5 Ways Get Old Tax Papers

Introduction to Tax Paper Retrieval

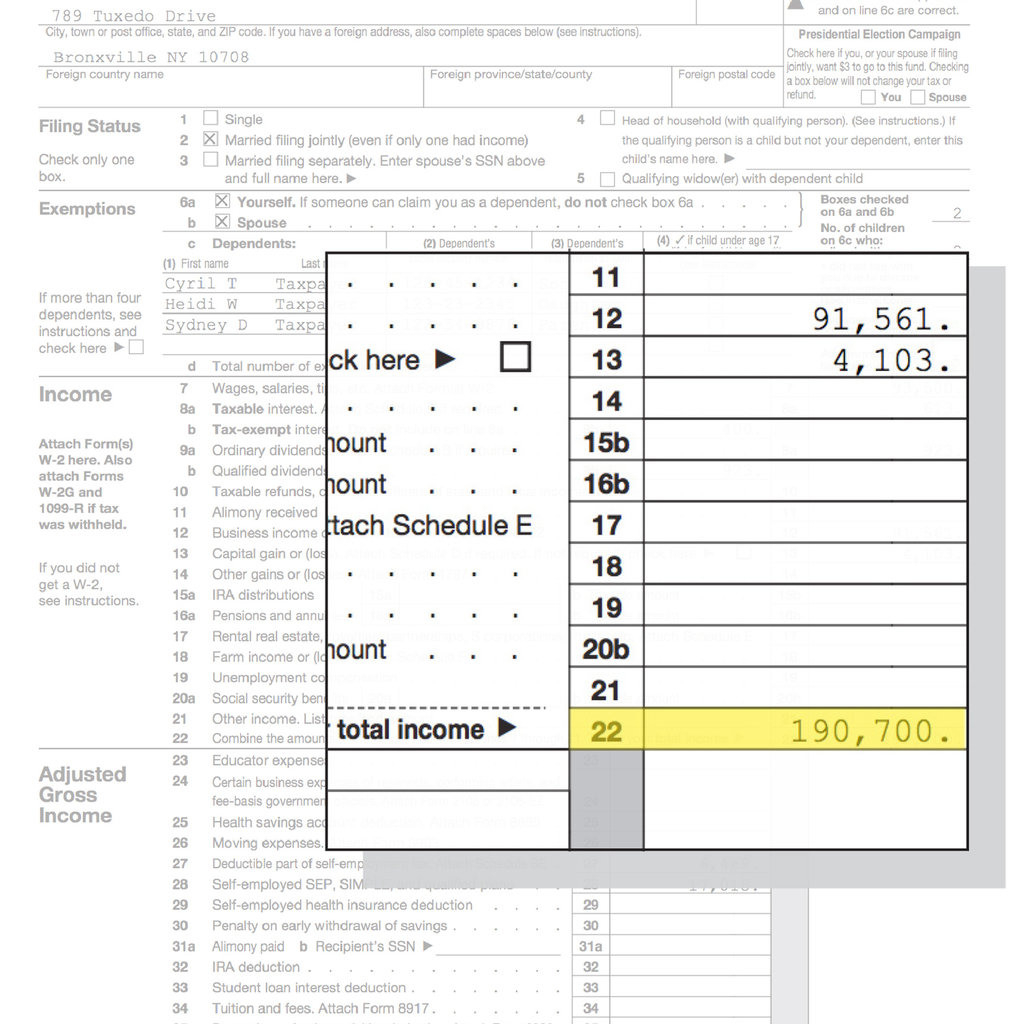

When it comes to managing your finances, one of the most crucial aspects is dealing with tax papers. Whether you’re an individual or a business, having access to your old tax papers is essential for a variety of reasons, including audits, loan applications, and understanding your financial history. However, over time, these documents can become misplaced, damaged, or even destroyed. This is where knowing how to retrieve or replace them becomes invaluable. In this article, we’ll explore five ways to get your old tax papers, ensuring you have the necessary documents at your fingertips when you need them.

Understanding the Importance of Old Tax Papers

Before diving into the methods of retrieval, it’s essential to understand why old tax papers are crucial. They serve as a record of your income, expenses, and tax obligations over the years. This information can be vital for: - Audits and Investigations: In case of an audit, having your tax papers readily available can help resolve any discrepancies quickly. - Loan Applications: Many loan applications require a history of your tax returns to assess your creditworthiness. - Financial Planning: Understanding your past financial situation can help in making informed decisions about your future.

