5 Steps to Claim Life Insurance

Understanding the Process of Claiming Life Insurance

When a loved one passes away, dealing with the emotional loss can be overwhelming, and navigating the process of claiming life insurance can add to the stress. However, understanding the steps involved in claiming life insurance can help make the process smoother and less daunting. The primary goal of life insurance is to provide financial protection to the beneficiaries in the event of the policyholder’s death. Claiming life insurance involves several key steps that beneficiaries must follow to receive the benefits.

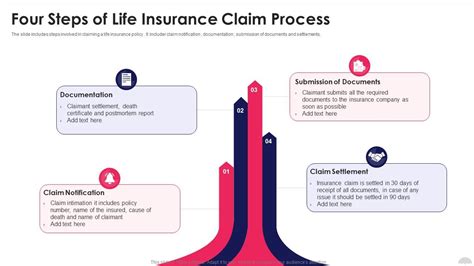

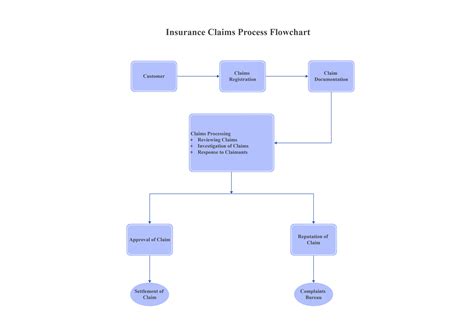

Step 1: Notify the Insurance Company

The first step in claiming life insurance is to notify the insurance company as soon as possible after the policyholder’s death. This notification can usually be done over the phone or through the company’s website. It’s essential to have the policy number and other relevant details ready when making the notification. The insurance company will then guide the beneficiaries through the claims process and provide them with the necessary forms and documentation required to proceed with the claim.

Step 2: Gather Required Documents

To process the life insurance claim, the insurance company will require several documents, including: * The policy document * The death certificate of the policyholder * Proof of identity of the beneficiaries * Any other documents specified by the insurance company It’s crucial to gather these documents promptly and ensure they are in order to avoid any delays in the claims process. Beneficiaries should also make photocopies of all documents and keep the originals safe, as they may be required for future reference.

Step 3: Fill Out the Claims Form

The insurance company will provide a claims form that beneficiaries must fill out accurately and completely. This form will require details about the policyholder, the beneficiaries, and the circumstances of the policyholder’s death. Beneficiaries should ensure they fill out the form correctly and attach all required documents to avoid any delays or rejection of the claim.

Step 4: Submit the Claim

Once the claims form is completed and all required documents are attached, beneficiaries can submit the claim to the insurance company. This can usually be done via mail, email, or through the company’s website, depending on the company’s preferred method. Beneficiaries should keep a record of the submission, including the date and method of submission, in case they need to follow up on the status of the claim.

Step 5: Receive the Claim Settlement

After submitting the claim, the insurance company will review the documentation and process the claim. If the claim is approved, the beneficiaries will receive the claim settlement, which can be paid out in various ways, such as a lump sum or in installments, depending on the policy terms. Beneficiaries should review the settlement offer carefully and ensure it aligns with the policy terms and their expectations.

💡 Note: Beneficiaries should be aware of any contestability period, which is a specified period during which the insurance company can investigate and potentially deny the claim if they find any inconsistencies or misrepresentations in the policy application or claims process.

In terms of the benefits provided by life insurance, the following are key points to consider: * Financial Protection: Life insurance provides financial protection to the beneficiaries in the event of the policyholder’s death. * Income Replacement: The death benefit can replace the policyholder’s income, ensuring the beneficiaries can maintain their standard of living. * Debt Repayment: The death benefit can be used to pay off outstanding debts, such as mortgages or loans. * Funeral Expenses: The death benefit can cover funeral expenses, reducing the financial burden on the beneficiaries.

| Policy Type | Death Benefit | Premium Payments |

|---|---|---|

| Term Life Insurance | Lump sum payment to beneficiaries | Level premiums for a specified term |

| Whole Life Insurance | Lump sum payment to beneficiaries, plus cash value accumulation | Level premiums for the life of the policy |

| Universal Life Insurance | Lump sum payment to beneficiaries, plus cash value accumulation and flexible premiums | Flexible premiums, with potential for cash value accumulation |

As the claims process comes to a close, beneficiaries can take comfort in knowing that they have taken the necessary steps to secure the financial protection provided by the life insurance policy. By following these steps and understanding the claims process, beneficiaries can navigate the complex and often emotional process of claiming life insurance with greater ease and confidence. Ultimately, the goal of life insurance is to provide peace of mind and financial security to the beneficiaries, and by claiming the benefits, they can ensure that the policyholder’s legacy lives on.

What is the first step in claiming life insurance?

+

The first step in claiming life insurance is to notify the insurance company as soon as possible after the policyholder’s death.

What documents are required to process a life insurance claim?

+

The required documents include the policy document, the death certificate of the policyholder, proof of identity of the beneficiaries, and any other documents specified by the insurance company.

How long does it take to process a life insurance claim?

+

The processing time for a life insurance claim can vary depending on the insurance company and the complexity of the claim, but it typically takes several weeks to several months.