5 Ways File Taxes

Introduction to Filing Taxes

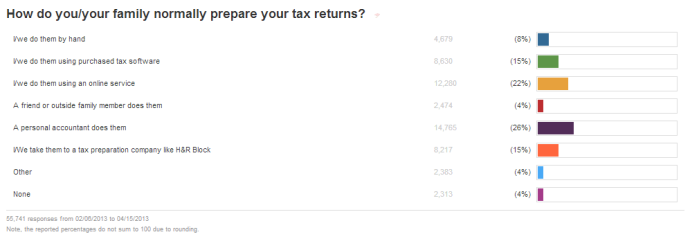

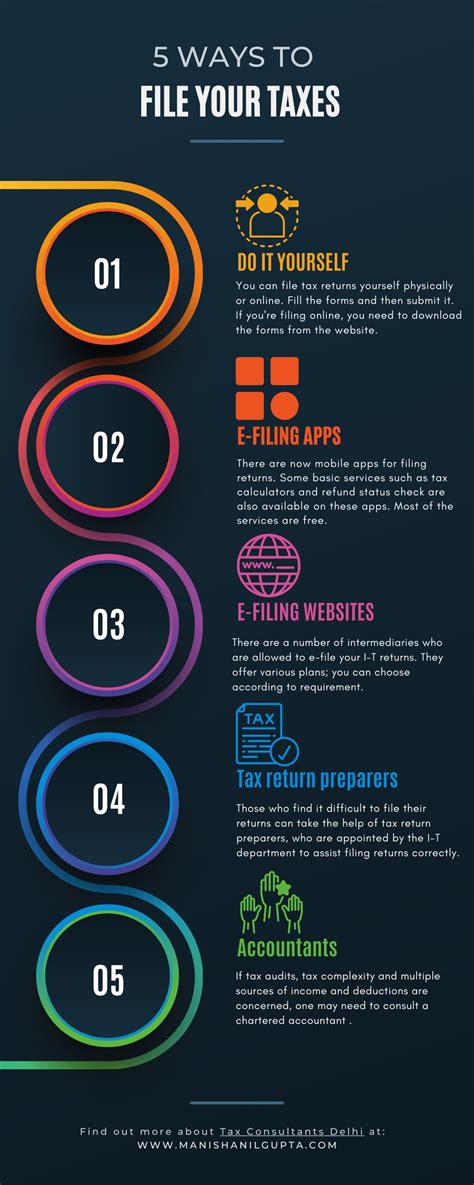

Filing taxes can be a daunting task, especially for those who are new to the process. With the numerous options available, it can be overwhelming to decide which method is the most suitable. In this article, we will explore five ways to file taxes, highlighting the benefits and drawbacks of each method. Whether you are a seasoned taxpayer or a beginner, this guide will provide you with the necessary information to make an informed decision.

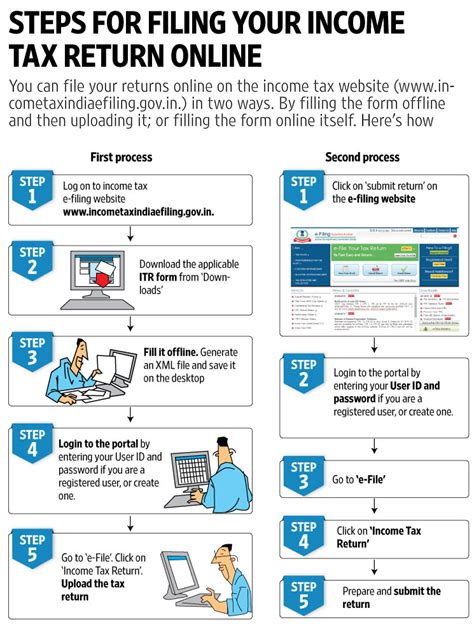

1. E-Filing Through the IRS Website

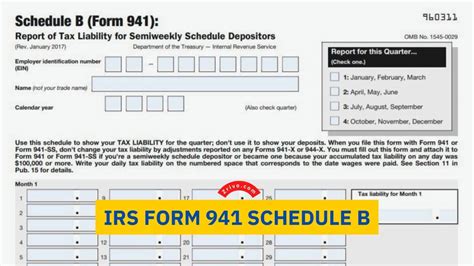

The Internal Revenue Service (IRS) offers a free e-filing option for individuals with simple tax returns. This method is convenient and easy to use, allowing taxpayers to prepare and submit their returns online. To qualify for free e-filing, taxpayers must have an income below $69,000 and meet certain eligibility criteria. The IRS website provides a range of free filing options, including IRS Free File and Free File Fillable Forms.

