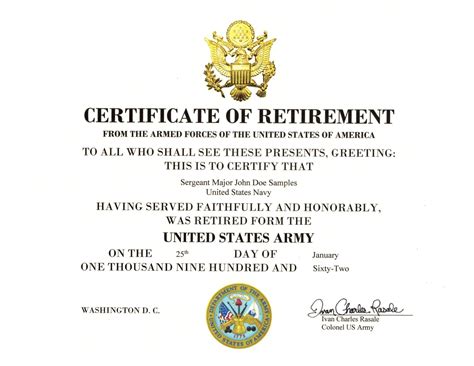

Soldier Retirement Paperwork Starts with Wife

Introduction to Military Retirement Planning

For military personnel, retirement is a significant milestone that marks the end of their service and the beginning of a new chapter in their lives. While the process of retirement can be complex and overwhelming, it is essential to start planning early to ensure a smooth transition. Interestingly, for many soldiers, the process of retirement planning often starts with their wives. The reason behind this is not just emotional support, but also the critical role that spouses play in managing the household, finances, and personal affairs of the family. In this article, we will explore the significance of spouse involvement in military retirement planning and provide a comprehensive guide on how to navigate the process.

Understanding the Importance of Spouse Involvement

Spouses of military personnel often take on a significant amount of responsibility, from managing the household to caring for children and handling financial matters. When it comes to retirement planning, their role is equally crucial. By being involved in the planning process, spouses can help ensure that their partner’s retirement benefits are maximized, and that the transition to civilian life is as seamless as possible. Effective communication and teamwork are essential in this process, as spouses can help their partners stay organized, meet deadlines, and make informed decisions about their retirement.

Key Steps in the Retirement Planning Process

The process of military retirement planning involves several key steps, including: * Determining eligibility for retirement benefits * Calculating retirement pay and benefits * Choosing a retirement date * Completing retirement paperwork * Planning for life after retirement Each of these steps requires careful consideration and planning, and spouses can play a vital role in ensuring that everything runs smoothly. By working together, couples can avoid common pitfalls and ensure that they are well-prepared for the transition to civilian life.

