Mortgage Pre Approval Paperwork Needed

Understanding the Mortgage Pre-Approval Process

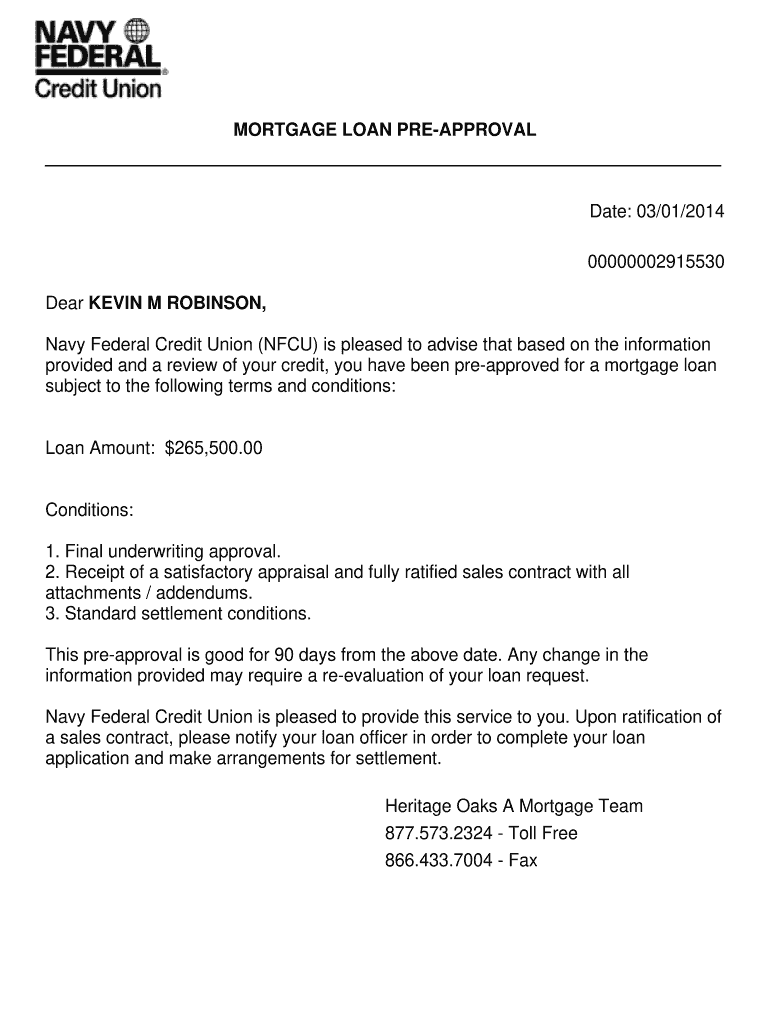

When considering purchasing a home, one of the first steps potential buyers should take is getting pre-approved for a mortgage. This process involves a lender reviewing the buyer’s financial information and providing a pre-approval letter stating the amount they are willing to lend. To initiate this process, buyers need to gather specific mortgage pre-approval paperwork. The required documents may vary slightly depending on the lender and the buyer’s financial situation, but there are common pieces of paperwork that are typically needed.

