IRS S Corp Paperwork Status

Understanding the IRS S Corp Paperwork Status

The Internal Revenue Service (IRS) requires corporations to file specific paperwork to maintain their S corporation status. This status is crucial for businesses as it provides pass-through taxation, where the corporation’s income is only taxed at the individual level, not at the corporate level. Maintaining this status involves several steps and ongoing compliance with IRS regulations.

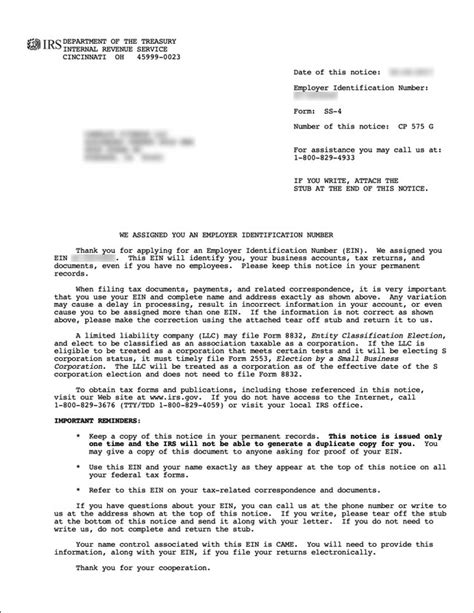

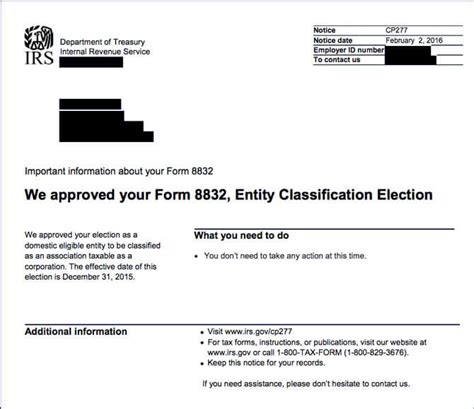

Initial Paperwork for S Corp Status

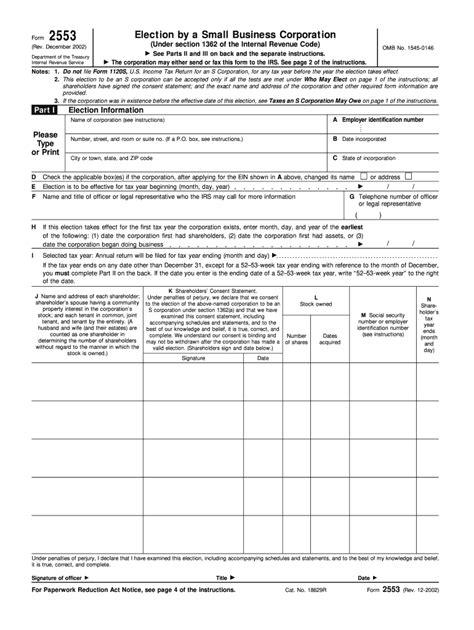

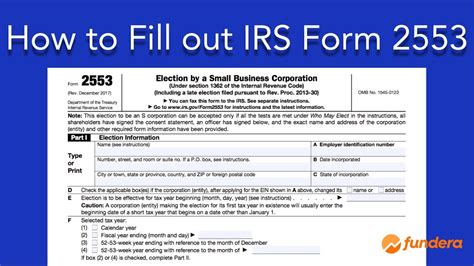

To obtain S corp status, a corporation must first file Form 2553, Election by a Small Business Corporation. This form must be submitted to the IRS within a specific timeframe, typically within 75 days of the corporation’s formation or during the first 75 days of the tax year for which the election is to take effect. The form requires detailed information about the corporation, its shareholders, and its intention to elect S corp status.

