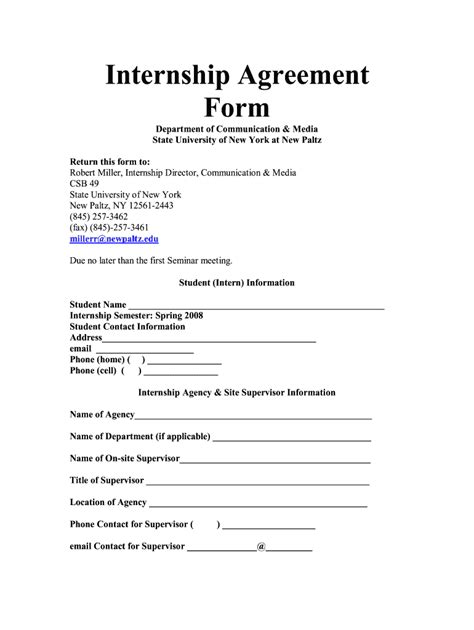

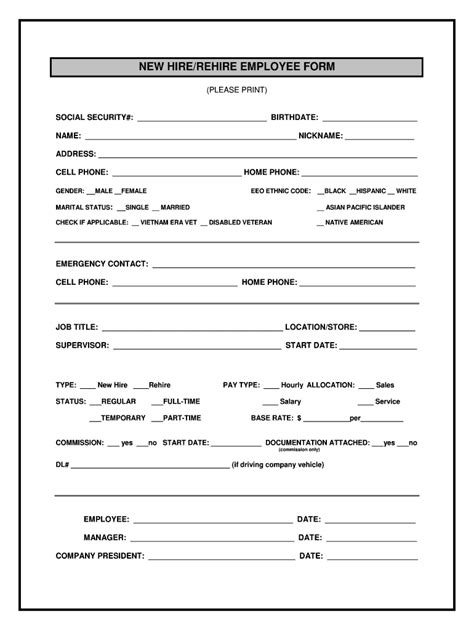

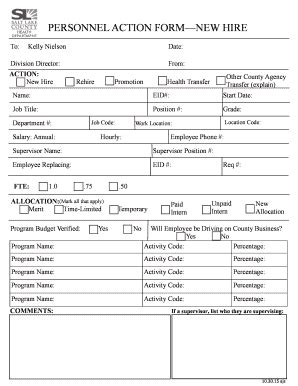

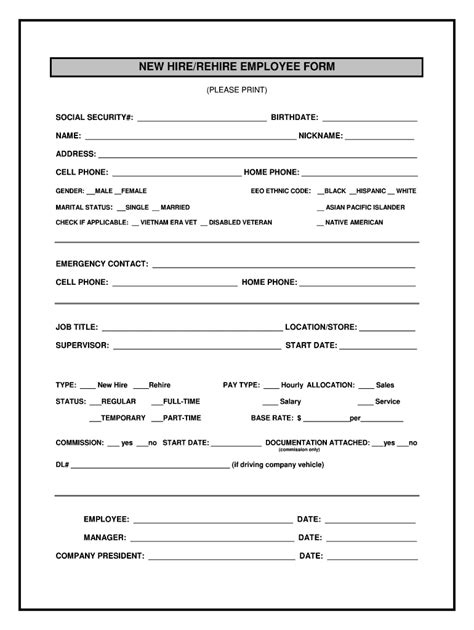

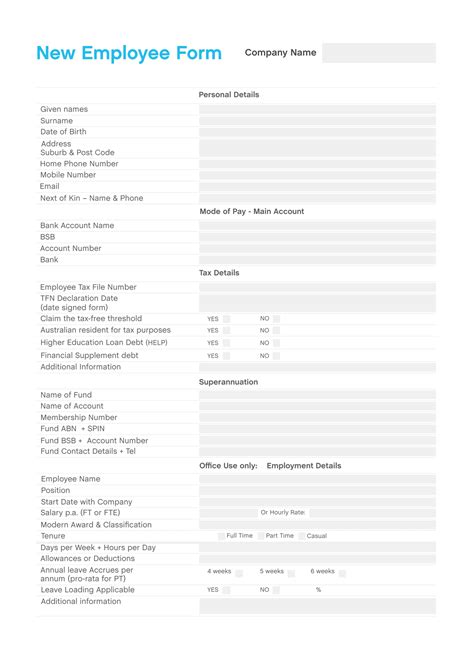

New Hire Forms

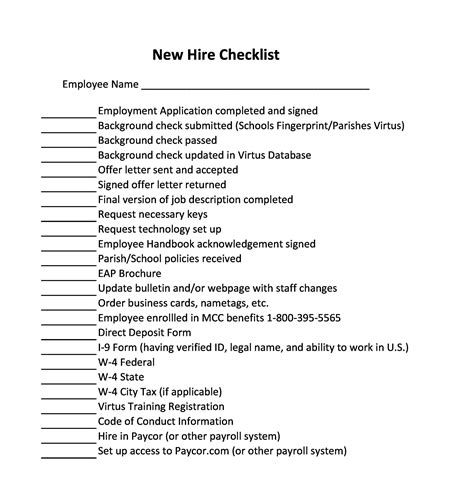

Once an employee has been hired, there are several forms that need to be completed. These include: * W-4 form: This form is used to determine the amount of federal income tax to be withheld from the employee’s wages. * I-9 form: This form is used to verify the employee’s identity and eligibility to work in the United States. * Benefits enrollment forms: These forms are used to enroll the employee in various benefits, such as health insurance, retirement plans, and life insurance. * Emergency contact form: This form provides contact information for the employee’s emergency contacts, such as family members or friends.

Tax-Related Documents

Employers are required to comply with various tax laws and regulations, including: * Withholding taxes: Employers are required to withhold federal, state, and local taxes from the employee’s wages. * Payroll tax returns: Employers are required to file payroll tax returns with the relevant authorities, such as the IRS. * W-2 forms: Employers are required to provide W-2 forms to employees, which show their income and taxes withheld for the year.

Employee Benefits

Employers may offer various benefits to their employees, including: * Health insurance: Employers may offer health insurance plans to their employees, which provide coverage for medical expenses. * Retirement plans: Employers may offer retirement plans, such as 401(k) or pension plans, which provide income to employees in retirement. * Life insurance: Employers may offer life insurance plans, which provide a death benefit to the employee’s beneficiaries. * Paid time off: Employers may offer paid time off, such as vacation days, sick leave, or holidays.

Compliance with Laws and Regulations

Employers must comply with various laws and regulations, including: * Fair Labor Standards Act (FLSA): This law regulates minimum wage, overtime pay, and working hours. * Family and Medical Leave Act (FMLA): This law provides eligible employees with up to 12 weeks of unpaid leave for certain family and medical reasons. * Americans with Disabilities Act (ADA): This law prohibits discrimination against employees with disabilities and requires employers to provide reasonable accommodations. * Equal Employment Opportunity (EEO) laws: These laws prohibit discrimination against employees based on their race, color, religion, sex, national origin, age, or genetic information.