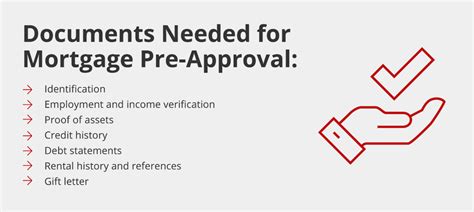

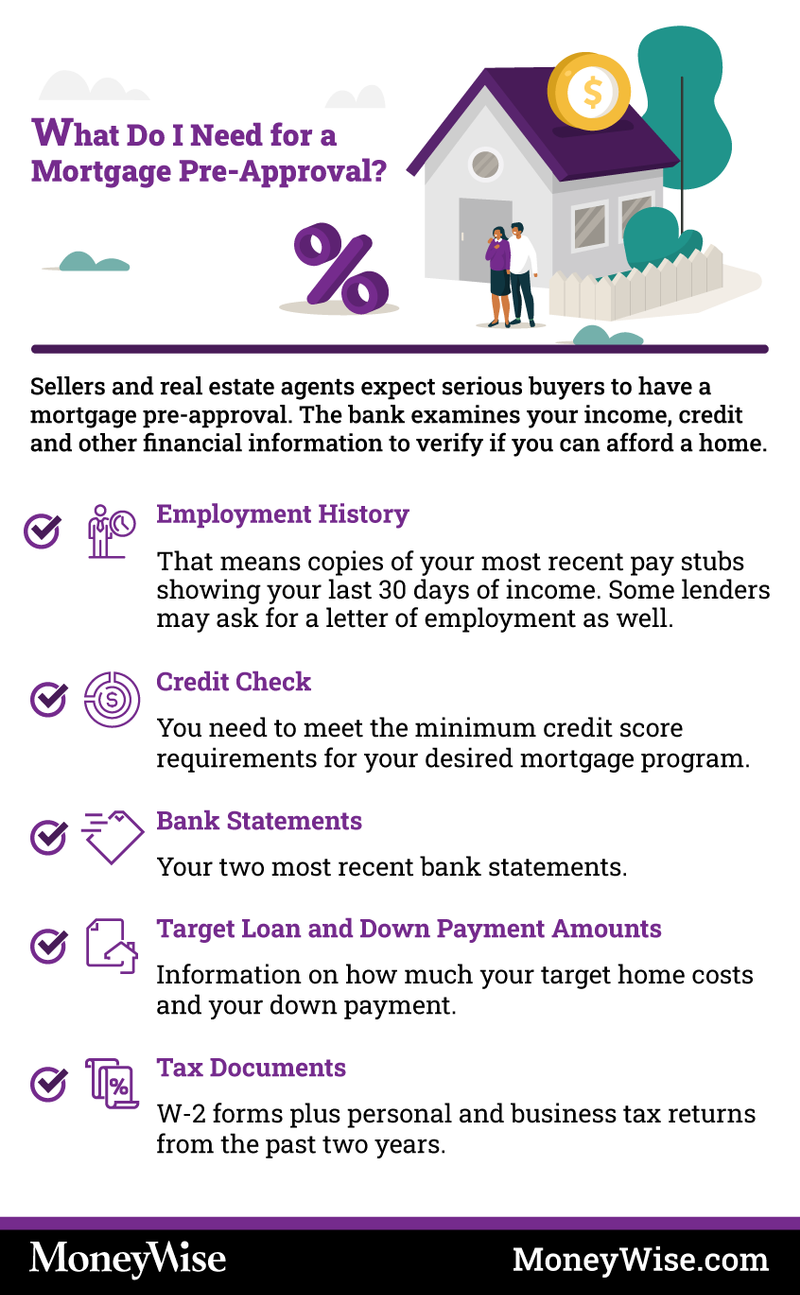

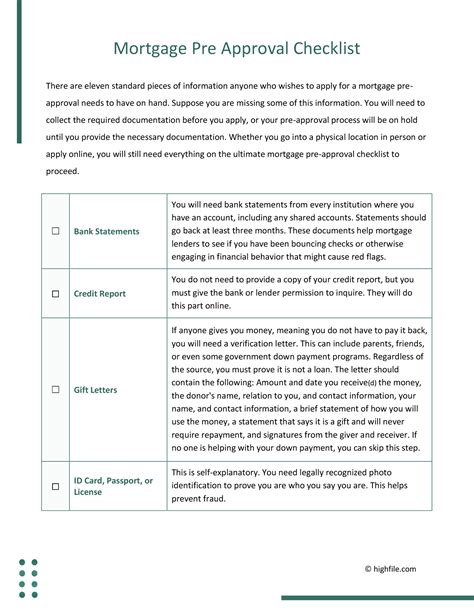

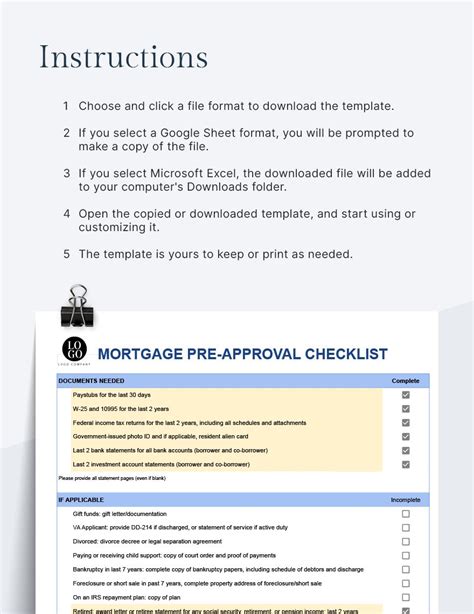

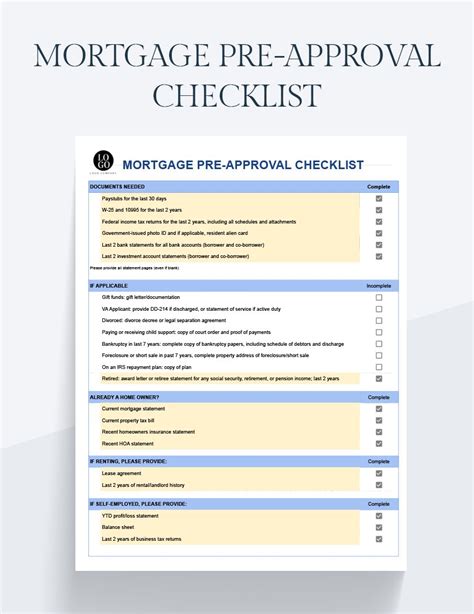

Common Documents Required for Mortgage Pre-Approval

The following are the most common documents required for mortgage pre-approval: - Identification: A valid government-issued ID, such as a driver’s license or passport, is necessary to verify identity. - Income Documents: - Pay stubs from the most recent 30 days. - W-2 forms from the last two years. - Tax returns from the last two years, including all schedules. - Asset Documents: - Bank statements from the last 60 days, including checking, savings, and investment accounts. - Retirement account statements. - Any other asset statements that could be used for the down payment or reserves. - Credit Reports: Lenders will pull credit reports, but having a recent copy can be helpful. - Employment Verification: A letter from the employer verifying the buyer’s position, income, and length of employment.

Additional Documents for Specific Circumstances

Certain situations may require additional paperwork: - Self-Employed Individuals: Business tax returns, a year-to-date profit and loss statement, and possibly a letter from an accountant. - Divorced or Separated Individuals: Divorce or separation agreements, especially if they impact income or debt obligations. - Gift Funds: If the down payment is being gifted, a gift letter and possibly documentation of the donor’s ability to give the gift. - Rental Income: If the buyer owns rental properties, they may need to provide rental agreements and tax returns showing rental income.

Importance of Organization

Being organized and having all necessary documents ready can significantly speed up the pre-approval process. Buyers should: - Ensure all documents are current and reflect the buyer’s current financial situation. - Keep digital and physical copies of all documents. - Be prepared to provide explanations for any financial anomalies, such as large deposits or credit inquiries.