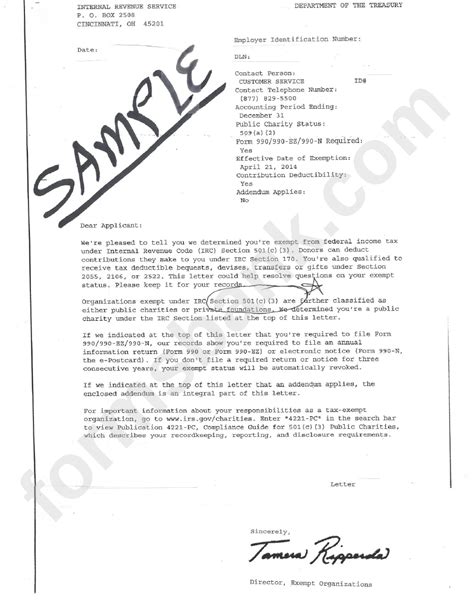

Maintenance and Compliance

After the initial election, the corporation must maintain its S corp status by adhering to certain requirements. These include: - Ensuring that the corporation has no more than 100 shareholders, all of whom must be U.S. citizens, resident aliens, or certain trusts and estates. - Maintaining a permitted tax year, typically a calendar year, unless a different tax year is approved by the IRS. - Filing an annual information return, Form 1120S, which reports the corporation’s income, deductions, and credits. - Issuing Schedule K-1 to each shareholder, detailing their share of the corporation’s income, deductions, and credits for the tax year.

Monitoring Paperwork Status

Corporations can monitor the status of their S corp paperwork by: - Checking the IRS website or contacting the IRS directly for the status of their Form 2553. - Ensuring timely receipt of confirmation from the IRS, which typically includes a stamped copy of Form 2553. - Regularly reviewing and updating corporate records to reflect any changes in ownership, address, or other critical information.

📝 Note: It's essential for corporations to keep detailed records of all correspondence with the IRS, including submission dates, receipt confirmations, and any subsequent communication regarding their S corp status.

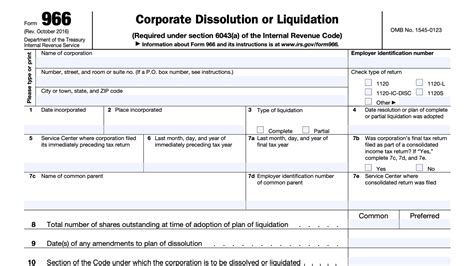

Consequences of Non-Compliance

Failure to comply with IRS requirements can result in the termination of S corp status. This termination can lead to the corporation being taxed as a C corporation, resulting in double taxation—once at the corporate level and again at the individual level when dividends are distributed. To avoid this, corporations must be vigilant in maintaining compliance and addressing any issues promptly.

Key Points for S Corp Maintenance

To maintain S corp status effectively, corporations should: - File all required forms on time, including annual information returns and shareholder statements. - Monitor ownership changes to ensure compliance with the 100-shareholder limit and eligibility requirements. - Review and update corporate records regularly to reflect any changes that may affect S corp status. - Seek professional advice when necessary to ensure compliance with all IRS regulations and to address any issues that may arise.

In summary, maintaining S corp status requires careful attention to initial and ongoing paperwork, compliance with IRS regulations, and prompt action to address any issues that may affect this status. By understanding and adhering to these requirements, corporations can enjoy the benefits of pass-through taxation and avoid the consequences of non-compliance.

What is the primary benefit of S corp status for a corporation?

+

The primary benefit of S corp status is pass-through taxation, which means the corporation’s income is only taxed at the individual level, not at the corporate level, thus avoiding double taxation.

How does a corporation initially obtain S corp status?

+

A corporation obtains S corp status by filing Form 2553, Election by a Small Business Corporation, with the IRS within the specified timeframe, typically within 75 days of the corporation’s formation or the start of its tax year.

What happens if an S corp fails to comply with IRS regulations?

+

If an S corp fails to comply with IRS regulations, it risks losing its S corp status. This can lead to the corporation being taxed as a C corporation, resulting in double taxation.