2. Tax Preparation Software

Tax preparation software, such as TurboTax and H&R Block, offers a user-friendly interface and step-by-step guidance to help taxpayers prepare and file their returns. These programs are available online or as downloadable software, and they often include features like audit support and deduction tracking. While these programs can be more expensive than other options, they provide a high level of accuracy and convenience.

3. Hiring a Tax Professional

For those with complex tax returns or who prefer personalized service, hiring a tax professional may be the best option. Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), have the expertise and knowledge to navigate even the most complex tax situations. They can also provide valuable advice on tax planning and savings strategies. However, hiring a tax professional can be more expensive than other options, with fees ranging from 100 to 500 or more, depending on the complexity of the return.

4. Tax Preparation Services

Tax preparation services, such as Jackson Hewitt and Liberty Tax, offer in-person tax preparation and filing services. These services often have multiple locations, making it easy to find a convenient location. Tax preparation services typically charge a fee based on the complexity of the return, with prices ranging from 50 to 200 or more. While these services can be more expensive than e-filing or tax preparation software, they provide personalized service and face-to-face interaction.

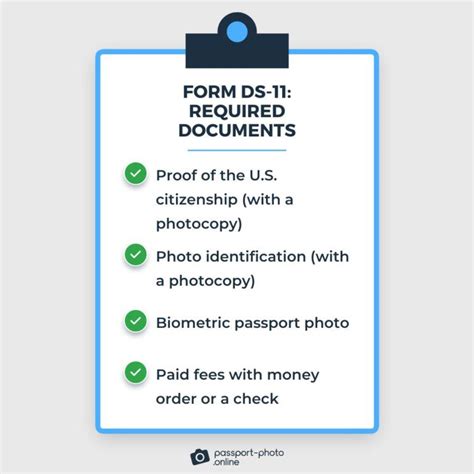

5. Mail-In Tax Returns

For those who prefer a more traditional approach, mail-in tax returns are still an option. Taxpayers can download and print tax forms from the IRS website or pick them up at a local IRS office. Once completed, the forms can be mailed to the IRS for processing. While this method can be more time-consuming than other options, it provides a tangible record of the tax return and can be a good option for those who are not comfortable with technology.

💡 Note: When choosing a tax filing method, it's essential to consider factors such as cost, convenience, and accuracy to ensure the best possible outcome.

In terms of cost, the prices for each method vary: * E-filing through the IRS website: free * Tax preparation software: 20-100 * Hiring a tax professional: 100-500 * Tax preparation services: 50-200 * Mail-in tax returns: free (although postage costs may apply)

The following table summarizes the key features of each method:

| Method | Cost | Convenience | Accuracy |

|---|---|---|---|

| E-filing through the IRS website | Free | High | High |

| Tax preparation software | 20-100 | High | High |

| Hiring a tax professional | 100-500 | Medium | High |

| Tax preparation services | 50-200 | Medium | High |

| Mail-in tax returns | Free | Low | Medium |

In conclusion, the best way to file taxes depends on individual circumstances and preferences. By considering factors such as cost, convenience, and accuracy, taxpayers can choose the method that best suits their needs. Whether you prefer the convenience of e-filing, the personalized service of a tax professional, or the traditional approach of mail-in tax returns, there is a tax filing method available to suit your lifestyle and budget.

What is the deadline for filing taxes?

+

The deadline for filing taxes is typically April 15th of each year, although this date may be subject to change.

Can I file my taxes for free?

+

Yes, you can file your taxes for free through the IRS website if you have an income below $69,000 and meet certain eligibility criteria.

What is the difference between a tax professional and a tax preparation service?

+

A tax professional, such as a CPA or EA, provides personalized tax preparation and planning services, while a tax preparation service, such as Jackson Hewitt or Liberty Tax, offers in-person tax preparation and filing services.