5 Tips for Late 941 Filing Penalties

Understanding Late 941 Filing Penalties

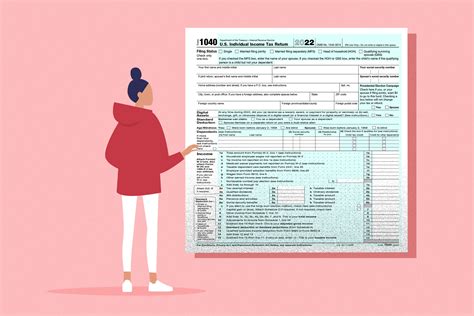

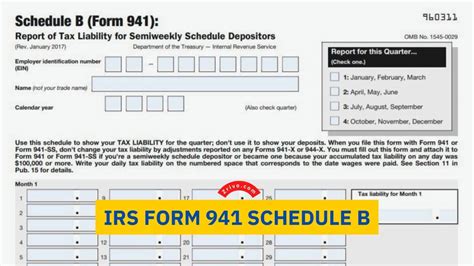

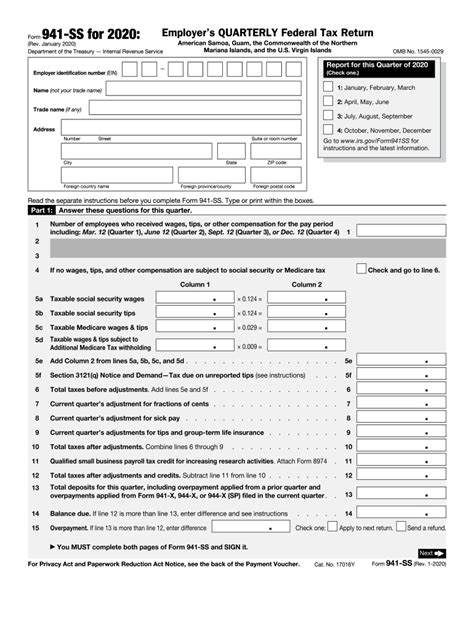

The Form 941 is a crucial document for employers, as it’s used to report employment taxes, including federal income tax withholding and Social Security and Medicare taxes. The Internal Revenue Service (IRS) requires employers to file this form on a quarterly basis, with specific deadlines for each quarter. Failure to file Form 941 on time can result in late filing penalties, which can be costly for businesses. In this article, we’ll explore five tips for handling late 941 filing penalties and provide guidance on how to avoid or minimize these penalties.

Tip 1: Understand the Penalty Structure

The IRS imposes penalties for late filing and payment of employment taxes. The penalty for late filing of Form 941 can be up to 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%. Additionally, there’s a penalty for late payment of employment taxes, which can be up to 0.5% of the unpaid tax for each month or part of a month, up to a maximum of 25%. It’s essential to understand the penalty structure to determine the best course of action for your business.

Tip 2: File Form 941 as Soon as Possible

If you’ve missed the deadline for filing Form 941, it’s crucial to file the form as soon as possible to minimize the penalty. The longer you wait, the more penalties and interest you’ll accrue. Make sure to complete the form accurately and include all required information to avoid any further delays or issues. You can file Form 941 online through the IRS Electronic Federal Tax Payment System (EFTPS) or by mail.

Tip 3: Pay Any Owed Taxes

In addition to filing Form 941, you must also pay any owed taxes to avoid further penalties and interest. You can pay online through EFTPS or by phone. Make sure to keep a record of your payment, including the date and amount paid, in case of any future disputes or issues.

Tip 4: Consider a Penalty Abatement

In some cases, the IRS may abate or waive penalties for late filing or payment of employment taxes. To qualify for a penalty abatement, you must demonstrate reasonable cause for the late filing or payment. This can include factors such as: * Business disruption due to natural disasters, fires, or other unforeseen events * Illness or death of the person responsible for filing Form 941 * Inaccurate advice from a tax professional or the IRS You can request a penalty abatement by filing Form 843, Claim for Refund and Request for Abatement.

Tip 5: Consult a Tax Professional

Dealing with late 941 filing penalties can be complex and time-consuming. If you’re unsure about how to handle the situation or need guidance on avoiding future penalties, consider consulting a tax professional. They can help you navigate the process, ensure compliance with IRS regulations, and provide valuable advice on managing employment taxes.

💡 Note: It's essential to address late 941 filing penalties promptly to avoid further complications and costs. By understanding the penalty structure, filing Form 941 as soon as possible, paying owed taxes, considering a penalty abatement, and consulting a tax professional, you can minimize the impact of late filing penalties on your business.

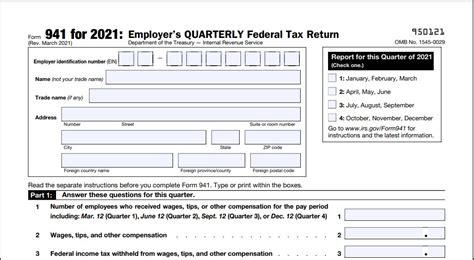

To illustrate the importance of timely filing and payment, consider the following table:

| Quarter | Filing Deadline | Payment Deadline |

|---|---|---|

| January-March | April 30th | April 30th |

| April-June | July 31st | July 31st |

| July-September | October 31st | October 31st |

| October-December | January 31st | January 31st |

In summary, late 941 filing penalties can be costly and time-consuming to resolve. By following these five tips, you can minimize the impact of late filing penalties on your business and ensure compliance with IRS regulations.

What is the penalty for late filing of Form 941?

+

The penalty for late filing of Form 941 can be up to 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%.

How can I request a penalty abatement for late 941 filing penalties?

+

You can request a penalty abatement by filing Form 843, Claim for Refund and Request for Abatement, and demonstrating reasonable cause for the late filing or payment.

What are the consequences of not paying employment taxes on time?

+

Failing to pay employment taxes on time can result in penalties, interest, and even trust fund recovery penalties. It’s essential to prioritize timely payment of employment taxes to avoid these consequences.