Claim PPI Without Paperwork

Introduction to PPI Claims

Payment Protection Insurance (PPI) has been a widely discussed topic in recent years, especially in the context of mis-selling by financial institutions. Many individuals have been affected by the mis-sale of PPI policies, which were often added to loans, credit cards, and mortgages without the consumer’s knowledge or consent. If you believe you have been a victim of PPI mis-selling, you may be eligible to claim back the premiums you paid, along with interest. The process of claiming PPI without paperwork can seem daunting, but it is achievable with the right guidance.

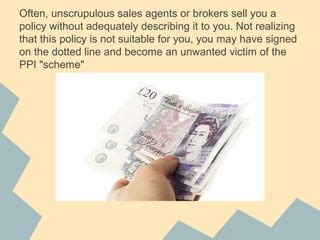

Understanding PPI and Its Mis-selling

PPI was designed to cover loan repayments if the borrower fell ill, had an accident, or lost their job. However, the policy was often mis-sold to individuals who did not need it or would not be eligible to claim under its terms. The mis-selling of PPI has led to a massive scandal, with billions of pounds being paid out in compensation. Key factors that contribute to a successful PPI claim include the policy being sold without the consumer’s knowledge, the policy being unsuitable for the consumer’s circumstances, or the consumer being told that the policy was compulsory.

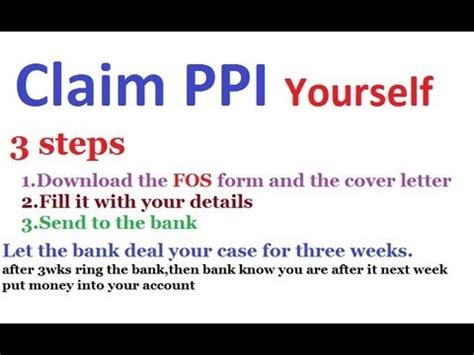

How to Claim PPI Without Paperwork

Claiming PPI without paperwork requires some effort but is definitely possible. Here are the steps you can follow: * Check if you had PPI: First, you need to confirm whether you had a PPI policy attached to any of your financial products. You can contact your bank or lender directly to ask about this. * Gather information: While you may not have the original paperwork, you can still gather relevant information such as the approximate dates when you took out the loan or credit card, and any details about the policy that you remember. * Use online tools and resources: There are several online tools and resources available that can help you determine if you had PPI and guide you through the claims process. * Contact the lender: Reach out to your lender and inform them that you wish to make a PPI claim. They will guide you through their specific process, which may involve filling out a claims form or providing additional information over the phone or via email. * Seek professional help: If you’re not comfortable handling the claim yourself, or if your claim is complex, you may want to consider hiring a reputable claims management company. They can handle the entire process on your behalf but be aware that they will charge a fee for their services.

What to Expect During the Claims Process

The process of claiming PPI can vary depending on the lender and the specifics of your case. Generally, you can expect the following: * Initial assessment: The lender will assess your claim to determine if you were mis-sold PPI. * Further investigation: If the lender believes you may have a valid claim, they will conduct a further investigation, which may involve requesting additional information from you. * Offer of compensation: If your claim is successful, the lender will offer you compensation, which typically includes a refund of the PPI premiums you paid, plus interest. * Appeal: If your claim is rejected, you have the right to appeal the decision. You can do this directly with the lender or through the Financial Ombudsman Service.

📝 Note: The claims process can take several months, so it's essential to be patient and persistent.

Benefits of Claiming PPI

Claiming PPI can have significant benefits, especially for those who were mis-sold policies and have been paying unnecessary premiums for years. The main benefits include: * Reclaiming the PPI premiums you paid * Receiving interest on those premiums * Potentially receiving additional compensation for distress and inconvenience * Bringing closure to a potentially stressful and frustrating experience

Common Challenges and How to Overcome Them

While claiming PPI without paperwork can be challenging, there are common obstacles that you might face and ways to overcome them: * Lack of documentation: If you don’t have any paperwork related to your PPI policy, contact your lender and ask if they have any records. You can also try to find old bank statements or other financial records that might indicate the presence of a PPI policy. * Time limits: There are time limits for making PPI claims, so it’s crucial to act as soon as possible. If you’re unsure about the time limits or how they apply to your situation, seek advice from a claims management company or the Financial Ombudsman Service. * Rejection: If your claim is rejected, don’t give up. You can appeal the decision, and it’s worth seeking professional advice to help you navigate the appeals process.

| Challenge | Solution |

|---|---|

| Lack of documentation | Contact lender for records, search for old financial documents |

| Time limits | Act promptly, seek advice on time limits and appeals process |

| Rejection | Appeal decision, seek professional advice for appeals process |

Conclusion and Next Steps

Claiming PPI without paperwork requires persistence and the right guidance. By understanding the process, gathering necessary information, and being prepared for potential challenges, you can successfully reclaim your PPI premiums and receive the compensation you deserve. Remember to stay informed, seek help when needed, and don’t hesitate to appeal if your claim is initially rejected. With the right approach, you can navigate the PPI claims process effectively and achieve a positive outcome.

What is PPI and how was it mis-sold?

+

PPI stands for Payment Protection Insurance. It was designed to cover loan repayments if the borrower fell ill, had an accident, or lost their job. However, it was often mis-sold to individuals who did not need it, would not be eligible to claim under its terms, or were not fully informed about the policy.

Can I claim PPI without any paperwork?

+

Yes, it is possible to claim PPI without paperwork. You can contact your lender to inquire about any PPI policies attached to your financial products and follow their process for making a claim. You may also use online tools and resources to guide you through the process.

How long does the PPI claims process typically take?

+

The length of time for the PPI claims process can vary. It often takes several months from the initial claim to the final decision. Factors such as the complexity of the case and the efficiency of the lender in handling claims can influence the duration.