5 Ways Get Bankruptcy Papers

Introduction to Bankruptcy Papers

When facing financial difficulties, individuals or businesses may consider filing for bankruptcy as a means to regain control over their finances. The process of filing for bankruptcy involves several steps, one of which is obtaining the necessary bankruptcy papers. These documents are crucial as they contain vital information about the debtor’s financial situation, assets, liabilities, and the proposed plan for debt repayment or elimination. In this article, we will explore five ways to get bankruptcy papers, highlighting the importance of each method and the benefits they offer.

Understanding the Importance of Bankruptcy Papers

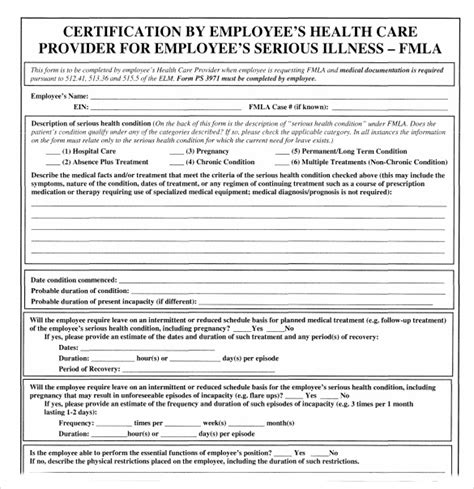

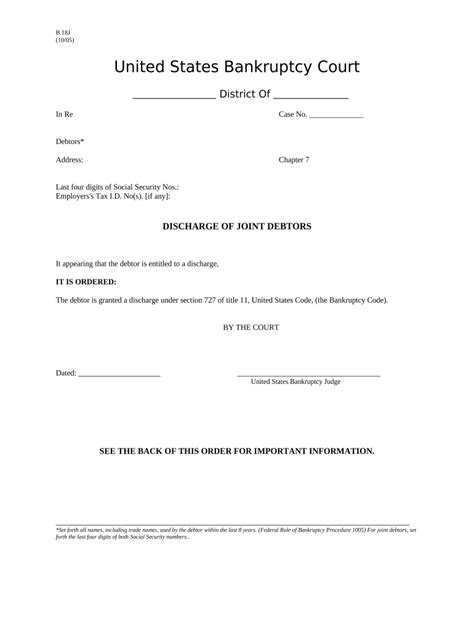

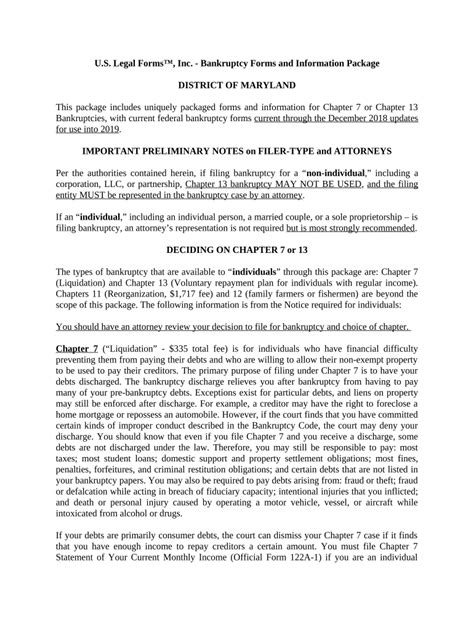

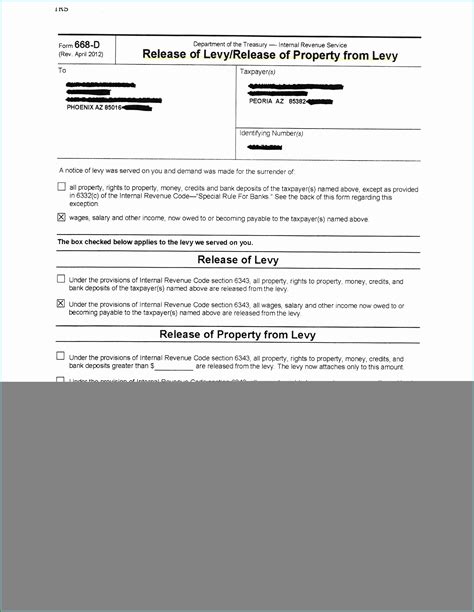

Bankruptcy papers are legal documents that must be filled out accurately and thoroughly. They typically include forms such as the Voluntary Petition, Schedules A-J, Statement of Financial Affairs, and in some cases, a Plan if the debtor is filing under Chapter 11, 12, or 13. The information provided in these documents helps the court understand the debtor’s financial situation and make informed decisions regarding the bankruptcy case.