📝 Note: Employers must ensure that they comply with all relevant laws and regulations, including those related to employment, tax, and benefits.

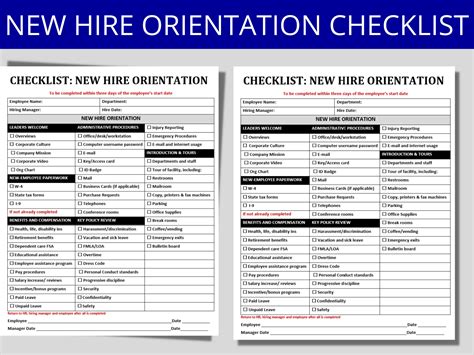

Best Practices for New Hire Paperwork

To ensure a smooth onboarding process, employers should follow these best practices: * Use electronic forms: Electronic forms can simplify the onboarding process and reduce errors. * Provide clear instructions: Employers should provide clear instructions on how to complete the forms and what information is required. * Use a checklist: Employers can use a checklist to ensure that all necessary forms and documents are completed. * Store documents securely: Employers must store employee documents securely to protect their confidentiality and comply with data protection laws.

| Document | Purpose |

|---|---|

| W-4 form | To determine federal income tax withholding |

| I-9 form | To verify employee identity and eligibility to work |

| Benefits enrollment forms | To enroll employees in benefits, such as health insurance and retirement plans |

In summary, new hire paperwork is an essential part of the onboarding process, and employers must ensure that they comply with all relevant laws and regulations. By following best practices and using electronic forms, employers can simplify the process and reduce errors. It is crucial for employers to provide clear instructions and store documents securely to protect employee confidentiality and comply with data protection laws. Ultimately, a well-organized onboarding process can help to ensure a positive experience for new employees and set them up for success in their new role.

What is the purpose of the W-4 form?

+

The W-4 form is used to determine the amount of federal income tax to be withheld from an employee’s wages.

What is the difference between a W-2 form and a W-4 form?

+

A W-2 form shows an employee’s income and taxes withheld for the year, while a W-4 form is used to determine the amount of federal income tax to be withheld from an employee’s wages.

What are the consequences of not completing new hire paperwork correctly?

+

The consequences of not completing new hire paperwork correctly can include fines, penalties, and legal action, as well as delays in processing employee benefits and tax returns.