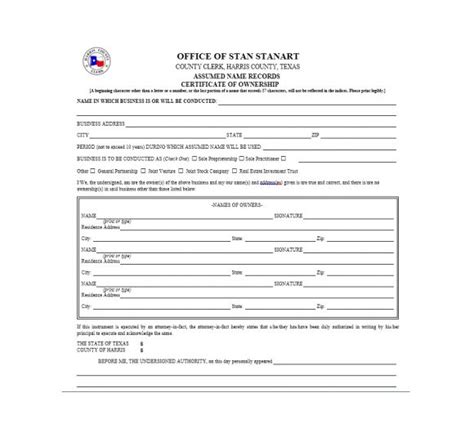

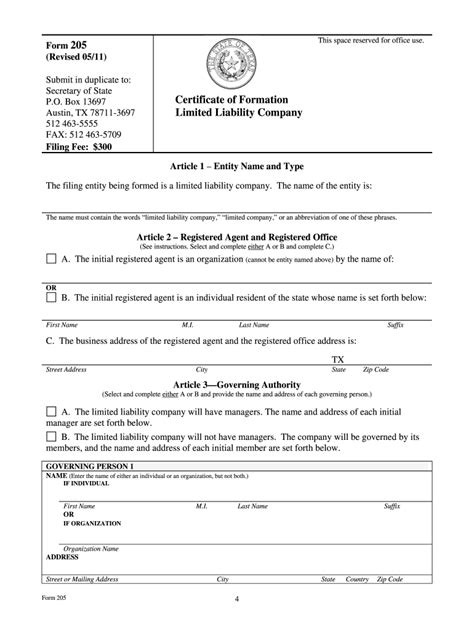

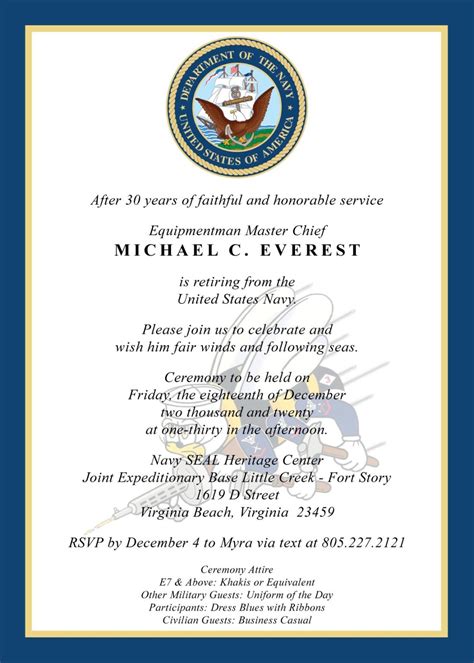

Retirement Paperwork and Benefits

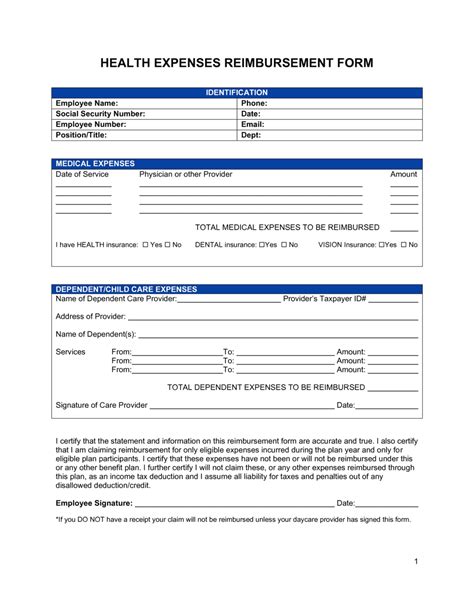

One of the most critical aspects of military retirement planning is completing the necessary paperwork. This includes: * Applying for retirement benefits * Updating beneficiary information * Choosing a retirement plan * Electing survivor benefit coverage The paperwork involved in military retirement can be complex and time-consuming, but spouses can help their partners stay on top of things. By being organized and proactive, couples can ensure that they receive all the benefits they are entitled to and avoid any potential delays or issues.

| Benefit | Description |

|---|---|

| Retirement Pay | Monthly payment based on years of service and rank |

| TRICARE | Health insurance coverage for retirees and their families |

| SBP | Survivor Benefit Plan, which provides coverage for spouses and children |

Planning for Life After Retirement

While the financial aspects of retirement are critical, they are not the only consideration. Couples must also think about what they want to do with their time in retirement and how they will stay engaged and fulfilled. This might involve: * Pursuing hobbies or interests * Volunteering or working part-time * Traveling or exploring new places * Spending time with family and friends By planning ahead and having a clear vision for their retirement, couples can ensure that they make the most of this new chapter in their lives.

💡 Note: It's essential to start planning for retirement early, as the process can take several months to a year or more to complete.

Navigating the Transition to Civilian Life

The transition to civilian life can be challenging, especially for those who have spent many years in the military. Spouses can play a critical role in supporting their partners through this transition, by: * Encouraging them to seek out new opportunities and experiences * Helping them to stay connected with friends and family * Supporting them as they navigate the challenges of civilian life By working together and supporting each other, couples can make the transition to civilian life as smooth as possible.

In the end, military retirement planning is a complex and multifaceted process that requires careful consideration and planning. By involving their spouses in the process, soldiers can ensure that they are well-prepared for the transition to civilian life and that they make the most of their retirement. With the right planning and support, couples can enjoy a happy, healthy, and fulfilling retirement.

What is the first step in the military retirement planning process?

+

The first step in the military retirement planning process is to determine eligibility for retirement benefits. This involves reviewing the soldier’s years of service, rank, and other factors to determine their eligibility for retirement pay and benefits.

How can spouses support their partners through the transition to civilian life?

+

Spouses can support their partners through the transition to civilian life by encouraging them to seek out new opportunities and experiences, helping them to stay connected with friends and family, and supporting them as they navigate the challenges of civilian life.

What is the Survivor Benefit Plan (SBP), and how does it work?

+

The Survivor Benefit Plan (SBP) is a program that provides coverage for spouses and children of military retirees. It works by providing a monthly payment to the surviving spouse or children in the event of the retiree’s death. The payment amount is based on the retiree’s years of service and rank.