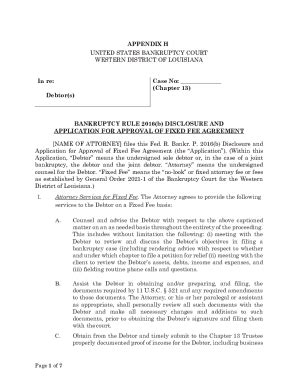

Method 1: Official Bankruptcy Forms from the US Courts Website

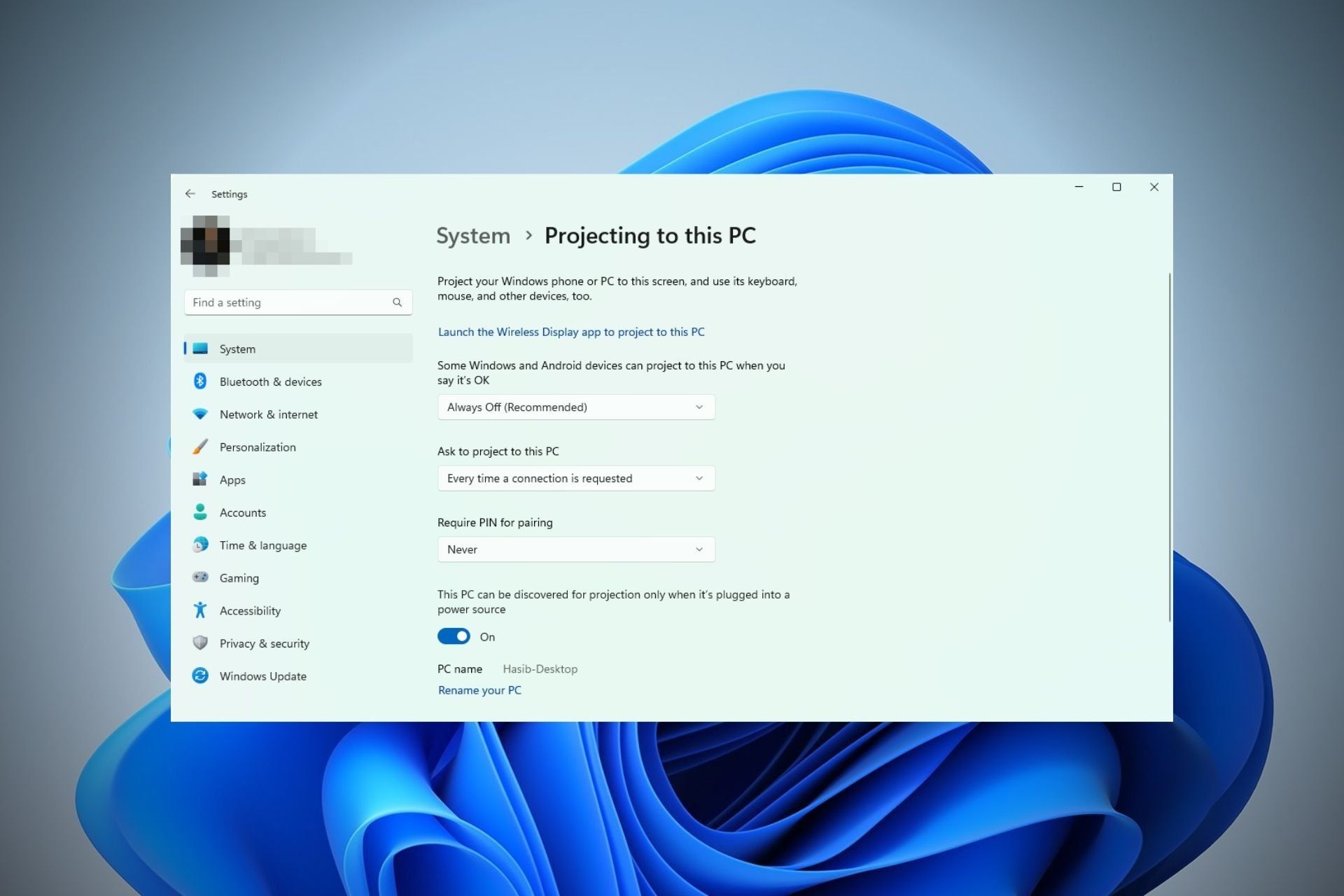

One of the most reliable ways to obtain bankruptcy papers is by visiting the official website of the US Courts. The website provides a comprehensive list of official bankruptcy forms, which are regularly updated to reflect changes in bankruptcy laws and procedures. These forms are available for download in PDF format and can be filled out electronically or printed and completed manually. Using official forms ensures that debtors have the most current and accurate documents for their bankruptcy filing.