📝 Note: The exact documents needed can vary, so it's essential to check with the lender for their specific requirements.

Gathering and Submitting Paperwork

Once all the necessary documents are gathered, the next step is to submit them to the lender. This can often be done online, through a secure portal, or in person, depending on the lender’s preferences. The lender will then review the documents and may request additional information if needed.

| Document Type | Description | Required For |

|---|---|---|

| Identification | Valid government-issued ID | All applicants |

| Income Documents | Pay stubs, W-2 forms, tax returns | All applicants |

| Asset Documents | Bank statements, retirement account statements | All applicants |

| Credit Reports | Recent credit report | All applicants |

Maintaining Financial Stability During the Process

After receiving pre-approval, it’s crucial for buyers to maintain their financial stability to ensure the pre-approval remains valid. This means: - Avoiding significant purchases or new debt. - Keeping credit utilization low. - Not changing jobs or reducing income, if possible. - Continuing to save for the down payment and closing costs.

In the end, understanding and gathering the necessary paperwork for mortgage pre-approval is a critical step in the home buying process. By being prepared and organized, buyers can navigate this process more smoothly and be one step closer to owning their dream home.

What is the first step in getting pre-approved for a mortgage?

+

The first step is to gather all necessary financial documents, including identification, income documents, asset documents, and credit reports.

Why do lenders require so many documents for pre-approval?

+

Lenders require these documents to assess the borrower’s creditworthiness and ability to repay the loan, ensuring they lend to qualified buyers.

How long does the pre-approval process typically take?

+

The pre-approval process can take anywhere from a few days to a few weeks, depending on the complexity of the buyer’s financial situation and the efficiency of the lender.