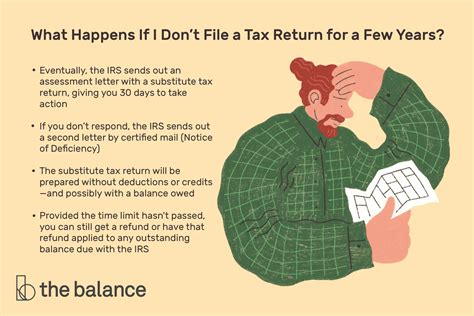

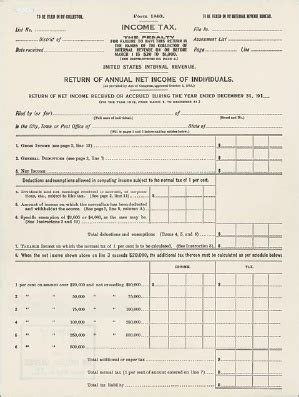

Method 1: Contact the IRS

The Internal Revenue Service (IRS) is a primary source for obtaining old tax papers. You can request a transcript of your tax return, which includes most of the line items from your original return, online or by phone. Here’s how: - Online: Visit the IRS website and use their Get Transcript Online tool. You’ll need to create an account or log in if you already have one. - By Phone: Call the IRS at 1-800-908-9946 to request a transcript.

📝 Note: The IRS typically keeps tax returns for a period of three years from the date the return was due or filed, whichever is later. However, in some cases, they may have returns from earlier years.

Method 2: Check with Your Employer or Bank

Sometimes, the information you need can be found through your employer or bank. - Employer: Your employer may have records of your W-2 forms, which are crucial for understanding your income and tax withheld. - Bank: Your bank may retain records of your interest statements (1099 forms) and other financial documents that can help in filling out your tax returns.

Method 3: Use Tax Preparation Software

Tax preparation software like TurboTax or H&R Block often retains your tax information from previous years. If you’ve used these services, you can log in to your account to access your old tax papers. This method is convenient and quick, provided you have an account with the service.

Method 4: Contact Your Tax Preparer

If you’ve worked with a tax preparer or accountant, they may have copies of your tax returns. Don’t hesitate to reach out to them; they can provide you with the documents you need. This method is especially useful if you have a long-standing relationship with your tax preparer.

Method 5: Visit Your Local Social Security Administration Office

For individuals, especially those looking for proof of income, visiting a Social Security Administration (SSA) office can be helpful. They can provide you with a statement of your earnings history, which, while not a tax return, can be useful for loan applications and understanding your income history.

| Method | Description | Usefulness |

|---|---|---|

| Contact the IRS | Request transcripts of your tax returns. | Highly useful for exact tax return details. |

| Check with Employer or Bank | Retrieve W-2 and 1099 forms. | Useful for income and interest details. |

| Use Tax Preparation Software | Access previous years' tax returns through your account. | Convenient for those who have used the software before. |

| Contact Your Tax Preparer | Obtain copies of your tax returns from your preparer. | Useful for those with a tax preparer. |

| Visit SSA Office | Get a statement of your earnings history. | Helpful for proof of income. |

In summary, retrieving old tax papers can seem daunting, but there are several straightforward methods to obtain them. Whether you’re dealing with an audit, applying for a loan, or simply wanting to understand your financial history, having access to these documents is crucial. By utilizing the methods outlined above, you can ensure that you have the necessary tax papers when you need them, helping to simplify your financial management and planning.

How long does the IRS keep tax returns?

+

The IRS typically keeps tax returns for three years from the date the return was due or filed, whichever is later. However, in some cases, they may have returns from earlier years.

Can I get my tax papers from my employer?

+

Yes, your employer may have records of your W-2 forms, which are crucial for understanding your income and tax withheld. It’s worth reaching out to them to see what information they can provide.

Do tax preparation software services keep my tax information?

+

Yes, services like TurboTax or H&R Block often retain your tax information from previous years. You can log in to your account to access your old tax papers.