Method 2: Legal Aid Organizations

For individuals who cannot afford legal representation, legal aid organizations can be a valuable resource. These organizations often provide free or low-cost legal assistance, including help with obtaining and completing bankruptcy papers. Legal aid attorneys and staff can guide debtors through the process, ensuring that all necessary documents are completed accurately and submitted on time.

Method 3: Bankruptcy Software and Online Services

Several software programs and online services are designed to assist individuals in preparing their bankruptcy papers. These tools guide users through the process of filling out the necessary forms, ensuring that all required information is included. Some of these services also offer reviews of the completed forms to catch any errors or omissions before the documents are filed with the court. While these services can be helpful, it’s essential to choose a reputable provider to ensure the accuracy and completeness of the prepared documents.

Method 4: Hiring a Bankruptcy Attorney

Engaging the services of a bankruptcy attorney is perhaps the most straightforward way to obtain and complete bankruptcy papers. An experienced attorney will have the necessary forms and can guide the debtor through the process of filling them out accurately. Attorneys are also well-versed in bankruptcy laws and can provide valuable advice on which chapter to file under and how to navigate the bankruptcy process effectively. Although hiring an attorney may seem like an added expense, the expertise and peace of mind it provides can be invaluable.

Method 5: Local Bankruptcy Court

Visiting the local bankruptcy court is another method for obtaining bankruptcy papers. Courts often have a clerk’s office where individuals can find the necessary forms and sometimes even receive basic guidance on how to fill them out. Some courts may also offer workshops or informational sessions for pro se filers (those representing themselves). While court staff cannot provide legal advice, they can direct individuals to the appropriate forms and resources.

📝 Note: It's crucial to ensure that all bankruptcy papers are filled out accurately and completely to avoid delays or dismissal of the bankruptcy case.

Choosing the Right Method for Your Needs

The best method for obtaining bankruptcy papers depends on the individual’s financial situation, the complexity of their case, and their comfort level with handling legal documents. For those who are comfortable with legal paperwork and have straightforward cases, using official forms from the US Courts website or a reputable online service might be sufficient. However, for more complex cases or for those who prefer professional guidance, hiring a bankruptcy attorney or seeking assistance from legal aid organizations might be more appropriate.

Preparation is Key

Regardless of the method chosen, preparation is key to a successful bankruptcy filing. This includes gathering all necessary financial documents, understanding the different types of bankruptcy and which one applies to your situation, and being prepared to provide detailed information about your income, expenses, assets, and debts.

| Method | Description | Cost |

|---|---|---|

| US Courts Website | Official bankruptcy forms for download | Free |

| Legal Aid Organizations | Free or low-cost legal assistance | Varies |

| Bankruptcy Software and Online Services | Guided preparation of bankruptcy forms | Varies |

| Hiring a Bankruptcy Attorney | Professional legal guidance and representation | Significant |

| Local Bankruptcy Court | Obtaining forms and basic guidance from court staff | Free |

In summary, obtaining bankruptcy papers is a critical step in the bankruptcy process, and there are several methods available to debtors, each with its own advantages and considerations. By understanding these methods and choosing the one that best fits their needs and financial situation, individuals can navigate the bankruptcy process more effectively and work towards achieving financial stability.

What are bankruptcy papers, and why are they important?

+

Bankruptcy papers are legal documents that contain vital information about a debtor’s financial situation, including assets, liabilities, and a proposed plan for debt repayment or elimination. They are crucial for the court to make informed decisions regarding the bankruptcy case.

Can I file for bankruptcy without an attorney?

+

Yes, it is possible to file for bankruptcy without an attorney, known as filing pro se. However, bankruptcy laws are complex, and the process can be challenging. Hiring an attorney can provide valuable guidance and ensure that all paperwork is completed accurately and submitted on time.

How do I choose the right bankruptcy chapter for my situation?

+

The choice of bankruptcy chapter depends on several factors, including the type of debts you have, your income, and whether you are an individual or a business. Chapter 7 is often used for liquidation, while Chapter 13 is used for reorganization and repayment plans for individuals. Consulting with a bankruptcy attorney can help determine the most appropriate chapter for your specific situation.

Related Terms:

- California bankruptcies Records

- Chapter 7 discharge letter